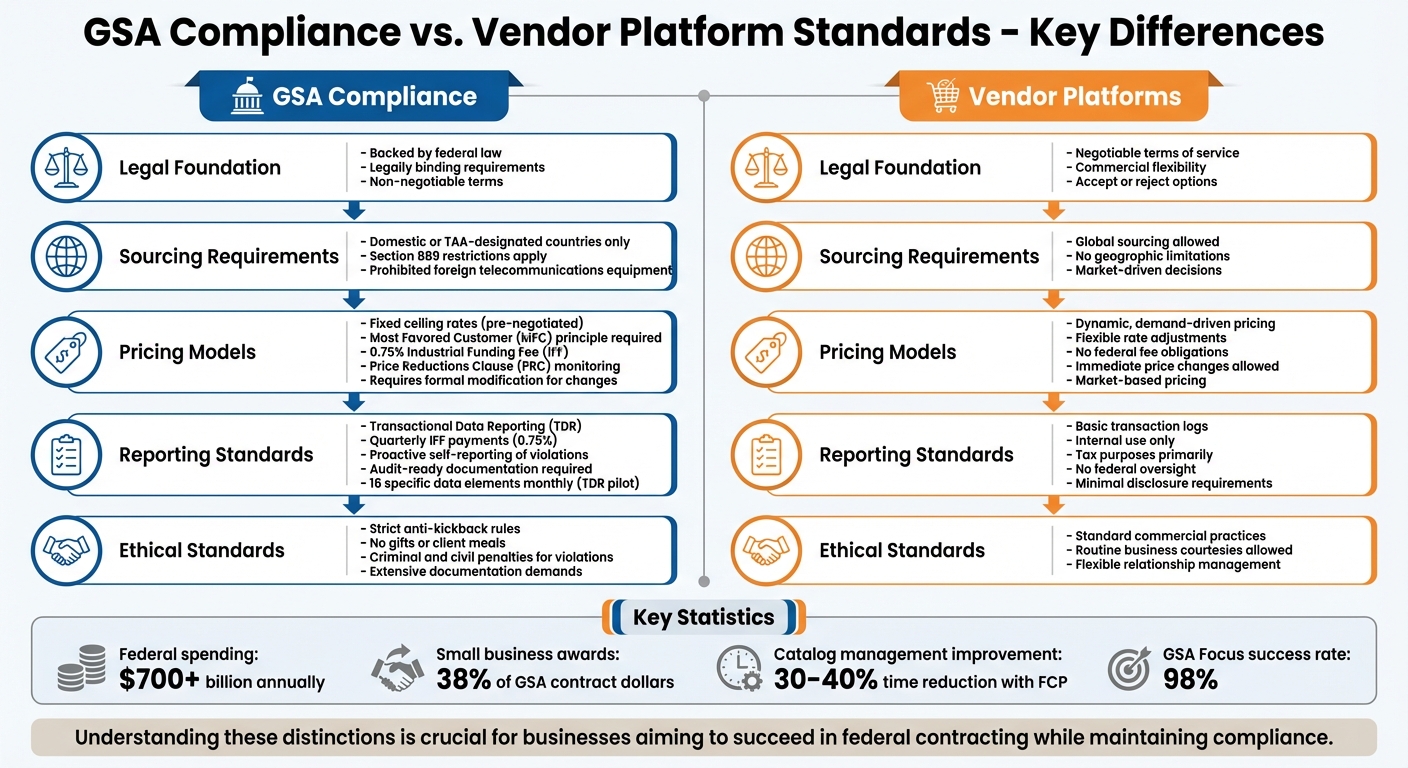

Navigating federal contracts under GSA compliance is a world apart from operating in commercial markets. While GSA compliance enforces strict rules around pricing, sourcing, and reporting, vendor platforms prioritize flexibility and market-driven practices. Here’s a quick breakdown:

- GSA Compliance: Governed by federal laws like the Trade Agreements Act (TAA) and Price Reductions Clause (PRC). Requires detailed reporting, fixed pricing structures, and adherence to ethical and sourcing standards.

- Vendor Platforms: Operate with fewer restrictions, allowing dynamic pricing, global sourcing, and simpler reporting tailored for commercial growth.

Key Differences:

- GSA rules are legally binding, while vendor platforms rely on negotiable terms.

- Federal contracts demand audit-ready records and proactive self-reporting; commercial platforms do not.

- GSA pricing is capped and pre-negotiated, whereas commercial platforms adjust prices based on demand.

Understanding these distinctions is crucial for businesses aiming to succeed in federal contracting while maintaining compliance. Below, we’ll dive deeper into pricing models, reporting standards, and integration challenges, plus tips for aligning vendor operations with GSA requirements.

GSA Compliance vs Vendor Platform Standards: Key Differences Comparison

Main Differences Between GSA Compliance and Vendor Platform Standards

Federal Regulations vs. Commercial Flexibility

The key distinction between GSA compliance and vendor platform standards lies in their legal foundation. GSA rules are backed by federal law, while vendor platform terms are negotiable. As the General Services Administration explains:

A GSAR rule specifically directed by statute has the force and effect of law.

This means GSA requirements are legally binding, unlike the flexible terms of service offered by commercial platforms, which businesses can either accept or reject.

One major area where this difference becomes evident is sourcing restrictions. GSA Schedule holders are required to source products either domestically or from Trade Agreements Act (TAA)-designated countries. Vendor platforms, on the other hand, allow global sourcing without such limitations. Furthermore, GSA compliance enforces restrictions under Section 889, which bans certain foreign telecommunications and video surveillance equipment .

Another significant difference is in ethical standards. Practices that might be routine in the commercial world, such as giving gifts or hosting client meals, can lead to anti-kickback violations under GSA contracts. These violations carry serious consequences, including criminal and civil penalties. As Crowell & Moring cautions:

The consequences for noncompliance can be dire and include criminal and civil penalties.

These stringent requirements, paired with extensive documentation demands, set GSA compliance apart from the more lenient practices of vendor platforms.

Audit-Ready Reporting vs. Basic Transaction Logs

The differences between GSA compliance and vendor standards extend into the realm of reporting and documentation, where GSA sets a much higher bar.

Detailed documentation is a cornerstone of GSA compliance. Contractors are required to maintain records that are audit-ready, including Transactional Data Reporting (TDR) and quarterly Industrial Funding Fee payments of 0.75%. In contrast, commercial vendors typically stick to basic transaction logs meant for internal use or tax purposes.

Moreover, GSA contracts mandate proactive self-reporting of violations, such as breaches of criminal law, the civil False Claims Act, or significant overpayments. This level of accountability is not a requirement for commercial vendor platforms, which generally operate with less stringent disclosure standards.

These higher reporting and ethical expectations underscore the rigorous nature of GSA compliance compared to the more relaxed protocols of vendor platforms.

Pricing and Reporting Standards Compared

Pricing Models: GSA Requirements vs. Vendor Flexibility

The GSA pricing model operates on a ceiling price structure, meaning vendors set maximum rates that cannot be exceeded without a formal contract modification. In contrast, commercial platforms allow for dynamic, demand-driven pricing, enabling vendors to adjust rates based on market conditions and client needs.

Under the Most Favored Customer (MFC) principle, GSA contractors are required to offer the government their best commercial rates. The U.S. General Accountability Office explains:

"The price analysis GSA does to establish the government’s MAS negotiation objective should start with the best discount given to any of the vendor’s customers [most favored customer(s)]."

The Price Reductions Clause (PRC) further ensures that any price reductions offered to a vendor’s "Basis of Award" customer must also be extended to the GSA. Commercial platforms, by contrast, are free from such obligations, allowing them to adjust prices quickly and without restriction.

GSA also encourages prompt payment discounts for agencies that settle invoices within 10–30 days. Additionally, all GSA pricing must be submitted as "Free On Board (FOB) Destination", meaning delivery costs are included in the quoted price.

| Feature | GSA Pricing Model | Vendor Platform/Commercial Standards |

|---|---|---|

| Price Structure | Fixed ceiling rates; pre-negotiated | Dynamic; varies by client, region, or volume |

| Best Price Guarantee | Required (Most Favored Customer/Basis of Award) | Not required; prices negotiated per deal |

| Fees | 0.75% Industrial Funding Fee (IFF) included | No federal fee obligations |

| Price Changes | Requires formal contract modification or EPA clause | Immediate, flexible adjustments |

| Compliance | Subject to Price Reductions Clause (PRC) monitoring | Minimal internal data management |

| Vetting | Rigorous "Fair and Reasonable" evaluation | Market-driven; no federal oversight |

These structured GSA pricing rules stand in sharp contrast to the more adaptable strategies seen in commercial markets.

Reporting Standards: Federal Compliance vs. Commercial Simplicity

When it comes to reporting, GSA requirements are far more detailed than those in commercial settings. Contractors must submit Commercial Sales Practices (CSP) disclosures, which include sales data from the previous 12 months and projected government sales for the upcoming year. Such transparency is not common in standard commercial contracts.

The Industrial Funding Fee (IFF) reporting clause (552.238-80) requires contractors to track all contract sales to facilitate quarterly fee payments. Participants in the TDR (Transactional Data Reporting) pilot program must report monthly on 16 specific data elements (e.g., contract number, part number). While TDR participants are exempt from the Price Reductions Clause, traditional non-TDR contracts require quarterly sales reporting by Special Item Number (SIN).

GSA retains the right to audit a contractor’s books, records, and documents at any point before an award or contract modification to ensure pricing and sales data accuracy. Commercial platforms, however, maintain proprietary control over their data and are not subject to external audits. Additionally, GSA Schedule contractors must publish and maintain an "Authorized Federal Supply Schedule Pricelist", which details all offered supplies, services, and terms.

Audits conducted by the GSA Office of Inspector General ensure compliance with pricing rules. Non-compliance can result in contract termination, mandatory refunds, or even False Claims Act liability. In contrast, commercial platforms typically limit reporting to basic transaction logs, used internally or for tax purposes, with no federal oversight or audit exposure. These differences highlight the GSA’s emphasis on accountability and transparency, which are central to its compliance framework.

Integration Challenges and Shared Features

GSA Systems vs. Vendor Platform Integration

Bringing GSA’s stringent protocols in line with the adaptability of vendor platforms is no small feat. For years, outdated systems like the Schedule Input Program (SIP) slowed down operations with their reliance on manual file uploads and specific hardware requirements. These inefficiencies made modernization a necessity.

The introduction of the web-based FAS Catalog Platform (FCP) has been a game-changer. Contractors have reported a 30–40% reduction in the time it takes to manage catalogs compared to the old SIP system. In March 2023, GSA began piloting the FCP with contractors under the Office Supplies 4th Generation (OS4) Special Item Number (SIN 339940OS4). This pilot ran until September 2023, focusing on fixing fragmented submission processes and automating error validation. The results of this test phase will pave the way for a broader rollout to all Multiple Award Schedule (MAS) contractors in FY 2024.

To avoid submission delays, vendors need to ensure their data stays consistent across GSA systems. The FCP simplifies this by merging multiple templates into a single "Product File", cutting down on inconsistencies. Also, aligning Seller Profiles with eMod contract data is essential for smooth submissions.

For high-volume vendors, implementing Electronic Data Interchange (EDI) is critical. After completing a 90-day ANSI X-12 testing phase, GSA conducts live production tests for up to 20 catalog items before full integration.

However, automation comes with its challenges. Real-time compliance checks for issues like Trade Agreements Act (TAA) violations, pricing thresholds, and prohibited products often create technical hurdles. The FCP’s Compliance & Pricing (C&P) Reports can help contractors address these problems quickly before submitting modifications.

These integration efforts lead naturally into a discussion of shared functionalities between GSA systems and commercial e-commerce platforms.

Shared Features in E-Commerce and GSA Platforms

Despite the complexities of integration, both GSA systems and commercial platforms share key e-commerce features that simplify the ordering process. Both support electronic ordering, catalog management, and automated transaction workflows. GSA provides contractors with two options: manual data entry via a Vendor Portal or automated high-volume processing through EDI.

| Feature | GSA Systems | Commercial Vendor Platforms |

|---|---|---|

| Transaction Methods | Vendor Portal or EDI (ANSI X-12) | Proprietary APIs or standard e-commerce protocols |

| Order Acknowledgement | 1 business day | Varies by platform; typically automated |

| Catalog Updates | Structured uploads via FCP; automated validation | Real-time updates; flexible formatting |

| Invoicing | EDI 810 or FedPay portal (not via Vendor Portal) | Integrated billing systems; multiple payment options |

| Compliance Filters | TAA, AbilityOne, small business set-asides | Optional; market-driven categorization |

The Commercial Platforms Program (CPP) taps into existing e-commerce tools, such as filters, to highlight mandatory sources like AbilityOne and small business suppliers. While GSA Advantage! remains the go-to platform for its added compliance features, the CPP makes routine commercial product purchases easier by offering familiar online interfaces with built-in compliance filters.

Both systems also require transactional data reporting, though GSA’s requirements are more detailed. GSA’s Transactional Data Reporting (TDR) collects line-item data to analyze purchasing trends, while commercial platforms generally provide broader post-purchase data to flag questionable buys and maintain internal compliance. Contractors working with GSA must acknowledge purchase orders or cancellations within one business day – an important performance metric tracked by the agency.

These shared features highlight how GSA systems borrow from commercial practices while layering on federal-specific compliance requirements. For example, while commercial platforms use standard measures to prevent counterfeiting, GSA adds stricter rules, such as banning sales to vendors listed on SAM.gov and enforcing Section 889 supply chain risk mandates. Additionally, any IT hardware or software accessing GSA networks must comply with IPv6 standards and Section 508 accessibility requirements.

This blend of commercial efficiency and federal oversight underscores the unique challenges and opportunities in integrating these systems.

How to Align Vendor Platforms with GSA Compliance

Methods for Aligning GSA Compliance with Vendor Operations

Ensuring your vendor platform aligns with GSA requirements can feel like navigating a maze, but tools like eMod simplify the process. This web-based system streamlines contract modifications, keeping data consistent and speeding up approval timelines. The result? Faster contract approvals and fewer compliance headaches.

For Trade Agreements Act (TAA) compliance, it’s essential to confirm that your products originate from the U.S. or TAA-designated countries . To stay on top of this, review your catalog’s country-of-origin data every quarter and update your GSA Advantage! listings as needed. GSA’s automated Robomod system also keeps things in check by flagging and removing non-compliant products using Verified Products Portal data.

When it comes to audits, maintaining detailed, audit-ready records is non-negotiable. This includes resumes, timesheets, financial statements, and proof of personnel qualifications – especially for professional services. These records are crucial for passing assessments conducted by Industrial Operations Analysts, a mandatory requirement that can’t be waived.

Shipping compliance is another key area. Use MIL-STD-129R markings for Department of Defense shipments and FED-STD-123H markings for civilian agencies. Additionally, clearly label non-contract items as “open market” or “non-schedule” on quotes and invoices to avoid scope violations.

Here’s a quick look at some critical compliance categories and their requirements:

| Compliance Category | Primary Requirement | Regulatory Reference |

|---|---|---|

| Trade Agreements Act (TAA) | Products must come from the U.S. or designated countries | FAR 52.225-5 |

| Labor Qualifications | Personnel must meet minimum education/experience standards | 29 C.F.R. Part 541 |

| Invoicing | Differentiate contract vs. open market items | GSAM 552.212-4 |

| Supply Chain Risk | Prohibit certain telecom/video equipment | FAR Subpart 4.21 |

| Marking/Labeling | Follow MIL-STD-129R or FED-STD-123H standards | GSAM 552.211-73 |

For vendors committed to compliance, meeting these standards isn’t just about avoiding penalties – it’s a way to build trust and credibility in the federal marketplace.

How GSA Focus Can Help with Compliance

Navigating GSA compliance can be overwhelming, but expert guidance can make all the difference. That’s where GSA Focus comes in. They offer a full-service solution that handles everything from document preparation to compliance assurance and negotiation support. Their team ensures that every submission meets federal requirements, reducing delays and costly mistakes.

GSA Focus doesn’t just react to compliance issues – they work proactively to keep you ahead of evolving regulations. Whether it’s staying on top of TAA requirements or addressing Section 889 supply chain restrictions, they identify and resolve potential problems before they grow. Their negotiation expertise also helps secure favorable contract terms, ensuring small businesses get the most out of their GSA Schedule opportunities.

With a 98% success rate and a refund guarantee, GSA Focus makes GSA Schedule acquisition seamless through a secure online platform and ongoing advisory support. For small businesses looking to tap into federal contracting without straying from their core operations, partnering with GSA Focus offers the expertise to turn compliance into a competitive advantage.

Getting Started in FCP – MAS Vendor Training

Conclusion

Grasping the distinctions between commercial platforms and GSA compliance is more than just a technical exercise – it’s about setting your business up for success in the federal marketplace. Where commercial platforms emphasize ease and speed, GSA compliance requires strict adherence to federal regulations, such as FedRAMP security standards, Section 508 accessibility requirements, and the Trade Agreements Act (TAA). These differences can be daunting, especially when your commercial agreements clash with federal laws. But within these challenges lie opportunities to thrive in federal contracting.

Thankfully, modern systems are bridging the gap by embedding federal requirements into commercial platforms. These integrations allow government buyers to enjoy a seamless shopping experience without compromising on critical compliance measures. With over $700 billion spent annually by the federal government and 38% of GSA contract dollars awarded to small businesses, the potential rewards are immense.

However, navigating this space requires meticulous attention to compliance. Even small mistakes can result in serious legal and financial repercussions, from hefty fines to contract termination. The stakes are high, but with the right approach, these challenges can be managed effectively.

This is where expert guidance can make all the difference. Partnering with experienced professionals, like GSA Focus, can turn compliance hurdles into strategic advantages. Their full-service approach – covering document preparation, compliance checks, and negotiation support – streamlines the process, backed by a 98% success rate and a refund guarantee. They help small businesses break into federal contracting with confidence and efficiency.

Whether you’re new to GSA contracts or managing an existing one, aligning your operations with federal standards doesn’t have to be overwhelming. With the proper support, compliance becomes more than an obligation – it becomes a strategic advantage, unlocking steady and lucrative revenue opportunities in the federal marketplace.

FAQs

What are the main compliance differences between GSA contracts and commercial vendor platforms?

GSA compliance is rooted in federal law and the Federal Acquisition Regulation (FAR), which sets out rigorous standards for contractors. These include transparent, pre-negotiated pricing, comprehensive documentation and reporting, and strict adherence to IT security and data-handling protocols. Additionally, vendors are required to list their products and services on the public GSA Advantage catalog, making pricing and product details accessible to all. Failure to comply can lead to penalties, contract termination, or even disqualification from future federal contracts.

On the other hand, commercial vendor platforms operate under private agreements and internal policies. Their focus is often on customer-centric terms of service, privacy measures, and industry-recognized certifications. Unlike GSA contracts, they are not bound by federal requirements for pricing transparency, audits, or mandatory catalog listings. The main distinction lies in the GSA’s focus on legal compliance, transparency, and government oversight, as opposed to the more adaptable and privately managed standards seen in commercial platforms.

How can businesses ensure their pricing aligns with GSA compliance standards?

To meet GSA compliance standards for pricing, businesses need to align their strategies with the Federal Acquisition Regulation (FAR) and GSA-specific guidelines. Start by checking if your contract requires certified cost or pricing data – this is mandatory for contracts exceeding certain thresholds. Additionally, ensure that your government pricing is equal to or lower than your lowest commercial price, as required by GSA regulations.

Here’s how businesses can approach this:

- Research the market to identify fair commercial rates and set an appropriate price ceiling. This helps establish a competitive yet compliant pricing structure.

- Document pricing details thoroughly, breaking down costs like labor and materials, and include any necessary discounts to meet GSA standards.

- Conduct internal reviews to verify that your pricing is both realistic and aligned with GSA expectations.

If this process feels overwhelming, experts like GSA Focus can provide guidance to simplify the steps and ensure your pricing fully complies with GSA requirements.

What challenges do vendors face when integrating their solutions with GSA systems?

Vendors aiming to integrate their solutions with GSA systems face stringent security and privacy requirements. This includes safeguarding Controlled Unclassified Information (CUI) and adhering to GSA’s detailed IT security guidelines. Falling short of these standards can lead to delays in contract awards or the need for expensive corrections.

On top of that, vendors must ensure their products align with the GSA IT Standards Profile, which specifies approved software and configurations. Meeting these standards often requires adjustments to data flows, authentication processes, and reporting formats. The process also demands close coordination with the GSA Chief Information Officer (CIO) and thorough documentation to demonstrate compliance.

For small businesses, navigating these intricate requirements can be overwhelming. That’s why many turn to specialists like GSA Focus, who offer expert guidance on compliance, documentation, and negotiation. Their support helps streamline the process, making integration smoother and more achievable.

Related Blog Posts

- Top 5 Compliance Issues in GSA Contracts

- Ultimate Guide to GSA Compliance Standards

- Common GSA Compliance Mistakes And Fixes

- What is the GSA Advantage Platform and How to Use It