Federal subcontracting plans are mandatory for large contractors bidding on federal projects exceeding specific dollar thresholds. These plans ensure opportunities for small businesses, including veteran-owned and disadvantaged enterprises. Non-compliance can lead to penalties, poor evaluations, and reduced future contract eligibility.

Key Points You Need to Know:

- Who Needs a Plan: Large businesses bidding on contracts over $750,000 ($1.5M for construction). Thresholds increase to $900,000 ($2M for construction) on Oct 1, 2025.

- Plan Essentials: Includes small business goals, administrative details, compliance assurances, reporting, and payment processes.

- Types of Plans: Individual (contract-specific), Commercial (covers fiscal year), and Master (template valid for 3 years).

- Compliance: Submit reports via eSRS, track performance monthly, and maintain records for audits.

Subcontracting Plan Compliance: What Large and Small Contractors Need to Know

Required Elements of a Subcontracting Plan

Creating a compliant subcontracting plan is no small task. It must include all the mandatory components outlined in FAR 52.219-9. Overlooking even one requirement can lead to plan rejection and possibly make you ineligible for a contract. Below, we’ll break down the essential elements that every subcontracting plan needs to cover.

Mandatory Plan Components

Here’s what needs to be included in your subcontracting plan to meet compliance standards:

Goals and Financial Projections

You’ll need to set specific goals for six categories of small businesses: small business, veteran-owned small business, service-disabled veteran-owned small business, HUBZone small business, small disadvantaged business, and women-owned small business concerns. These goals should be expressed in two ways: as total dollars subcontracted and as a percentage of planned subcontracting dollars. For individual plans, contracting officers may also require goals expressed as a percentage of the total contract value.

Descriptive and Administrative Elements

This section requires a detailed breakdown of planned subcontracting dollars. For individual plans, specify the total dollars allocated for subcontracts. For commercial plans, include total projected sales and the estimated value of subcontracts. You’ll also need to outline the principal types of supplies and services you plan to subcontract for each small business category. Be sure to explain how you developed your goals, name the person responsible for managing the subcontracting program, and describe their duties. If indirect costs are included in your goals, explain how you calculated each small business category’s share.

Compliance Assurances

Your plan must ensure fair opportunities for all small business categories to compete for subcontracts. It should include a commitment to incorporate FAR 52.219-8 ("Utilization of Small Business Concerns") in all subcontracts that allow for further subcontracting. Additionally, subcontractors with awards exceeding $750,000 (or $1.5 million for construction) must adopt compliant subcontracting plans.

Reporting and Record-Keeping

You’re responsible for cooperating with studies and surveys, submitting periodic reports through eSRS (Electronic Subcontracting Reporting System), and ensuring that subcontractors also submit reports via eSRS. Include details on the records you’ll maintain, such as source lists, organizations contacted, solicitation records, outreach efforts, and internal guidelines.

Good Faith Efforts

Your plan must reflect a commitment to actively source supplies, services, or construction work from small business concerns as outlined in your proposal. If you’re unable to meet these commitments, you’re required to provide a written explanation to the contracting officer within 30 days of completing the contract.

Payment and Communication

Subcontractors must be able to discuss payment-related issues with the contracting officer. Your plan should also commit to timely payments and include a process to notify the contracting officer about any delays or payment reductions.

3 Types of Subcontracting Plans

The government recognizes three types of subcontracting plans. Selecting the right one depends on your business model and contracting needs.

Individual Subcontracting Plans

These plans are contract-specific and cover the entire duration of the contract, including any option periods. Goals are based on the anticipated subcontracting for that specific contract and must address each small business category separately. Indirect costs can be allocated on a prorated basis. Contractors must submit Individual Subcontract Reports (ISRs) semi-annually and within 30 days of contract completion, along with Summary Subcontract Reports (SSRs). Accurate, contract-specific records are a must.

Commercial Subcontracting Plans

Ideal for contractors providing commercial products or services, these plans cover your fiscal year and apply to all commercial and government business. Instead of focusing on a single contract, they address your overall subcontracting efforts. Once approved, a commercial plan is valid for all contracts requiring a subcontracting plan, provided the products and services remain commercial.

Master Subcontracting Plans

A master plan serves as a template, including all required elements of an individual plan except for goals. Approved master plans are valid for three years and can be referenced in individual plans. However, you’ll still need to develop specific goals and address any unique requirements for each individual contract.

Choosing the right plan type depends on your operational structure and contract portfolio. Commercial plans are best for companies offering standardized products or services, while individual plans suit contractors with unique project requirements. Master plans, on the other hand, streamline the process for businesses frequently bidding on similar contracts, ensuring consistent subcontracting practices across multiple projects.

How to Create and Submit Your Subcontracting Plan

Crafting a subcontracting plan involves more than just filling out forms – it’s about setting achievable goals, completing the necessary paperwork, and addressing feedback from contracting officers. By understanding each step, you can avoid delays and improve your chances of approval.

Setting Small Business Goals

When establishing your subcontracting goals, focus on realistic opportunities for small businesses. The government expects these goals to reflect actual chances for small business participation, not arbitrary figures.

Start by reviewing your past subcontracting data to set a baseline. Look into the types of work you’ve subcontracted and the small business categories involved. If you’re new to federal contracting, research similar businesses in your industry or check publicly available subcontracting reports to understand typical participation rates.

Your goals should be expressed in two ways:

- Dollar-based goals: These represent the dollar amounts you plan to subcontract to each small business category. For individual plans, this ties directly to your specific contract. For commercial plans, it covers your entire fiscal year across all activities.

- Percentage-based goals: These translate your dollar amounts into percentages of your total planned subcontracting dollars. Contracting officers will compare your percentages to government-wide benchmarks and agency-specific targets. While you don’t have to match these benchmarks exactly, you’ll need solid reasoning for any significant differences.

Consider the nature of your work and the availability of qualified small businesses in your industry. For instance, a construction project may have different participation patterns than an IT services contract. Document the factors influencing your goals, as this will help if contracting officers question your targets.

Market research plays a key role. Use tools like SAM.gov to find potential small business subcontractors, and reach out to local Small Business Development Centers or Procurement Technical Assistance Centers to better understand the capabilities of small businesses in your area.

Once your goals are established, prepare the required documentation.

Completing and Submitting Required Documents

The paperwork you’ll need to complete depends on your contract and agency requirements, but most agencies provide templates to guide you. These templates align with FAR 52.219-9 standards, ensuring you include all necessary details.

For example, GSA Form 4006 is often used for GSA contracts. This form organizes the required elements, including your goals, methodology, outreach efforts, and compliance assurances. Completing it thoroughly reduces the risk of missing critical information.

When filling out the form, be specific. Avoid vague statements and instead detail your outreach methods, such as the databases you’ll use to identify small businesses and the steps to ensure fair competition. Clearly explain your methodology, including how you used market research, historical data, or industry benchmarks to develop your goals.

Include contact details for the program manager responsible for implementing the plan. This individual should have the authority and resources to ensure the plan’s success.

Submission methods vary by agency. Some require electronic uploads through specific portals, while others accept email or physical submissions. Pay close attention to formatting requirements, file size limits, and naming conventions outlined in the solicitation.

Submit your plan early to allow time for review and potential revisions. Rushed, last-minute submissions increase the likelihood of errors or requests for significant changes.

Responding to Feedback and Making Revisions

After submitting your plan, contracting officers may request clarifications or revisions. This is a normal part of the process and doesn’t mean your plan is being rejected.

To address feedback, focus on refining your goal justifications and methodologies. For example, if your goals are deemed too high or too low compared to industry norms, provide clear explanations. If you’re increasing goals, explain what new opportunities you’ve identified or how your outreach approach will change. If defending lower goals, cite specific market research or operational constraints.

Improving your documentation often involves making your commitments more measurable. Replace general statements with specifics, like how many small businesses you’ll contact or how often you’ll conduct market research. Clearly outline the methods you’ll use to track progress.

Stick to the deadlines for submitting revisions. Missing these can delay your contract award or even result in your proposal being deemed non-responsive.

Throughout this process, maintain professional and collaborative communication. If feedback is unclear, ask for clarification. Provide updates on your progress to show you’re actively working toward a resolution. This builds confidence in your ability to manage the subcontracting program once the contract is awarded.

Keep detailed records of all feedback and revisions. These records will not only help you during the current process but also serve as valuable references for future subcontracting plans. By following these steps, you’ll not only secure approval but also set yourself up for long-term success in meeting compliance requirements.

Maintaining Compliance After Approval

Getting your subcontracting plan approved is just the first step. The real challenge begins when you start executing the contract and tracking your progress toward the goals you committed to. To stay compliant, you’ll need to consistently report, monitor performance closely, and maintain detailed records for potential government reviews.

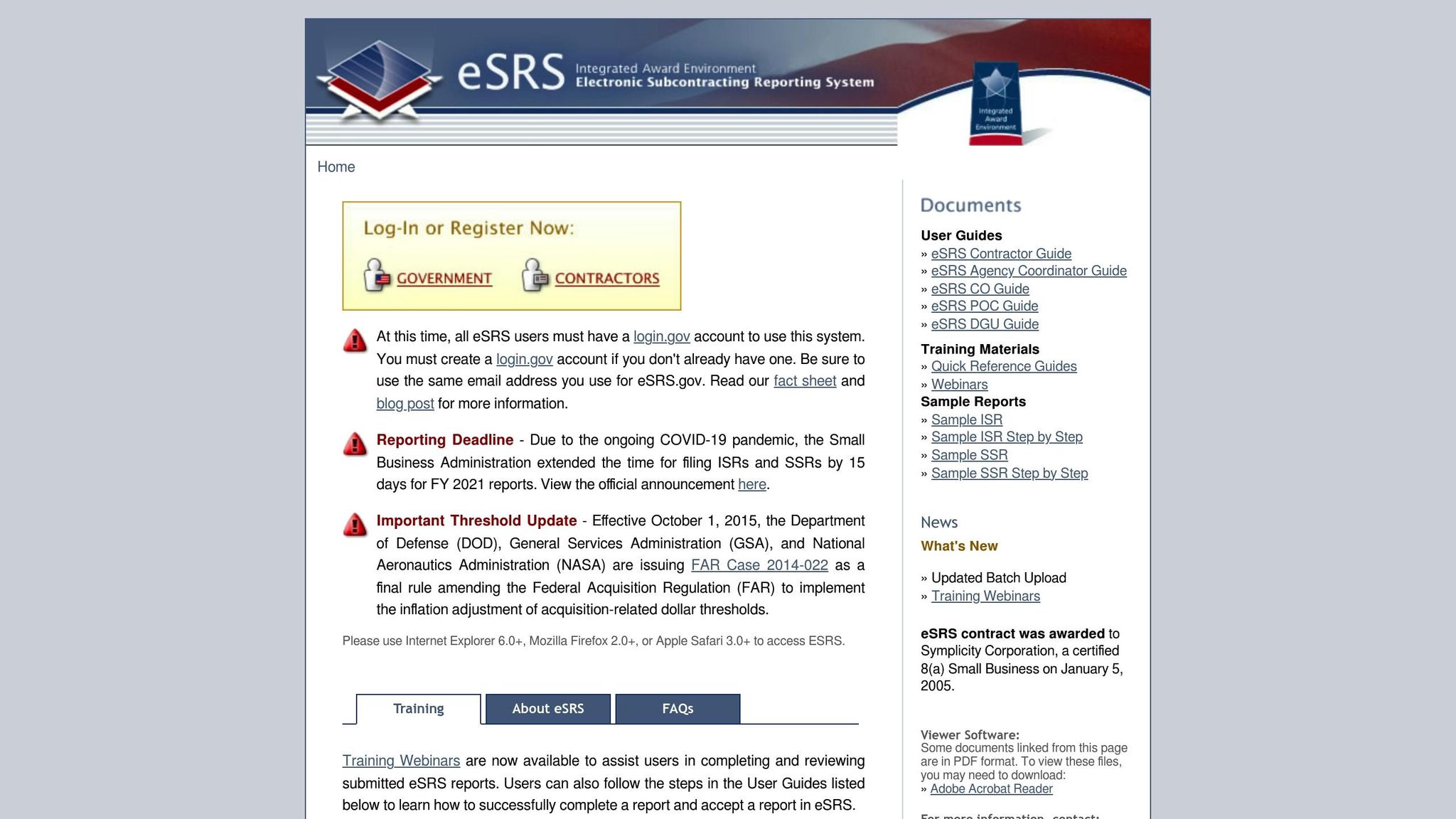

Submitting Reports in eSRS

The Electronic Subcontracting Reporting System (eSRS) is the government’s main platform for tracking subcontracting performance across federal agencies. Depending on your contract terms, you’ll need to submit reports either semi-annually or annually.

Once you begin subcontracting, your reporting obligations kick in. Each report requires detailed data about your subcontracts, such as the subcontractor’s business size, the dollar amount awarded, and the type of work performed. You’ll also need to show your progress toward each small business category goal, both in dollars and percentages.

- Individual contract reports focus on the specific contract tied to your subcontracting plan. These track your performance against the goals for that particular contract.

- Summary reports, often used for commercial plans, provide an overview of all your subcontracting activity across contracts during the reporting period.

The eSRS system helps by validating your data as you enter it, flagging errors like mismatched totals or incorrect percentages. It also cross-checks subcontractor information with the System for Award Management (SAM) database to confirm business size certifications. Pay close attention to these validations – they can save you from submitting inaccurate reports.

Missing deadlines can lead to payment delays, so it’s wise to set up internal reminders to ensure timely submissions. Also, double-check NAICS codes and business size classifications to avoid skewing performance metrics. Once your reporting is on track, the focus shifts to real-time performance monitoring to meet your goals.

Tracking Your Performance

Tracking performance isn’t just about recording subcontract awards – it’s about keeping a close eye on your progress throughout the contract period and addressing potential issues before they escalate.

Conduct monthly performance reviews to measure how you’re doing against your initial goals. These reviews help you identify whether any delays are due to normal contract timing or if you need to ramp up outreach to small businesses.

Document everything. Keep records of your outreach efforts, including the small businesses you contacted, the opportunities you advertised, and the responses you received. If you fall short of your goals, this documentation will show that you made genuine efforts to meet them.

Sometimes, external factors like shifting market conditions can affect your ability to meet goals. For instance, if a specialized service is no longer available from small businesses in your area, document your search efforts and explain why qualified small businesses couldn’t perform the work.

Your tracking system should flag potential issues early. For example, if you’re consistently awarding fewer subcontracts to small businesses than planned, investigate why. Is it due to a lack of qualified small businesses, or are internal processes unintentionally favoring larger subcontractors? Identifying and addressing these problems early can prevent larger compliance issues down the line.

If a small business subcontractor underperforms and you need to replace them with a larger business, thoroughly document the situation. Include records of the performance issues, your attempts to resolve them, and your efforts to find another qualified small business replacement.

Consider using automated tracking tools that integrate with your accounting and procurement systems. These tools can provide real-time updates on your progress and alert you to trends that suggest you might miss your targets.

Getting Ready for Audits and Reviews

Strong tracking and documentation practices not only help you stay compliant but also prepare you for audits and reviews. Government agencies may conduct desk audits of your eSRS reports or more in-depth on-site reviews of your records and processes. Being ready means keeping detailed, organized documentation and knowing what auditors will look for.

Record retention rules generally require you to keep records for three years after the contract ends, though some agencies may have longer requirements. Organize your records by reporting period and small business category. Include not just final subcontracts but also solicitation documents, quotes received, evaluation criteria, and selection rationale.

Auditors will verify subcontractor certifications to ensure they were valid at the time of the award. If a subcontractor’s size status changes during the contract, document when you learned of the change and how it impacted your reporting.

Your outreach documentation should tell a complete story of your efforts to engage small businesses. Include copies of opportunity announcements, event attendance records, correspondence with small business organizations, and responses to your outreach efforts. Auditors want to see genuine engagement, not just surface-level compliance.

Be prepared to show how you identified subcontracting opportunities, evaluated potential subcontractors, and made award decisions. Demonstrate that your processes considered small businesses while maintaining technical requirements and fairness.

Create summary documents that outline your overall approach and highlight successes. Go beyond dollar amounts – mention the number of small businesses you’ve worked with, repeat partnerships, or any mentoring and support provided to small business subcontractors.

Financial documentation should clearly connect the subcontracting dollars you reported to the actual payments made. Auditors may ask for detailed breakdowns, especially for subcontracts spanning multiple reporting periods or involving complex payment structures.

Train your staff on what to expect during audits and designate specific team members as primary contacts. These individuals should fully understand your subcontracting program and the relevant regulations to handle reviewer questions confidently.

Available Resources and Professional Help

Navigating subcontracting plan compliance can feel overwhelming, but there are plenty of resources and professional services to help you stay on track. Below, we’ve outlined key tools and support systems to simplify the process and keep you compliant.

GSA Focus Compliance Services

GSA Focus takes the hassle out of subcontracting plan management with a full-service approach designed to save you time and effort. Their team handles everything from drafting your plan to ensuring ongoing compliance, so you can focus on growing your business.

Here’s how GSA Focus supports you:

- Tailored Plan Creation: They craft subcontracting plans that align with your contract’s specific requirements, ensuring they meet both regulatory standards and contracting officer expectations.

- Negotiation Assistance: GSA Focus manages revisions and handles queries from contracting officers, ensuring your plan meets all necessary benchmarks.

- Centralized Document Management: Their secure online platform organizes your subcontracting documents, making updates and historical data easy to access for audits or reports.

- Ongoing Compliance Support: After your plan is approved, they help you navigate regulatory changes, meet reporting deadlines, and address any compliance challenges.

This comprehensive service ensures that every detail is covered, giving you peace of mind and more time to focus on your business goals.

Government Training and Templates

For those looking to take a hands-on approach, government agencies offer a wealth of free resources to guide you through subcontracting compliance:

- Small Business Administration (SBA): The SBA provides online training modules that cover everything from basic compliance to advanced reporting techniques. Their Subcontracting Assistance Program also hosts workshops and webinars, along with a library of templates to help you get started.

- GSA’s Office of Small and Disadvantaged Business Utilization (OSDBU): OSDBU offers guidance specific to GSA contracts, including sample language and tips for setting achievable small business goals.

- Procurement Technical Assistance Centers (PTACs): Located across the U.S., PTACs provide localized federal contracting support. Many centers offer free or low-cost services, such as reviewing your subcontracting plan drafts and providing feedback.

Additional Industry Resources

Beyond government programs, several industry-specific organizations provide tools and insights tailored to your sector:

- Professional Services Council: Offers resources for service contractors.

- National Defense Industrial Association: Focuses on manufacturing and technology compliance needs.

Additionally, platforms like the eSRS (Electronic Subcontracting Reporting System) offer built-in help features, including step-by-step guides for report submissions and explanations for flagged entries.

Final Compliance Checklist

Before submitting or reviewing your subcontracting plan, use this checklist to ensure every requirement is covered. A thorough review not only confirms compliance with federal standards but also sets the stage for smooth contract execution.

Plan Structure and Required Elements

Make sure your plan includes all the necessary components:

- Clearly defined and measurable goals for small business participation.

- Transparent methods for identifying and evaluating subcontractors.

- A detailed outline of proactive measures to engage small businesses.

- A designated point of contact responsible for overseeing the plan.

Documentation and Record-Keeping Systems

Set up a system to track every interaction, including solicitation records, quote evaluations, and award decisions. Use automated alerts to flag critical dates like renewal periods, payment deadlines, and review schedules. A centralized repository for contract data is essential – this allows you to monitor deadlines, evaluate performance against goals, and stay audit-ready. Such a system demonstrates your commitment to compliance throughout the contract’s duration.

Performance Monitoring and Reporting Preparation

Before the contract kicks off, define clear Key Performance Indicators (KPIs) to measure the success of your subcontracting efforts. These could include:

- The percentage of contract dollars awarded to small businesses.

- The total number of subcontracts issued.

- Timeliness in meeting payment and deliverable schedules.

Regularly check in with subcontractors to evaluate their performance in areas like quality, timeliness, and overall reliability. Documenting these interactions not only supports active management but also helps identify and resolve issues early, ensuring compliance stays on track.

Final Verification Steps

Carefully review your plan to ensure it aligns with the specific requirements of your prime contract, including any unique agency criteria. Verify that your small business goals are realistic and backed by market research and past performance data.

Double-check that all signatures and certifications are complete, including approvals from corporate leadership or legal counsel if required. Confirm that the plan’s structure fits your contract type and addresses any special considerations relevant to your industry or agency.

FAQs

What happens if you don’t comply with a federal subcontracting plan?

Failing to comply with a federal subcontracting plan can bring about serious repercussions. These might involve financial penalties, contract termination, and harm to your reputation as a federal contractor. Repeated violations could also jeopardize your ability to win future contracts.

On top of that, federal agencies might demand corrective action plans to address any non-compliance issues and, in some cases, escalate the matter to higher authorities. Staying compliant is crucial to preserving your standing and keeping the door open for future federal contracting opportunities.

How do I choose the right subcontracting plan for my business?

When deciding on the right subcontracting plan, several key factors come into play. Start by examining the size and scope of your contract. Subcontracting plans are generally required for contracts exceeding $750,000 – or $1.5 million if it’s a construction project.

Next, determine your subcontracting objectives and decide whether an individual plan (focused on a single contract) or a commercial plan (applying to multiple contracts) better fits your needs. Consider your business’s ability to meet these objectives, the timeline of your project, and the specific subcontractors you’ll need to bring on board.

It’s also a good idea to compile a list of qualified vendors and evaluate your technical capacity to manage these partnerships effectively. By tailoring your plan to these elements, you’ll be better positioned to meet compliance requirements and achieve your project goals.

What should I do if I realize I might not meet my subcontracting goals during the contract period?

If you realize you might not meet your subcontracting goals, the first step is to pinpoint the reasons behind the shortfall. Contact your Contracting Officer as soon as possible to explain the situation and explore potential solutions. They may request a corrective action plan or additional documentation to address the issue.

In some cases, you might need to submit a revised subcontracting plan or report – usually within 30 days – to illustrate your good faith effort in complying with the requirements. Maintaining open communication and planning ahead shows your dedication to meeting your obligations and could help you avoid penalties.

Related Blog Posts

- Incentives vs. Penalties in Subcontracting Compliance

- How to Use GSA Subcontracting Plan Templates

- Why Subcontracting Plans Matter for GSA Contracts

- GSA Subcontracting Plans: Key Requirements