Want to win and keep GSA contracts? Start here. GSA compliance can open doors to $45 billion in federal opportunities annually, but strict rules make it tricky to navigate. Only 4% of small businesses secure a spot on GSA Schedules, so staying compliant is key to success. Here’s what you need to know:

- Update SAM.gov Annually: Keep your registration active to stay eligible.

- Follow Trade Agreements Act (TAA): Ensure products are made or transformed in compliant countries.

- Stick to Price Reduction Rules: Monitor discounts and notify GSA of changes.

- Report Sales & Pay IFF On Time: Meet deadlines to avoid penalties.

- Check Compliance Regularly: Conduct periodic reviews of pricing, reporting, and certifications.

- Maintain Records: Keep organized files for audits and contract renewals.

- Stay Updated on Rules: Monitor GSA updates to adapt quickly.

- Train Your Team: Educate staff on GSA requirements to avoid mistakes.

- Work Within Limits: Follow contract scope, pricing, and order thresholds.

- Prepare for Audits: Stay audit-ready with complete documentation and internal checks.

Quick Tip: Missing deadlines or violating rules can lead to penalties or contract termination. Use tools, automation, and expert help to simplify compliance and focus on growing your federal business.

Keeping your GSA Multiple Award Schedule (MAS) Contract Compliant

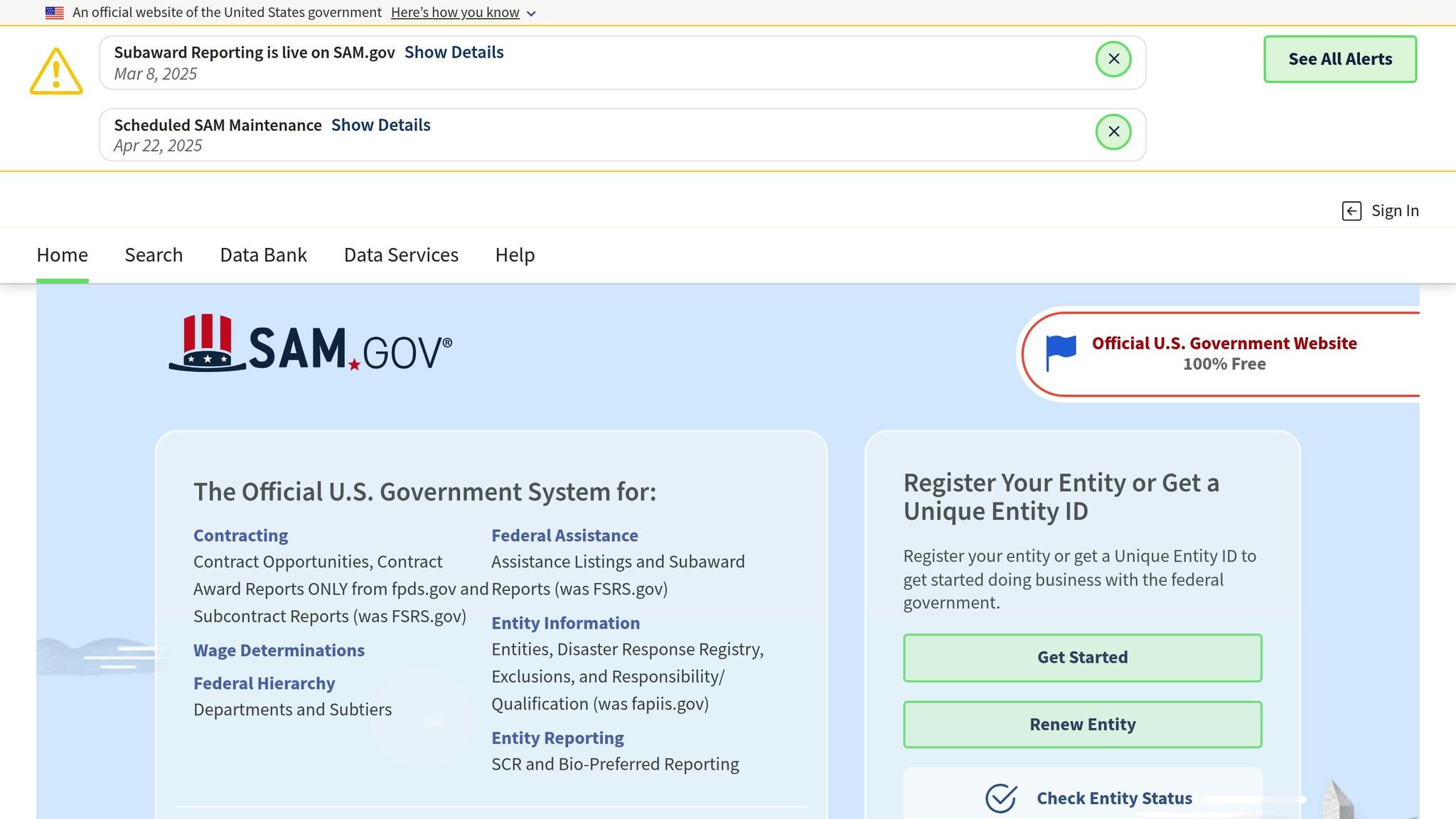

1. Keep SAM.gov Registration Current

To remain eligible for GSA contracts, it’s essential to keep your SAM.gov registration up to date. This registration provides your Unique Entity ID – a key requirement for federal contracting.

Here’s what you need to focus on:

- Renew Annually: Make sure to renew your registration every year to avoid lapses.

- Entity Administrator Responsibilities: If you’re the Entity Administrator, it’s your job to ensure the renewal is completed on time.

- Active Status Check: Regularly log in to SAM.gov to confirm your status remains "Active."

Heads-up: SAM.gov will undergo scheduled maintenance on May 10, 2025, from 8:00 AM to 1:00 PM EST. During this time, registration and exclusion services won’t be available. Plan accordingly!

2. Meet Trade Agreements Act Standards

The Trade Agreements Act (TAA) plays a key role in GSA Schedule contracts. To comply, your products must be either manufactured or substantially transformed in TAA-compliant countries, such as the United States or nations with established trade agreements.

Understanding Country of Origin

A product’s country of origin is determined by where it undergoes "substantial transformation" – essentially, where it becomes a completely new item. For instance, if components from various countries are assembled in Mexico, the assembly process must significantly alter the product to qualify as TAA-compliant.

| TAA Status | Countries | Examples of Qualifying Activities |

|---|---|---|

| Compliant | USA, Canada, Mexico, Most EU Countries, Japan | Final assembly creating a new product, Complete manufacturing |

| Non-Compliant | China, India, Russia | Simple packaging, Minor changes, Basic assembly |

This transformation must be thoroughly documented to confirm compliance.

Documentation Requirements

To prove TAA compliance, maintain comprehensive records such as:

- Certificates of origin from your suppliers

- Detailed documentation of the manufacturing process

- Written statements from manufacturers

- Supply chain audit records

"The GSA regularly audits contractors for TAA compliance, and non-compliance is a common reason for contract termination or penalties".

Best Practices for Maintaining Compliance

Regularly review your product catalog, especially when changes occur in:

- Supplier relationships

- Manufacturing locations

- Product designs

- Updates to TAA-compliant country lists

If you identify a non-compliant product in your catalog, remove it immediately and inform your GSA contracting officer. Acting quickly and transparently shows your commitment to compliance and protects your contract status.

For complicated situations or uncertainties, consider consulting compliance experts to ensure you’re on the right track.

3. Follow Price Reduction Rules

Adhering to price reduction rules is critical to maintaining your GSA Schedule contract. The Price Reductions Clause (PRC) plays a central role in ensuring compliance and protecting your agreement.

Understanding the Basis of Award Customer

Your Basis of Award (BOA) customer acts as the pricing benchmark established during your initial contract negotiations. This customer typically receives your best pricing and discounts, setting the standard for all future pricing decisions.

| Customer Type | Pricing Relationship | Required Action |

|---|---|---|

| BOA Customer | Pricing benchmark | Monitor discounts and terms closely |

| GSA Customer | Must receive equivalent terms | Adjust pricing when BOA terms change |

| Other Commercial | Varies by contract | Track for potential pricing impacts |

With the BOA customer defined, it’s essential to monitor and document all pricing changes systematically.

Monitoring Price Relationships

To stay compliant, keep a close eye on pricing relationships:

- Conduct quarterly pricing audits, document changes, and ensure there’s a clear approval process in place.

- Act quickly to correct any deviations from the BOA terms.

When Price Reductions Are Triggered

A price reduction occurs when your BOA customer is offered better terms than those outlined in your GSA contract. If this happens:

- Notify your Contracting Officer in writing as soon as you identify the issue.

- Update GSA pricing to match the adjusted BOA terms.

- Apply the new pricing to all future task and delivery orders.

"GSA has explicitly stated they are addressing MAS contractor non-compliance and allowing non-compliant contracts to expire as part of their initiative to rightsize the Multiple Awards Schedule Program".

TDR vs. Traditional Contracts

If you operate under a Transactional Data Reporting (TDR) contract, the PRC requirements differ from traditional contracts. Here’s how they compare:

| Requirement | TDR Contract | Traditional Contract |

|---|---|---|

| PRC Status | Modified or eliminated | Fully active |

| Reporting Frequency | Monthly (by the 30th) | Quarterly |

| Focus Area | Transaction data | Price relationships |

| Compliance Method | Data analysis | BOA comparison |

Understanding these differences is key to managing compliance effectively.

Best Practices for Compliance

To ensure PRC compliance, consider implementing these practices:

- Assign a dedicated team member to oversee price monitoring.

- Standardize your discount approval process.

- Use automated alerts to flag potential triggering events.

- Keep detailed, organized digital records.

- Train your sales team regularly on PRC requirements.

"Compliance with the Price Reductions Clause is specifically mentioned as essential in maintaining your GSA Schedule contract".

Non-compliance can lead to severe consequences, including contract termination, financial penalties, or suspension from government contracting. Proactive monitoring and management of your pricing relationships are essential to staying on track with GSA requirements.

4. Report Sales and Pay IFF On Time

Staying on top of your sales reports and Industrial Funding Fee (IFF) payments is essential to maintaining your GSA Schedule contract.

Reporting Deadlines You Need to Know

Each contract type comes with its own reporting schedule. Here’s a quick breakdown:

| Contract Type | Reporting Frequency | Due Dates |

|---|---|---|

| Non-TDR Contracts | Quarterly | April 30, July 30, October 30, January 30 |

| TDR Contracts | Monthly | 30th of each month |

| VA Sales Systems | Quarterly | February 28, May 31, August 31, November 30 |

Missing these deadlines can lead to compliance headaches, so mark your calendar.

What You Should Know About the IFF

The Industrial Funding Fee (IFF) is a small percentage – 0.75% – of your total GSA Schedule sales. This fee supports the administration of the GSA program. Even if you don’t have any sales during a reporting period, you’re still required to submit a zero-activity report.

Key Reporting Details to Track

For accurate and compliant reporting, keep a close eye on these areas:

- Total GSA Schedule sales to ensure proper calculations.

- Basis of Award customer information to stay aligned with your contract terms.

- Transaction details for precise 72A reporting.

- IFF calculations and payment records, so payments are accurate and on time.

Simplify Compliance with Automation

Deadlines can sneak up on you, but automation can help you stay ahead. Here’s how to streamline your accounting and reporting process:

- Use automated reminders to track submission dates.

- Invest in accounting software that separates GSA sales from other transactions.

- Keep digital records for easy access during audits.

- Conduct internal reviews before submitting reports to catch errors early.

Common Reporting Mistakes to Avoid

Avoid these pitfalls to keep your contract in good standing:

- Inaccurate Sales Tracking: Double-check that all GSA Schedule sales are properly recorded.

- Late Submissions: Submit reports ahead of deadlines to avoid last-minute stress.

- Incomplete Documentation: Maintain thorough records of every transaction and IFF payment.

- Data Errors: Regularly verify the accuracy of your reports before submission.

What Happens If You Miss the Mark?

Falling behind on reporting or payments can lead to penalties, audits, or even suspension of your contract. To minimize this risk, consider adopting a compliance management system or working with GSA contract experts. For example, GSA Focus provides tailored solutions to help you navigate reporting requirements with ease.

Keep in mind, GSA’s Federal Acquisition Service actively monitors contractor compliance. Staying on top of your reporting not only keeps you in line with regulations but also reinforces your reputation as a dependable government contractor.

5. Check Compliance Regularly

Once you’ve tackled registration, trade, and pricing challenges, it’s crucial to keep a close eye on compliance. Regular checks ensure your GSA contract stays intact and aligned with requirements. With GSA’s Rightsize initiative, maintaining compliance is more important than ever for preserving your contract.

Key Compliance Areas to Watch

Here are the primary areas to monitor and how often to review them:

| Compliance Area | Review Frequency | Key Elements to Check |

|---|---|---|

| Sales Reporting | Monthly | Sales data and IFF calculations |

| Pricing | Quarterly | BOA customer pricing and pricing clauses |

| Documentation | Monthly | Contract files and modifications |

| Certifications | Quarterly | SAM.gov status and registrations |

| Performance | Monthly | Delivery times and quality metrics |

Setting Up a Review Schedule

For non-TDR contracts, plan reviews quarterly. For TDR contracts, conduct reviews monthly, ideally before the 30th.

Assembling Your Compliance Team

A strong team is essential for effective compliance management. Here’s how roles can be divided:

- Contract Manager: Oversees all compliance activities and coordinates reviews.

- Finance Team: Handles sales reporting and ensures accurate IFF payments.

- Operations Staff: Monitors delivery schedules and performance metrics.

- Legal/Compliance Team: Keeps track of regulatory requirements and changes.

Leveraging Technology for Compliance

Digital tools can simplify the compliance process and reduce manual workload. Consider these options:

- Automated Calendars: Set reminders for reporting deadlines.

- Document Management Systems: Organize contract files and modifications efficiently.

- Sales Tracking Software: Separate and monitor GSA sales data.

- Digital Checklists: Ensure all requirements are met and verified.

Common Compliance Challenges to Avoid

Steer clear of these frequent pitfalls:

- Outdated SAM.gov Information: Keep your registration up to date.

- Missed Reporting Deadlines: Use alerts to track submission timelines.

- Incomplete Documentation: Maintain well-organized and thorough records.

- Price Reduction Violations: Continuously monitor commercial pricing to avoid issues.

Addressing Compliance Issues

If a problem arises, follow this step-by-step plan to resolve it quickly:

- Identify: Pinpoint the specific compliance issue.

- Document: Record all relevant details about the problem.

- Develop: Create a corrective action plan.

- Implement: Make the necessary changes or modifications.

- Follow Up: Verify that the issue has been resolved effectively.

For added support, consider consulting GSA contract specialists. Experts like GSA Focus can help you set up a reliable compliance system and avoid common mistakes. Their guidance can make all the difference in safeguarding your contract.

6. Keep Complete Contract Records

Keeping thorough and accurate records is a cornerstone of GSA contract compliance. Good documentation not only protects your contract but also simplifies the audit process. Organized records, paired with regular compliance checks, help maintain the integrity of your agreement.

Essential Documentation Requirements

GSA contractors are required to maintain a variety of records. Here’s a quick breakdown of what you need to keep and for how long:

| Document Category | Required Items | Retention Period |

|---|---|---|

| Contract Documents | Original award, modifications, price lists | 3–6 years |

| Sales Records | Purchase orders, invoices, delivery documentation | 3 years minimum |

| Financial Reports | 72A reports, IFF payments, reconciliation sheets | 3 years |

| Compliance Records | SAM.gov registrations, certifications | Duration of contract |

| Price Documentation | Basis of Award customer information, pricing analyses | 6 years |

Organized documentation is key to staying compliant and audit-ready.

Digital Record-Keeping Best Practices

Using digital tools can make managing your records more efficient and secure. Here are some tips to help you stay on top of things:

- Organize files into separate digital folders for each contract element.

- Use consistent file names that include dates (e.g., "GSA_Mod_05092025").

- Store records in secure cloud-based systems with regular backups.

- Enable version control to track document updates.

- Limit access to sensitive files through controlled permissions.

These steps can save time and reduce stress when you need to retrieve records.

Critical Reporting Documentation

It’s crucial to stay on schedule with required reports. Keep documentation for the following:

- Non-TDR Contracts: Submit quarterly reports by January 30th, April 30th, July 30th, and October 30th.

- TDR Contracts: Submit monthly reports by the 30th of each month.

- Small Business Reports: Submit ISRs by April 30th and October 30th, and SSRs by October 30th.

Maintaining a calendar for these deadlines can help you avoid missed submissions.

Audit-Ready Organization

To prepare for audits, set up a system that ensures all necessary documentation is readily available:

- Develop a reusable "audit package" template.

- Conduct internal reviews of your documentation every quarter.

- Keep detailed records of price reduction analyses.

- Save all GSA-related communications and correspondence.

- Document compliance checks and any corrective actions taken.

This proactive approach can make audits far less daunting.

Subcontracting Documentation

If your contract includes small business subcontracting requirements, you’ll need to maintain specific records, such as:

- Approved subcontracting plans.

- Documentation of outreach efforts to small businesses.

- Payment records for subcontractors.

- Tracking records for utilization goals.

- Annual commercial plan submissions.

Detailed subcontracting records demonstrate your commitment to meeting these requirements.

Security Measures

Protecting sensitive contract information is non-negotiable. Here are some ways to safeguard your records:

- Use access controls to limit who can view or edit files.

- Perform regular security audits to identify vulnerabilities.

- Store files in encrypted locations.

- Set up verified backup systems to prevent data loss.

- Use authentication protocols for added security.

Strong security practices not only protect your data but also ensure compliance with GSA requirements. Proper, secure record-keeping is essential for smooth contract management and successful audits.

sbb-itb-8737801

7. Stay Current with GSA Rules

Keeping up with GSA rules is a must for maintaining contract compliance and staying competitive in federal contracting. Staying informed helps you avoid pitfalls and ensures your compliance strategies remain effective.

Monitoring Official Updates

To stay ahead of regulatory changes, track updates from trusted sources like:

- GSA Interact: Subscribe for regular updates.

- Federal Register: Monitor Federal Acquisition Regulation (FAR) changes.

- GSA eLibrary: Keep an eye on modifications.

- Key GSA platforms: Regularly check for announcements.

- GSA’s social media: Follow their official accounts for timely updates.

Implementation Strategy

Having a clear plan to handle regulatory updates is essential. Here’s a structured approach:

| Phase | Action Items | Timeline |

|---|---|---|

| Review | Assess how changes impact operations. | Within 48 hours |

| Plan | Outline necessary adjustments. | 3–5 business days |

| Execute | Update internal processes. | 1–2 weeks |

| Verify | Test new compliance measures. | 1 week |

| Document | Record all updates and actions taken. | Ongoing |

This process ensures changes are smoothly integrated into your compliance routine.

Critical Areas to Monitor

Certain areas demand extra attention to align with GSA requirements:

- Pricing regulations and policies

- Trade Agreements Act compliance

- Small business subcontracting rules

- Reporting formats and deadlines

- Cybersecurity standards

- Supply chain security protocols

By focusing on these, you can reinforce your compliance framework.

Documentation Management

Organizing your compliance documentation is key to staying on top of changes. Consider these steps:

- Maintain a compliance calendar for deadlines.

- Use version control to track document updates.

- Log implementation dates for regulatory changes.

- Keep records of staff training completion.

- Store interpretations of regulations for reference.

- Document compliance verification results.

Internal Communication Protocol

Clear communication is vital for managing updates effectively. Here’s how to streamline internal processes:

- Assign a compliance coordinator to oversee updates.

- Hold regular team briefings to share changes.

- Set up notifications for critical updates.

- Create a system to document acknowledgment of updates by relevant staff.

"Dealing with compliance… hiring lawyers, googling 1,000 things a day, etc." – GSA Schedules Services

This quote underscores the frustration many face with compliance, highlighting the value of a well-organized system. On average, GSA Focus clients generate $927,000 in steady revenue.

Technology Solutions

Take advantage of digital tools to simplify compliance tracking and implementation:

- Automated alert systems for updates

- Document management platforms for easy access

- Compliance tracking software to monitor progress

- Training management systems to ensure staff readiness

- Audit preparation tools for smoother inspections

Regularly reviewing and updating these tools not only ensures compliance but also allows you to stay focused on growing your business. Staying on top of GSA rules positions your company for long-term success in federal contracting.

8. Train Staff on GSA Requirements

Training your team on GSA requirements is critical to avoid costly mistakes and ensure everyone understands their responsibilities.

Core Training Components

Your GSA compliance training should cover the following areas:

| Training Area | Key Topics | Frequency |

|---|---|---|

| Reporting Requirements | 72A reports, IFF payments | Quarterly |

| Contract Management | Price lists, TAA compliance | Semi-annually |

| Documentation | Record keeping, audit prep | Monthly |

| SAM.gov | Registration updates, verification | Annually |

| Regulatory Updates | Rule changes, new requirements | As needed |

Additionally, make sure your team is well-versed in meeting critical reporting deadlines to avoid compliance issues.

Critical Reporting Deadlines

Your staff should be fully aware of these key deadlines:

- Non-TDR Contracts: Quarterly reports are due on April 30, July 30, October 30, and January 30.

- TDR Contracts: Monthly reports must be submitted by the 30th of each month.

- VETS-4212: For contracts exceeding $150,000, the annual report is due by September 30.

- EEO-1: Companies with 50+ employees and contracts over $50,000 must submit this report by March 31.

Documentation Management

Proper record keeping is a cornerstone of compliance, and your team should be trained to maintain:

- Sales reports and IFF payment confirmations

- Updates to price lists and modifications

- Communications with GSA officials

- Records of contract changes and amendments

- Materials prepared for compliance audits

- Certificates confirming training completion

Good documentation practices require collaboration across different departments.

Cross-Departmental Coordination

To strengthen compliance, establish clear communication and coordination between teams:

- Sales: Ensure understanding of contract terms and pricing rules.

- Finance: Handle reporting deadlines and IFF payments.

- Legal: Stay updated on regulatory changes.

- Operations: Maintain high standards for documentation.

Companies that invest in structured training programs often see fewer compliance-related issues. For instance, organizations working with GSA Focus have noted measurable improvements in compliance through targeted training.

Training Assessment

Evaluate the effectiveness of your training efforts by:

- Conducting regular compliance audits

- Monitoring adherence to reporting deadlines

- Checking the quality of documentation

- Collecting feedback from staff surveys

- Running mock GSA audit exercises

Training isn’t a one-time effort – it’s an ongoing process. Regular refreshers and expert-led sessions help keep your team sharp and compliance-ready.

9. Work Within Contract Limits

Sticking to the boundaries of your GSA Schedule contract isn’t just a good practice – it’s essential to avoid penalties, refunds, or even losing the contract altogether.

Understanding Contract Scope

Your GSA Schedule contract comes with clear guidelines you must follow:

| Parameter | Description | Compliance Requirement |

|---|---|---|

| Special Item Numbers (SINs) | Categories of authorized products/services | Offer only items approved under your SINs |

| Maximum Order Threshold | The highest dollar amount for individual orders | Get approval before going over this limit |

| Pricing Structure | Pre-approved rates and discounts | Stick to your agreed pricing |

| Geographic Coverage | Areas where you’re authorized to operate | Provide services only in these regions |

These parameters ensure you stay within your contract’s boundaries, keeping things on track and compliant.

Avoiding Unauthorized Activities

Regularly monitoring your contract terms is the best way to avoid stepping outside the lines. For instance, an IT services company once exceeded its order limits, leading to mandatory refunds and corrective measures.

Here are some ways to prevent similar issues:

- Use automated tools to track orders.

- Review your contract scope regularly.

- Keep thorough records of any modifications.

- Document all sales and transactions.

- Confirm that products meet origin requirements.

Setting Up Internal Controls

Establishing strong internal controls can help ensure compliance with your contract terms.

Daily Tasks

- Check each order against your contract’s terms.

- Verify that pricing aligns with approved rates.

- Confirm that all products or services are eligible under your SINs.

Monthly Audits

- Review sales to ensure they fall within contract limits.

- Audit modification requests for accuracy and approval.

- Update compliance documentation regularly.

Keeping Documentation in Order

Good recordkeeping is critical for staying compliant. Make sure to maintain:

- Detailed sales reports and transaction logs.

- Approvals for any contract modifications.

- Correspondence with GSA officials.

- Certifications for product origin.

- Documentation of service delivery.

Technology can be a big help here, making it easier to organize and access the necessary records.

Tools to Monitor Compliance

Contract management software can simplify the process of staying within your contract’s limits. These tools can:

- Track order thresholds automatically.

- Monitor pricing to ensure it aligns with your contract.

- Alert your team to potential compliance issues.

- Generate reports to demonstrate compliance.

- Maintain a clear authorization trail for audits.

If you’re unsure about any requirements, working with GSA contract specialists or services like GSA Focus can help you navigate the rules while maximizing the opportunities your contract provides.

Failing to follow contract terms can lead to serious consequences, including:

- Termination of your contract.

- Financial penalties or mandatory refunds.

- Suspension from federal contracting.

- Increased scrutiny through audits.

Staying within the limits of your GSA Schedule contract is not just about avoiding penalties – it’s about ensuring your business remains a trusted partner in federal contracting.

10. Prepare for GSA Audits

Staying prepared for GSA audits is essential to keeping your contract in good standing. These audits are a key part of ensuring compliance, particularly with GSA’s "Rightsize the Multiple Awards Schedule Program" initiative increasing oversight.

Types of GSA Audits

| Audit Type | Timing | Focus Areas |

|---|---|---|

| Contractor Assistance Visits (CAVs) | Within the first 2 years | Initial compliance check |

| IOA Reviews | Throughout the contract term | Performance and reporting |

| OIG Audits | Based on risk factors | Comprehensive evaluation |

Understanding these audit types is the first step. The next is making sure you have the right documentation ready for each review.

Audit-Specific Documentation

Be sure to maintain:

- Evidence of Trade Agreements Act (TAA) compliance

- Pricing documentation specific to audits

- Records verifying labor qualifications

- Proof of subcontracting compliance

- Submissions like VETS-4212 and EEO-1 reports

Building an Audit-Ready Program

To stay ahead, assign a GSA compliance officer who can:

- Conduct regular (ideally quarterly) reviews

- Implement consistent documentation practices

- Verify reports and payments for accuracy

- Organize mock audits to identify potential gaps

- Maintain a compliance calendar to track key deadlines

Technology Solutions

Leverage contract management software to streamline your efforts. These tools can help:

- Track compliance requirements

- Organize and store digital documentation

- Monitor triggers for the Price Reduction Clause

- Generate accurate sales reports

- Keep tabs on compliance metrics

Immediate Response Protocol

If you’re notified of an audit, follow these steps:

- Review the audit scope carefully.

- Notify all relevant stakeholders.

- Assign a lead to manage the audit response.

- Gather all necessary documentation promptly.

- Conduct an internal assessment to identify any issues.

- Prepare clear, concise explanations for auditors.

- Organize your documents for easy access.

- Schedule preparation meetings with your team.

Common Compliance Issues

Audits often reveal recurring problems, such as:

- Errors in sales reporting or Industrial Funding Fee (IFF) calculations

- Violations of the Price Reduction Clause

- Offering unauthorized products

- Expired registrations on SAM.gov

- Insufficient or missing documentation

Professional Support

If you’re feeling overwhelmed or unsure, it may be worth consulting GSA contract specialists. They can assist with:

- Preparing for your first audit

- Navigating contract renewals

- Setting up new compliance systems

- Addressing findings from previous audits

- Managing constraints on time or resources

Being well-prepared for audits not only safeguards your contract but also reinforces your reputation as a dependable government contractor. With thorough documentation and consistent reporting practices, you’ll be ready to tackle any GSA audit with confidence.

Conclusion

From keeping your registrations up to date to preparing for audits, every step strengthens your position in the federal marketplace. With only 4% of small businesses listed on GSA Schedules, those who prioritize compliance gain a clear edge over competitors.

Non-compliance, on the other hand, can lead to losing access to platforms like GSA eBuy and Advantage, missing out on bids, and spending valuable time fixing errors.

Why Compliance Matters

Managing your GSA contracts effectively comes with significant benefits:

| Category | Impact |

|---|---|

| Competition | Fewer competitors due to strict compliance standards |

| Sales Cycle | Faster sales processes thanks to pre-established pricing structures |

| Revenue | Opportunity for meaningful growth in your bottom line |

| Market Access | Direct entry into the steady demand of the federal market |

"Every day you’re not on GSA, you’re missing out on $50m+ in opportunities." – Josh Ladick, Founder of GSA Focus

These advantages highlight why staying compliant is more than just a requirement – it’s a pathway to growth.

What’s Next?

While GSA compliance can seem overwhelming, it shouldn’t hold your business back from pursuing lucrative opportunities. By maintaining clear documentation and adhering to timely reporting, you create a foundation for long-term success.

If you’re unsure where to start, consider reaching out to GSA contract specialists. These experts can help you establish proper systems, ensure accurate reporting, and maintain compliance – so you can focus on expanding your federal business while staying aligned with GSA requirements.

FAQs

What are the biggest compliance challenges businesses face with GSA contracts, and how can they overcome them?

Navigating GSA Contract Compliance

Staying compliant with a GSA contract can be a tough road for many businesses. Common hurdles include maintaining pricing that aligns with contract terms, meeting strict reporting deadlines, and keeping up with ever-changing regulations. Falling short in any of these areas can lead to serious consequences, like financial penalties or even losing your GSA contract altogether.

So, how do you stay on top of it? Start by routinely reviewing your pricing to ensure it matches the terms outlined in your contract. Make it a priority to submit all required reports on time, and keep an eye on updates to GSA policies. If this feels overwhelming, consider teaming up with professionals who specialize in navigating GSA contracts. Their expertise can help you tackle these challenges and keep your compliance efforts running smoothly.

What steps can small businesses take to ensure their products comply with the Trade Agreements Act (TAA)?

To comply with the Trade Agreements Act (TAA), small businesses need to pay close attention to the origin of their products. The TAA requires that products are either manufactured in or undergo a substantial transformation in a designated country. Since the list of TAA-compliant countries can change, it’s a good idea to check it regularly to ensure your products meet the requirements.

Keeping thorough records of your supply chain is another key step. Detailed documentation can make it easier to prove compliance during audits or reviews. If you’re uncertain about the rules or how they apply to your business, reaching out to professionals who specialize in GSA contracts can provide valuable clarity and help you avoid mistakes. Taking these steps can make navigating TAA requirements much smoother.

How can a company prepare for a GSA audit and ensure all required documentation is ready?

Preparing for a GSA Audit

Getting ready for a GSA audit requires businesses to stay on top of their records and ensure they meet compliance standards. Here’s how you can approach it:

- Keep your documentation in order: Make sure all contract-related records – like pricing details, sales reports, and compliance certifications – are well-organized and easy to retrieve when needed.

- Stay familiar with your contract terms: Regularly go over the terms and conditions of your GSA Schedule to make sure you’re consistently meeting the requirements.

- Perform internal checks: Conduct self-audits periodically to catch and fix any compliance issues before the official audit rolls around.

By staying proactive, you can reduce the chances of running into problems during the audit and show that you’re serious about adhering to GSA standards.

Related posts

- How to Track GSA Contract Compliance

- Top 5 Compliance Issues in GSA Contracts

- Common GSA Compliance Mistakes And Fixes

- Checklist for GSA Construction Contract Compliance