Striking the right pricing balance for GSA contracts is critical. Setting rates too low can erode margins over time, while pricing too high risks losing opportunities. This article explores strategies to help you price effectively while staying compliant with GSA rules.

Key Takeaways:

- Fixed Pricing vs. Volume Discounts: Fixed pricing offers simplicity and steady margins, while volume discounts can encourage larger orders but require careful compliance management.

- Economic Price Adjustment (EPA) vs. Built-in Escalation: EPA adapts to real cost changes but involves more paperwork. Built-in escalation provides predictable increases but risks mismatching inflation rates.

- Price Reductions Clause (PRC) vs. Transactional Data Reporting (TDR): PRC ties discounts to a specific customer, while TDR allows more flexible pricing but demands detailed reporting.

- Tiered Pricing vs. Prompt Payment Discounts: Tiered pricing encourages bulk purchases, while prompt payment discounts improve cash flow.

Bottom Line: The right strategy depends on your business goals, cost structure, and compliance capacity. For small businesses, simpler models like fixed pricing or tiered discounts can reduce complexity while maintaining profitability. Partnering with experts like GSA Focus can streamline the process and safeguard your margins.

How Does GSA Pricing Work? – CountyOffice.org

1. Fixed Pricing vs. Volume Discounts

When setting up a GSA Schedule, you’ll need to decide between fixed pricing (a single rate per product or service) or volume discount tiers (offering lower unit prices for larger orders). Many contractors lean toward fixed pricing because it’s straightforward – your rates remain steady until you formally modify the contract. However, volume discounts can make your offerings more appealing for bulk purchases by rewarding agencies that place larger orders. This choice affects both your profitability and compliance, as outlined below.

Profitability Considerations

Your pricing model has a direct impact on your margins and long-term financial stability. Fixed pricing allows you to maintain consistent margins and forecast revenue more reliably over the life of the contract. On the other hand, volume discounts can improve profitability on large orders by spreading fixed costs like shipping or setup across more units. But there’s a catch – if your discount tiers aren’t carefully aligned with actual cost savings, high-volume discounts could lead to mandatory price reductions under the Price Reductions Clause (PRC), which could eat into your margins.

Compliance Challenges

Fixed pricing is simpler from a compliance standpoint. You only need to maintain one set of ceiling rates, demonstrate that your pricing is "fair and reasonable", and handle modifications when necessary. Volume discounts, however, add layers of complexity. If your volume discounts are tied to PRC, you may need to extend those same discounts to GSA customers. Contractors using the Transactional Data Reporting (TDR) option have more flexibility to adjust discount tiers but face stricter requirements for accurate transaction-level reporting. This raises the need for robust internal controls and audit preparedness.

Administrative Complexity and Flexibility

A fixed-price model is easier to manage. It simplifies catalog updates, reduces pricing scenarios for audits, and streamlines order processing. Volume discount tiers, while more complex, allow you to offer competitive pricing for large purchases while keeping higher rates for smaller orders. This flexibility is particularly useful as federal category management increasingly emphasizes consolidated, high-value purchases.

Finding the Right Balance

GSA requires your pricing to match or beat your Most Favored Customer rate. By combining fixed ceiling rates with structured volume discount tiers, you can strike a balance: predictable margins for routine orders and competitive pricing for larger opportunities. This approach also helps you navigate compliance requirements without overcomplicating your pricing structure.

2. Economic Price Adjustment (EPA) vs. Built-in Escalation Clauses

When it comes to pricing adjustments in GSA Schedule contracts, you have two primary options: Economic Price Adjustment (EPA) clauses or built-in escalation clauses. Both approaches manage price increases over the 20-year contract term, but they come with distinct trade-offs in terms of profitability, compliance, and administrative effort.

Profitability Impact

EPA clauses let you adjust prices based on actual cost changes, such as inflation or supplier price hikes. To justify these adjustments, you’ll need to provide supporting data, like figures from the Producer Price Index. While this approach helps protect your margins during unexpected cost spikes, delays in approval can temporarily erode profitability.

Built-in escalation clauses, on the other hand, offer predictable rate increases – typically 2–3% annually – without requiring additional justification each year. This predictability is helpful if your actual cost growth aligns with the fixed rate. However, there’s a risk: if inflation exceeds the agreed-upon rate, your margins could shrink. Conversely, if inflation stays below the fixed increase, GSA might later question whether your rates were inflated during renegotiations.

Compliance Requirements and Administrative Complexity

EPA requests come with a fair amount of paperwork and scrutiny. You’ll often face a 12-month waiting period and will need to submit detailed pricing data to support your request. GSA Contracting Officers are becoming stricter, and requests lacking robust documentation are more likely to be denied.

Built-in escalation clauses simplify things. Since rate increases are pre-approved, you avoid the annual back-and-forth of justifying cost adjustments. However, during the initial contract award process, you’ll need to prove that your escalation rate is fair and reasonable. GSA won’t allow you to "pad" your rates in anticipation of future inflation.

Flexibility and Scalability

EPA clauses provide flexibility, making them a better fit for industries with volatile costs. Built-in escalation clauses, by contrast, are a good choice for businesses operating in stable environments. For some, a hybrid approach might strike the right balance, offering both predictability and responsiveness.

Up next, we’ll dive into PRC and TDR approaches to further refine your pricing strategy.

3. Price Reductions Clause (PRC) vs. Transactional Data Reporting (TDR)

When managing your GSA pricing strategy, you’ll need to decide between the Price Reductions Clause (PRC) and Transactional Data Reporting (TDR). This choice directly impacts how you handle commercial pricing relationships and the administrative workload tied to your contract. A careful evaluation of how each approach affects your profit margins is essential.

Profitability Impact

The PRC ties your GSA pricing to a specific Basis of Award (BOA) customer. If you later offer better terms to that BOA customer, your GSA prices must also be adjusted downward to match. This can create a significant challenge, especially if commercial discounting becomes aggressive, as it may erode your federal margins over the life of the contract.

On the other hand, TDR eliminates the BOA linkage entirely. Instead, it requires you to submit detailed sales reports, allowing greater pricing flexibility. This means you can adjust prices based on market conditions without automatically reducing your GSA prices. For businesses with pricing models that vary – like volume-based discounts – TDR provides a way to protect margins by separating federal pricing strategies from commercial ones.

Compliance Requirements and Administrative Complexity

Compliance is another key factor to consider. With PRC, you must identify and document your BOA customer at the outset and continually monitor your commercial sales to ensure GSA terms remain as favorable. This requires meticulous record-keeping and immediate action if a trigger event occurs. The 2025 GSA pricing guidance emphasizes that "you’ll be tied to a Basis of Award customer", and offering better discounts to that customer "can force you to lower your GSA prices too". To stay compliant, you’ll need to train your sales and finance teams and implement clear internal processes to flag deals that could trigger reductions.

TDR, by comparison, shifts the focus to monthly electronic reporting. You’ll need to provide detailed transaction data through GSA’s systems, which demands a robust data management process and staff familiar with submission protocols. While this removes the need to monitor a specific BOA customer, it introduces a different kind of administrative workload. Regardless of the method you choose, GSA expects contractors to maintain detailed records and be "audit-ready and documentation strong" to meet compliance standards.

Flexibility and Scalability

When evaluating scalability, consider how each approach aligns with your growth goals. PRC enforces a fixed pricing structure, which can make it difficult to adapt to varied commercial strategies. In contrast, TDR supports scalability by allowing dynamic pricing adjustments as your federal sales increase. For businesses aiming to expand their GSA presence, the flexibility of TDR may outweigh the added reporting requirements.

Ultimately, your choice between PRC and TDR will shape your ability to maintain profitability and adapt to federal pricing rules as your business evolves.

4. Tiered Pricing Models vs. Prompt Payment Discounts

When shaping your GSA pricing strategy, you’ll find tiered pricing models and prompt payment discounts each offer distinct advantages for boosting profitability. Tiered pricing adjusts rates based on order volume – think 5% off orders over $10,000 or 10% off orders exceeding $50,000. This approach encourages larger federal purchases while maintaining healthy margins on smaller deals. On the other hand, prompt payment discounts typically offer a 1–2% reduction for faster payments (within 10–15 days), improving cash flow without changing your base prices. Let’s break down how these models impact profitability, compliance, and scalability.

Profitability Impact

Tiered pricing often drives higher revenue by encouraging bulk purchases. Contractors have reported revenue increases of 10–20% when volume tiers incentivize bundled orders. For example, one IT services contractor saw a remarkable 25% jump in orders after implementing this model. Meanwhile, prompt payment discounts help accelerate cash flow by reducing the payment cycle from 30 days to as little as 10 days. While this approach improves liquidity for reinvestment, it does slightly lower margins by 1–2% per invoice. For contracts with fluctuating order volumes, prompt payment discounts can provide stability by ensuring faster access to funds.

Compliance Requirements and Administrative Complexity

Each pricing model comes with its own compliance and administrative considerations. Tiered pricing requires meticulous documentation of discounts and careful tracking of volume thresholds to ensure compliance with GSA regulations. You’ll need robust cost-monitoring systems to update GSA Advantage! listings and prevent offering better terms to BOA customers than your GSA rates.

In contrast, prompt payment discounts are simpler to manage. Since they don’t alter ceiling prices or base discount relationships, compliance involves transparently listing the discount in your contract and applying it consistently. This straightforward approach minimizes audit risks during Contractor Assistance Visits. Additionally, prompt payment discounts don’t require tracking under the Price Reductions Clause (PRC) or Transactional Data Reporting (TDR), making them less administratively burdensome.

Flexibility and Scalability

Tiered pricing shines when it comes to flexibility. Over the life of a long-term contract – sometimes stretching up to 20 years – you can add new tiers, adjust thresholds, or adapt pricing based on transactional data and competitor insights from platforms like GSA eLibrary. This adaptability supports repeat business and positions contractors for growth in high-volume sectors like IT services.

Prompt payment discounts, while less flexible, still offer value by uniformly incentivizing faster payments across all orders, regardless of size. They require no contract modifications, making them a straightforward tool for improving cash flow during growth phases without triggering PRC risks. While tiered pricing is ideal for sectors with high transaction volumes, such as IT services, prompt payment discounts are better suited for consulting or service-based contracts.

5. GSA Focus Services

Navigating the tightrope between profitability and compliance can feel like a daunting task for small businesses. That’s where GSA Focus steps in, offering expert pricing negotiations and ongoing contract management to let you focus on serving your federal customers.

With over 18 years of experience and a 98% success rate across more than 600 clients, GSA Focus has mastered the art of pricing strategy. Their team directly collaborates with Contracting Officers to secure rates that are competitive yet profitable. Whether it’s tiered discounts, EPA clauses, or choosing between the Price Reductions Clause (PRC) and Transactional Data Reporting (TDR) models, they’ve got the expertise to justify your pricing structure. They also analyze your sales trends and discounting practices to select a compliance model that supports flexible pricing while minimizing audit risks.

"We’re your ‘dedicated negotiators’ for GSA… We’ll make sure you get fair, lucrative and reasonable prices." – GSA Focus

GSA Focus takes on the heavy lifting by handling 95% of the contracting paperwork – saving you over 100 hours of effort. From price proposals and BOA/MFC disclosures to supporting documentation, they ensure your rates meet the federal "fair and reasonable" standard. They also design escalation mechanisms to account for inflation and wage growth, helping you maintain profitability over the 5-year base period and option years.

For ongoing contract management, GSA Focus monitors your pricing compliance with PRC/TDR obligations, prepares modifications for price adjustments, and conducts competitive analyses using GSA Advantage! and eLibrary. This ensures your rates stay aligned with the market while keeping your documentation audit-ready. With their support, your time investment drops to just about 3 hours.

The results speak for themselves. Clients partnering with GSA Focus typically achieve an average 87× ROI and add roughly $927,000 in consistent revenue. Their efficient, done-for-you approach is also 4–6× faster than handling the process on your own, opening doors to federal contracting opportunities while conserving your internal resources.

Pros and Cons

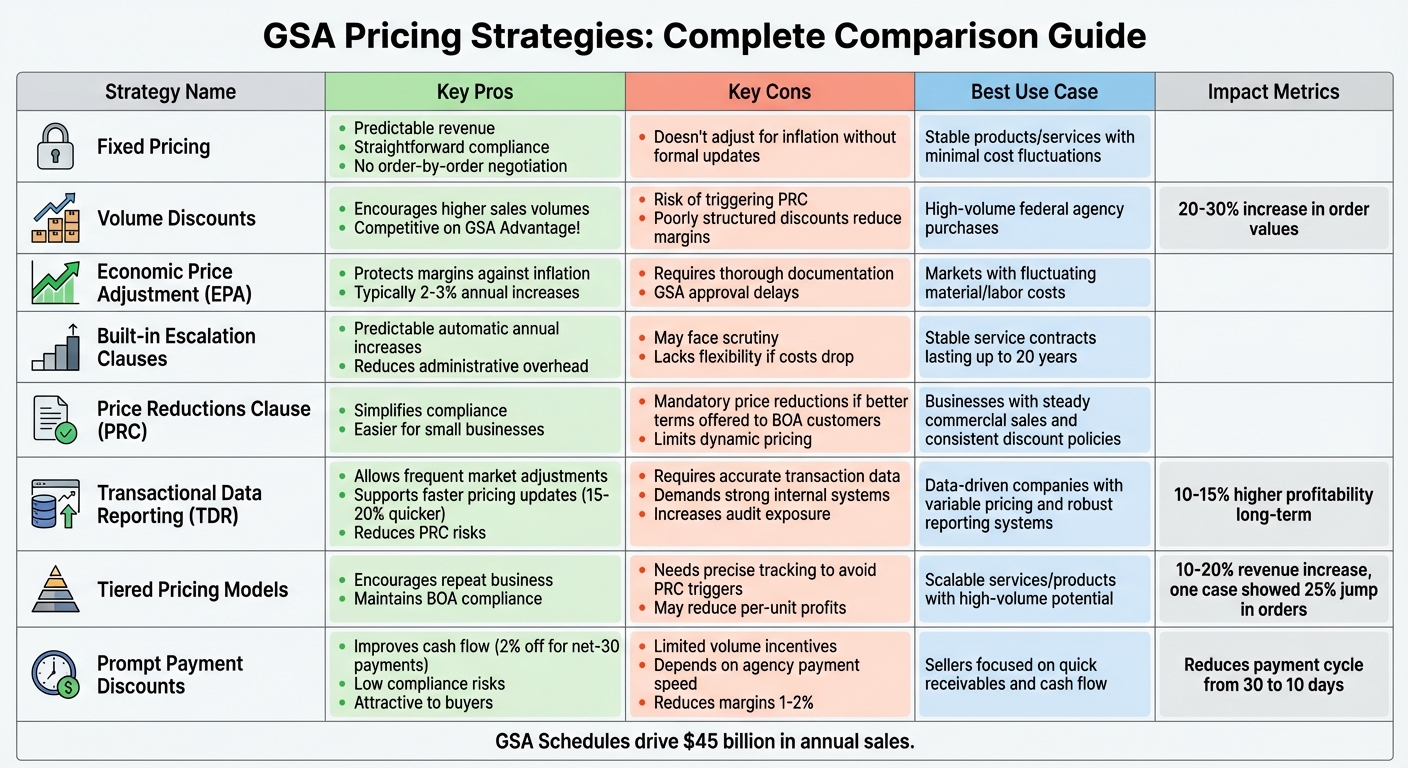

GSA Pricing Strategies Comparison: Pros, Cons, and Best Use Cases

This section breaks down the strengths, weaknesses, and ideal applications for various pricing strategies. The table below highlights the key differences between these approaches.

| Strategy | Pros | Cons | Best Use Case |

|---|---|---|---|

| Fixed Pricing | Predictable revenue; straightforward compliance; no need for order-by-order negotiation | Doesn’t adjust for inflation or cost changes without formal updates | Best for stable products or services with minimal cost fluctuations |

| Volume Discounts | Encourages higher sales volumes; boosts total sales; competitive on GSA Advantage | Risk of triggering PRC if discounts surpass Basis of Award; poorly structured discounts can reduce margins | Ideal for high-volume buyers like federal agencies purchasing in bulk |

| Economic Price Adjustment (EPA) | Protects margins against inflation and labor cost increases (typically 2-3% annually) | Requires thorough documentation of cost changes; GSA approval can cause delays | Works well in markets with fluctuating material or labor costs |

| Built-in Escalation Clauses | Provides predictability with automatic annual increases; reduces administrative overhead for long-term contracts | May face scrutiny under fair pricing evaluations; lacks flexibility if costs drop | Useful for stable service contracts lasting up to 20 years |

| Price Reductions Clause (PRC) | Simplifies compliance by tracking against Basis of Award/Most Favored Customer pricing; easier for small businesses to manage | Requires mandatory price reductions if better terms are offered to BOA customers; limits dynamic pricing options | Best for businesses with steady commercial sales and consistent discount policies |

| Transactional Data Reporting (TDR) | Allows frequent market adjustments; supports faster pricing updates; reduces PRC risks | Requires accurate and timely transaction data; demands strong internal systems; increases audit exposure | Ideal for data-driven companies with variable pricing and robust reporting systems |

| Tiered Pricing Models | Encourages repeat business while maintaining BOA compliance; can increase order values by 20-30% | Needs precise tracking to avoid PRC triggers; may reduce per-unit profits | Best for scalable services or products with high-volume potential |

| Prompt Payment Discounts | Improves cash flow (e.g., 2% off for net-30 payments); low compliance risks; attractive to buyers | Offers limited volume incentives; depends on agency payment speed; can reduce margins | Suited for sellers focused on quick receivables and cash flow improvement |

Real-world data underscores these trends. For example, hardware vendors using tiered discounts reported a 20-30% increase in order values without triggering PRC issues. On the other hand, companies unprepared for PRC obligations faced mandatory price cuts that reduced margins by 10-15%.

Market data also shows that GSA Schedules, which drive $45 billion in annual sales, favor TDR adopters for faster pricing adjustments – 15-20% quicker than PRC’s more rigid structure. Contractors with strong cost-tracking systems often see 10-15% higher profitability over the long term.

If your product offerings are stable and low-risk, fixed pricing is a simple, effective choice. However, for dynamic markets, TDR provides flexibility – provided you have the infrastructure to manage reporting. EPA is ideal for inflation-sensitive services where increases can be backed by CPI data. Regardless of the strategy, competitive analysis on GSA Advantage! and audit-ready documentation are essential to protect margins and maintain compliance with GSA pricing standards.

Conclusion

Selecting the right GSA pricing strategy starts with evaluating your business’s size, systems, and contract objectives. For small businesses, simpler pricing models – like fixed pricing with tiered discounts – help reduce administrative complexity while maintaining healthy margins over time. The Price Reductions Clause (PRC) is often easier to manage compared to Transactional Data Reporting (TDR) since it focuses on monitoring a specific Basis of Award customer rather than tracking every transaction. This foundational assessment sets the stage for more tailored strategies as businesses scale.

As your business grows, so does the potential for more sophisticated pricing approaches. Contractors with moderate or advanced reporting capabilities can incorporate built-in escalation for predictable cost increases, Economic Price Adjustment (EPA) clauses, and TDR for more dynamic pricing adjustments. For larger or data-driven businesses, TDR provides the flexibility to fine-tune pricing by product line, customer segment, or contract type when detailed transaction data is available. Combining multi-level volume discounts, contract-length incentives, and EPA clauses tied to published indices helps maintain competitive pricing while safeguarding profits in fluctuating markets.

Your overall contract goals will shape the ideal mix of discounts and escalations. If expanding market share is the priority, focus on volume discounts, flexible tools like TDR and EPA, and incentives for prompt payment, while ensuring minimum acceptable margins. On the other hand, if maximizing margins is the goal, limit discounts, rely on fixed or modestly tiered pricing, and use built-in escalation to protect long-term profitability. By modeling various scenarios in dollars (USD) over a 5- to 20-year GSA term, you can better understand how different pricing structures affect gross margins under varying order sizes, discount levels, and inflation rates.

To ensure success, start by auditing your current costs, commercial pricing, and discount trends. Decide between PRC and TDR based on your reporting capabilities, and establish robust internal controls – such as pricing approvals, discount tracking, and regular reviews – to stay compliant and adaptable. This calculated approach reinforces the importance of balancing profitability with compliance. And if navigating these choices feels overwhelming, partnering with GSA Focus ensures fair pricing, compliance, and strong margins right from the start.

FAQs

What compliance challenges should businesses consider when deciding between fixed pricing and volume discounts for GSA contracts?

When deciding between fixed pricing and volume discounts for GSA contracts, businesses encounter several compliance hurdles. One major challenge is keeping pricing accurate and current to align with GSA standards. Offering excessive discounts can not only breach compliance but also hurt profitability. On the other hand, managing volume discounts demands meticulous attention to regulations to prevent unintentional violations, all while staying competitive in the market.

Successfully navigating these complexities allows businesses to maintain compliance and optimize profitability within their GSA contracts.

What makes an Economic Price Adjustment (EPA) more flexible than a built-in escalation clause?

An Economic Price Adjustment (EPA) offers more flexibility by enabling periodic rate adjustments tied to external economic factors like inflation or market indices. This approach differs from built-in escalation clauses, which rely on pre-set percentages or formulas and may struggle to adapt when market conditions take an unexpected turn.

By using an EPA, businesses can adjust their pricing to better reflect current economic realities, helping them stay compliant while protecting profitability. On the other hand, built-in escalation clauses provide predictability but lack the agility to respond quickly to shifting economic landscapes.

Why would a business opt for Transactional Data Reporting (TDR) instead of the Price Reductions Clause (PRC)?

Businesses may lean toward Transactional Data Reporting (TDR) instead of the Price Reductions Clause (PRC) because TDR provides more room to maneuver when it comes to pricing and reporting. PRC demands price consistency for specific customers and can lead to automatic price cuts, which might hurt profitability. TDR, on the other hand, removes this concern entirely.

By using TDR, companies submit detailed sales data rather than adhering to rigid pricing rules. This approach is particularly beneficial for businesses that regularly adjust their pricing strategies or cater to a varied customer base. It offers the flexibility needed to adapt without compromising on financial stability.

Related Blog Posts

- How to Analyze GSA Competitor Pricing

- How to Set GSA Prices for Federal Contracts

- 5 GSA Discounting Rules for Compliance

- Price Reasonableness in GSA Contracts: Basics