GSA Sales Reporting is essential for businesses with GSA Schedule contracts. It ensures compliance, helps track sales, and supports the Federal Supply Schedules program through the Industrial Funding Fee (IFF). Here’s what you need to know:

- Who must report? All GSA Schedule holders – monthly for TDR contractors and quarterly for CSP contractors.

- What is reported? Sales of products or services under your GSA contract. Non-GSA sales, like open market items, are excluded.

- Why it matters: Accurate reporting avoids penalties, ensures contract compliance, and builds trust with federal agencies.

- How to report: Use the FAS Sales Reporting Portal to submit sales data and pay the 0.75% IFF through Pay.gov.

Key deadlines:

- CSP: Quarterly reports due January 30, April 30, July 30, and October 30.

- TDR: Monthly reports due by the 15th of the following month.

Understanding these basics is crucial to maintaining your GSA contract and growing your federal business. Let’s dive deeper into the details.

GSA Sales Reporting Requirements

Legal Rules and Compliance Guidelines

GSA sales reporting operates under strict federal regulations that every Multiple Award Schedule (MAS) contract holder must adhere to. According to GSAR 552.238-80, contractors are obligated to track and report MAS sales accurately and on time, ensuring proper remittance of the Industrial Funding Fee (IFF). The reporting schedule depends on the type of contract. For those using Commercial Sales Practices (CSP), quarterly reports must be submitted at the Special Item Number (SIN) level. On the other hand, contractors under the Transactional Data Reporting (TDR) system are required to file monthly reports, which must include 12 specific data points. Regardless of the reporting method, all sales reports must be submitted within 30 days after the reporting period ends, and the IFF – currently 0.75% of reported sales – must be paid within the same timeframe. These regulations clearly define what qualifies as a reportable transaction and impose strict penalties for non-compliance.

GSA Sales vs. Non-Reportable Transactions

To determine whether a transaction qualifies as a reportable MAS sale, three criteria must be met: the customer must be eligible to use the MAS contract, the product or service must be listed on the contract, and no alternative contracting method should be in use. Reportable sales include all contract items sold to authorized users, such as federal agencies and state or local governments participating under Cooperative Purchasing authority. Conversely, non-reportable transactions include open market items, most subcontracted work, and sales conducted under separate contracting arrangements. In cases where there’s uncertainty about whether a transaction should be reported, it’s best to verify with the ordering organization to confirm the use of your MAS contract for that order.

Penalties for Non-Compliance

Failing to comply with GSA sales reporting requirements can lead to serious consequences, including the cancellation of sales or even the termination of the entire contract. Missing the 30-day deadline for IFF payments triggers immediate financial penalties. Any unpaid IFF becomes a contract debt to the U.S. Government, which can offset payments and charge interest. Additionally, falsifying or omitting sales data can result in the termination of your GSA Schedule and the removal of your pricelist. Non-compliance may also prompt in-depth audits that examine your contract performance and overall business practices. Considering that GSA Federal Supply Schedule contracts accounted for $33 billion in sales in Fiscal Year 2015 – over 7% of total federal contract spending – it’s critical to follow these reporting rules and deadlines carefully.

FAS Sales Reporting Portal (SRP) training

How to Report GSA Sales

Submitting your sales data on time and accurately is essential for staying compliant with your GSA contract and avoiding penalties. Knowing your reporting method and understanding the submission process are key to meeting your obligations.

Choosing Between CSP and TDR Methods

Your GSA MAS contract will specify whether you need to report sales through the CSP (Commercial Sales Practices) method or the TDR (Transactional Data Reporting) method. Each has its own requirements for frequency, deadlines, and the level of detail required.

- CSP Reporting: This method requires you to report aggregate sales totals by Special Item Number (SIN) on a quarterly basis.

- TDR Reporting: With TDR, you’ll need to submit transaction-level data monthly. This includes details like product descriptions, part numbers, quantities sold, price per unit, and total sales amounts.

Currently, the TDR program applies to 65 SINs across various GSA Schedules, such as IT Schedule 70 (specific SINs), Professional Services Schedule 00CORP (engineering SINs), the Hardware Superstore Schedule 51 V, and the Audio/Video Schedule 58 I.

| Reporting Method | Frequency | Deadline | Data Required |

|---|---|---|---|

| CSP | Quarterly | January 30, April 30, July 30, October 30 | Aggregate sales totals by SIN |

| TDR | Monthly | 15th of the following month | Individual transaction details |

To confirm which method applies to your contract, visit the GSA’s Vendor Support Center and search for your contract number. This will also guide you on whether to use the 72A system (for CSP) or the FAS Sales Reporting Portal (for TDR).

"Mastering the art of GSA contract sales reporting through either the 72a or FAS system is key for contractors, especially for those affected by TDR. Staying well-informed, verifying contract particulars, and ensuring accurate reporting are pivotal steps in maintaining compliance with GSA Schedule requirements." – Pedro, Contracting Officer and Contract Specialist

Once you’ve determined your reporting method, the next step is to navigate the FAS Sales Reporting Portal for efficient data submission.

Using the FAS Sales Reporting Portal

The FAS Sales Reporting Portal (SRP) is the central platform for submitting GSA sales data and managing Industrial Funding Fee (IFF) payments. It supports over 15,000 MAS contracts and collects data for various federal schedules.

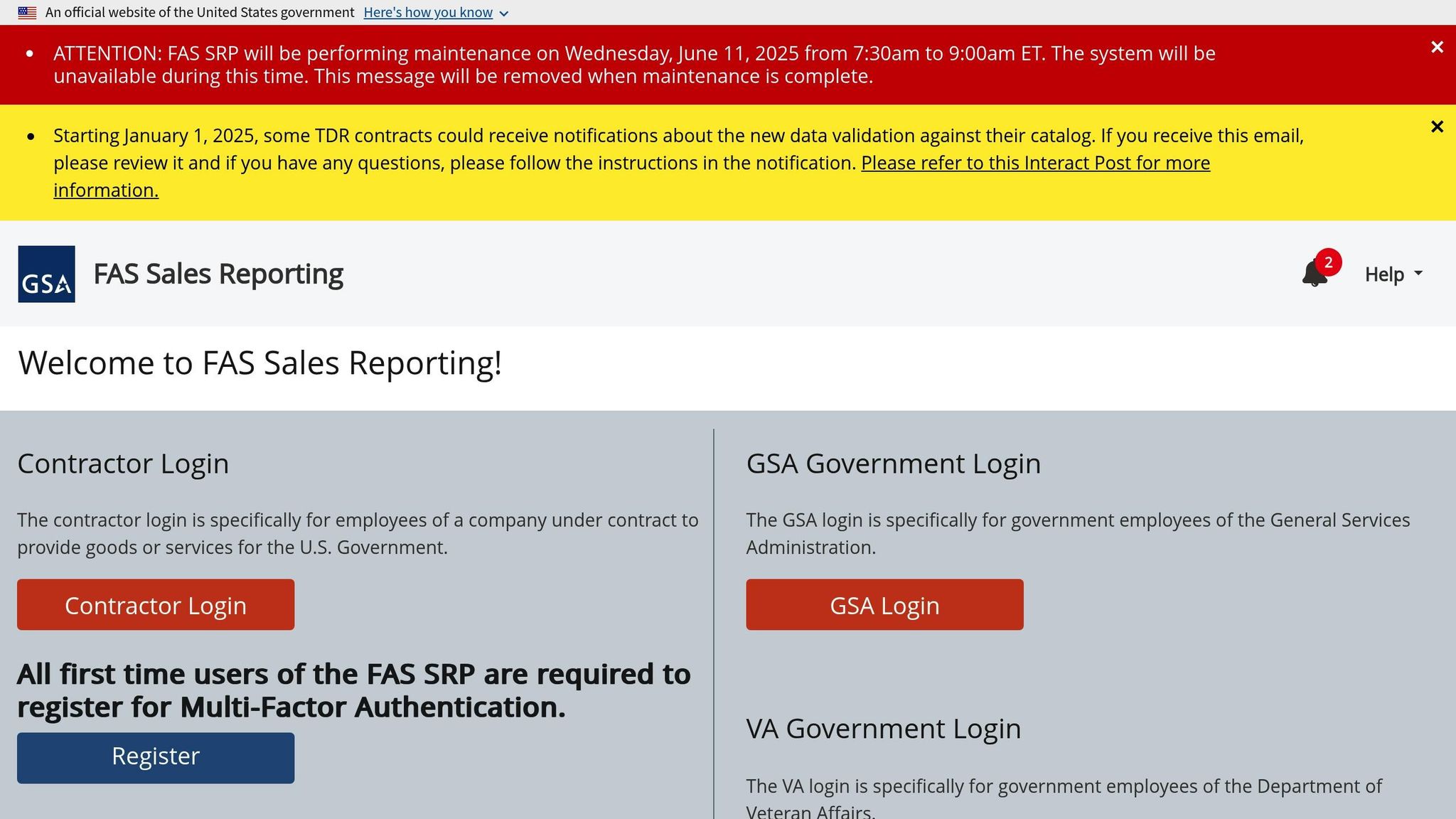

To access the portal, you must be listed on your contract as an Industrial Funding Fee Point of Contact, an administrative representative, or an authorized negotiator. After confirming your role, register for a GSA FAS ID, which uses multi-factor authentication with one email and password.

- Log in at https://srp.fas.gsa.gov/ using your GSA FAS ID.

- Verify access with the security code sent to your email.

- Ensure you log in at least once every 90 days to avoid account deactivation.

The system offers two main ways to report data:

- Form Entry: Manually enter quarterly SIN totals for CSP reporting.

- File Upload: Submit detailed transaction data, which is ideal for TDR reporting on a monthly basis.

For payments, the portal integrates with Pay.gov. Navigate to the "Payment" tab in the left-hand menu, select "Make Payments", and choose your preferred payment method to settle your Industrial Funding Fee, which is currently 0.75% of your quarterly sales totals.

Even if you have no sales to report, you’ll need to follow the same process to stay compliant.

Zero-Sales Reporting Requirements

If you don’t have any sales during a reporting period, you’re still required to file a zero-sales report. This applies to both CSP and TDR contractors and is essential for keeping your contract active.

To submit a zero-sales report:

- Log into the FAS Sales Reporting Portal.

- Enter $0.00 for each SIN on your contract during the reporting period.

- CSP contractors must submit quarterly zero-sales reports.

- TDR contractors must file monthly zero-sales reports by the 15th of the following month.

Submitting these reports ensures compliance and prevents potential contract issues. Even during periods with no sales, GSA uses these reports to monitor contract activity and confirm that contractors remain engaged with their obligations.

sbb-itb-8737801

Managing the Industrial Funding Fee (IFF)

The Industrial Funding Fee (IFF) is a mandatory part of your GSA sales reporting, designed to support GSA’s operations. Knowing how to calculate, manage, and submit this fee correctly is essential to stay compliant and avoid penalties.

How to Calculate the IFF

The IFF is set at 0.75% of your total GSA contract sales for each reporting period. This fixed percentage applies to all GSA Schedule contracts.

To calculate the IFF, you must first identify which sales qualify as reportable. Only sales of products or services listed on your GSA-approved pricelist should be included. For example, if your GSA sales for a reporting period total $100,000, your IFF payment would be $750 ($100,000 × 0.0075). Ensuring accuracy in determining reportable sales is critical.

To include the IFF in your pricing, divide your discounted price by 0.9925. This ensures the fee is accounted for in your GSA rates.

The IFF isn’t just a small detail – it’s a major contributor to GSA’s funding. In 2021, contractors generated nearly $39 billion in MAS revenue, resulting in $293 million in IFF payments. By fiscal year 2023, GSA Schedule sales had surpassed $41.1 billion.

Once you’ve calculated your fee, the next step is submitting it through Pay.gov.

Paying the IFF via Pay.gov

IFF payments must be submitted electronically via Pay.gov – paper checks are not accepted. You can access the payment system through the FAS Sales Reporting Portal by selecting "Make Payments" under the "Payment" tab.

While payments are due quarterly, you can choose to remit them monthly to better manage cash flow. Regardless of the frequency, all payments must be made within 30 days after the end of each reporting quarter.

Pay.gov supports various payment methods, offering flexibility based on your transaction size:

| Payment Method | Transaction Limit | Best For |

|---|---|---|

| ACH Transfer | $99,999,999.99 | Large payments, low processing costs |

| Debit Card | Unlimited | Payments of any size, immediate processing |

| Credit Card | $24,999 | Smaller payments, potential rewards |

| PayPal | $10,000 | Small to medium payments, convenient option |

Most contractors find ACH transfers cost-effective for larger payments, while credit cards may suit smaller amounts, particularly during the early stages of contract activity.

Timeliness is crucial. Missing the 30-day deadline results in a contract debt to the U.S. Government. This debt can lead to collection actions and put your contract at risk.

Common IFF Management Errors to Avoid

Mistakes in IFF management can lead to compliance headaches. Here are some common errors and how to sidestep them:

- Misidentifying Reportable Sales: Including non-GSA revenue or excluding eligible GSA sales can result in overpayment or underpayment. For example, travel and direct costs should only be included if they are explicitly listed on your GSA Schedule.

- Subcontractor Reporting Issues: If you’re a prime contractor using subcontractors, only report the portion of sales that corresponds to your GSA Schedule items.

- Lack of Documentation: Poor record-keeping can lead to audit complications. Maintain clear and organized documentation that separates GSA Schedule revenue from other income streams on quotes, orders, and invoices.

- Pricing Errors: Forgetting to include the 0.75% IFF in your GSA pricing means you’ll absorb the cost instead of passing it on. Your awarded GSA rates should already account for this fee.

If you’re unsure about your calculations or processes, seeking advice from MAS contracting professionals can save you from costly mistakes. The expense of professional guidance is minor compared to the penalties and contract issues that can arise from repeated errors.

Tips for Accurate Reporting

Getting GSA sales reporting right requires a solid system, well-organized records, and preparation ahead of time. Small businesses that prioritize these steps early on can avoid compliance headaches and build credibility with GSA.

Here’s how you can improve your reporting accuracy while staying compliant with GSA guidelines.

Setting Up a Sales Tracking System

A reliable accounting system is the backbone of accurate reporting. It’s crucial to implement one that can track GSA Schedule sales and differentiate between various revenue streams.

Make sure every purchase order and invoice includes your GSA Schedule contract number. Additionally, invoices should list the GSA contract number, DUNS number, SIN, part number, and a clear description of the service or product.

To streamline tracking, create unique customer codes in your accounting software. This helps separate government sales from commercial and other customer types, ensuring precise Industrial Funding Fee (IFF) calculations and avoiding overpayments.

If your business handles Order Level Materials (OLMs), coding these items correctly as GSA-related in your system is critical. Your system should also be able to monitor order limits (33.33%) and identify OLMs exceeding the Simplified Acquisition Threshold. Clearly mark any open market items on GSA orders to avoid mistakenly paying IFF fees on them.

Training your team is equally important. Staff should know how to document and track GSA Schedule sales and understand the difference between GSA and non-GSA transactions. Keep the latest version of your pricelist accessible to the appropriate team members and promptly address any errors in GSA sales classifications.

Finally, conduct regular quality checks by pulling sales reports and sampling orders. This helps catch errors early and ensures compliance. If manual steps are part of your reporting process, use system checks to flag any inconsistencies.

Once your tracking system is in place, focus on organizing your documentation to further support accurate reporting.

Organizing Your Documentation

Good documentation not only ensures accurate reporting but also prepares your business for audits. Keep detailed records supporting your TDR reports, as this information may be reviewed during an audit.

In your accounting software, separate GSA sales from non-GSA sales to ensure accurate IFF calculations. Your processes should clearly distinguish contract items from open market items, making it easier to generate precise reports and avoid including non-reportable revenue.

Download the GSA Schedule Contractor Compliance Checklist to monitor your company’s compliance efforts. Regular self-assessments can help you spot and address potential issues before they escalate.

Maintain thorough records of contract modifications, pricing updates, and Trade Agreements Act (TAA) compliance documents. These records not only ensure reporting accuracy but also demonstrate your commitment to staying compliant.

Make sure GSA prompt payment terms and volume discounts are clearly noted on quotes, proposals, contracts, and invoices. This documentation supports your adherence to contract terms and explains any pricing differences in your reports.

These steps will also help your business stay audit-ready.

Preparing for Audits

Audit preparation starts with educating your team about GSA Schedule requirements, including identifying GSA sales, handling modifications, and ensuring TAA compliance.

When you receive an audit notice, request the agency’s requirements right away. Conduct an internal pre-audit to identify and resolve any potential issues before the audit begins. Gather all requested documents, make copies, and have them ready for review.

Prepare your management team for their role in the process. Request an entrance meeting to clarify the audit scope, establish communication protocols, and introduce your team to the auditors. Assign a single point of contact to manage all communications during the audit.

During the audit, ensure all necessary documents are readily available and keep a record of all communications. Train employees on how to handle interview questions and provide accurate information.

At the end of the audit, request an exit meeting to review findings, clarify next steps, and determine when the final report will be issued. This is an opportunity to address any concerns and understand the results.

Once the audit is complete, conduct periodic internal reviews to address compliance risks or create a corrective action plan if needed. These ongoing efforts show your dedication to compliance and help prevent future issues.

Key Takeaways

To succeed with your GSA contract, you need a robust tracking system that clearly separates GSA revenue from commercial revenue. This is critical for calculating the 0.75% Industrial Funding Fee (IFF) accurately and ensuring compliance with reporting requirements.

Once your tracking system is solid, the next step is choosing the right reporting method. Transactional Data Reporting (TDR) can be a game-changer, especially for small businesses. Unlike Commercial Sales Practices (CSP), TDR doesn’t require tracking Most Favored Customer pricing or adhering to the Price Reductions Clause. With over 75% of GSA Schedule contractors being small businesses, TDR’s monthly reporting is often easier to manage compared to CSP’s quarterly aggregate requirements.

The benefits of a GSA contract are clear in the numbers. For instance, a Virginia-based IT services company increased its annual revenue from $450,000 to $2.3 million in just three years. Similarly, a woman-owned healthcare staffing business earned over $1.1 million and added 15 employees within 18 months.

Simplify with Automation

Make your reporting process smoother by leveraging automation tools. Software that integrates with the Sales Reporting Portal can reduce manual errors significantly. Standardizing data formats – such as dates, prices, and product descriptions – and conducting internal audits before submission are equally important. These steps not only minimize mistakes but also make data reconciliation more efficient.

Build Confidence with Consistency

Consistency in reporting practices is essential. As guidance from vsc.gsa.gov emphasizes:

"When a government order fits within the MAS contract parameters, the order should be considered a MAS sale unless the ordering agency indicates otherwise. When in doubt, ask the ordering organization if they are using your GSA contract for that order."

Stay on top of your GSA contract by keeping your SAM.gov registration current, responding promptly to solicitation updates, and maintaining well-organized records. Your GSA contract isn’t just about compliance – it’s a powerful tool for growth. In fiscal year 2023 alone, GSA Schedule sales reached $41.1 billion.

Train Your Team for Success

Empower your team with the knowledge they need to differentiate between GSA and non-GSA transactions. Assign a dedicated team member to manage reporting and IFF remittance. Whether you handle these tasks internally or partner with specialists like GSA Focus, attention to these details ensures your contract remains in good standing. By mastering these fundamentals, you’ll be well-positioned to thrive in the federal contracting space.

FAQs

What’s the difference between CSP and TDR reporting for GSA sales, and how can I find out which one applies to my contract?

The key distinction between Commercial Sales Practices (CSP) and Transactional Data Reporting (TDR) lies in the type of data you’re required to report and the rules tied to each method.

With CSP, the focus is on sharing information about your pricing practices to ensure compliance with the Price Reduction Clause (PRC). This clause links your GSA pricing to your Most Favored Customer (MFC). Using CSP means working with aggregate sales data and keeping track of customer classes, which can involve a more detailed review of pricing structures.

TDR, on the other hand, shifts the focus to transaction-level data. This requires reporting the exact prices paid for goods or services on a monthly basis. Unlike CSP, TDR doesn’t require MFC disclosures or adherence to the PRC, which can make it a more flexible option and potentially reduce the administrative burden for contractors.

If you’re unsure which method applies to your GSA Schedule, check the terms of your contract. For those eligible for TDR, it could simplify your reporting process. You can log in to the GSA Sales Reporting Portal to confirm your eligibility and understand your specific reporting requirements.

How can I ensure my GSA sales reporting is accurate and compliant to avoid penalties?

To keep your GSA sales reporting accurate and compliant, it’s essential to have a solid accounting system in place. This system should clearly distinguish between GSA and non-GSA sales, making it easier to track and report correctly. Remember, you need to submit your sales reports – even if there’s nothing to report – within 30 days after each quarter ends.

Take the time to regularly review your pricing policies and internal controls. This helps catch potential issues like pricing errors or overlooked Industrial Funding Fee (IFF) payments before they become a problem. Another smart move? Providing ongoing training for your team members involved in reporting. Educating your staff can significantly reduce common errors and ensure everyone is aligned with GSA’s requirements.

By staying organized, double-checking your processes, and being proactive, you can safeguard your contract status and steer clear of penalties.

What are the best practices for managing the Industrial Funding Fee (IFF) and avoiding calculation errors?

To handle the Industrial Funding Fee (IFF) effectively and steer clear of common pitfalls, a few essential strategies can make all the difference. Start with accurate sales tracking by using dependable systems that capture every GSA sale. Make it a habit to regularly compare your internal sales records with GSA reports. This practice helps identify and fix discrepancies early, preventing potential compliance headaches.

Remember, the IFF is 0.75% of total GSA sales, so precision in your calculations is key. Submitting your payments on time is equally critical. Consider automating your reporting process – this can minimize human errors and simplify compliance tasks. Staying up-to-date on GSA requirements and deadlines ensures you avoid unnecessary issues and maintain a solid partnership with the GSA.

Related posts

- How to Track GSA Contract Compliance

- How to Track Federal Sales with GSA Tools

- Top 5 Compliance Issues in GSA Contracts

- Common GSA Compliance Mistakes And Fixes