GSA Schedule pricing is about setting pre-negotiated rates for federal contracts, ensuring competitiveness while protecting your profit margins. With over $45 billion spent annually through GSA Schedules, understanding pricing strategy is crucial. Here’s a quick breakdown:

- Pricing Flexibility: Rates are capped but allow discounts. Economic Price Adjustment (EPA) clauses help adjust prices based on market changes, though documentation is required.

- Competitor Analysis: Compare rates using tools like GSA Advantage and CALC. Stay competitive without underpricing.

- Regulations: Compliance is strict. Choose between Commercial Sales Practices (CSP) or Transactional Data Reporting (TDR) for simpler reporting.

- Profit Margins: Include all costs upfront (labor, materials, overhead). Avoid underpricing to maintain sustainability over the contract’s 20-year potential lifespan.

Balancing these factors ensures compliance, competitiveness, and profitability in the federal marketplace. For small businesses, expert guidance, like from GSA Focus, can simplify this complex process.

Pricing and Pricelist Training for MAS Vendors

1. Market and Economic Conditions

Market and economic conditions play a significant role in determining how much leeway you have when setting GSA Schedule prices. Since GSA contracts can last up to 20 years, it’s important to consider potential economic fluctuations when establishing your rates.

Impact on Pricing Flexibility

Economic Price Adjustment (EPA) clauses are designed to adjust prices based on shifts in economic indicators, such as the BLS Employment Cost Index, or unforeseen market changes. Contracting officers rely on these indices to analyze historical pricing trends and make projections for future changes, providing a clear foundation for price adjustments. However, most EPA requests can only be made after a 12-month waiting period from the contract award date and must be backed by solid, cost-based evidence.

"EPA provides for the increase and decrease to stated contract pricing upon the occurrence of specified conditions described in the EPA method, such as market index changes or unforeseeable significant changes in market conditions." – General Services Administration

That said, any adjustments must strictly adhere to compliance requirements and standards.

Compliance Requirements

Your pricing must include the 0.75% Industrial Funding Fee and comply with the Trade Agreements Act, which mandates that products must be manufactured or substantially transformed in the U.S. or designated countries. For small businesses, understanding Transactional Data Reporting (TDR) is crucial. TDR allows the government to analyze purchasing patterns and streamline federal spending. This system is replacing older pricing controls and provides more flexibility in offering commercial discounts, as long as transparency is maintained.

Beyond compliance, factors like market competitiveness and operational models also impact pricing strategies.

Competitiveness

Market conditions can determine whether your contract earns a "Best-in-Class" (BIC) designation, signaling that your pricing and terms stand out in the federal marketplace. Small businesses can stay competitive by leveraging programs like 8(a), HUBZone, or SDVOSB, even when economic pressures drive prices higher. Tools such as GSA Advantage and eBuy can help you monitor competitor pricing and refine your own rates strategically.

Operational Complexity

Developing pricing strategies often involves using market baskets that account for at least 40% of the estimated dollar value and include a minimum of 75 items to reflect key cost drivers. Additionally, the government employs reverse auctions for procurements above the micro-purchase threshold, creating competitive environments where vendors bid prices down in real time. Keeping a close eye on high-value and high-volume items ensures your pricing models stay accurate as market conditions evolve.

2. Competitor Pricing Analysis

Getting a handle on your competitors’ pricing is a critical step in carving out your position in the GSA marketplace. Contracting Officers will compare your rates to similar products or services listed on other GSA Schedules. But it’s not just about undercutting competitors – you need to demonstrate that your rates are fair and reasonable. This analysis is a cornerstone of your GSA pricing strategy and helps shape your competitive edge.

Competitiveness

Competitor analysis plays a pivotal role in strategic pricing decisions, much like monitoring market conditions. Your GSA-approved rates act as ceiling rates, meaning you can’t charge above them, but you have the flexibility to offer discounts below these rates on specific bids. This allows for competitive pricing during agency negotiations. However, pricing yourself significantly higher than competitors can put you at a disadvantage right out of the gate. As Alexander Domocol, Federal Contracts Strategist at Road Map Consulting, points out:

"Being significantly higher-priced than competitors can limit your success".

Use government pricing tools to benchmark your rates effectively. Don’t just focus on the numbers – examine the full package your competitors offer, including warranty terms, delivery timelines, and other value-added features. These details often influence Best Value determinations, where agencies weigh price alongside factors like past performance and other qualitative criteria.

Compliance Requirements

When analyzing competitor pricing, you’ll need to navigate key compliance rules. The Commercial Sales Practices (CSP) guidelines require you to disclose your Most Favored Customer (MFC) and establish a Basis of Award (BOA) customer to benchmark your pricing. If you later offer a better discount to your BOA customer, the Price Reductions Clause (PRC) obligates you to lower your GSA pricing accordingly.

Alternatively, the Transactional Data Reporting (TDR) option replaces the PRC requirement with monthly sales data reporting, focusing on market-based transparency rather than commercial discount disclosures. To stay compliant, consider setting clear discount tiers, such as volume-based or early-payment discounts. This approach helps protect your BOA relationship and minimizes the risk of triggering mandatory price reductions. With compliance in place, you can shift your attention to crafting a well-rounded pricing strategy.

Operational Complexity

Pricing is often one of the trickiest parts of a GSA proposal. It’s not enough to simply cite competitor rates – Contracting Officers expect detailed documentation, like invoices and quotes, to back up your claim that your pricing is fair and reasonable.

Take the example of Dig Defence, LLC, a woman-owned small business that secured a GSA Schedule in April 2025. By leveraging volume-based discounts and performance justifications for a niche product, they successfully navigated the pricing complexities. With guidance from USFCR, they presented a proposal that addressed unique pricing models, earning contract approval faster than usual. This case highlights how thorough competitor research, paired with well-documented pricing strategies, can set your proposal apart in a crowded field.

3. Government Pricing Regulations

Impact on Pricing Flexibility

GSA pricing regulations, guided by the Most Favored Customer (MFC) requirement, impose strict rules on how flexible your rates can be. Essentially, the government expects the rates you offer them to match – or even beat – the best deal you give to your top commercial customer. However, you can justify price differences if there are valid reasons, like higher administrative costs tied to government contracts or unique services that your commercial customers use but the government does not.

One of the few ways to adjust pricing under GSA contracts is through Economic Price Adjustment (EPA) clauses. These clauses allow price changes based on factors like fixed escalation rates, market indexes (such as the Bureau of Labor Statistics Employment Cost Index), or updates to your commercial price list. Considering that GSA contracts can last up to 20 years (a five-year initial term plus three five-year renewal options), including EPA clauses during negotiations can safeguard your margins against inflation and labor cost increases.

While these mechanisms offer some room for adjustment, they operate within a compliance-heavy framework that governs GSA pricing.

Compliance Requirements

Alongside limited pricing flexibility, strict compliance measures ensure rate parity across different customer groups. Businesses must follow one of two main compliance pathways: the Commercial Sales Practices (CSP) paired with the Price Reduction Clause, or the Transactional Data Reporting (TDR) system. If you choose CSP, you’ll need to disclose your commercial pricing, discount structures, and sales data to maintain alignment with your Basis of Award customer.

Additionally, every GSA rate must include the Industrial Funding Fee (IFF) of 0.75%, which requires quarterly reporting and payment. For non-commercial items priced over $2.5 million, you’re also required to submit certified cost or pricing data, which can increase the risk of audits and add to your compliance workload. Alternatively, the TDR option lets you bypass CSP disclosures and the Price Reduction Clause, but it requires detailed monthly transaction reporting instead.

Operational Complexity

Staying compliant with GSA pricing regulations is no small task. You’ll need robust systems to track every commercial sale and ensure you don’t accidentally violate the discount relationship tied to your Basis of Award customer. Failing to comply could lead to GSA audits or even liability under the False Claims Act. Moreover, GSA has the authority to review your books, records, and sales data at any time before awarding or modifying a contract.

Any changes to pricing – whether it’s adding new products, adjusting rates through an EPA clause, or modifying discount structures – must go through a formal contract modification process, which requires approval from a GSA Contracting Officer. For businesses without a dedicated compliance team, these administrative demands can quickly become overwhelming. Services like GSA Focus are designed to help small businesses manage these challenges by streamlining documentation, monitoring, and reporting processes.

4. Business Costs and Profit Margins

Impact on Pricing Flexibility

Managing internal costs effectively is key to maintaining healthy profit margins, especially under GSA Schedule contracts. These contracts cap your pricing at pre-negotiated levels, meaning you can’t charge more than the agreed-upon rates for listed products or services. This makes it critical to factor in enough margin upfront to cover all expenses, including direct labor, materials, and overhead costs like management. Unlike commercial pricing, which can adapt quickly to market changes, GSA contracts lock you into these ceiling rates for potentially up to 20 years.

While Economic Price Adjustment (EPA) clauses offer some flexibility to protect margins, they come with limitations. For instance, they require a 12-month waiting period and documented proof of cost increases. If you plan to use EPA Clause 552.216-70 for products or I-FSS-969 for services, ensure these terms are negotiated during the initial contract discussions.

Compliance Requirements

Profit margins under GSA contracts are determined using a structured approach. Contracting officers assign specific weight ranges to various cost elements: material acquisition typically falls between 1% and 4%, conversion direct labor ranges from 4% to 12%, and general management overhead is set between 2% and 5%. The type of contract also influences profit – firm fixed-price contracts allow for higher risk-based profit margins (3% to 7%) compared to cost-reimbursement contracts, which range from 0% to 3%.

"The contracting officer shall base the analysis of profit factors on information available to the Government before negotiations."

Compliance costs are another crucial consideration. Regular audits, contract modifications, quarterly Industrial Funding Fee reporting, and maintaining detailed documentation can significantly impact your margins. It’s vital to avoid underpricing your offerings simply to secure a spot on the Schedule. As Bipin from GSA-CS cautions:

"Avoid underpricing just to get on the Schedule – you might get stuck with prices that hurt your margins for years".

Competitiveness

Striking a balance between competitive pricing and sustainable margins requires strategic planning. Offering temporary discounts for specific bids can help secure contracts without compromising your long-term profitability. Implementing tiered pricing – such as offering lower rates for larger volume orders (e.g., 1–10 units at $100, 11–50 units at $95) – is another way to encourage bulk purchases while preserving margins on smaller transactions. Additionally, tools like the Contract-Awarded Labor Category (CALC) tool for services and GSA Advantage! for products can help you benchmark your pricing to meet the "fair and reasonable" standard.

Operational Complexity

Managing costs and margins under a GSA contract requires robust internal systems. You’ll need to track both direct costs and indirect expenses, such as travel, relocation, and consultant fees, as these are scrutinized during profit negotiations. If a significant portion of your work is subcontracted, your risk (and allowable profit) may be reduced since some of the risk is transferred to the subcontractor.

Staying on top of pricing and compliance is an ongoing effort. Annual pricing reviews, combined with regular compliance checks, are essential to avoid breaching the Price Reduction Clause. For smaller businesses, the administrative workload – especially without a dedicated compliance team – can be particularly challenging.

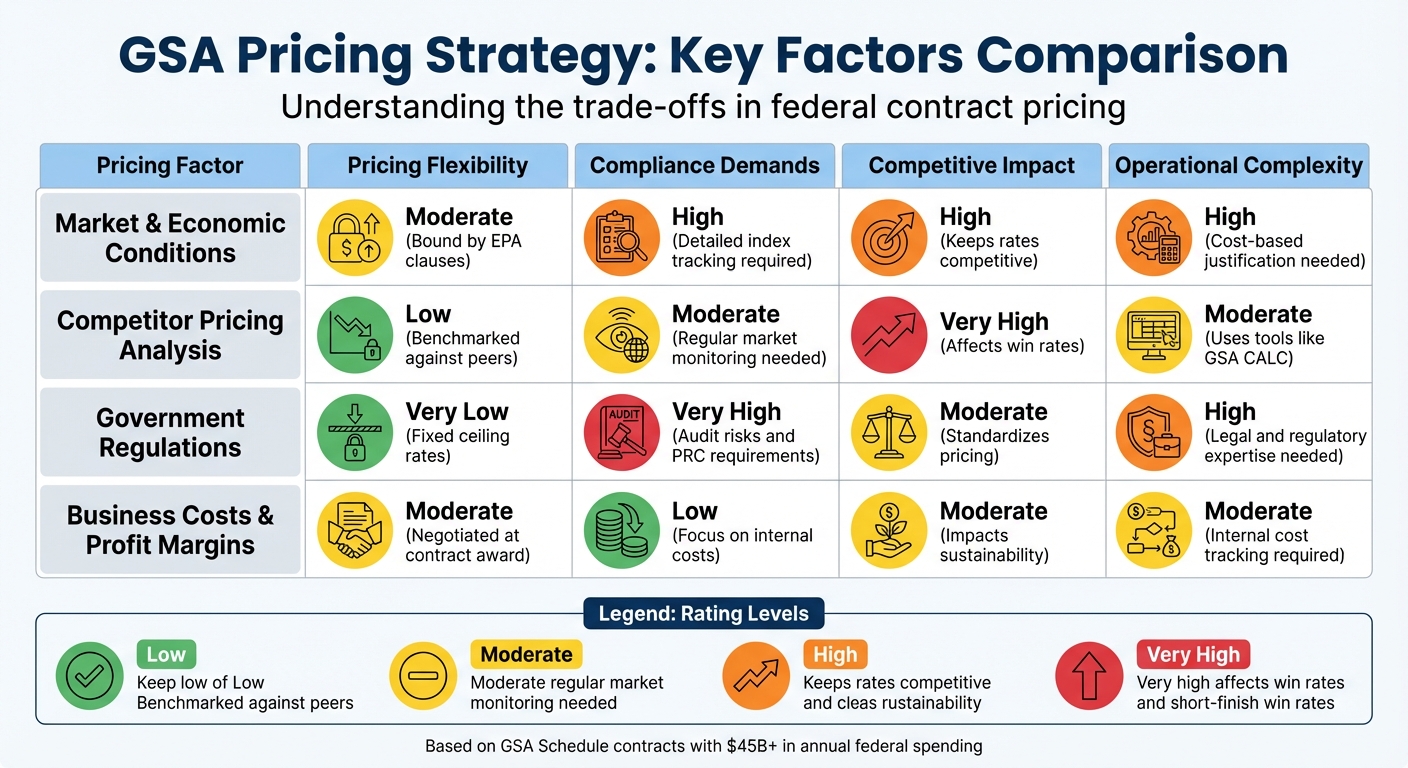

Advantages and Disadvantages

GSA Pricing Strategy Factors Comparison: Flexibility, Compliance, and Complexity

Every pricing decision within the GSA contract framework involves a balancing act, with trade-offs that can impact your long-term success. Let’s break down the key factors:

Market and Economic Conditions offer some room for adjustment through Economic Price Adjustment (EPA) clauses. These clauses allow for moderate flexibility, but they come with a catch – rigorous documentation requirements. You’ll need to track economic indexes and provide detailed cost-based justifications. While this effort ensures your rates remain competitive with industry peers, the administrative workload can be significant.

On the other hand, Competitor Pricing Analysis plays a pivotal role in determining your bid success rate. Tools like the CALC database allow GSA to benchmark your offerings against similar products, giving you insight into how you stack up. However, this process offers limited pricing flexibility since it’s largely dictated by market competition. The compliance demands here are relatively manageable, as this mostly involves market research rather than extensive regulatory reporting.

When it comes to Government Pricing Regulations, the constraints are much stricter. Pricing flexibility is minimal – your ceiling rates are locked in, and the Price Reductions Clause (PRC) may force you to lower prices if you offer better deals commercially. Compliance is a heavy burden here, with substantial audit risks and mandatory reporting requirements. Opting into Transactional Data Reporting (TDR) can reduce some of this complexity by eliminating the need for CSP disclosures, but it requires monthly data submissions instead. While these regulations ensure fairness across the board, they also reinforce the fixed nature of GSA pricing.

Lastly, Business Costs and Profit Margins give you a moderate level of control. These are typically negotiated during the contract award process and focus on internal cost accounting rather than external audits. However, underpricing to win a contract can lead to unsustainable rates over time, which can erode profitability. With GSA Schedule spending exceeding $45 billion annually, finding the right balance between competitive pricing and long-term sustainability is crucial.

To summarize these factors:

| Pricing Factor | Pricing Flexibility | Compliance Demands | Competitive Impact | Complexity |

|---|---|---|---|---|

| Market & Economic Conditions | Moderate (Bound by EPA clauses) | High (Detailed index tracking required) | High (Keeps rates competitive) | High (Cost-based justification needed) |

| Competitor Pricing Analysis | Low (Benchmarked against peers) | Moderate (Regular market monitoring needed) | Very High (Affects win rates) | Moderate (Uses tools like GSA CALC) |

| Government Regulations | Very Low (Fixed ceiling rates) | Very High (Audit risks and PRC requirements) | Moderate (Standardizes pricing) | High (Legal and regulatory expertise needed) |

| Business Costs & Profit Margins | Moderate (Negotiated at contract award) | Low (Focus on internal costs) | Moderate (Impacts sustainability) | Moderate (Internal cost tracking required) |

The key to navigating these challenges lies in identifying the elements you can control. While government regulations are non-negotiable, you can focus on optimizing internal costs and keeping a close eye on competitor pricing. This allows you to position your offerings effectively within the constraints of the GSA framework, ensuring both competitiveness and profitability.

Conclusion

Creating a successful GSA pricing strategy requires finding the right balance between staying competitive in the market, adhering to compliance rules, and protecting your profit margins. The GSA’s ceiling price structure offers flexibility to provide additional discounts for specific bids without permanently affecting your contract price. However, your initial pricing decisions can significantly influence the long-term success of your contract.

Key early decisions, like selecting between the Commercial Sales Practices (CSP) format and the Transactional Data Reporting (TDR) option, shape your administrative and pricing approach. For example, contractors eligible for TDR bypass the Price Reductions Clause entirely, meaning they avoid the risk of mandatory price drops if a commercial customer secures a better deal.

By focusing on these foundational pricing elements, you can position your business competitively while safeguarding long-term margins. Successfully navigating the complexities of GSA pricing not only ensures compliance but also unlocks significant opportunities in the federal marketplace.

GSA Focus is here to help small businesses tackle these challenges and make the most of federal contracting opportunities. Their team manages everything from document preparation to negotiating with Contracting Officers to prevent underpricing and handling price increase modifications. With a 98% satisfaction rate and clients achieving an average 87x return on investment, their expertise ensures contractors can stay competitive while maintaining healthy profit margins within the GSA framework.

FAQs

How do Economic Price Adjustment (EPA) clauses impact GSA contract pricing?

Economic Price Adjustment (EPA) clauses give GSA contractors the flexibility to modify their contract prices when market conditions shift. These adjustments can stem from various factors, such as updates to commercial price lists, shifts in the Consumer Price Index (CPI) or Producer Price Index (PPI), cost-of-living changes, or fluctuations in wages.

This built-in adaptability benefits both contractors and the government. Contractors can stay competitive in a dynamic market, while the government secures fair and up-to-date pricing. It’s a practical way to keep contracts aligned with the realities of the economy.

What is the difference between Commercial Sales Practices (CSP) and Transactional Data Reporting (TDR)?

Commercial Sales Practices (CSP) and Transactional Data Reporting (TDR) are two distinct approaches for managing sales reporting under GSA contracts.

CSP involves submitting a CSP-1 form when you’re offering a Multiple Award Schedule (MAS) contract. This form lays out your discounting policies, identifies your Most Favored Customer (MFC), and forms the foundation for GSA to negotiate pricing. Essentially, CSP focuses on the how – how you determine pricing for your products or services.

TDR, by contrast, is a monthly reporting system that captures actual transaction details. This includes contract numbers, item descriptions, unit prices, and total prices. Submitted through the GSA Sales Reporting Portal, TDR offers a snapshot of what the government is paying in real-time. Many contractors find TDR to be a less cumbersome alternative to CSP for pricing transparency.

To put it simply: CSP explains your pricing approach, while TDR records what you’ve sold and for how much.

How can small businesses comply with GSA pricing regulations?

To meet GSA pricing regulations, small businesses must ensure their contract rates are fair, reasonable, and in line with the most-favored-customer (MFC) rule. This involves offering prices that are no higher than the best commercial rates they provide. Additionally, the Price Reduction Clause requires businesses to lower their GSA prices if they offer better rates to commercial customers. Because of this, regularly monitoring sales and making necessary pricing adjustments is crucial.

Here are some essential steps to help maintain compliance:

- Conduct market research: Compare competitor pricing and industry standards to ensure your rates are competitive and fair.

- Keep detailed records: Maintain accurate documentation of your commercial pricing to demonstrate compliance with the MFC rule.

- Perform cost analysis: Break down direct costs (like materials and labor) and indirect costs (such as overhead and utilities) to ensure your profit margins are reasonable.

- Review and update regularly: Stay on top of GSA compliance requirements, including the Price Reduction Clause and reporting obligations, by routinely reviewing your pricing schedule.

By staying proactive with these strategies, small businesses can remain compliant and better position themselves for success in federal contracting. For those seeking additional guidance, GSA Focus provides expert support with documentation, cost analysis, and compliance management, helping businesses save time and reduce stress.

Related Blog Posts

- How to Analyze GSA Competitor Pricing

- How to Set GSA Prices for Federal Contracts

- How GSA Negotiates Pricing

- Price Reasonableness in GSA Contracts: Basics