Life Cycle Cost Analysis (LCCA) is a method to evaluate the total ownership cost of a product or service over its lifetime – not just the upfront price. For small businesses bidding on GSA contracts, this approach shifts the focus from initial costs to long-term savings, helping proposals align with federal priorities. Here’s why it matters:

- What is LCCA? It calculates costs like purchase, operation, maintenance, and disposal, offering a full picture of long-term value.

- Why does it matter for GSA contracts? Federal agencies prioritize value over low initial bids. LCCA helps justify higher upfront costs with data on lifetime savings.

- Key benefits: Stronger bids, better cost justification, reduced risk, and smarter pricing strategies.

LCCA isn’t optional for many federal projects – it’s a requirement under regulations like 10 C.F.R. § 436. It demonstrates compliance, ensures competitive pricing, and highlights long-term savings, making it essential for securing GSA contracts.

Life Cycle Cost Analysis (LCCA) Compliance

Common Pricing Problems in GSA Contract Bidding

Grasping the real value of Life-Cycle Cost Analysis (LCCA) means tackling some frequent pricing missteps in GSA contract bidding.

Why Initial Cost Pricing Falls Short

A common misconception among small businesses is that the lowest bid always wins. But focusing only on initial costs can be deceptive. Over a 30-year span, initial costs might make up just 2% of total ownership expenses, while operations, maintenance, and personnel costs can climb to 6% and 92%, respectively. Competitors who propose higher upfront costs but showcase lower overall life-cycle costs – thanks to better efficiency or durability – often have the edge.

"LCCA provides a significantly better assessment of the long-term cost-effectiveness of a project than alternative economic methods that focus only on first costs or on operating-related costs in the short run." – WBDG – Whole Building Design Guide

Why Cost Justification Is Critical

Federal agencies prioritize value over just the lowest price. For example, GSA Facilities Standards (P100) Chapter 1.8 requires Life-Cycle Costing for Public Buildings Service projects. Similarly, energy and water conservation initiatives must adhere to LCCA guidelines under 10 C.F.R. § 436. Without a thorough cost justification, bids are often evaluated solely on the Lowest Price Technically Acceptable (LPTA) criteria, which can overlook factors like quality, durability, and long-term savings. Moreover, failing to justify costs can lead to missed opportunities for contracts that align with optimized spending goals.

These challenges highlight why a thoughtful and detailed LCCA approach is essential for crafting competitive GSA proposals.

What is Life Cycle Cost Analysis (LCCA)?

Life Cycle Cost Analysis (LCCA) is an economic approach to evaluating the total cost of ownership for a product or system, spanning from its purchase to its eventual disposal. Unlike focusing solely on the purchase price, LCCA takes into account all expenses over the entire lifecycle – this includes installation, energy use, maintenance, repairs, replacements, and even the costs associated with disposal.

The process calculates annual costs and applies a discount rate to convert future expenses into present-value dollars, enabling a fair comparison of costs across options. The core formula for LCCA is: LCC = I (Investment) + Repl (Replacement) – Res (Residual Value) + E (Energy) + W (Water) + OM&R (Operating, Maintenance & Repair) + O (Other costs). Using current dollars as a baseline, it adjusts future expenses for inflation and discounts them back to their present value.

While low upfront costs may seem appealing, LCCA reveals the true long-term cost. For instance, a high-efficiency HVAC system might have a higher initial price but could save thousands over its lifespan. This kind of comprehensive cost analysis is particularly crucial for small businesses looking to create competitive and compliant proposals for GSA contracts.

Main Elements of LCCA

To conduct an effective LCCA, costs are broken down into several key categories:

- Initial costs: These include the capital outlay for land, construction, renovations, and equipment.

- Operational costs: Costs for energy and water use, calculated based on current rates and projected price trends.

- OM&R costs: Operating, maintenance, and repair expenses, often estimated using historical data or industry standards like R.S. Means.

- Replacement costs: These account for replacing building systems or components based on their expected useful life.

- Residual values: The remaining value at the end of the analysis period, such as resale, salvage, or scrap value, minus disposal costs.

Timing plays a critical role in LCCA. The analysis is most impactful when performed early in the design or proposal stages, allowing for adjustments that can reduce long-term costs. For Federal Energy Management Program (FEMP) analyses, the evaluation period is capped at 40 years. Importantly, LCCA focuses only on costs that are "relevant" (those that differ between alternatives) and "significant" enough to influence decisions.

How LCCA Meets Federal Standards

Federal agencies adhere to strict guidelines when conducting LCCA. For energy and water conservation projects, 10 C.F.R. § 436, Subpart A outlines the necessary methodology and procedures. The GSA Public Buildings Service mandates Life Cycle Costing under PBS-P100 Chapter 1.8, which sets facility standards. Additionally, NIST Handbook 135 is the go-to resource for LCC methodology in federal projects.

Discount rates are updated annually to ensure accuracy. FEMP establishes rates for energy and water projects, while the Office of Management and Budget (OMB) provides rates via Circular A-94 for other programs. Analysts rely on the annual supplement to NIST Handbook 135 for current energy price escalation rates and discount factors. This structured and formula-driven approach ensures uniformity in federal cost assessments.

For GSA proposals that include energy conservation measures, LCCA isn’t just a recommendation – it’s a requirement. Following these federal standards not only ensures compliance but also strengthens the long-term value of your proposal, giving it a competitive edge.

Key Benefits of LCCA for GSA Contracts

Life Cycle Cost Analysis (LCCA) changes the game for small businesses vying for GSA contracts. Instead of focusing solely on the lowest upfront cost, this method shifts the spotlight to the total cost of ownership over an asset’s lifespan. This approach gives businesses offering solutions with long-term savings a competitive edge.

Here’s how LCCA strengthens your proposals and boosts your chances of winning contracts.

Stronger Bid Competitiveness

Federal evaluators aim to select the bid that offers the "most advantageous to the government" option. LCCA provides solid, objective metrics – like Net Savings and Savings-to-Investment Ratios – that clearly quantify your solution’s overall value compared to competitors. These metrics make your proposal stand out by showcasing measurable benefits.

Better Cost Justification

LCCA allows you to justify premium pricing with hard data. By converting future expenses into present-value dollars using federal discount rates, you align your proposal with established standards like GSA PBS-P100 and OMB Circular A-94. This approach focuses on costs that are both "relevant" (those that vary between options) and "significant" (those that influence decisions). Including the residual value – the estimated worth of an asset at the end of the study period – further strengthens your case.

This rigorous analysis demonstrates why your solution is worth the investment, even if it comes with a higher upfront price tag.

Lower Risk and Better Planning

Uncertainty can derail even the best proposals, but LCCA helps you tackle this head-on. By incorporating sensitivity analysis, you can show how your bid remains cost-effective despite changes in energy prices, maintenance schedules, or other variables. Break-even analysis highlights the minimum benefits needed to justify the investment, reducing perceived risks.

Conducting LCCA early also helps identify potential cost overruns and gives you time to address them. For federal energy projects, the analysis often spans up to 40 years, offering a clear planning window and reducing the likelihood of surprises. This proactive approach naturally supports a more confident and strategic pricing plan.

Better Pricing Strategy

LCCA turns pricing into a science, balancing upfront costs with long-term savings. Here are some key metrics and how they add value:

| Measure | What It Shows |

|---|---|

| Lowest LCC | Proves overall cost-effectiveness |

| Net Savings (NS) | Highlights dollar savings compared to a baseline |

| Savings-to-Investment Ratio (SIR) | Ranks your project against competing bids |

| Discounted Payback | Shows how quickly the investment pays for itself |

With this data-driven foundation, your pricing strategy becomes more than just a number – it becomes a compelling argument for why your solution delivers unmatched value over the contract’s lifecycle.

How to Use LCCA in Your GSA Proposal

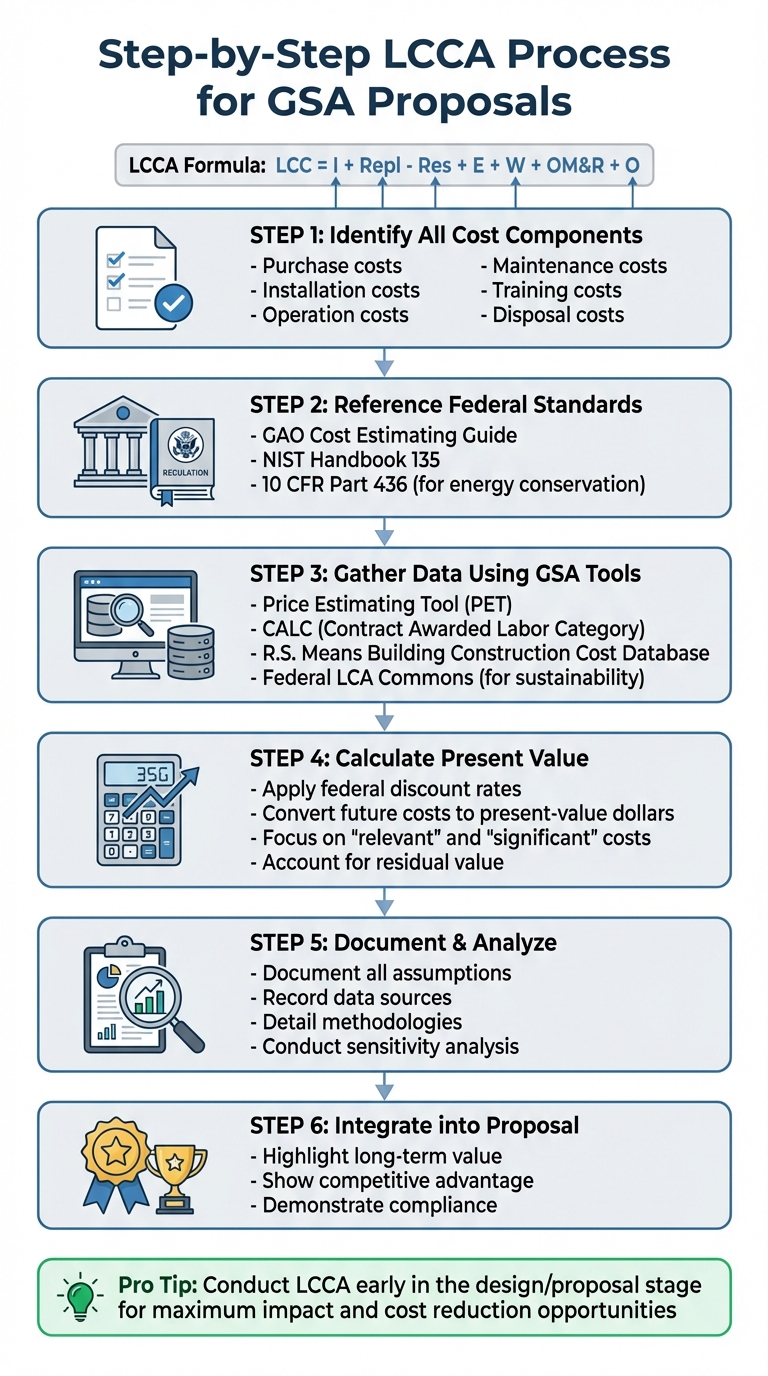

Life Cycle Cost Analysis Process for GSA Contracts

Step-by-Step LCCA Process

When incorporating Lifecycle Cost Analysis (LCCA) into your GSA proposal, it’s essential to cover all cost aspects thoroughly. This includes purchase, installation, operation, maintenance, training, and disposal costs. Federal evaluators want a clear, comprehensive breakdown – not just the upfront expenses.

Start by referencing federal standards like those outlined in the GAO Cost Estimating Guide and NIST Handbook 135. If your proposal involves energy conservation measures for federal buildings, keep in mind that LCCA is legally required under 10 CFR Part 436.

Next, leverage GSA’s pricing tools available on buy.gsa.gov to gather accurate data. Tools like the Price Estimating Tool (PET) and CALC (Contract Awarded Labor Category) offer market benchmarks to compare your costs against similar solutions. For construction and maintenance estimates, resources such as the R.S. Means Building Construction Cost Database and the Whitestone Research Facility Maintenance and Repair Cost Reference can be invaluable. If sustainability is a factor, you can turn to the Federal LCA Commons for environmental data.

Use federal discount rates to convert future costs into present-value dollars. Focus on costs that are both "relevant" (those that differ between alternatives) and "significant" (large enough to impact the decision). Don’t forget to account for residual value based on the remaining useful life of assets.

Lastly, document everything – assumptions, data sources, and methodologies. Conduct a sensitivity analysis to ensure your findings hold up under variable conditions. A well-executed LCCA not only demonstrates long-term value but also gives your proposal a competitive edge.

When your analysis is complete, seeking expert advice can help you seamlessly integrate it into your proposal for maximum impact.

How GSA Focus Can Help with LCCA

Once you’ve prepared your LCCA, specialized expertise can take your proposal to the next level. Conducting a compliant LCCA requires a deep understanding of federal standards, access to reliable data, and the ability to craft a proposal that resonates with government evaluators. This is where GSA Focus steps in.

GSA Focus specializes in helping small businesses navigate the complexities of GSA Schedule Contracts by offering a full-service approach. Their team ensures your LCCA aligns with GSA compliance requirements. They know which federal standards apply to your case and how to structure your cost analysis to highlight the total cost of ownership, rather than just the initial price. This strategy makes your proposal more competitive and provides evaluators with clear evidence of your solution’s long-term benefits.

In addition, GSA Focus offers negotiation support, using your LCCA findings to strengthen discussions with contracting officers. With a 98% success rate, they have a proven track record of crafting proposals that stand out in the federal marketplace. Their approach ensures your pricing strategy demonstrates both value and cost-effectiveness.

To streamline the process, GSA Focus provides a secure online platform for uploading documents and offers comprehensive advisory support every step of the way. Their refund guarantee is a testament to their commitment to helping small businesses succeed in acquiring GSA Schedule Contracts. For more information about integrating LCCA into your proposal and enhancing your overall submission, visit https://gsascheduleservices.com to schedule an appointment.

Conclusion

Life-Cycle Cost Analysis (LCCA) transforms the way GSA contract pricing is approached by focusing on the total cost of ownership rather than just upfront expenses. Instead of limiting the evaluation to initial costs, LCCA takes a broader view – factoring in acquisition, operation, maintenance, and disposal. This approach provides federal evaluators with a clear, long-term perspective on value, which can make your proposal stand out. It not only highlights the overall worth of your bid but also underscores the importance of expert guidance when navigating the complexities of federal contracting.

By using metrics like Net Savings, Savings-to-Investment Ratio, and Internal Rate of Return, LCCA demonstrates how your bid delivers cost savings over time. It also reduces risk by ensuring your proposal aligns with long-term savings goals. Tools like break-even analysis further protect your bid by identifying the minimum benefits required to justify the investment, preventing underpricing that could hurt profitability or over-promising that might damage your credibility.

A strong LCCA can give your proposal a competitive edge. It shows that while your initial costs might be higher, the long-term value – through reduced operating expenses – makes your bid more appealing than those focused solely on low upfront costs. This approach also ensures compliance with federal regulations like 10 C.F.R. § 436 and OMB Circular A-94, which strengthens your position while meeting government requirements. Incorporating LCCA into your GSA proposal is essential for demonstrating superior long-term value and achieving compliance, and expert support can make this process smoother and more effective.

Given the complexity of federal standards and the technical nature of present-value calculations, executing a compliant LCCA often requires specialized expertise. For small businesses, navigating these challenges alone can be daunting. This is where expert guidance becomes invaluable – streamlining everything from data collection and sensitivity analysis to documentation and proposal integration. With GSA Focus’s proven 98% success rate and comprehensive support, small businesses can confidently use LCCA to secure federal contracts without being overwhelmed by the intricacies of the process.

FAQs

How does Life Cycle Cost Analysis (LCCA) help small businesses create competitive GSA contract bids?

Life Cycle Cost Analysis (LCCA) gives small businesses an edge in GSA contract bids by emphasizing long-term cost efficiency. Instead of just focusing on upfront costs, LCCA looks at the total cost of ownership, which includes factors like operations, maintenance, and potential savings.

This method helps businesses craft pricing strategies that are competitive yet realistic. It also underscores the overall value of their solutions across the contract’s duration, showcasing a commitment to cost-conscious and effective results – qualities that federal buyers often find appealing.

What are the main steps involved in Life Cycle Cost Analysis (LCCA)?

Life Cycle Cost Analysis (LCCA) is a methodical approach used to calculate the total cost of owning and operating a system or facility throughout its entire lifespan. Here’s how the process typically unfolds:

- Goal setting: Begin by outlining the objectives, defining the scope, and identifying key assumptions to guide the analysis.

- Inventory analysis: Measure the resources consumed, such as energy and materials, alongside outputs like emissions and waste.

- Impact assessment: Evaluate how these inputs and outputs influence both costs and environmental factors.

- Interpretation: Bring all findings together to make well-informed decisions, while accounting for uncertainties and assumptions.

By adhering to these steps, businesses can better manage resources, enhance cost-effectiveness, and create pricing strategies that align with the demands of GSA contracts.

Why is Life Cycle Cost Analysis (LCCA) important for federal projects and how does it help with compliance?

Life Cycle Cost Analysis (LCCA) plays a key role in federal projects by looking at the total cost of ownership across a project’s entire lifespan – not just the initial price tag. This approach takes into account long-term expenses like operations, maintenance, and potential savings. By doing so, it helps agencies make smarter, cost-conscious decisions that align with federal guidelines.

Another benefit of LCCA is its role in ensuring compliance. Using a standardized process, it evaluates all project costs, including direct and indirect expenses, inflation, and present value. This creates a clear and consistent framework for decision-making, allowing federal agencies to meet regulatory standards while managing projects in a way that’s both financially sound and sustainable.

Related Blog Posts

- How GSA Contracts Impact Federal Construction Compliance

- Cost Element Breakdown in GSA Contracts

- Energy Efficiency Standards in GSA Contracts

- Lifecycle Cost Analysis for GSA Contracts