When bidding on government contracts, getting indirect costs right is critical. Misjudging these costs – such as fringe benefits, overhead, and general and administrative expenses – can lead to lost opportunities or financial losses. Accurate classification and allocation of these costs are essential for compliance with Federal Acquisition Regulation (FAR) and for maintaining competitive bids. Here’s what you need to know:

- Indirect Costs: These include fringe benefits (e.g., health insurance, retirement), overhead (e.g., rent, utilities), and general administrative expenses (e.g., leadership salaries, HR costs).

- Compliance: FAR 31.202 and 31.203 require consistent treatment of costs to avoid penalties. Misclassifying costs can lead to audits and financial repercussions.

- Fully Loaded Rates: Combine direct labor and indirect costs to create competitive, compliant bids. These rates are crucial for long-term contracts like GSA Schedules.

- Documentation: Certification and accurate proposals are mandatory. Without them, your bid may not be accepted.

- Allocation Bases: Choose a fair method to distribute indirect costs across contracts. Consistency is key to compliance.

Understanding these principles ensures you stay compliant, avoid penalties, and protect your profit margins. Proper planning and accurate cost allocation are non-negotiable for success in federal contracting.

How to Price Your Labor: Indirect Rates and Cost Structures (Government Contracting)

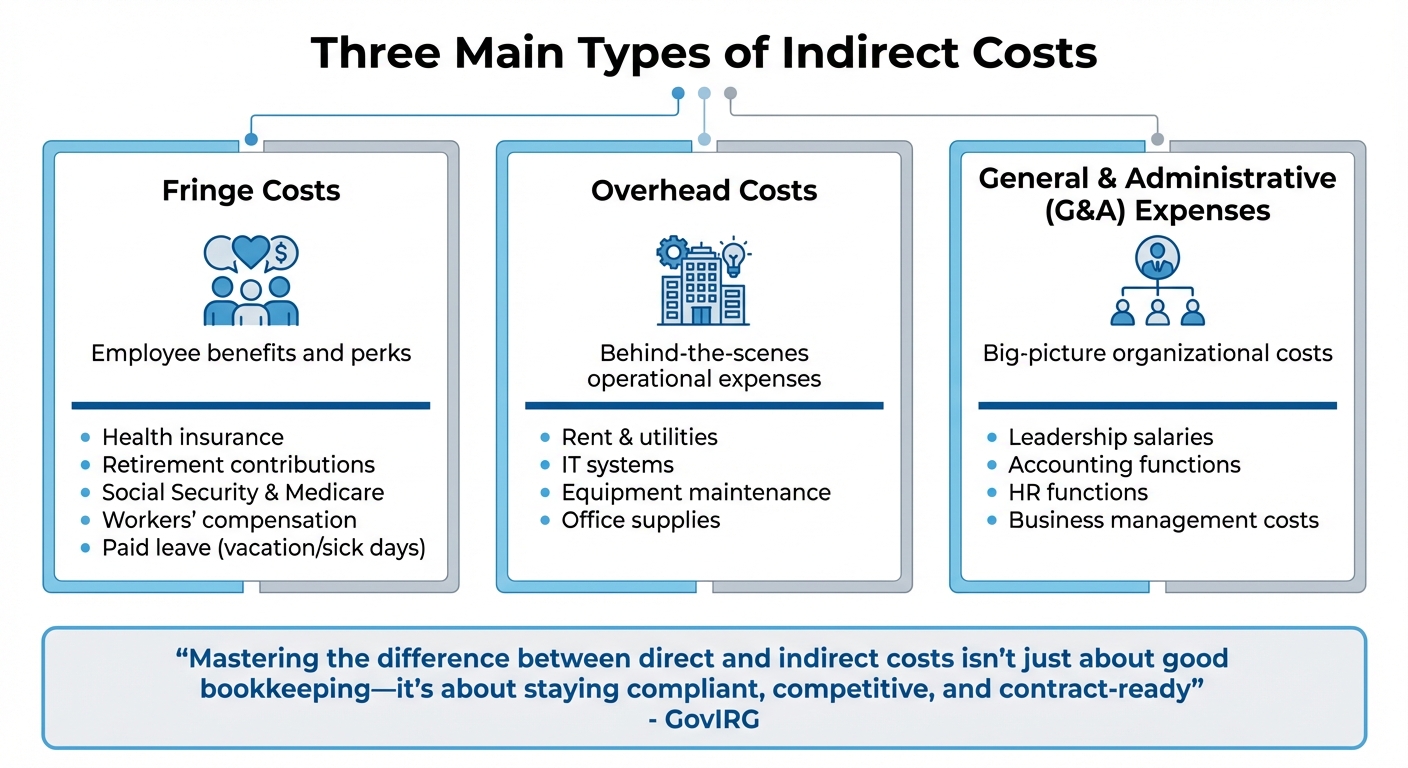

Main Types of Indirect Costs

Three Main Types of Indirect Costs for Government Contractors

When working as a government contractor, you’ll encounter three main types of indirect costs: fringe benefits, overhead, and general and administrative (G&A) expenses. Each plays a unique role in keeping your business running smoothly while ensuring compliance with both the Federal Acquisition Regulation (FAR) and Generally Accepted Accounting Principles (GAAP).

Understanding these categories isn’t just a matter of good accounting – it’s crucial for staying competitive and avoiding costly mistakes. As GovIRG puts it, "Mastering the difference between direct and indirect costs isn’t just about good bookkeeping – it’s about staying compliant, competitive, and contract-ready". Misclassifying costs can lead to serious consequences, like audit issues with the Defense Contract Audit Agency (DCAA), pricing errors that hurt your bids, or even penalties for disallowed costs plus interest. Proper categorization ensures accurate cost allocation, which is critical when preparing competitive proposals. Let’s break down each category.

Fringe Costs

Fringe costs cover the benefits and perks you provide to your employees. This includes things like health insurance, retirement contributions, Social Security, Medicare, workers’ compensation, and paid leave (vacation or sick days). These costs are vital for maintaining a productive workforce and should always be factored into your bids.

Overhead Costs

Overhead costs are the behind-the-scenes expenses that support your contract work but can’t be tied to a specific project. Think of things like rent and utilities for your office, IT systems, equipment maintenance, and general office supplies. These are the resources that keep your operations running day to day.

General and Administrative (G&A) Expenses

G&A expenses represent the big-picture costs that benefit your entire organization. These include salaries for leadership, as well as the accounting and HR functions that keep your business on track. These expenses are essential for managing and growing your company as a whole.

Separating Indirect Costs from Direct Costs

Understanding the difference between direct and indirect costs is a critical step for ensuring compliance and improving your chances of winning bids. According to the Federal Acquisition Regulation (FAR), costs incurred for the same purpose must always be treated the same way across all contracts. FAR 31.203(b) emphasizes this point: "No final cost objective shall have allocated to it as an indirect cost any cost, if other costs incurred for the same purpose, in like circumstances, have been included as a direct cost of that or any other final cost objective". This means if you classify an expense, like travel, as a direct cost for one contract, you must do the same for all similar contracts. Inconsistent classifications can lead to double-charging and audit complications. Start by identifying your direct costs to ensure proper allocation.

What Counts as Direct Costs

Direct costs are those that can be directly tied to a specific contract. These typically include:

- Direct labor: Time employees spend working exclusively on a contract.

- Direct materials: Supplies or materials purchased specifically for that contract.

- Other Direct Costs (ODCs): Expenses like travel or equipment used solely for one project.

The key is that these costs can be clearly and exclusively traced back to a single contract.

When to Treat Minor Direct Costs as Indirect

Sometimes, tracking every small expense as a direct cost can become overly complicated. In such cases, FAR 31.203(c) allows you to classify minor traceable costs as indirect, provided this approach is consistent across all contracts. For example, small items like printer paper or long-distance phone charges might be better suited for inclusion in your overhead pool. However, once you decide to treat a particular type of expense as indirect, you must apply this method uniformly to all similar costs. Consistency is non-negotiable – violations can lead to penalties, including repayment of disallowed costs plus interest.

Justifying Fair and Reasonable Indirect Costs

When working with contracting officers, you need to demonstrate that your indirect costs are valid and justified. A key piece of this puzzle is the Certificate of Indirect Costs, a formal document mandated under FAR 52.242-4. According to FAR 42.703-2, "A proposal shall not be accepted and no agreement shall be made to establish final indirect cost rates unless the costs have been certified by the contractor". Without this certification, your proposal won’t even get a foot in the door.

Another essential requirement is submitting an Adequate Final Indirect Cost Rate Proposal. This proposal must align with FAR 52.216-7(d) and include detailed, verifiable financial schedules. These schedules, often prepared in Excel, should be based on your chart of accounts and accounting records, ensuring every dollar you claim is allowable and properly allocated.

Using DCAA-Approved Indirect Rates

Having DCAA-approved rates can make federal contracting much smoother. Once a cognizant agency establishes final indirect cost rates, they apply across all federal agencies and contracting offices. This eliminates the need for repeated audits or renegotiations for every new contract. FAR 42.703-1 underscores this, stating, "An agency shall not perform an audit of indirect cost rates when the contracting officer determines that the objectives of the audit can reasonably be met by accepting the results of an audit that was conducted by any other department or agency of the Federal Government".

This approval simplifies the administrative process. When bidding, you can refer to your existing DCAA-approved rate agreements to meet the fair and reasonable cost justification. Additionally, these approved billing rates help maintain cash flow during contract performance by allowing interim reimbursement of indirect costs.

However, if you don’t have DCAA-approved rates, you’ll need to rely on alternative documentation methods.

Documentation Options Without Approved Rates

If DCAA-approved rates aren’t available, you can still demonstrate that your indirect costs are reasonable. Start by proposing billing rates for interim reimbursement. These rates should be based on audited historical data, prior contract experience, or other verified sources. Contracting officers often use this information to establish temporary rates, which are typically conservative to avoid reimbursing unallowable costs.

Be sure to follow agency-specific checklists to include all necessary supporting documentation. FAR 42.705-1 highlights the importance of collaboration, stating, "The contractor, contracting officer, and auditor must work together to make the proposal, audit, and negotiation process as efficient as possible". Engage with auditors early to resolve any issues, and ensure that unallowable and one-time costs are excluded from your calculations. Including such costs can result in penalties equal to the disallowed amounts, plus interest – a mistake worth avoiding.

Including the Industrial Funding Fee (IFF)

When bidding on a GSA Schedule contract, one key cost you need to account for is the Industrial Funding Fee (IFF). This fee is essential because it reimburses the GSA’s Federal Acquisition Service for running the Federal Supply Schedules Program, as outlined in 40 U.S.C. 321 (GSAM 552.238-80). To comply with federal requirements, you must include the IFF in your contract prices, ensuring it’s part of the total amount charged to ordering activities.

The IFF is calculated as a percentage of your total quarterly sales under the GSA Schedule. While the ordering activity pays the fee as part of the contract price, it’s your responsibility to remit the collected amount to the GSA. Additionally, you’re required to report all contract sales – including when there are no sales – within 30 days after the end of each reporting quarter. Missing this deadline could result in a debt owed to the U.S. Government and may even lead to the termination of your contract.

When working on your indirect cost proposal, make sure to factor the IFF into your pricing. It’s also a good idea to check the GSA Vendor Support Center annually for updates on the IFF percentage. Whether you base your accounting on receipt of orders, shipments, or invoice issuance, ensure that your method is consistent with your established commercial practices.

IFF revenues not only support the Federal Supply Schedules Program but also fund other Federal Acquisition Service (FAS) initiatives. If you’re a contractor under Transactional Data Reporting (TDR), your reported unit prices and overall pricing must include the IFF to remain compliant.

Treat the IFF as an integral part of your indirect cost structure, much like overhead or administrative expenses. Neglecting to include it could lead to compliance problems and cost shortfalls. For those new to GSA contracting, GSA Focus can help you create proposals that align with federal requirements and ensure your pricing is on point.

Choosing the Right Allocation Bases

After identifying your indirect cost pools, the next step is selecting an allocation base that fairly distributes those costs across your contracts. The allocation base serves as a way to measure how much each contract benefits from indirect costs. Picking the wrong base can lead to unfair cost distribution and potential compliance issues.

Your chosen base must reflect the benefits received by each contract. As stated in FAR 31.203(c), "The base selected shall allocate the grouping on the basis of the benefits accruing to intermediate and final cost objectives". For example, facility costs like rent and utilities could be allocated using square footage or labor hours, depending on which measure best represents the benefit to each contract.

Additionally, the allocation base must apply consistently across all cost objectives being allocated. If you’re spreading overhead costs across five contracts, the base – whether it’s direct labor hours, direct labor dollars, or total costs – must work for all five. When multiple allocation methods yield similar results, opt for the simpler one. Regulations encourage practicality, so there’s no need to overcomplicate the process. Selecting the right base not only ensures fair cost allocation but also aligns with FAR requirements.

Types of Allocation Measures

Once you’ve chosen a base, the next step is determining the most accurate measure for allocating costs. The government prioritizes resource consumption measures (input measures) as the most accurate. These directly track how much of a resource each cost objective uses. Examples include direct labor hours, machine hours, or square footage. For instance, in a manufacturing facility, machine hours can measure equipment usage effectively.

If input measures aren’t feasible, consider output measures that focus on the final product. For example, purchasing department costs could be allocated based on the number of purchase orders processed for each contract. Similarly, a print shop might use the number of pages printed to allocate costs.

When neither input nor output measures are practical, you can use a surrogate measure – a proxy that aligns with the services provided. For instance, a personnel department might allocate costs based on the number of employees assigned to each contract, as staffing levels often correlate with HR needs.

For General and Administrative (G&A) expenses, which support the entire organization, the base should represent the total activity of your business. Commonly, this means using total operating expenses or total costs, as G&A expenses are not tied to specific functions but benefit the organization as a whole.

Avoiding Base Fragmentation

Once you’ve established an allocation base, it’s crucial to maintain its integrity and avoid base fragmentation. FAR 31.203(d) clearly states: "Once an appropriate base for allocating indirect costs has been accepted, the contractor shall not fragment the base by removing individual elements".

This means you cannot exclude specific cost elements from the base once it’s defined and accepted. For example, if your G&A base includes total costs, you must include all items properly includable in that base, even unallowable costs like entertainment expenses or penalties. These unallowable costs must still bear their share of indirect costs. As the regulation specifies, "All items properly includable in an indirect cost base shall bear a pro rata share of indirect costs irrespective of their acceptance as Government contract costs".

Failing to follow this rule can lead to compliance issues. If auditors find that you’ve removed certain cost elements to avoid allocating indirect costs to them, you may face recalculations and adjustments to your contract pricing. To stay compliant, include all proper elements in the base. Additionally, if your business experiences significant changes – such as fluctuations in sales volume, manufacturing processes, or subcontracting levels – you should reassess your allocation method to ensure it still provides equitable results. This approach also helps maintain consistency across cost proposals.

Indirect Costs for Order-Level Materials (OLM)

Managing indirect costs for order-level materials (OLMs) requires a tailored approach that aligns with the principles of indirect cost allocation.

OLMs refer to products, services, or solutions acquired to support an order under a Federal Supply Schedule contract but were not part of the original GSA Schedule contract. These materials present unique challenges because their costs must be determined at the order level, rather than being pre-negotiated.

To ensure pricing clarity, fixed dollar charges – not percentage rates – should be used when specifying indirect costs for OLMs.

Allowable Indirect Costs for OLMs

Recovering indirect costs for OLMs is possible when those costs directly support the acquisition and management of these materials. One of the most common recoverable costs is material handling charges, which cover the administrative tasks associated with procuring, receiving, inspecting, and managing materials outside the original contract scope.

Another allowable cost is subcontract administration charges, applicable when third-party vendors are involved in fulfilling OLM requirements. These fixed charges account for the oversight, coordination, and compliance efforts needed to manage subcontractors effectively. Additionally, for OLMs, a fixed Industrial Funding Fee (IFF) of 0.75% must be applied to reported sales and submitted within 30 days after the end of each quarter.

When determining fixed indirect costs for OLMs, work closely with the Ordering Activity Contracting Officer as outlined in GSAR 538.7104-2. Document your calculations thoroughly to demonstrate how the charges reflect the administrative burdens incurred. By aligning these fixed charges with your overall pricing strategy, you can ensure compliance while remaining competitive in your bids.

Aligning Costs with Accounting Periods

To ensure fairness and consistency in distributing indirect costs, it’s crucial to align their allocation with your company’s accounting periods. This means using the cost accounting period during which expenses are incurred and accumulated. Such alignment promotes consistent indirect cost allocation across your proposals and supports compliance with established regulations.

For contractors not governed by Cost Accounting Standards (CAS), the base period must correspond to the fiscal year used for financial reporting under Generally Accepted Accounting Principles (GAAP). Sticking to this standardized 12-month period ensures that indirect costs are allocated in proportion to the benefits derived from the related activities. This approach facilitates timely settlement of cost-reimbursement contracts and ensures consistency across various government agencies. Matching your fiscal year to GAAP not only ensures compliance but also lays the groundwork for accurate interim billing.

When your business operations change, it’s essential to revisit and adjust your allocation methods. These changes could include shifts in business focus, increased subcontracting, fixed-asset improvements, inventory changes, variations in sales or production volumes, updates to manufacturing processes, or modifications to your product line.

"The method of allocating indirect costs may require revision when there is a significant change in the nature of the business, the extent of subcontracting, fixed-asset improvement programs, inventories, the volume of sales and production, manufacturing processes, the contractor’s products, or other relevant circumstances." – FAR 31.203(e)

During the accounting period, use billing rates for interim reimbursement and adjust them as needed to reflect changes. These adjustments help keep billing rates aligned with the anticipated final indirect cost rates, reducing the risk of significant overpayment or underpayment by the government. Once the fiscal year concludes, submit a final indirect cost rate proposal within six months. This proposal should establish the actual rates based on certified costs incurred during the period, ensuring accuracy in cost allocation.

Key Takeaways

Getting your indirect costs right is essential. Overestimating them can make your bids uncompetitive, while underestimating eats into your profits. To avoid these pitfalls, stick to consistent cost classification practices. This prevents double counting, audit disallowances, and helps you stay compliant with CAS 418. Having written cost-classification policies is a smart move to ensure clarity and compliance.

When allocating costs, make sure your allocation bases fairly represent the benefits each contract gets. The connection between the base and the costs being allocated should be logical and transparent. Don’t fragment your allocation base by excluding specific cost elements – every cost item should carry its fair share of indirect costs.

Once your cost structure is set, get it properly certified. The government won’t finalize rates without certification, so it’s a non-negotiable step. Submit your final indirect cost rate proposal within six months after the fiscal year ends. Missing this deadline could lead to unilateral rate-setting, which might exclude allowable costs. Also, be cautious about including unallowable indirect costs – penalties can be severe, reaching up to twice the disallowed amount if those costs were previously identified as unallowable. Regular updates to your certified proposals are essential to reflect changes in your business.

Keep an eye on your rates throughout the year. As your business changes – whether through shifts in sales, subcontracting levels, or product lines – your allocation methods might need adjustments to ensure fairness. Regular reviews help you recover costs effectively while staying competitive in the market.

FAQs

What’s the difference between direct and indirect costs in government contracts?

Direct costs refer to expenses that can be directly tied to a specific contract or project. Think of things like labor, materials, or equipment that are solely used for that particular job. Indirect costs, by contrast, are shared expenses that benefit more than one project or objective. These typically include overhead costs – like office rent or utilities – and general and administrative (G&A) expenses, which are distributed across multiple contracts using an equitable allocation method.

Grasping the difference between these cost types is essential when preparing bids for government contracts. Properly categorizing expenses not only ensures compliance but also helps maintain a competitive edge.

What steps should I take to ensure my indirect cost rates comply with FAR regulations?

To make sure your indirect cost rates align with FAR regulations, start by categorizing your indirect costs into appropriate pools, such as overhead or general and administrative (G&A). It’s essential that these costs are reasonable, allowable, and allocable to your contracts. Choose a logical allocation base – like direct labor or total costs – to distribute these expenses fairly across all final cost objectives.

Then, collaborate with your cognizant federal agency to establish a Negotiated Indirect Cost Rate Agreement (NICRA). This agreement formalizes your rates and ensures compliance with FAR standards. Make it a habit to regularly review and adjust your rates to reflect actual costs. Apply these rates consistently across contracts to maintain transparency and ensure proper reimbursement for your indirect costs.

What should I do if I don’t have DCAA-approved indirect cost rates?

If you don’t already have DCAA-approved indirect cost rates, you’ll need to put together an indirect cost proposal to get them established. This process includes breaking down your indirect costs, selecting the right allocation bases, and keeping detailed records. Make sure to stick to the rules outlined in federal regulations like 2 CFR Part 200 and FAR Part 31 to stay compliant.

After submission, your proposal will go through a review and negotiation process. If everything checks out, you’ll receive a negotiated indirect cost rate agreement, which you can use for billing and reimbursement purposes. If it’s not approved, you might have to rely on a de minimis rate or another temporary method until your rates are officially approved.

Related Blog Posts

- Cost Element Breakdown in GSA Contracts

- How to Develop Competitive Indirect Cost Rates

- How Indirect Costs Impact Government Contract Pricing

- How Indirect Costs Impact Government Bids