Federal contractors must follow subcontracting plans that set targets for awarding work to small businesses. These plans are legally binding, and failing to comply can lead to penalties, including liquidated damages and reduced chances of winning future contracts. Common compliance problems include missed reporting deadlines, poor record-keeping, and late payments to subcontractors. With federal oversight increasing – 17 compliance reviews were conducted in FY 2024 compared to just six in FY 2021 – contractors need to act now to avoid breaches.

Key Points:

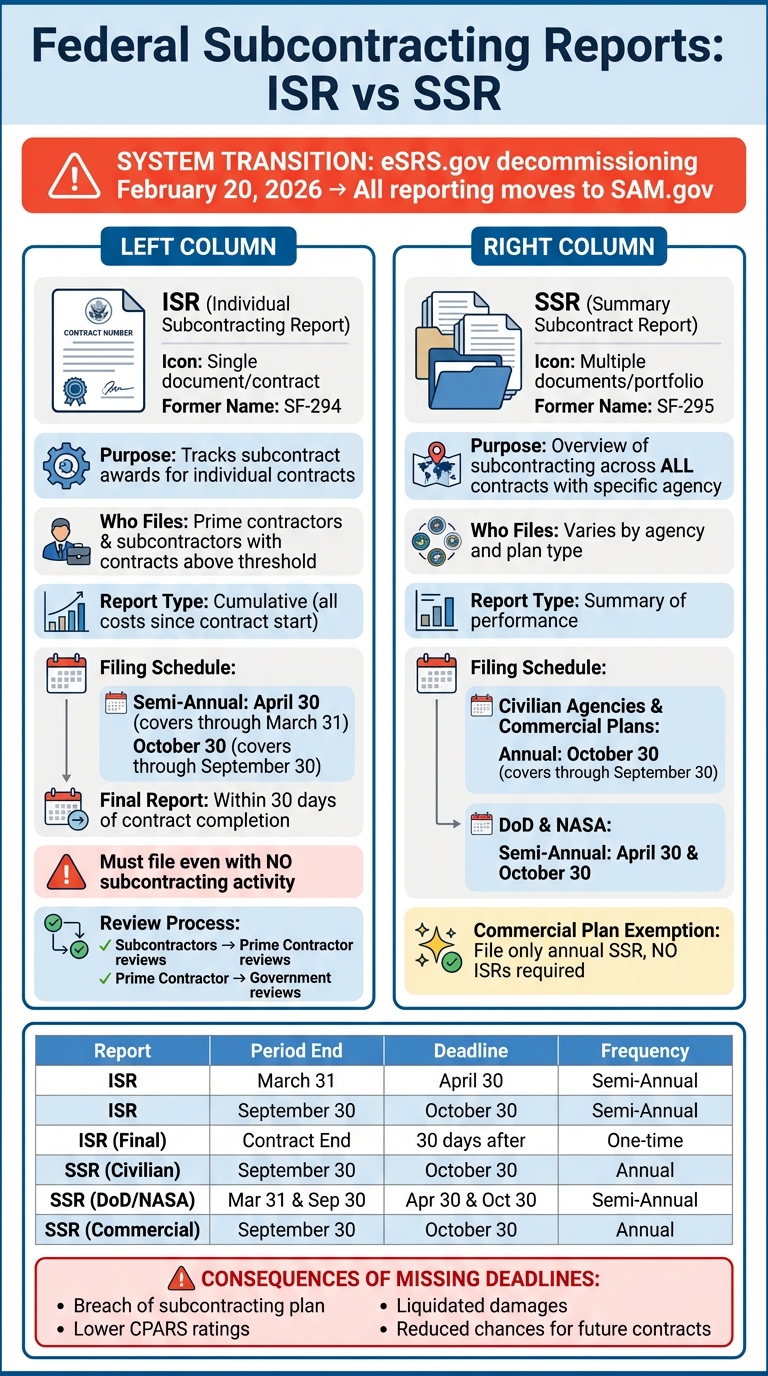

- Submit Individual Subcontracting Reports (ISR) and Summary Subcontract Reports (SSR) on time via SAM.gov (eSRS.gov decommissioning on Feb 20, 2026).

- Maintain detailed records of subcontracting efforts, including market research and payment timelines.

- Address late payments promptly and document all outreach to small businesses.

Subcontracting Plan Compliance: What Large and Small Contractors Need to Know

Common Compliance Problems in Subcontracting Plans

Compliance issues in subcontracting plans often boil down to three main problems: missed reporting deadlines, poor record-keeping, and delayed payments to subcontractors. These challenges can lead to serious consequences, including enforcement actions. Let’s break down each issue and its impact on contract performance.

Missing Report Deadlines

One of the most common pitfalls is failing to submit required reports, such as Individual Subcontracting Reports (ISR) or Summary Subcontract Reports (SSR), through the electronic Subcontracting Reporting System (eSRS) on time. This failure is often seen as a sign of bad faith. The root cause? A lack of oversight. Many contractors don’t assign a specific person to oversee compliance and ensure timely submissions.

The numbers back this up. A Government Accountability Office (GAO) review of 26 federal contracts found that for 14 of them, contracting officers did not ensure the required reports were submitted. Missing or late reports don’t just signal non-compliance – they also show up in Contractor Performance Assessment Reporting System (CPARS) ratings, which can hurt your chances of winning future federal contracts.

Poor Record-Keeping

Another frequent problem is inadequate documentation, which makes compliance reviews difficult. Federal Acquisition Regulation (FAR) 19.705-7 requires contractors to keep detailed records to show how they’re meeting their subcontracting plan and flow-down requirements. Without these records, proving genuine efforts toward subcontracting goals becomes nearly impossible.

"Without complete and accurate information about a contractor’s subcontracting goals, an agency cannot adequately assess a contractor’s performance in meeting its subcontracting plan responsibilities." – U.S. GAO

Some of the most neglected records include market research logs (like searches in the System for Award Management or SBA’s SUBNet), solicitation timelines showing that small businesses had enough time to respond, and justifications for changes to subcontracting goals. In a GAO study, 50% of the contracts reviewed lacked evidence that Procurement Center Representative (PCR) reviews were conducted as required. This lack of documentation makes it harder to track and assess compliance efforts.

Late Payments to Subcontractors

Delays in paying subcontractors are another red flag. Payments are considered late if they’re more than 90 days past due under the agreed terms for supplies or services that the Government has already paid for. When this happens, contractors are required to notify the Contracting Officer in writing within 14 days.

Late payments not only signal non-compliance but can also lead to payment suspensions. Contracting officers are empowered to step in immediately when these issues arise. To avoid this, contractors must have formal, written procedures in place to ensure payments are made on time, as outlined in their subcontracting plans.

These compliance problems are more than administrative headaches – they can directly impact your reputation and future opportunities in federal contracting. Taking proactive steps to address these issues is not just good practice; it’s essential.

Required Reports and Deadlines

Federal Subcontracting Report Types and Deadlines Guide

Filing the right reports on time is a critical part of maintaining compliance. Submitting these reports accurately and by their deadlines helps avoid common issues like missed filings or poor record-keeping. The two primary reports you’ll need to focus on are the Individual Subcontracting Report (ISR) and the Summary Subcontract Report (SSR). Each serves a specific purpose and follows its own timeline. Staying on top of these deadlines is key to avoiding the compliance pitfalls mentioned earlier.

Important Update: As of today, February 13, 2026, the Electronic Subcontracting Reporting System (eSRS.gov) is set to be decommissioned on February 20, 2026. All subcontracting reporting will transition to SAM.gov. Make sure your UEI (Unique Entity Identifier) and organizational information are current on SAM.gov, as these details will automatically populate fields in the new reporting system.

Individual Subcontracting Reports (ISR)

The ISR, previously known as SF-294, tracks subcontract awards for individual contracts. If you’re a prime contractor or subcontractor with a contract above the applicable threshold and a subcontracting plan, this report is required. ISRs are cumulative, covering all costs incurred since the start of the contract.

Deadlines: ISRs must be submitted semi-annually – by April 30 (covering activity through March 31) and October 30 (covering activity through September 30). Additionally, a final ISR is required within 30 days of contract completion. Even if no subcontracting activity occurred, you’re still required to file a report.

Prime contractors are responsible for reviewing ISRs from their subcontractors, while the government reviews ISRs submitted by the prime contractor. Be sure to monitor the system for any rejections, as reports can be sent back for revisions by either the government or higher-tier contractors.

Summary Subcontract Reports (SSR)

Unlike ISRs, SSRs provide a broader overview of subcontracting achievements across all contracts with a specific federal agency. The SSR, formerly known as SF-295, summarizes subcontracting performance and follows a different schedule depending on the agency and subcontracting plan type.

For civilian agencies and contractors operating under a commercial subcontracting plan, SSRs are due annually by October 30 (covering activity through September 30). For DoD and NASA contracts, SSRs must be submitted semi-annually – by April 30 and October 30. Contractors with an approved commercial subcontracting plan only need to file the annual SSR and are exempt from filing ISRs.

Here’s a quick breakdown of key deadlines for both reports:

| Report Type | Reporting Period End Date | Submission Deadline | Frequency |

|---|---|---|---|

| ISR (Individual) | March 31 | April 30 | Semi-Annual |

| ISR (Individual) | September 30 | October 30 | Semi-Annual |

| ISR (Completion) | Contract End Date | Within 30 days of completion | Once per contract |

| SSR (Civilian Agency) | September 30 | October 30 | Annual |

| SSR (DoD & NASA) | March 31 & September 30 | April 30 & October 30 | Semi-Annual |

| SSR (Commercial Plan) | September 30 (Gov Fiscal Year) | October 30 | Annual |

Missing these deadlines isn’t just a minor issue – it’s a serious compliance risk. Late or incomplete ISR and SSR submissions can signal a failure to make a "good faith effort" to adhere to your subcontracting plan. This could lead to formal breach notices, lower past performance ratings, and even liquidated damages. The stakes are high, so staying organized and meeting these deadlines is non-negotiable.

Solutions for Maintaining Compliance

Navigating compliance challenges like missed deadlines, poor record-keeping, and late payments requires more than just understanding the rules. It’s about embedding compliance into your daily operations. By focusing on better record-keeping systems, fostering strong subcontractor relationships, and maintaining thorough documentation, you can ensure that your subcontracting plan becomes a seamless part of your workflow.

Setting Up Better Record-Keeping Systems

A reliable record-keeping system starts with well-defined internal policies. Begin by creating a written policy or guidance that firmly commits your procurement team to following the Small Business Act. Your system should track subcontracting dollars for each socioeconomic category – Small Business, VOSB, SDVOSB, HUBZone, SDB, and WOSB – individually. Additionally, maintain source lists that detail how potential subcontractors were identified, using tools like DSBS or SAM.

Don’t overlook flowdown verification: ensure that FAR 52.219-8 is included in all subcontracts. For subcontractors (other than small businesses) receiving awards over $750,000 – or $1.5 million for construction – confirm they have their own subcontracting plan in place, as required. Assign a compliance official to oversee the program and monitor adherence within your organization. With these systems in place, the next step is building strong subcontractor relationships.

Building Strong Subcontractor Relationships

Paying subcontractors on time isn’t just good practice – it’s a compliance requirement. Late payments can be seen as a failure to make a good faith effort. Engage with subcontractors early, giving them ample time to prepare competitive bids. Share detailed project plans, specifications, and performance requirements to ensure they fully understand your expectations.

Also, consider assisting subcontractors with potential challenges like bonding, securing lines of credit, obtaining insurance, or acquiring necessary equipment. Breaking down work into smaller, manageable units can also make contracts more accessible. Participating in mentor–protégé programs further highlights your commitment to supporting small businesses. Alongside these efforts, documenting every step you take is critical to demonstrating compliance.

Documenting Good Faith Efforts

When subcontracting goals aren’t met, thorough documentation can help prove your good faith effort. Contracting officers assess your overall actions – not just whether you hit your targets – to determine compliance. Keep a detailed record of all efforts to locate and engage small businesses. As FAR 19.705-7 emphasizes:

"Failure to maintain records or otherwise demonstrate procedures adopted to comply with the plan" is considered an indicator of failure to make a good faith effort.

Log your searches in SBA’s SUBNet or DSBS, and document participation in matchmaking events. Record any technical assistance provided to subcontractors. Use the "Remarks" section in your eSRS reports (transitioning to SAM.gov) to explain enhanced efforts or justify low-dollar awards. If you exceeded goals in one category to cover shortfalls in another – or faced market challenges like unavailability or unreasonable pricing – make sure to document these specifics and your attempts to find alternative sources.

Penalties for Non-Compliance and How to Fix Problems

When compliance issues arise, the consequences can hit hard – but they’re not set in stone. Knowing how enforcement works and acting quickly can help you avoid financial penalties and safeguard your reputation.

How Enforcement Actions Work

If a contracting officer determines that you haven’t made a good faith effort to comply with your subcontracting plan, they’ll issue a written notice outlining the breach. You’ll then have 15 working days to respond and show what steps you’ve taken. Ignoring this notice could be seen as an admission that no valid explanation exists.

The evaluation isn’t solely about meeting your subcontracting goals. The contracting officer considers the “totality of your actions.” As FAR 19.705-7 states:

"The fact that the contractor failed to meet its subcontracting goals does not, in and of itself, constitute a failure to make a good faith effort."

Certain actions – or lack thereof – can raise red flags, prompting further scrutiny. These include:

- Missing deadlines for Individual Subcontracting Reports (ISRs) or Summary Subcontract Reports (SSRs).

- Falsifying records or providing inaccurate information.

- Late payments to small business subcontractors.

- Company policies that undermine your subcontracting plan’s goals.

If penalties are assessed, the contracting officer’s final decision will also inform you of your right to appeal under the contract’s Disputes clause [4,12].

Preventing Liquidated Damages

Non-compliance doesn’t just hurt your finances – it can also damage your track record. Liquidated damages are calculated based on the dollar amount by which you fell short of your subcontracting goals. For instance, if your plan committed $500,000 to small businesses but only awarded $400,000, you could owe $100,000 in damages.

For commercial plans, the calculation is proportional to the Government’s share of your total sales. For example, if Government contracts make up 10% of your sales, the liquidated damages would equal 10% of the total shortfall.

Beyond monetary penalties, enforcement actions affect your past performance record, which can hurt your chances of winning future contracts [4,12]. To minimize risks:

- If you anticipate a shortfall, submit a written explanation to the contracting officer within 30 days of contract completion. Detail the efforts you made and any challenges you faced in the market [4,19].

- If you receive a notice of failure, use the 15-day response period to provide evidence of your outreach, subcontractor engagement, and other good faith efforts.

Taking these steps can demonstrate your commitment to compliance and help protect your business from long-term consequences.

Conclusion

Subcontracting plan compliance isn’t just about checking boxes – it’s about safeguarding your financial interests, reputation, and eligibility for federal contracts. With the SBA ramping up its formal compliance reviews from 6 in FY2022 to 17 in FY2024 – and even more projected for FY2025 – the message is clear: enforcement is tightening.

The good news? Most compliance issues can be avoided with proactive measures. Staying on top of reporting deadlines, maintaining accurate records, and documenting your efforts are key. Contracting officers look at the totality of your actions, not just whether you hit numerical goals. This means that actions like effective outreach, thorough market research, and engaging with subcontractors carry weight – even if unforeseen circumstances prevent you from meeting every target.

Failing to comply, however, comes with serious consequences. Liquidated damages and enforcement actions can jeopardize your ability to secure future contracts.

If you’re struggling with compliance or want to set up your subcontracting plan the right way, expert guidance can make all the difference. For small businesses, GSA Focus provides full-service solutions, including compliance assurance and document preparation, to simplify contract management and help you meet regulatory standards.

Investing in expert assistance today can pave the way for long-term success. By addressing current challenges and putting systems in place to avoid future issues, you’re not just protecting your business – you’re positioning it for growth. The effort you put into planning and documentation now will pay off in future contract opportunities, fewer penalties, and a stronger reputation with federal agencies.

FAQs

Do I need to file an ISR if there was no subcontracting activity?

No, you don’t need to file an ISR if no subcontracting activity took place during the reporting period. However, it’s important to double-check your subcontracting plan requirements to ensure you’re meeting all compliance obligations.

What records should I keep to prove a good faith effort?

Keeping thorough records is essential when working to meet subcontracting plan requirements. Use tools like the Dynamic Small Business Search (DSBS) to gather market research data. Additionally, maintain copies of emails or other correspondence with small business resources such as SBA offices, APEX Accelerators, minority business development agencies, and local chambers of commerce. Documenting outreach efforts to identify potential small business subcontractors not only helps streamline the process but also serves as evidence of a contractor’s genuine effort to fulfill their obligations.

How do I report subcontracting after eSRS.gov is decommissioned?

After eSRS.gov is officially retired on February 20, 2026, all subcontracting reporting will shift to SAM.gov. Make sure to wrap up any outstanding tasks and download any critical data from eSRS before this deadline to keep your records intact and ensure a seamless transition.

Related Blog Posts

- Incentives vs. Penalties in Subcontracting Compliance

- Penalties for Subcontracting Plan Violations

- Checklist for Subcontracting Plan Compliance

- Why Subcontracting Reports Matter for GSA Contracts