Want to outshine your competitors in the GSA Schedule market? Here’s the quick answer: Use free government tools like GSA eLibrary, GSA Advantage!, SSQ+, CALC Tool, and FPDS to analyze pricing, sales, contracts, and competitor strategies. These tools help you:

- Set Competitive Prices: Use GSA Advantage! and the CALC Tool to analyze real-time pricing and labor rates.

- Track Sales Trends: SSQ+ shows historical sales data and quarterly trends.

- Understand Competitor Contracts: FPDS provides detailed contract award data and agency preferences.

- Identify Market Gaps: GSA eLibrary helps spot under-served areas and market density.

Quick Comparison of Tools

| Tool | Purpose | Key Insights |

|---|---|---|

| GSA eLibrary | Competitor identification | Contractor data, SINs, market gaps |

| GSA Advantage! | Real-time pricing analysis | Product specs, pricing, positioning |

| SSQ+ | Sales tracking | Quarterly sales by SIN and trends |

| CALC Tool | Labor rate benchmarking | Service-related pricing comparisons |

| FPDS | Contract award research | Historical awards, agency patterns |

For deeper insights and strategy, consider professional services like GSA Focus to save time and turn raw data into actionable plans. Ready to dive in? Let’s explore each tool in detail.

6 Free Tools to Research Your GSA Competitors

GSA eLibrary: Resource for Competitor Insights

GSA eLibrary serves as the go-to government database for GSA Schedule contract holders. As the official directory, it’s a practical starting point for identifying competitors in your industry.

How to Use GSA eLibrary

- Filter by Schedule and SIN Categories: Narrow down competitors based on specific contract types and Special Item Numbers (SINs).

- Compare Contracts: Look at contract durations and business classifications to spot trends.

- Analyze Market Density: Gauge the competition by checking the number of contractors in each category.

What GSA eLibrary Offers

- Contract Information: Find detailed contract numbers and their durations.

- SIN Listings: View complete category and subcategory details for awarded contracts.

- Contractor Information: Access business size classifications and contact details.

- Organized Schedule Categories: Easily browse contractors by schedule type.

Strengths and Weaknesses

| Strengths | Weaknesses |

|---|---|

| Free access with no limits | No pricing data available |

| Extensive contractor database | Lacks historical insights |

| Official government source | Missing advanced analytics tools |

| Straightforward search options | Limited functionality |

While GSA eLibrary provides a solid foundation for competitive research, it works best when combined with other tools. Its database of contract holders and service categories can support strategic decisions on pricing and market positioning.

GSA Advantage!: Analyzing Products and Pricing

GSA Advantage! offers a window into how competitors price their products and services on the government’s official purchasing platform. While GSA eLibrary identifies who your competitors are, GSA Advantage! shows exactly how they price and position their offerings.

How GSA Advantage! Works

GSA Advantage! serves as a central database where federal buyers can browse and purchase products from GSA Schedule contractors. Each product listing includes key details like specifications, prices, and vendor information, making it a valuable tool for analyzing competitors.

Using GSA Advantage! for Competitive Analysis

To get the most out of GSA Advantage!, focus on reviewing product listings in your target category. The platform enables you to:

- Compare vendor prices

- Examine product descriptions and technical details

- Review delivery terms

- Identify competitor strengths and positioning

Keep an eye on quarterly updates to competitor listings. These updates can reveal price adjustments and new product launches, helping you stay ahead of market trends and uncover opportunities to stand out.

Strengths and Weaknesses of GSA Advantage!

| Strengths | Weaknesses |

|---|---|

| Access to real-time pricing data | Limited filtering options |

| Detailed product information | Accuracy depends on vendor updates |

| Easy competitor comparisons | Basic search features |

| Vendor contact details | No historical pricing data |

| Visibility into product specs | Minimal market insight tools |

For price-sensitive categories, these insights are especially useful. Pair the data from GSA Advantage! with SSQ+’s sales tracking (covered next) to gain a broader understanding of the market. Its real value lies in helping businesses stay competitive with pricing strategies.

GSA Schedule Sales Query Plus (SSQ+): Tracking Competitor Sales

GSA Advantage! focuses on pricing, but SSQ+ dives deeper by showing what’s actually selling. It tracks competitor sales using historical data organized by SINs (Special Item Numbers) and product categories. With 12 pre-formatted reports, it highlights quarterly sales trends and fiscal year comparisons.

Features of SSQ+

SSQ+ simplifies competitor analysis with its pre-built reports, which break down sales data by fiscal year, quarter, contractor, and SIN classifications. These reports help identify market trends and competitor performance over time.

Key features include:

- Historical sales data

- Quarterly performance insights

- SIN-specific breakdowns

- Fiscal year comparisons

Using SSQ+ for Sales Analysis

One of the most useful reports is the "Total by Quarter & SIN by Contract Number and Fiscal Year." This report provides a clear view of how competitors are performing in specific product categories. It’s a great way to spot market leaders and uncover potential opportunities.

Pros and Cons of SSQ+

Like many government tools, SSQ+ comes with its own set of strengths and challenges:

| Pros | Cons |

|---|---|

| Tracks historical sales | Data updates quarterly, not in real-time |

| Offers pre-formatted reports | New users may face a learning curve |

| Free for contractors | Navigation can be tricky |

| SIN-specific insights | Relies on contractor-submitted data |

| Includes filtering options |

While it can take some time to get the hang of, mastering SSQ+ can provide a better understanding of your competitors and the market as a whole. This tool is a valuable resource for refining your competitive strategy.

sbb-itb-8737801

Contract-Awarded Labor Category (CALC) Tool: Comparing Labor Rates

While SSQ+ tracks product sales trends, the CALC Tool focuses on labor rate data for service contractors, helping businesses make informed pricing decisions in the federal market.

What is the CALC Tool?

The CALC Tool is a GSA platform designed to compile labor rates from government contracts. It specializes in service-related contracts, allowing users to compare and analyze rates across various labor categories. This helps contractors benchmark costs when preparing federal bids.

How to Use the CALC Tool for Pricing

Here’s how to make the most of the CALC Tool:

- Search labor categories: Enter categories relevant to your services, applying filters for education level, experience, and contract year.

- Compare rates: Analyze rates across contracts to spot pricing trends and assess your position against competitors.

- Adjust your pricing: Use the data to refine your strategy, considering median rates and any outliers that could signal unique opportunities.

Pros and Cons of the CALC Tool

| Pros | Cons |

|---|---|

| Easy-to-use interface | Limited to service-related contracts |

| Free to access | Data may not always reflect the latest market trends |

| Advanced filtering options | Requires frequent updates to stay relevant |

| Detailed rate comparisons | May not include all contract variations |

| Integrates with other GSA tools | Can take time to learn for new users |

The CALC Tool is most effective when combined with other market research efforts. Regularly analyzing market data is key to staying competitive.

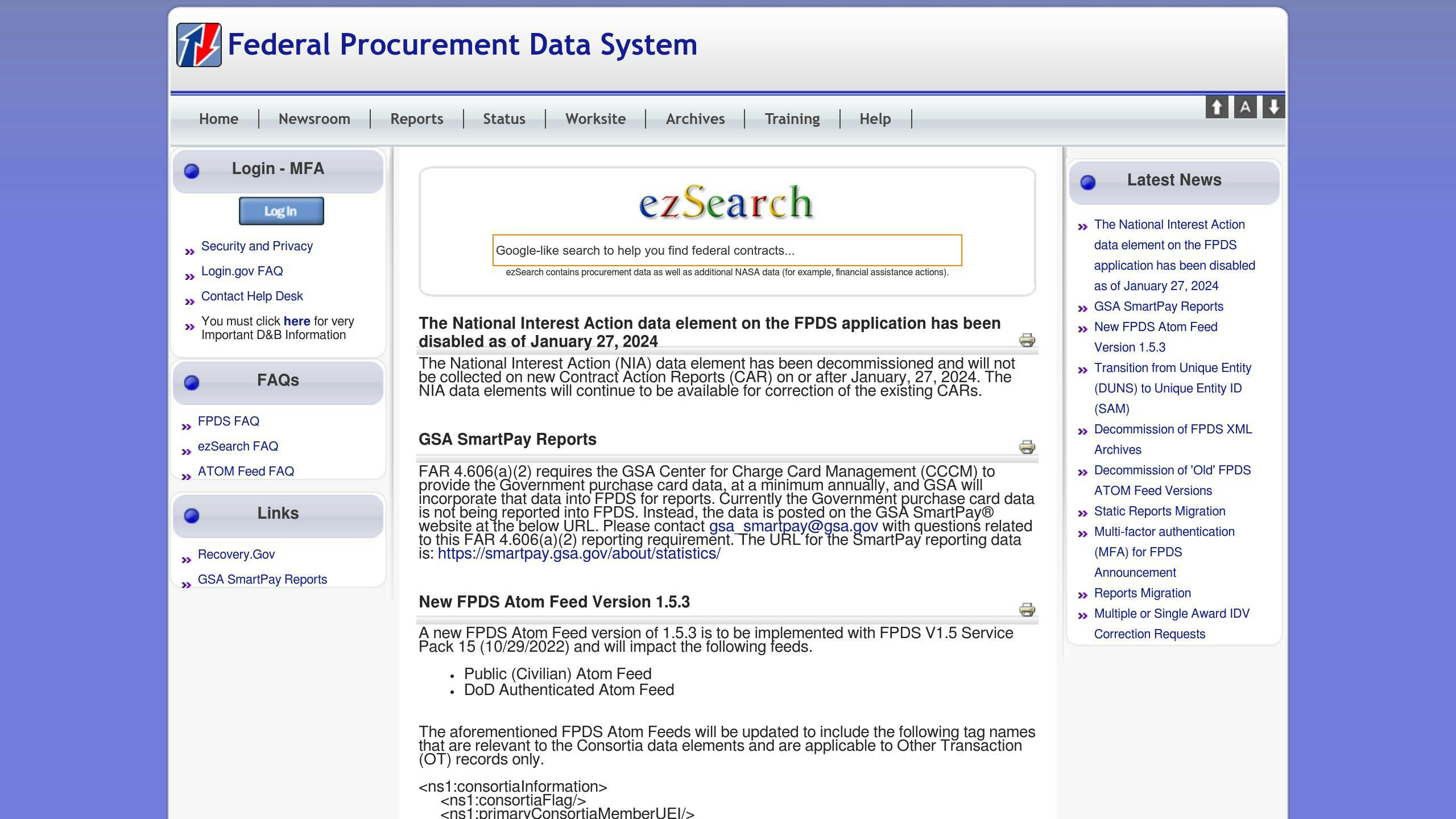

Federal Procurement Data System (FPDS): Researching Contract Awards

FPDS is the federal government’s main resource for tracking contract award data. It’s a powerful tool for GSA Schedule contractors looking to analyze competitors and understand market trends. The system keeps records of all federal contracts over $3,500, offering a detailed view of government contracting activities.

Overview of FPDS

FPDS holds a massive database with over 20 million contract records from more than 300,000 contractors. It includes data going back to 2004, making it ideal for long-term analysis. The platform provides detailed insights into:

- Contract values and award dates

- Information on winning contractors

- Purchasing patterns of specific agencies

- Set-aside categories and contract types

- Contract durations

Using FPDS for Competitor Research

FPDS goes beyond tools like CALC, which focuses on labor rates, or SSQ+, which tracks sales. It offers a broader look at competitor contracts. Some critical data points to focus on include:

- NAICS Codes: Identify direct competitors in your industry.

- Contract Values: Understand typical award sizes and pricing trends.

- Agency Awards: Discover which agencies frequently work with your competitors.

- Geographic Data: Track where competitors are active.

- Award Frequency: Analyze how often competitors win contracts.

Pros and Cons of FPDS

FPDS has its strengths and challenges when it comes to competitor research:

| Pros | Cons |

|---|---|

| Access to detailed contract data | Complex interface that requires training |

| Ability to study historical trends | Quarterly updates may delay the latest data |

| Insights into competitor performance | Filtering data effectively has a learning curve |

| Customizable search options | Extracting data can be time-intensive |

| Requires expertise to interpret market patterns |

For the best results, combine FPDS with other GSA tools like CALC for labor rate comparisons or SSQ+ for SIN-specific insights to get a complete view of your competitive landscape.

When to Seek Professional Help: Using Services like GSA Focus

Self-service tools can handle simple research tasks, but when it comes to more complex analysis, expert help can make a big difference. For small businesses with limited time and resources, professional services can simplify the process and turn raw data into useful strategies.

Overview of GSA Focus Services

GSA Focus specializes in helping small businesses get the most out of their GSA Schedule contracts. Their services cover several key areas:

| Service Area | Description |

|---|---|

| Document Analysis | Reviews competitor contracts |

| Market Intelligence | Tracks competitors over time |

| Compliance Support | Ensures adherence to regulations |

| Data Integration | Merges insights from GSA tools |

How GSA Focus Supports Competitor Research

GSA Focus takes complex data and turns it into practical strategies. Their process is built around three main steps:

1. Data Collection and Analysis

They pull data from essential GSA platforms to give clients a full picture of the competitive landscape.

2. Strategic Guidance

The team helps clients interpret the data, offering insights into:

- Pricing trends in specific contract categories

- Patterns in successful bids

- High-performing contract options

- New market opportunities

3. Execution Support

GSA Focus works side-by-side with clients to implement strategies based on their findings. This includes:

- Adjusting contracts for better performance

- Creating tailored plans for targeting specific agencies

For businesses that find competitor research overwhelming, services like GSA Focus save time and provide sharper insights. This is especially helpful for newcomers or teams with limited resources, turning raw data into actionable plans.

Conclusion: Key Points for GSA Competitor Research

To succeed in GSA competitor research, you need the right mix of tools and know-how. Free government tools, when used together, offer a deep dive into competitor activities and market trends.

Here’s how key tools work together to give you an edge:

| Tool | Primary Use | Key Benefit |

|---|---|---|

| GSA eLibrary | Contract Information | Access to contractor data and SINs |

| GSA Advantage! | Product Analysis | Insights into real-time pricing |

| SSQ+ | Sales Data | Tracks quarterly performance |

| CALC Tool | Labor Rates | Analyzes market-based pricing |

| FPDS | Contract Awards | Reviews historical award trends |

For small businesses, competitor research should be seen as an ongoing effort, not a one-off task. Using these tools together uncovers trends that help pinpoint both opportunities and risks.

If your team is short on resources, outsourcing complex analysis can turn raw data into actionable insights. As highlighted in the GSA Focus section, professional services can streamline data review, freeing up your team to focus on core priorities.

Throughout this guide, we’ve seen that successful GSA Schedule contractors often combine self-directed research with expert support. This approach allows small businesses to navigate the federal marketplace effectively while gaining the competitive intelligence needed to thrive.

Related Blog Posts

- The Stuck Subcontractor who got a GSA Contract…

- GSA Price List Update Success Stories

- How Value-Based Pricing Impacts GSA Contracts

- How to Remove Products from GSA Schedule