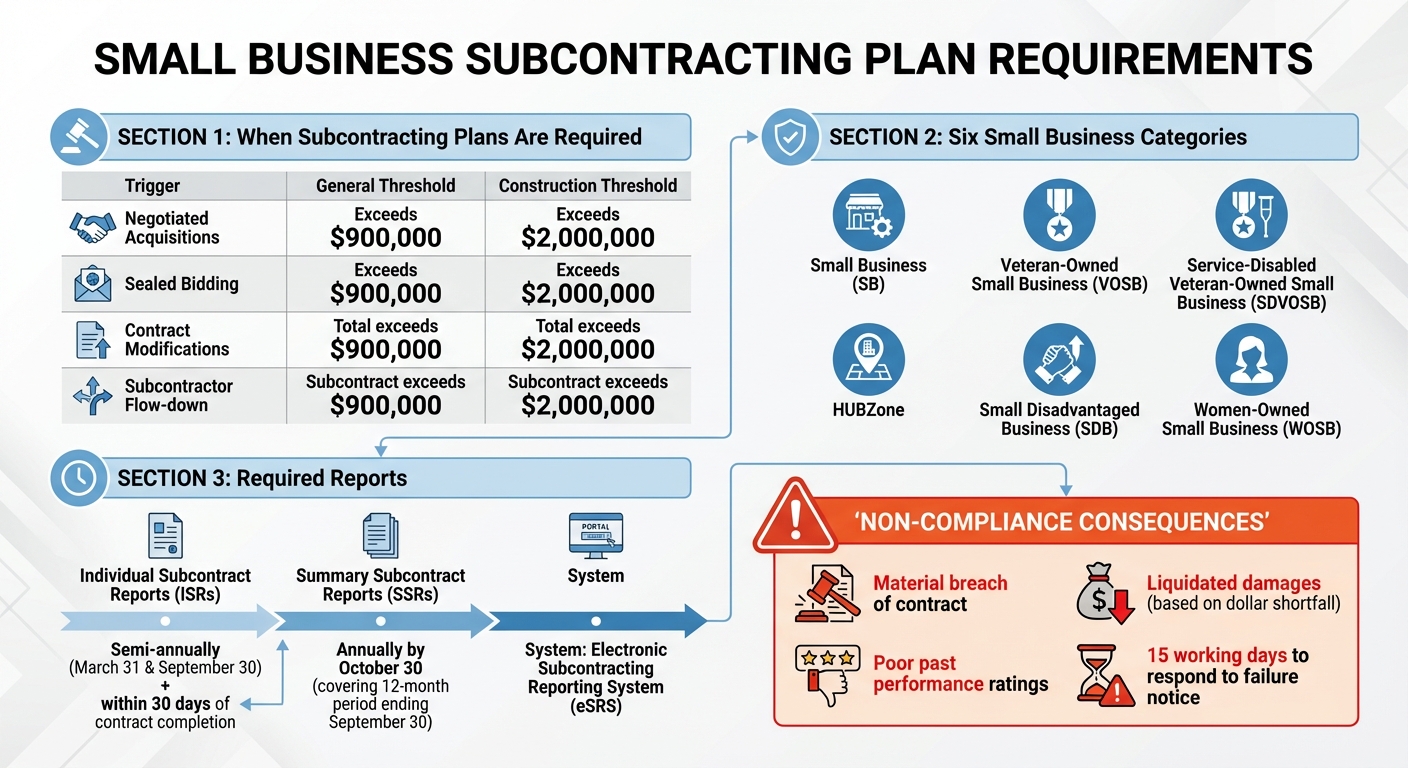

When large companies win federal contracts, they often need to involve small businesses through a Small Business Subcontracting Plan. This plan ensures small businesses get a fair chance to participate in federal projects. Here’s what you need to know:

- Purpose: Allocate portions of federal contracts to small businesses, helping them gain experience and revenue.

- Who It Applies To: Mandatory for large companies with contracts over $900,000 ($2 million for construction) if subcontracting opportunities exist.

- Key Elements: Goals for six small business categories (e.g., Women-Owned, HUBZone), reporting requirements, and compliance through the eSRS system.

- Consequences of Non-Compliance: Breach of contract, liquidated damages, and poor past performance ratings.

Subcontracting Plan Compliance: What Large and Small Contractors Need to Know

Legal Requirements and When They Apply

Small Business Subcontracting Plan Requirements and Thresholds

Federal Acquisition Regulation (FAR) Requirements

The Federal Acquisition Regulation (FAR) lays out clear rules for submitting subcontracting plans in federal contracts. For negotiated acquisitions that exceed the established thresholds, the winning offeror must provide an acceptable subcontracting plan before the contract is awarded. According to FAR 19.704, failing to meet this deadline during negotiations disqualifies the offeror.

Each subcontracting plan, as required by FAR 19.704, must include the following elements:

- Separate percentage goals for various small business categories, such as Small Business (SB), Veteran-Owned Small Business (VOSB), Service-Disabled Veteran-Owned Small Business (SDVOSB), HUBZone, Small Disadvantaged Business (SDB), and Women-Owned Small Business (WOSB).

- A description of the goods or services to be subcontracted.

- The methodology used to set goals.

- The designation of an administrator responsible for implementing the plan.

Additionally, prime contractors must include FAR clause 52.219-8 in subcontracts that offer further subcontracting opportunities. This ensures that subcontractors, unless they are small businesses themselves, develop their own subcontracting plans. Contractors are also required to submit regular reports through the Electronic Subcontracting Reporting System (eSRS). These reports include:

- Individual Subcontract Reports (ISRs): Due semi-annually (for periods ending March 31 and September 30) and within 30 days of contract completion.

- Summary Subcontract Reports (SSRs): Due annually by October 30, covering the twelve-month period ending September 30.

These requirements kick in once contract values exceed the statutory thresholds.

Contract Value Thresholds

Subcontracting plans are mandatory for contracts expected to surpass certain dollar thresholds. For most contracts, the threshold is $900,000, while construction contracts require a plan if they exceed $2,000,000. These thresholds account for the total value of the basic contract plus any option periods. If a contract modification pushes the total value above these limits and subcontracting opportunities exist, a plan becomes necessary. For indefinite-delivery contracts, such as Multiple Award Schedules, the threshold is based on the estimated total value of all orders over the contract’s lifespan.

| Trigger | General Threshold | Construction Threshold |

|---|---|---|

| Negotiated Acquisitions | Exceeds $900,000 | Exceeds $2,000,000 |

| Sealed Bidding | Exceeds $900,000 | Exceeds $2,000,000 |

| Contract Modifications | Total exceeds $900,000 | Total exceeds $2,000,000 |

| Subcontractor Flow-down | Subcontract exceeds $900,000 | Subcontract exceeds $2,000,000 |

Small businesses are exempt from this requirement, regardless of the contract value. Subcontracting plans are also not required for personal services contracts or contracts performed entirely outside the United States and its territories.

Consequences of Non-Compliance

Failing to meet subcontracting plan requirements can lead to serious consequences. FAR 19.702(c) states: "Any contractor or subcontractor failing to comply in good faith with the requirements of the subcontracting plan is in material breach of its contract". Beyond being a breach of contract, a lack of good faith effort can result in liquidated damages. These damages are calculated based on the actual dollar shortfall for unmet subcontracting goals. Contractors typically have 15 working days to respond to a notice of failure before a final decision on liquidated damages is made.

Non-compliance can also negatively impact a contractor’s past performance ratings, which federal contracting officers consider for future awards. Examples of actions that indicate a lack of good faith effort include:

- Failing to submit required ISR or SSR reports.

- Delaying payments to small business subcontractors by more than 90 days after government reimbursement.

- Adopting policies that undermine the objectives of the subcontracting plan.

- Failing to appoint a plan administrator.

FAR defines a lack of good faith effort as a "willful or intentional failure to perform in accordance with the requirements of the subcontracting plan, or willful or intentional action to frustrate the plan".

To demonstrate compliance, contractors must keep detailed records of their market research, solicitations, and outreach efforts directed at small businesses.

What to Include in a Subcontracting Plan

When drafting a subcontracting plan, it’s essential to outline clear, measurable goals and proactive steps to engage small businesses effectively. Federal regulations provide a detailed framework to guide this process.

Setting Goals for Small Business Categories

Federal law requires subcontracting plans to include 15 specific elements, starting with percentage and dollar goals for various small business categories: Small Business (SB), Veteran-Owned Small Business (VOSB), Service-Disabled Veteran-Owned Small Business (SDVOSB), HUBZone, Small Disadvantaged Business (SDB), and Women-Owned Small Business (WOSB). These goals must be expressed in both total planned subcontracting dollars and as a percentage of your total subcontracting budget.

Additionally, your plan should identify the key goods or services to be subcontracted and specify which small business categories will be targeted for those opportunities. Explain your methodology for setting these goals, including whether indirect costs are factored in, and provide separate goals for the base contract and any option periods.

Leverage tools like SAM (System for Award Management) and DSBS (Dynamic Small Business Search) to identify potential small business partners before finalizing your goals. Ensure your goals reflect the "maximum practicable opportunity" for small businesses to participate, tailored to the specific contract requirements. Notably, subcontracts awarded to Alaska Native Corporations (ANCs) or Indian tribes count toward both SB and SDB goals, regardless of their size or SBA certification status.

Outreach and Good Faith Efforts

Your plan must detail the steps you’ll take to ensure small businesses have a fair chance to compete for subcontracts. This includes documenting outreach activities such as engaging with small business organizations, attending trade events, and providing guidance to internal buyers.

For subcontract awards exceeding the simplified acquisition threshold, you’re required to document whether small businesses were solicited. If not, you must record the specific reasons why they weren’t included. These "why not" records are vital for demonstrating good faith efforts during compliance reviews. Partnering with organizations like APEX Accelerators, the Minority Business Development Agency (MBDA), and local chambers of commerce can help you identify diverse suppliers. Your plan should also include assurances that you’ll make a genuine effort to work with the small businesses identified in your proposal and thoughtfully consider small business opportunities in all "make-or-buy" decisions.

These outreach efforts are a cornerstone of the compliance framework and reflect your commitment to supporting small business participation.

Documentation and Reporting Requirements

To back up your goals and outreach efforts, maintaining thorough records and ensuring timely reporting is crucial. Assign a responsible individual to oversee this process and clearly define their duties. Commit to submitting Individual Subcontracting Reports (ISRs) semi-annually and Summary Subcontracting Reports (SSRs) annually through the eSRS system.

Your plan should specify the types of records you’ll keep to demonstrate compliance. This includes source lists from SAM, documentation of outreach activities, and records of any organizations you’ve contacted. If small businesses are excluded, ensure you document the reasons why. Additionally, include a pledge to incorporate FAR clause 52.219-8 in all relevant subcontracts.

Another key element is addressing payment practices. Your plan must include a commitment to timely payments to small business subcontractors and a requirement to notify the Contracting Officer in writing of any payments delayed by more than 90 days.

"Failure to submit reports may be considered a lack of good faith effort and may result in assessment of liquidated damages or may be considered in any past performance evaluation of the contractor." – GSAM 519.706

How to Create and Manage Subcontracting Plans

Working with Compliance Experts

Navigating the intricate requirements of FAR 19.704 – covering everything from percentage goals to flow-down clauses and payment commitments – can feel overwhelming for contractors. These 15 elements demand a careful balance between compliance and your core business operations. That’s where compliance experts come in. Their deep understanding of federal contracting regulations can help you simplify the process, from drafting your initial plan to managing ongoing reporting requirements.

For example, GSA Focus offers a comprehensive solution tailored to meet these needs. Their services include preparing documents, ensuring compliance, and providing negotiation support. This is especially helpful if you’re tackling your first subcontracting plan or juggling multiple contracts with varying deadlines. With expert guidance, you can focus on your business while staying on top of federal requirements.

Once you’ve got the basics covered, take advantage of government tools to streamline your subcontracting plan further.

Using Tools and Resources

Government-provided tools can make a big difference in simplifying your subcontracting efforts. Start with GSA’s Model Subcontracting Plans, SAM (System for Award Management), and DSBS (Dynamic Small Business Search) to ensure your plan meets all requirements and to connect with qualified small business partners. Need to post subcontracting opportunities? SBA SUBNet is a valuable platform where small businesses can find and respond to your solicitations.

When it comes to reporting, the Electronic Subcontracting Reporting System (eSRS) is your go-to hub. Use it to submit Individual Subcontract Reports (ISRs) semi-annually and Summary Subcontract Reports (SSRs) annually. Make sure to follow eSRS reporting deadlines to avoid compliance issues. Before submitting your plan, GSA Form 4006 – the Subcontracting Plan Review Checklist – can help you catch any missing elements. And if you need further assistance, reach out to APEX Accelerators or a Procurement Center Representative for pre-award guidance and technical support.

Once you’ve got these tools in place, the focus shifts to staying compliant over the life of your contract.

Maintaining Compliance Over Time

Creating a solid subcontracting plan is just the beginning. Sustaining compliance requires ongoing attention and consistent management. Assign a specific employee to oversee your subcontracting program, and clearly outline their responsibilities. This person should maintain detailed records of source lists, outreach activities, and communications with potential small business partners. These records will be crucial during compliance reviews to demonstrate your good faith efforts.

Accuracy is key, so ensure your subcontractors use the correct prime contract number and UEI when making eSRS entries. For multi-year contracts, update your individual subcontracting plan with clear goals for each option period. If you’re using a master subcontracting plan (valid for three years after approval), make sure it’s incorporated into individual contract plans and updated regularly.

"Submission of timely and accurate reports is an indication a contractor takes its small business subcontracting responsibilities seriously." – GSAM 519.705-4

If compliance deficiencies arise, act quickly – submit a corrective action plan right away to avoid negative past performance ratings or potential liquidated damages. Remember, compliance isn’t about being perfect. It’s about demonstrating consistent good faith efforts through thorough documentation, proactive outreach, and timely reporting.

Conclusion and Next Steps

Key Takeaways

Crafting a compliant subcontracting plan involves addressing 15 mandatory elements, including setting specific percentage goals for categories like VOSB, SDVOSB, HUBZone, SDB, and WOSB. Your plan must detail the supplies or services to be subcontracted and explain the method used to establish these goals. Knowing when these requirements apply and ensuring every element is covered is crucial for staying compliant.

Compliance goes beyond just hitting numeric targets – it requires demonstrating a genuine, good faith effort. Keep thorough records of your outreach activities, such as source lists and the rationale behind selecting (or not selecting) specific small businesses. Submitting accurate and timely reports not only reflects your commitment to compliance but also positively impacts your past performance ratings.

Failing to show a good faith effort can lead to serious consequences, including liquidated damages, a breach of contract, or poor past performance ratings that may hurt your chances for future opportunities. To avoid these pitfalls, break your work into manageable units, involve small businesses early in the process, and document every decision and outreach effort. These practices lay the groundwork for compliance and position you for success.

How GSA Focus Can Help

Navigating the requirements of FAR 19.704 can feel overwhelming, but expert guidance makes it manageable. GSA Focus provides a full-service solution, handling everything from document preparation to compliance assurance and negotiation support. Their team knows the complexities of subcontracting plans and works to ensure you meet all requirements while allowing you to concentrate on running your business.

GSA Focus streamlines the entire process – from drafting your initial plan to managing ongoing eSRS reporting. Whether you’re tackling your first subcontracting plan or juggling multiple contracts with varying deadlines, their expertise saves you time and clears the path to federal contracting opportunities. Visit https://gsascheduleservices.com to schedule an appointment and learn how they can help you stay compliant and competitive.

FAQs

What are the main components of a Small Business Subcontracting Plan?

A Small Business Subcontracting Plan is a crucial document that outlines how a prime contractor plans to involve small businesses in their projects, as mandated by federal regulations. It ensures that opportunities are extended to small businesses across various socio-economic categories. Here’s what it typically includes:

- Details of subcontracted work: This includes a breakdown of the work to be subcontracted and the total contract value, which forms the basis for setting subcontracting goals.

- Defined goals: Specific targets, expressed in both dollar amounts and percentages, are set for small business categories such as women-owned, HUBZone-certified, service-disabled veteran-owned, and socially disadvantaged businesses.

- Actionable strategies: These include methods for sourcing, outreach efforts, and documentation of good-faith efforts to involve small businesses.

- Performance tracking and reporting: Processes are outlined to monitor progress, ensure compliance, and submit required reports to federal agencies.

- Commitment to small businesses: A clear prioritization of small businesses over larger firms whenever feasible.

These components, required by FAR Subpart 19.7, emphasize not only setting goals but also taking active steps to ensure small business participation. By working with experts like GSA Focus, contractors can streamline this process, stay compliant with federal requirements, and reduce administrative challenges.

What are the consequences of not complying with a Small Business Subcontracting Plan?

Non-compliance with a Small Business Subcontracting Plan can result in serious consequences for contractors. If they fail to meet their subcontracting goals or can’t demonstrate a good-faith effort, they might face liquidated damages – essentially paying the government an amount equal to the shortfall. On top of that, the government has the authority to terminate the contract, withhold payments, or even disqualify the contractor from bidding on future federal contracts.

But the impact doesn’t stop at financial penalties. Falling short on compliance can damage a contractor’s reputation with federal agencies, making it tougher to secure future contracts. It may also lead to stricter oversight or trigger audits, adding more challenges. By staying compliant, contractors not only avoid these pitfalls but also build trust with government agencies – an essential step toward long-term success in federal contracting.

What are some helpful resources for creating and managing small business subcontracting plans?

Creating a compliant small business subcontracting plan involves understanding the right guidelines and leveraging the best tools available. The Federal Acquisition Regulation (FAR) lays out the key requirements, including the necessary elements of a plan, reporting responsibilities, and performance standards. Specific FAR clauses – such as 52.219-8, 52.219-9, and 52.219-16 – provide clear instructions for working with small businesses, drafting subcontracting plans, and staying compliant.

Government resources can be incredibly helpful in this process. For example, the Small Business Administration (SBA) offers detailed guides that walk you through registering in SAM, finding subcontracting opportunities, and identifying potential partners. To stay current with regulatory updates, tools like the Electronic Code of Federal Regulations (eCFR) are invaluable.

If you’re looking for more hands-on assistance, companies like GSA Focus provide specialized services. They handle everything from preparing your subcontracting plan to monitoring compliance and supporting negotiations. This allows small businesses to meet federal requirements without losing focus on their growth and operations.

Related Blog Posts

- Penalties for Subcontracting Plan Violations

- Why Subcontracting Plans Matter for GSA Contracts

- GSA Subcontracting Plans: Key Requirements

- Checklist for Subcontracting Plan Compliance