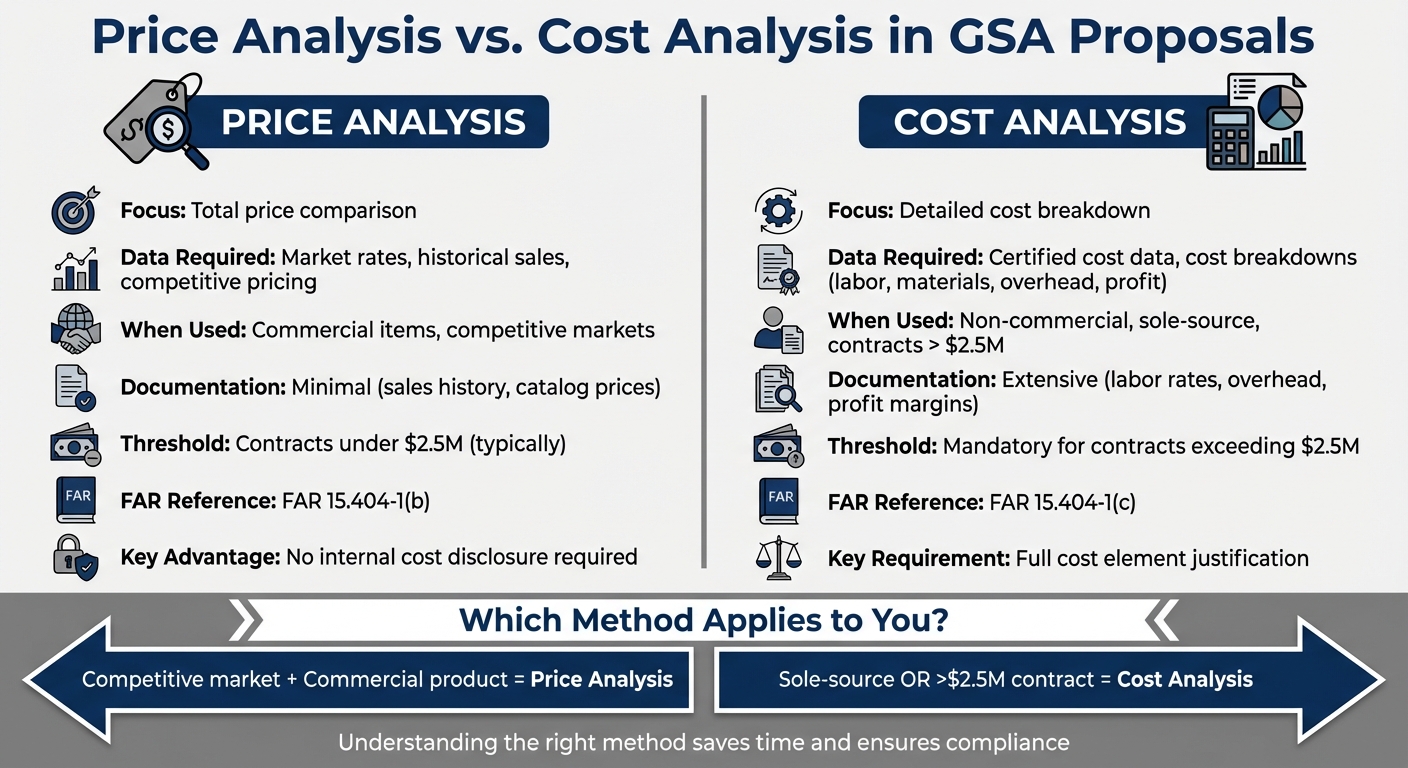

When preparing a GSA proposal, understanding the difference between price analysis and cost analysis is critical. Both methods aim to ensure your pricing is fair and reasonable, but they differ in approach and application:

- Price Analysis: Focuses on comparing your total proposed price to market rates, historical data, or competitive pricing. It doesn’t require a breakdown of internal costs and is commonly used for commercial products or services.

- Cost Analysis: Requires a detailed breakdown of individual cost components (e.g., labor, materials, overhead, profit). This method is mandatory for contracts exceeding $2.5 million or in sole-source scenarios.

Knowing which method applies to your proposal can save time, reduce unnecessary disclosures, and streamline compliance with federal standards. Below is a quick comparison to help you determine the right approach.

Quick Comparison

| Aspect | Price Analysis | Cost Analysis |

|---|---|---|

| Focus | Total price comparison | Detailed cost breakdown |

| Data Required | Market rates, historical sales, competitive pricing | Certified cost data, cost breakdowns |

| When Used | Commercial items, competitive markets | Non-commercial, sole-source, contracts > $2.5M |

| Documentation | Minimal (e.g., sales history, catalog prices) | Extensive (e.g., labor rates, overhead, profit) |

| FAR Reference | FAR 15.404-1(b) | FAR 15.404-1(c) |

Price Analysis vs Cost Analysis in GSA Proposals: Key Differences

What is Price Analysis?

Definition and Purpose

Price analysis is the process of evaluating a proposed price by comparing it to external benchmarks, rather than dissecting the individual cost components or profit margins involved. This approach is commonly used in commercial acquisitions and GSA Schedule proposals when certified cost or pricing data are not required.

"Price analysis is the process of examining and evaluating a proposed price without evaluating its separate cost elements and proposed profit."

– FAR 15.404-1(b)

Contracting officers use this method to determine whether a proposed price is fair and reasonable by comparing it to prices at which similar items have been sold in the past. For contractors, one of the key advantages of price analysis is that it eliminates the need to disclose sensitive internal financial details. Instead, contractors can demonstrate competitive pricing through sources like published price lists, historical sales data, or comparable market prices. Grasping the fundamentals of price analysis is essential before diving into how it contrasts with cost analysis, which will be discussed later.

Common Price Analysis Techniques

To ensure fair pricing, contracting officers often compare proposals to competitor pricing and historical data. If these primary methods don’t provide enough information, secondary techniques may come into play. These include:

- Parametric estimating: Using general metrics, like dollars per pound or per horsepower, to spot pricing inconsistencies.

- Market research: Comparing proposed prices with data derived from broader market studies.

- Published price lists: Referring to competitive catalogs, commodity market indexes, or similar benchmarks.

- Independent Government Cost Estimate (IGCE): Comparing the proposed price to an independent estimate prepared by the Government.

When historical pricing is used, adjustments are sometimes needed to account for factors like time gaps, differences in terms and conditions, varying quantities, or shifts in market conditions. If neither historical nor competitive data is sufficient, contractors might be asked to provide "data other than certified cost or pricing data", such as sales history. This straightforward method of evaluating total prices lays the groundwork for understanding the more detailed approach of cost analysis, which will be explored later.

What is Cost Analysis?

Definition and Purpose

In the context of GSA proposals, cost analysis is a meticulous process designed to ensure that all proposed costs comply with federal cost standards. This involves breaking down a proposal into its individual cost elements – such as labor, materials, overhead, and profit – and evaluating the fairness and accuracy of each one.

"Cost analysis is the review and evaluation of any separate cost elements and profit or fee in an offeror’s or contractor’s proposal."

– FAR 15.404-1(c)

This review becomes mandatory for contracts exceeding $2.5 million. The primary aim is to assess "cost realism", which means verifying whether the proposed costs reasonably reflect what the contract should cost under efficient and economical conditions. Each cost element is checked to ensure it meets federal standards for reasonableness, allowability (as outlined in FAR Part 31), and allocability.

For GSA multiple-award IDIQ contracts, cost realism analysis typically takes place at the task order level for cost-reimbursement orders, rather than at the broader IDIQ contract level. This level of scrutiny ensures adherence to established contract cost principles and, when applicable, compliance with Cost Accounting Standards (CAS).

The next section explores the techniques used to evaluate these cost elements in detail.

Common Cost Analysis Techniques

Contracting officers rely on a variety of methods to examine and validate each cost element. Direct costs – such as labor hours, labor rates, materials, supplies, and subcontractor quotes – are closely reviewed, often using audited or negotiated figures as benchmarks. Indirect costs, including overhead, depreciation, and administrative expenses, undergo similar scrutiny.

One common approach is trend projection, which uses a combination of current and historical data to predict future costs and identify potential inefficiencies. Officers also compare proposed costs to Independent Government Cost Estimates (IGCEs) and may consult technical experts to determine whether the proposed quantities of labor and materials align with the scope of work. For high-value proposals, agencies like the Defense Contract Audit Agency (DCAA) may conduct assist audits to verify labor rates and overhead.

The level of scrutiny increases with the value of the proposal. Cost elements tied to higher-dollar items or those appearing less credible are examined more rigorously. The guiding principle is that a reasonable businessperson would only incur necessary costs in a competitive environment. These methods collectively ensure that your proposal adheres to federal cost guidelines and withstands thorough evaluation.

Government Contracting: Proposal Pricing & Compliance Considerations

Main Differences Between Price Analysis and Cost Analysis

Now that we’ve outlined their definitions, let’s dive into the key differences between price analysis and cost analysis. While both aim to ensure that the agreed price is fair and reasonable, they take very different paths to get there. Price analysis looks at the overall proposed price without dissecting its individual components. On the other hand, cost analysis digs into the details – examining elements like labor, overhead, and profit to verify if each part is reasonable.

The type of data required for each method is also distinct. Price analysis leans on external market data, such as competitive bids, historical pricing for similar items, published catalogs, and Independent Government Cost Estimates (IGCEs). This process typically doesn’t require certified data. In contrast, cost analysis demands a detailed breakdown of internal costs and often calls for Certified Cost or Pricing Data, especially for contracts exceeding $2.5 million.

When it comes to application, contracting officers often choose price analysis for commercial products or services where ample competition exists. Cost analysis, however, becomes essential when certified cost data are required – usually for non-commercial, sole-source contracts or when price analysis alone cannot confirm a fair price.

Price analysis is less resource-intensive and requires minimal disclosure of internal cost structures, making it the go-to method when competitive pricing is sufficient. Cost analysis, while more demanding, provides the deep dive necessary to ensure that every cost element aligns with what the contract should reasonably cost under efficient operations. These differences set the stage for more detailed evaluation methods, as outlined below.

Comparison Table: Price Analysis vs. Cost Analysis

Here’s a side-by-side look at how these two approaches differ:

| Feature | Price Analysis | Cost Analysis |

|---|---|---|

| Definition | Evaluates the total price without breaking down individual cost components | Examines individual cost elements and profit to ensure reasonableness |

| Primary Data Source | External market data: competitive quotes, historical prices, published catalogs, IGCEs | Certified cost or pricing data or detailed cost breakdowns |

| When Required | For commercial items or when certified cost data isn’t necessary | For non-commercial, sole-source contracts or when certified cost data is required |

| Objective | Confirms the overall price is fair and reasonable | Ensures individual cost elements reflect efficient and reasonable costs |

| GSA Application | Common for GSA Schedule offers and commercial product acquisitions | Used for complex, non-commercial requirements or cost-reimbursement task orders |

| FAR Reference | FAR 15.404-1(b) | FAR 15.404-1(c) |

When to Use Price Analysis in GSA Proposals

Price analysis plays a key role in GSA Schedule proposals, as contracting officers use external market data to determine if pricing is reasonable. Since GSA Multiple Award Schedule (MAS) contracts are based on commercial offerings, the General Services Administration typically relies on price analysis during the initial proposal phase. This approach works particularly well in competitive procurement scenarios.

In competitive procurements, fair pricing is established when multiple vendors submit independent bids. However, even a single offer can be evaluated if competition was anticipated. As the Federal Acquisition Regulation (FAR) puts it:

"Normally, adequate price competition establishes a fair and reasonable price".

Price analysis is required in cases where certified cost or pricing data isn’t necessary. For example, this applies to acquisitions below the simplified acquisition threshold or under $2.5 million for prime contracts awarded on or after July 1, 2018. If your contract doesn’t meet the criteria for certified data, you’ll operate within the price analysis framework. Similarly, procurements with prices set by law or regulation also rely on price analysis instead of cost analysis.

For GSA Schedule holders, price analysis is particularly important because your pricing is established as a maximum ceiling rate. Ordering Contracting Officers (OCOs) use this method to assess whether your rates are competitive by comparing them against these pre-negotiated ceilings and other market benchmarks. They review your proposed prices alongside historical government purchase data, published price lists, and tools like GSA’s CALC+ Prices Paid system.

When to Use Cost Analysis in GSA Proposals

Cost analysis becomes necessary when competitive market conditions fail to ensure fair pricing. This is particularly relevant for proposals requiring certified cost or pricing data on prime contracts exceeding $2.5 million (or $950,000 for awards made before July 1, 2018).

Beyond these thresholds, there are other situations where a detailed cost breakdown is essential. For instance, sole source contracts, which lack competitive bidding, require contracting officers to examine specific cost components – such as labor, materials, overhead, and profit – to determine if the pricing is reasonable. Cost analysis is also required for cost-reimbursement task orders under GSA IDIQ contracts and in cases where market data is insufficient to establish fair pricing, such as with commercial services that lack comparable pricing benchmarks.

Additionally, large sole source commercial contracts valued at more than $25 million must include certified cost or pricing data to confirm that the proposed pricing aligns with actual costs.

When cost analysis is mandated, contracting officers use structured weight ranges to evaluate profit. For example, contractor effort might fall within a range of 4%–12% for conversion direct labor, while contract cost risk could range from 3%–7% for fixed-price contracts. It’s critical that your accounting systems can back up these cost elements with proper documentation.

How to Apply Price and Cost Analysis in GSA Proposals

Understanding the distinction between price and cost analysis is just the first step. Knowing how to apply these methods in your GSA proposals is where the real work begins. The key is to demonstrate a fair and reasonable price by selecting the appropriate analysis method and backing it up with solid documentation.

If certified cost or pricing data isn’t required, you’ll rely on price analysis. This involves comparing your proposed prices to competitive bids or using historical sales data for similar items. On the other hand, when certified data is required – typically for contracts exceeding $2.5 million – you’ll need to conduct a cost analysis. This process involves breaking down and justifying each element of cost in line with FAR Part 31 principles, ensuring your proposal is consistent and accurate.

Gathering the Right Data

Start by identifying what data you need. The Federal Acquisition Regulation (FAR) stresses the importance of collecting only the data necessary to establish a fair and reasonable price – nothing more, nothing less. For price analysis, focus on competitive pricing or historical sales data. If you’re using historical prices, remember to adjust them based on the earlier discussion on price analysis methods. For cost analysis, your accounting systems should be capable of providing clear documentation for every cost element, from labor rates to indirect costs.

In more complex proposals, technical analysis might come into play. Contracting officers may call in experts to verify that your proposed resources – such as labor mixes or material quantities – are essential and reasonably priced. If you’re offering commercial products that require modifications or involve "similar-to" comparisons, be prepared to explain how these changes affect your pricing.

Mistakes to Avoid

Pricing errors can derail even the most well-prepared proposals. One common issue is imbalanced pricing, where items are mispriced, leading to increased performance risks and potential rejection. Make sure unit prices accurately reflect the value of each item. As FAR 15.404-1(f) warns:

"Any method of distributing costs to line items that distorts the unit prices shall not be used."

Other pitfalls include computational errors, omissions, or duplications in your pricing data. These factual mistakes must be caught and corrected before submission. Also, proposing to subcontract more than 70% of the total cost without proper written approval from the contracting officer can raise red flags.

When conducting cost analysis, avoid basing future cost estimates on inefficient or outdated practices. Instead, focus on realistic, efficient projections to build a stronger case.

Working with Consulting Services

If navigating price and cost analysis feels overwhelming, you’re not alone – especially if you’re a small business new to federal contracting. This is where consulting services can make a difference.

GSA Focus, for instance, specializes in helping small businesses craft GSA proposals that are both compliant and competitive. With a 98% success rate, they handle the details, from organizing historical sales data to structuring cost breakdowns that align with FAR Part 31. Their secure online platform makes document uploads easy, while their expert advisory team helps you sidestep common mistakes like imbalanced pricing or incomplete documentation.

Conclusion

When preparing your GSA proposal, ensure your final submission reflects fair and reasonable pricing. The choice between price analysis and cost analysis hinges on whether certified cost or pricing data is required. For commercial products, services, or competitive markets, price analysis is typically the go-to method. It requires less documentation and focuses on comparing your total price against market benchmarks. On the other hand, if certified cost data is necessary – usually for contracts exceeding $2.5 million or in sole-source scenarios – cost analysis becomes essential. This method involves a detailed breakdown of individual cost elements.

The Federal Acquisition Regulation provides clear guidance: "Price analysis shall be used when certified cost or pricing data are not required" and "Cost analysis shall be used to evaluate the reasonableness of individual cost elements when certified cost or pricing data are required". Understanding which threshold applies to your proposal ensures compliance and competitiveness.

To meet federal standards, your documentation should clearly demonstrate pricing accuracy while avoiding common issues like unbalanced pricing or computational errors. By adopting these approaches, you align your submission with government expectations and strengthen your position in the bidding process.

GSA Focus has supported hundreds of contractors in crafting compliant proposals, achieving a 98% success rate. Their expertise spans everything from organizing data to ensuring compliance, helping businesses avoid pitfalls and focus on securing federal contracts.

Set your business up for success in the federal marketplace by selecting the right analysis method for your proposal.

FAQs

When should I choose price analysis instead of cost analysis for my GSA proposal?

When certified cost or pricing data isn’t needed, price analysis is your go-to method. It’s all about determining whether the price is fair and reasonable by comparing it to market rates, historical data, or catalog listings.

This method works best when you don’t need to dig into the nitty-gritty of individual cost components. It’s faster and simpler, making it a practical choice for evaluating pricing in GSA proposals. On the other hand, cost analysis dives deeper, breaking down elements like labor, materials, and overhead to assess the price in detail.

What documentation is required for cost analysis on contracts over $2.5 million?

For contracts over $2,500,000, the offeror is required to submit certified cost or pricing data to justify each cost component. This data should include audited cost records, direct labor and indirect rates, cost of money calculations, and any other pertinent documents or records. These details are crucial for maintaining transparency and meeting federal regulations.

How can I set competitive pricing for my GSA proposal without sharing sensitive cost details?

To keep your pricing competitive while safeguarding sensitive financial details, turn to price analysis techniques. This involves comparing your rates with market prices, historical contract data, published price lists, independent government estimates, or using parametric models. These methods help you establish fair and reasonable pricing by focusing on the end price, without needing to disclose intricate cost details.

By prioritizing clarity in your pricing strategy while keeping proprietary information secure, you can meet GSA requirements and strengthen trust with federal buyers.

Related Blog Posts

- How to Analyze GSA Competitor Pricing

- Cost Element Breakdown in GSA Contracts

- Cost Estimation Basics for GSA Proposals

- Risk Factors in Cost Analysis for GSA Contracts