The Federal Procurement Data System (FPDS) is a publicly accessible database that tracks federal government spending on contracts. It provides small businesses with detailed insights into procurement trends, competitor activities, and agency purchasing patterns. This tool is essential for businesses looking to identify federal opportunities, refine their strategies, and improve their chances of securing government contracts.

Key Takeaways:

- Access Real-Time Data: FPDS tracks all federal contracts worth $10,000 or more, offering real-time updates on awards and modifications.

- Identify Opportunities: Analyze historical purchasing patterns to align your offerings with federal demand.

- Competitive Insights: Understand competitor pricing, contract vehicles, and agency preferences.

- Set-Aside Tracking: Discover opportunities tailored to small businesses, such as Woman-Owned or Veteran-Owned set-asides.

- Streamline Searches: Use filters like agency, location, NAICS codes, or Product Service Codes (PSCs) to target high-potential contracts.

By leveraging FPDS, businesses can better understand federal spending trends, position themselves effectively, and craft stronger proposals for government contracts.

How to Search the Federal Procurement Data System (FPDS Gov)

How to Access and Navigate FPDS

FPDS offers a streamlined way to explore federal procurement data, making it an essential tool for government contracting research. Here’s how you can get started and make the most of its features.

How to Access FPDS

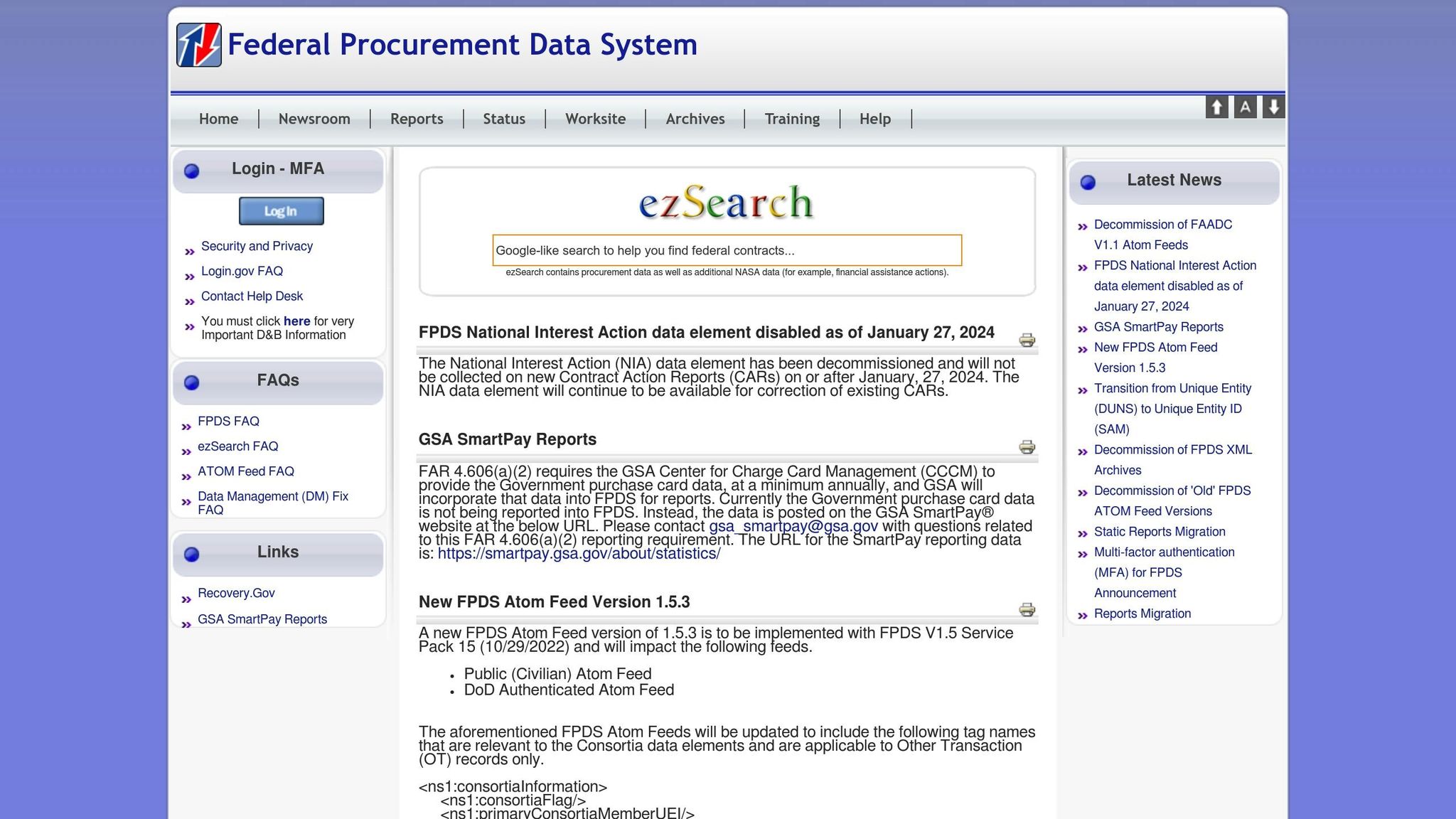

To begin, head over to www.fpds.gov and complete a quick registration process using your email address. Once registered, you’ll land on the welcome page, which provides an overview of the platform’s features and available data. For guidance, check out the detailed Help files – they’re packed with instructions on using various functions and search tools.

Main Features and Tools in FPDS

FPDS houses a massive database with nearly 50 million records covering federal procurement activities. The platform’s primary search tool, FPDS-NG ezSearch, simplifies navigation by allowing you to enter keywords or phrases related to your interests. To refine your search, you can apply filters such as department, agency, vendor, or vendor state.

One of FPDS’s strengths is its real-time updates, which track all contracts with awards exceeding $10,000. The database provides detailed insights into contracts, including supplier names, types of work, locations, and contract amounts. These details are invaluable for competitive intelligence and market research.

Understanding Data Fields in FPDS

To gain actionable insights, it’s important to understand the key data fields FPDS offers. With over 200 data elements available, focusing on the most relevant fields can make your research more effective. Here are some of the critical fields to know:

- Contract Action Type: Identifies whether the record is for a new award, modification, or other actions.

- Product or Service Codes (PSCs): Categorize what the government is purchasing, using standardized codes. These are helpful for tracking spending trends and identifying contracts that align with your business offerings.

- Agency Identifier: Indicates the government entity overseeing the purchase, including both the parent agency and the specific sub-agency or office responsible for the contract.

- Contractor Information: Provides details about the company that won the contract, including its name, location, and business size classification. This information is useful for competitive analysis and finding potential teaming partners.

FPDS also includes data on contract dates, amounts, purchaser details, competition levels, legislative mandates, service specifics, and preference programs. By mastering these fields and using FPDS’s search and filtering tools – such as narrowing results by date range, agency, contract value, or contractor name – you can conduct thorough and effective federal market research.

Conducting Market Research with FPDS

Now that you’ve learned how to navigate FPDS and understand its data fields, it’s time to put that knowledge to work. Using FPDS for market research requires a focused strategy – one that involves smart searching, analyzing competitor behavior, and leveraging advanced filters to uncover actionable insights.

Running Targeted Searches

Effective FPDS research begins with targeted searches that align with your business goals. Start broad and then refine your criteria step by step. Use official government terminology rather than industry-specific slang. For example, instead of searching for "IT solutions", try terms like "information technology services", or go even more specific with phrases like "cybersecurity" or "network infrastructure."

One of the most powerful tools for narrowing your search is filtering by Product Service Codes (PSCs). These standardized codes help track federal spending trends and identify contracts that match your services. You can refine your results further by combining keywords with filters. For instance, you could pair a set-aside designation like "Woman-Owned Small Business (WOSB)" with "construction" contracts or combine an agency name like "Department of Energy" with a focus area like "renewable energy." The ezSearch tool’s multi-filter functionality is particularly helpful for zeroing in on opportunities that fit your niche. Once your search results are refined, analyzing spending trends can help guide your strategy.

Analyzing Spending Patterns and Competitors

FPDS, managed by the GSA, is a treasure trove of data on federal procurement activities. By reviewing historical spending data, you can pinpoint which agencies are most active in your area of interest, allowing you to adjust your business strategy to align with those opportunities.

Competitor analysis is another valuable use of FPDS. You can evaluate how other contractors are performing, their bidding strategies, and their overall market approach. Focus on metrics like total contract value, the number of contracts awarded, contractor performance ratings, and spending by category. Using NAICS codes alongside keyword searches can help you refine your findings and uncover relevant spending trends. Advanced filters can take this analysis even further, enabling you to target specific contract opportunities with precision.

Advanced Filtering Techniques

Once you’ve mastered targeted searches and spending analysis, advanced filtering techniques can help you turn raw data into actionable insights. FPDS offers tools that go beyond basic keyword searches, making it easier to locate specific contracts quickly. For instance, wildcard searches using the "%" symbol – such as "COM%" – can help you capture variations like "computer", "communications", "commercial", and "compliance". Additionally, the ellipsis look-up feature expands your search options, letting you refine parameters by choosing from an extended list of possibilities.

You can also filter by competition type (e.g., full and open, set-aside, or sole-source), award date, and contract value to focus on opportunities that align with your business strategy. To ensure your data analysis is accurate, remove duplicate entries, standardize formats, and clearly label and organize your findings. Visualization tools can be particularly useful here – charting trends and patterns can help you identify areas with strong growth potential and spot emerging opportunities.

sbb-itb-8737801

Using FPDS Data for Federal Contracting Strategy

Once you’ve sifted through and analyzed FPDS data, the next step is turning those numbers and trends into actionable strategies. This is where the magic happens – using insights to target the right customers, set competitive pricing, and create a winning bid approach.

Finding Potential Agency Customers

FPDS data is a goldmine for identifying government agencies that regularly purchase what you offer. By filtering the data with your NAICS code, you can uncover which agencies have historically awarded contracts in your industry. Narrow it down further by geographic region to locate local agency offices or regional procurement centers. These smaller, localized offices might offer easier opportunities for relationship-building and contract fulfillment.

Understanding government spending patterns also helps you spot which products or services are in high demand. With this knowledge, you can fine-tune your offerings to match the specific needs of federal agencies.

Understanding Pricing and Contract Structures

FPDS data doesn’t just tell you who’s buying – it also gives you a peek into how much they’re paying and the types of contracts they prefer. This is invaluable for shaping your pricing strategy and understanding how to structure your bids.

When analyzing pricing trends, focus on key metrics like total contract value and the number of contracts awarded. You might notice patterns, such as certain agencies leaning heavily on indefinite delivery, indefinite quantity (IDIQ) contracts, while others prefer firm-fixed-price arrangements. Keeping an eye on changes in contract types or shifts among top contractors can help you spot new opportunities or potential shifts in the market. To make the most of these insights, ensure your data is standardized and reliable before drawing conclusions.

Connecting FPDS Research to GSA Schedule Opportunities

FPDS insights can also guide your strategy for GSA Schedule contracts, giving you a competitive edge. The GSA Schedules program handles around $40 billion in annual procurement from more than 12,000 contractors, making it a major avenue for federal contracting.

By analyzing procurement trends in FPDS, you can see how the government has worked with suppliers in your industry in the past. This knowledge helps you develop a strategy that aligns with GSA Schedule requirements, identifying the products and services most in demand and positioning your offerings accordingly.

GSA Schedule contracts are a type of IDIQ contract, offering government buyers access to products and services at pre-negotiated, discounted prices. FPDS data reveals what agencies are purchasing and at what price points, while the GSA Schedule provides a structured, efficient way to compete for these opportunities. With shorter lead times and a transparent process, combining FPDS insights with GSA Schedule positioning can significantly improve your chances of success.

How GSA Focus Helps with FPDS Market Research

For small business owners, navigating the Federal Procurement Data System (FPDS) can feel like trying to find a needle in a haystack. The platform holds an overwhelming amount of procurement data, but extracting meaningful insights often requires more time and expertise than most entrepreneurs can spare. That’s where GSA Focus steps in, turning the complexity of FPDS into actionable strategies that empower businesses.

Simplifying FPDS Data Analysis

GSA Focus takes the headache out of analyzing FPDS data. By helping you filter searches and zero in on the most relevant opportunities, they make it possible to uncover valuable insights without derailing your day-to-day operations. Instead of spending countless hours trying to identify procurement patterns or decipher government spending trends, you can focus on growing your business while GSA Focus handles the heavy lifting. Their expertise ensures that raw data transforms into a clear picture of federal procurement trends, giving you a competitive edge.

Comprehensive GSA Schedule Services

Beyond data analysis, GSA Focus offers end-to-end GSA Schedule services designed to help businesses break into the federal market. From preparing documents to ensuring compliance and even negotiating on your behalf, they provide everything needed to navigate the GSA Schedule process successfully. Using insights from FPDS, GSA Focus fine-tunes your application and pricing strategies, aligning them with federal purchasing trends.

FPDS data reveals what federal agencies are buying and at what price points, while a GSA Schedule positions your business to compete for those opportunities. GSA Focus bridges the gap by leveraging this data to shape your pricing and application strategies. They also provide ongoing support, including pricing updates, contract modifications, and reporting, ensuring that your business remains compliant and competitive.

With an impressive 98% success rate and a refund guarantee, GSA Focus backs its services with confidence. By combining FPDS analysis and GSA Schedule management under one roof, they equip businesses to make informed decisions based on historical pricing and contract data, enabling them to approach federal agencies with clarity and confidence.

Using FPDS for Federal Market Growth

The Federal Procurement Data System (FPDS) takes raw government spending data and translates it into actionable insights that can drive your federal market growth. With the right approach, this data becomes a powerful tool for identifying opportunities and making smarter business decisions.

By diving into FPDS data, businesses can uncover consistent demand patterns and spot emerging opportunities in the federal market. For example, analyzing historical spending trends helps you pinpoint agencies that frequently purchase products or services like yours. This gives you a clear path to position your business for future opportunities.

To get started, establish clear goals for your research. Are you aiming to better understand your market position? Identify new agency customers? Or perhaps analyze your competitors’ strategies? Each objective shapes how you use FPDS data. Long-term success comes from understanding the purchasing behaviors of specific agencies. FPDS provides insights into these patterns, allowing you to fine-tune your approach and build relationships that lead to sustained growth.

Top-performing federal contractors don’t stop there. They use FPDS as part of a broader market strategy. By analyzing pricing trends, they stay competitive. They also track competitors to identify gaps in the market, turning one-off contract wins into a steady stream of opportunities.

For even greater impact, consider partnering with GSA Focus. Their expertise in interpreting complex procurement data can help you turn FPDS insights into a strategic plan for federal market expansion. When you align these insights with your GSA Schedule positioning, as discussed earlier, you create a solid foundation for building a strong presence in the federal market.

FAQs

How can small businesses use FPDS to find federal contracting opportunities?

Small businesses can tap into the Federal Procurement Data System (FPDS) to explore federal contracting opportunities by examining procurement trends and monitoring active contracts tied to their NAICS codes. This tool sheds light on which agencies are purchasing the products or services they offer, opening doors to potential partnerships.

FPDS also provides insights into competitor contract awards, helping businesses understand government buying habits and uncover future opportunities. By analyzing this data effectively, small businesses can position themselves more strategically to align with federal contracting demands.

What advanced search techniques can help businesses find the right federal contracts in FPDS?

To get better results in FPDS, take advantage of the Advanced Search feature. This tool lets you refine your search by applying filters like contract type, federal agency, or small business set-asides. You can even stack multiple filters to zero in on specifics such as contract value, award date, or location.

If you need even more targeted information, try the custom reporting options. These allow you to tailor searches to match your business priorities, making it easier to find federal contracts that fit your goals. It’s a great way to save time and focus on the opportunities that matter most.

How can analyzing historical spending data in FPDS improve your federal contract bid strategy?

When you dive into historical spending data in FPDS, you gain valuable insights into federal procurement trends. By spotting in-demand services and analyzing agency purchasing patterns, you can shape your bids to match what agencies are actively looking for. On top of that, keeping an eye on competitor activity and their pricing strategies can give you an edge, helping you position your business more effectively.

Using this data-driven strategy deepens your understanding of the federal market and boosts your chances of submitting bids that align with agency goals and priorities.

Related posts

- How to Track Federal Sales with GSA Tools

- How To Research Federal Contract Opportunities

- Types of Federal Procurement Methods Explained

- GovCon Market Research Explained (FAR Part 10)