Federal subcontracting offers $45 billion in opportunities annually for small businesses. Large contractors with contracts over $750,000 (or $1.5 million for construction) must include small businesses in their plans, creating daily opportunities worth $50 million. However, navigating federal subcontracting can be challenging due to compliance requirements, paperwork, and complex regulations.

This guide highlights seven resources to simplify the process, meet compliance standards, and connect with prime contractors:

- FAR Subpart 19.7: Outlines subcontracting rules and compliance requirements.

- GSA Subcontracting Templates: Preformatted plans for prime contractors.

- SBA Procurement Center Representatives (PCRs): Help small businesses find opportunities and meet goals.

- GSA Schedule & Certifications: Boost visibility with federal agencies.

- SAM Registration: Essential for federal contracting.

- GSA Subcontracting Directory: Connects small businesses with prime contractors.

- GSA Focus Services: Simplifies contract management and compliance.

These tools can help you secure federal contracts, build partnerships, and grow your business in the federal marketplace.

How to Win Federal Contracts Through Subcontracting (Step-by-Step Guide)

1. Federal Acquisition Regulation (FAR) Subpart 19.7

FAR Subpart 19.7 provides the legal foundation for small business subcontracting plans in federal contracts, outlining the rules and expectations that large businesses must follow when working with small business partners. This regulation plays a key role in ensuring that small businesses have fair access to subcontracting opportunities.

Under this framework, large businesses awarded federal contracts exceeding $750,000 – or $1,500,000 for construction projects – must submit an approved subcontracting plan before the contract is finalized. This requirement stems from Section 8(d) of the Small Business Act, which aims to maximize opportunities for small businesses to compete for federal subcontracts.

Key Requirements of FAR 19.7

Prime contractors are required to set specific goals for six categories of small businesses, detailing both dollar amounts and percentage targets for each group. This ensures that all small business classifications are given fair consideration. Additionally, contractors must take actionable steps to facilitate small business participation, and when maintaining lists of potential subcontractors, they are obligated to make reasonable efforts to include qualified small businesses over time.

For contracts that include option periods, subcontracting plans must address both the base contract and each option period separately. This approach ensures that small business goals remain clear and measurable throughout the contract’s lifecycle, preventing contractors from postponing their commitments or failing to meet objectives during extensions.

Compliance and Enforcement

FAR 19.7 includes strong enforcement measures to hold contractors accountable. The Small Business Administration (SBA) assigns Commercial Market Representatives to conduct compliance reviews, ensuring that contractors meet their socioeconomic goals and adhere to their plans. These reviews are shared with contracting officers and the agency’s Office of Small and Disadvantaged Business Utilization, creating a multi-layered accountability system. Non-compliance can have serious consequences, potentially impacting a contractor’s ability to win future federal contracts.

Tools and Resources for Small Businesses

Small businesses can leverage FAR 19.7 to identify opportunities and connect with prime contractors. The SBA’s Directory of Federal Government Prime Contractors with Subcontracting Plans lists companies required to have approved plans, offering a clear starting point for small businesses seeking partnerships. Additionally, the SBA’s SUBNet database allows small businesses to search for subcontracting opportunities directly.

Prime contractors are also required to pass essential subcontracting clauses down to their subcontractors, ensuring that small business requirements extend through multiple tiers of the supply chain. To support this, prime contractors must secure acceptable flow-down plans from their subcontractors, reinforcing compliance at every level.

Practical Support for Compliance

Federal agencies provide valuable resources to help businesses navigate these requirements. APEX Accelerators (formerly known as Procurement Technical Assistance Centers) offer free counseling to explain subcontracting plan obligations. The SBA also provides free online training for both prime contractors and subcontractors, and its regional offices house Commercial Market Representatives who can offer hands-on guidance for meeting compliance requirements and finding opportunities.

2. GSA Small Business Subcontracting Plan Templates

The GSA Small Business Subcontracting Plan Templates provide a clear and structured way for prime contractors to create subcontracting plans that meet the requirements of FAR 52.219-9. These templates eliminate the uncertainty of drafting from scratch, ensuring all mandatory elements are included before submission. This approach simplifies compliance and paves the way for a smoother approval process.

The templates are designed to cover six small business categories: Small Businesses, Small Disadvantaged Businesses, Women-Owned Small Businesses, HUBZone Small Businesses, Veteran-Owned Small Businesses, and Service-Disabled Veteran-Owned Small Businesses. Each category is addressed in its own section, with specific subsections for the base contract and any option periods.

For federal contracts exceeding $750,000 – or $1,500,000 in the case of construction projects – prime contractors are required to submit an approved subcontracting plan before the contract is awarded. These templates simplify this process by offering preformatted sections that meet the expectations of contracting officers. They include fields for estimating costs related to supplies or services sourced from external vendors, and all subcontracting details must be included without exception. Contractors typically submit these templates as part of their proposals, refining them as necessary during negotiations or over the course of multi-year contracts, as directed by the Contracting Officer.

Once finalized and incorporated into a contract, the subcontracting plan becomes a binding document. Compliance is monitored regularly, and contractors may face penalties for failing to meet their small business spending commitments.

While these templates are primarily aimed at prime contractors, they also provide useful insights for small businesses. By exploring the SBA’s Directory of Federal Government Prime Contractors with a Subcontracting Plan, small businesses can identify potential opportunities and better understand what prime contractors are required to achieve. Additionally, registering in the Small Business Search database – complete with socioeconomic details and certifications – can enhance visibility to prime contractors. Various support resources are also available to help small businesses navigate these opportunities effectively.

3. Small Business Administration (SBA) Procurement Center Representatives

SBA Procurement Center Representatives (PCRs), also called Commercial Market Representatives (CMRs), play a crucial role in advocating for small businesses within federal agencies. Their mission is to ensure that small businesses get fair opportunities to compete for and secure subcontracts from large companies holding federal prime contracts.

PCRs are responsible for reviewing subcontracting plans tied to contracts exceeding $750,000 (or $1,500,000 for construction projects). They also conduct compliance checks to verify that prime contractors are meeting their commitments to engage small businesses. The results of these reviews are shared with contracting officers and the agency’s Office of Small and Disadvantaged Business Utilization (OSDBU), ensuring accountability.

In addition to compliance oversight, PCRs help small businesses navigate the federal contracting landscape. They identify prime contractors with active subcontracting plans and provide guidance on aligning your business with the six socioeconomic categories. They also clarify eligibility and certification requirements to help businesses position themselves effectively.

PCRs don’t just stop at guidance – they actively connect small businesses with opportunities. To get in touch with your local PCR, you can check the SBA’s Directory of Commercial Market Representatives, which lists contact information for representatives assigned to specific agencies and regions. Alternatively, you can email subcontracting@sba.gov for support. Engaging with a PCR during the pre-award phase is particularly beneficial, as it allows you to explore subcontracting opportunities early in the process.

PCRs also recommend leveraging tools like SUBNet, a reverse marketplace where subcontracting opportunities can be filtered by state or keyword. They advise creating a complete and detailed profile in the Small Business Search database, including certifications, NAICS codes, and a record of past performance, to enhance your visibility to potential partners.

Beyond identifying opportunities, PCRs help small businesses understand the specifics of subcontracting plan requirements. This includes the dollar and percentage goals set for different socioeconomic categories. They stress that all subcontracts must be accounted for in the prime contractor’s plan and warn that failing to meet these commitments can lead to penalties.

Finally, PCRs often direct small businesses to APEX Accelerators (formerly known as Procurement Technical Assistance Centers). These centers provide free, personalized counseling to help businesses stay informed about opportunities and compliance requirements. Regular engagement with these resources can significantly enhance your competitiveness in the federal subcontracting space.

4. GSA Schedule Eligibility and Socioeconomic Certification Programs

Securing a GSA Schedule and obtaining socioeconomic certifications can open doors to countless federal subcontracting opportunities. These credentials position your business as a go-to partner for prime contractors, who are required to meet specific small business participation goals.

Having a GSA Schedule boosts your business’s visibility in the federal marketplace. It designates your company as an approved vendor with the General Services Administration (GSA), making it easier for prime contractors to find and engage you as a subcontractor. This visibility is critical since large contractors often actively seek qualified small business partners to meet their federal requirements.

While the process of obtaining a GSA Schedule can seem daunting, GSA Focus offers a streamlined, full-service solution. By handling preparation, compliance checks, and negotiations, they minimize the time and effort required from your end, helping you secure your GSA Schedule Contract efficiently.

The Role of Socioeconomic Certifications

Beyond the GSA Schedule, socioeconomic certifications add another layer of opportunity. These certifications create specialized procurement pathways, giving your business a competitive edge. Some of the most impactful certifications include:

- Women-Owned Small Business (WOSB)

- HUBZone Small Business

- Service-Disabled Veteran-Owned Small Business (SDVOSB)

- Small Disadvantaged Business (SDB)

These certifications are more than just labels – they’re strategic tools. For instance, federal prime contractors bidding on contracts over $750,000 (or $1,500,000 for construction) are required to meet specific subcontracting goals for these categories. Holding certifications like WOSB or SDVOSB makes your business a sought-after partner for these contractors.

HUBZone certification, in particular, offers preferential treatment for businesses in Historically Underutilized Business Zones. If you’re eligible, keep in mind the Small Business Administration’s (SBA) updated rule, effective January 16, 2025, to ensure compliance with the latest requirements.

Maximizing Your Certifications

Once you’ve obtained your certifications, make them work for you. Start by optimizing your profile in the Small Business Search (SBS) database (formerly the Dynamic Small Business Search). This database acts as a digital storefront, helping prime contractors find qualified subcontractors. Ensure your profile highlights your certifications, capabilities, relevant keywords, NAICS codes, and performance history. A detailed and up-to-date profile significantly improves your chances of being discovered.

Integrate your certifications into your overall strategy. Regularly update your profiles, showcase your certified status in communications with prime contractors, and align your certifications with your core strengths. For example, if you’re a women-owned business in a HUBZone, emphasize both certifications in your marketing materials to stand out.

Compliance and Resources

Compliance is a key part of the equation. When you take on work from a prime contractor with a subcontracting plan, you become part of their compliance reporting process. Understanding these obligations ensures you stay in good standing while successfully fulfilling your subcontracting roles.

If you need help navigating the certification process, resources like APEX Accelerators (formerly Procurement Technical Assistance Centers) and the SBA offer targeted support and comprehensive guidance.

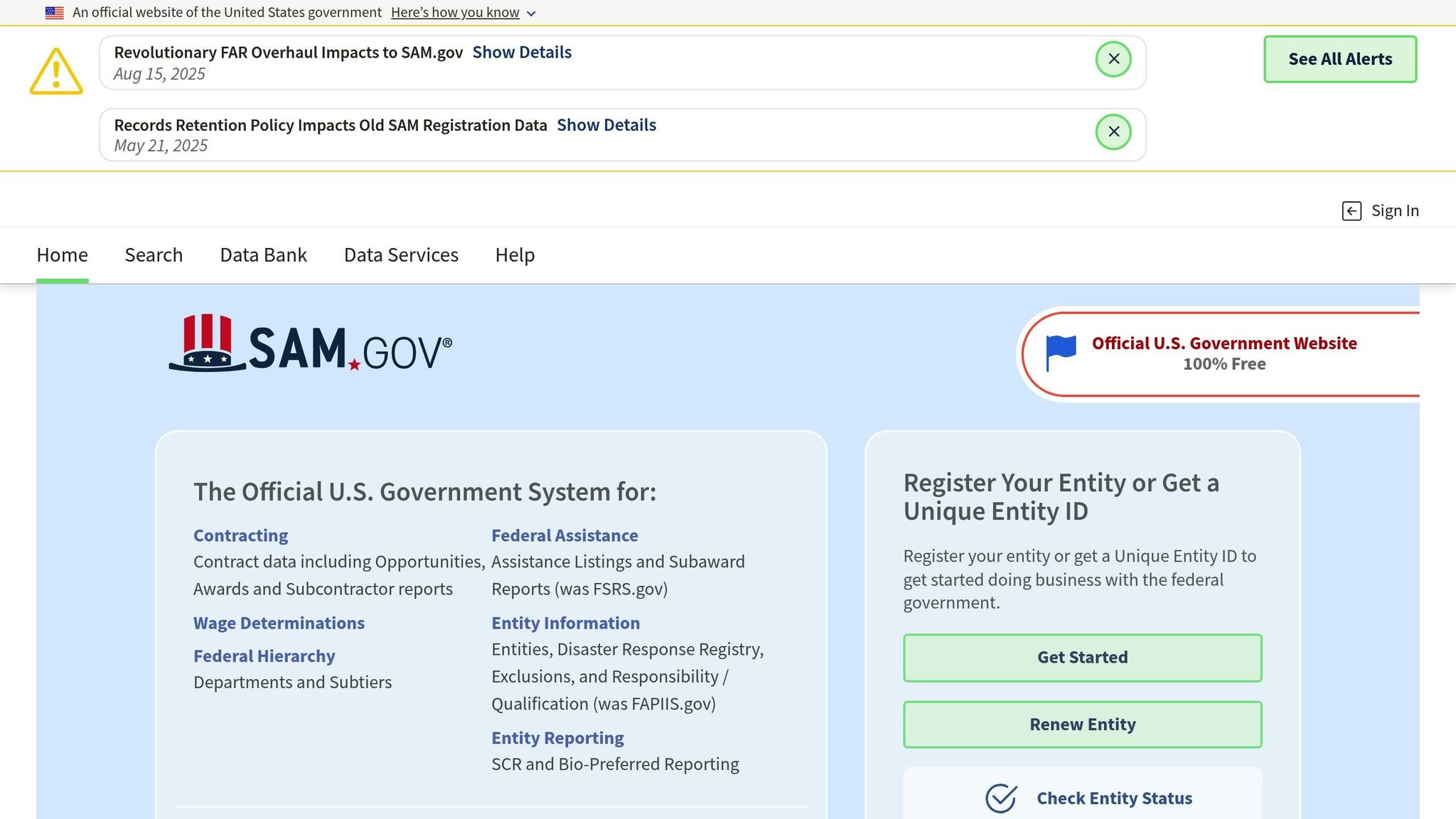

5. System for Award Management (SAM) Registration

If you’re eyeing federal subcontracting opportunities, registering with the System for Award Management (SAM) is a must. SAM serves as the official U.S. government database for federal contracting, connecting small businesses with federal contracts and subcontracting opportunities. For federal contracts exceeding $750,000 – or $1,500,000 in construction – prime contractors must submit subcontracting plans that set specific goals for working with small businesses.

By registering in SAM, you make it easier for federal agencies and prime contractors to find your business. The best part? Registration is completely free, and it acts as your digital storefront in the federal contracting world.

Building a Profile That Stands Out

Registration is just the first step. To truly get noticed, you need to optimize your SAM profile. Highlight your socioeconomic certifications (like WOSB, HUBZone, SDVOSB, or SDB), clearly outline your expertise and services, and include relevant NAICS codes and keywords. Don’t forget to showcase your performance history – this helps demonstrate your reliability and experience. Including these details boosts your visibility and makes your business more appealing to potential partners.

Keeping Your Profile Updated

An outdated SAM profile can hurt your chances of landing contracts. Regularly review and update your profile with new certifications, completed projects, and any changes to your services. Pay particular attention to the expiration dates on your socioeconomic certifications to ensure your profile remains compliant. Keeping your profile current not only helps you stay visible but also connects you to more federal resources.

Tapping Into Federal Tools and Resources

A well-maintained SAM profile is your gateway to additional tools and opportunities. For instance, the SBA’s Subcontracting Networking System (SubNet) allows prime contractors to post subcontracting opportunities, giving you a chance to find potential partnerships. Federal agencies like the EPA also provide resources like the Small Business Subcontracting Opportunities Dashboard, Active Contract List, and a Point of Contact Directory. If you’re unsure how to optimize your profile or navigate these resources, APEX Accelerators (formerly Procurement Technical Assistance Centers) offer expert guidance.

Your Role in Prime Contractor Compliance

When you land a subcontract under a federal subcontracting plan, you become part of the prime contractor’s compliance framework. Prime contractors are required to monitor and enforce compliance with flow-down clauses, subcontracting plans, and reporting requirements. Failing to meet small business spending commitments can lead to penalties. By maintaining an accurate and detailed SAM profile, you not only help meet these obligations but also strengthen your relationships in the federal marketplace, paving the way for long-term success.

6. GSA Subcontracting Directory

The GSA Subcontracting Directory is a federal database created by the General Services Administration (GSA) to connect small businesses with prime contractors that hold GSA Schedule contracts. These prime contractors are required to meet federal subcontracting obligations, making this directory a powerful resource for small businesses looking to tap into federal work opportunities. By offering detailed information, the directory helps businesses pinpoint subcontracting prospects that align with their expertise.

Why This Directory Matters

Federal subcontracting requirements create consistent opportunities for small businesses. The GSA Subcontracting Directory provides direct access to Small Business Liaisons at major GSA prime contractors. It also includes key details about active contracts, such as work descriptions, contract values, buyer information, and expiration dates. This information equips small businesses with the tools they need to identify and pursue opportunities that match their skills and services.

How to Use the Directory Effectively

The directory’s detailed listings make it easier to find subcontracting work that aligns with your capabilities. You can filter opportunities by state or keyword to focus on the most relevant contracts. Subcontracting opportunities through GSA prime contractors cover a wide array of industries, including HVAC services, construction, professional services, technology solutions, and research and development. Once you identify a contractor whose work fits your expertise, contact their Small Business Liaison to express your interest and inquire about current or future projects.

Before diving into the directory, ensure your profile in the Small Business Search (SBS) system is up-to-date. Include key details like your socioeconomic certifications, a clear capabilities narrative, relevant keywords, NAICS codes, and a record of your performance history. A polished profile increases your chances of being noticed by prime contractors.

Combining Resources for Better Results

To maximize your efforts, pair the GSA Subcontracting Directory with other federal tools like SUBNet, which lists subcontracting opportunities across all federal agencies, and the Active Contract List, which highlights vendors with existing prime contracts. For additional support, reach out to an APEX Accelerator (formerly Procurement Technical Assistance Center). These organizations provide personalized guidance to help small businesses succeed in federal contracting.

Ensuring Contractor Compliance

If you encounter compliance issues, the SBA has established reporting channels. You can report concerns through your local SBA Area Office or by emailing Subcontracting@sba.gov.

7. GSA Focus Contract Management Services

Securing a GSA Schedule Contract can unlock federal opportunities, but for many small businesses, the process can feel like navigating a maze. That’s where GSA Focus steps in. They specialize in helping small businesses not only acquire but also manage these contracts with a hands-off, done-for-you approach. From preparing documents to ensuring compliance and assisting with negotiations, they handle the complicated stuff so business owners can focus on what they do best. The result? A smoother, more efficient contracting experience.

What GSA Focus Brings to the Table

GSA Focus offers a full-service solution that takes care of nearly every aspect of the GSA Schedule acquisition process. They handle 95% of the paperwork, saving over 100 hours of effort – leaving you with just three hours of involvement.

It all begins with a free eligibility assessment to confirm if your business qualifies for a GSA Schedule Contract. To meet the basic requirements, businesses must be for-profit, independently owned, and not dominant in their field. Once eligibility is confirmed, GSA Focus provides an estimated timeline and a step-by-step guide to set you up for success.

Their document preparation goes beyond cookie-cutter templates. While the GSA offers standard subcontracting plan templates, GSA Focus customizes these documents to highlight your specific capabilities, past performance, and certifications. This tailored approach not only strengthens your competitive edge but also minimizes the risk of compliance issues that could delay your contract.

Proven Speed and Results

GSA Focus’s approach is designed for both speed and success. They complete the process 4-6 times faster than businesses attempting it on their own, with an impressive 98% success rate in securing contracts for their clients. Over 600 small businesses have benefited from their expertise, and remarkably, 57% of these clients had no prior government contracting experience.

"GSA Focus was crucial in helping us get our GSA contract quickly with no headaches, setting us on the path to some big wins." – Deena T., Pacific Point

The financial outcomes speak volumes. On average, clients see $927,000 in additional revenue, translating to an 87x return on investment. This revenue growth comes from both direct contract opportunities and increased visibility to federal agencies seeking subcontractors.

Staying Compliant and Supported

Federal contracting comes with layers of compliance requirements. Businesses must keep pricing accurate, meet delivery schedules, follow flow-down clauses, and ensure certifications are up to date. GSA Focus stays ahead of regulatory updates, such as the SBA’s final rule on HUBZone certification programs effective January 16, 2025, ensuring your business remains compliant.

With decades of experience, their team anticipates changes and helps you avoid potential violations that could lead to contract termination or even debarment. This proactive approach safeguards your ability to thrive in the federal contracting space.

Expertise in Negotiation and Pricing

Pricing is a make-or-break element of GSA Schedule contracts. GSA Focus brings seasoned expertise to price negotiations, ensuring your rates are competitive without sacrificing profitability. By avoiding common mistakes – like pricing too high and losing bids or pricing too low and cutting into margins – they help you strike the perfect balance.

"Great team! They handled every step and were very responsive. Highly recommend working with GSA Focus!" – Raja S., GeoIdentity

For businesses that already hold GSA Schedules, GSA Focus also offers marketing and maintenance services to maximize the value of existing contracts. From advisory support to training, they guide you through every stage of the GSA contracting process.

Enhancing Your Subcontracting Opportunities

A GSA Schedule Contract doesn’t just open doors to prime contracts – it also positions you to qualify as a subcontractor. This dual opportunity is particularly valuable since federal contracts exceeding $750,000 ($1,500,000 for construction) require prime contractors to meet specific subcontracting goals for small businesses.

GSA Focus helps you align your certifications and capabilities with what prime contractors need. They also guide you in leveraging resources like SUBNet and the GSA Subcontracting Directory, increasing your visibility to both federal agencies and prime contractors actively seeking subcontractors.

Ready to Get Started?

GSA Focus takes the risk out of the equation with a refund guarantee if you’re not satisfied. To see if their services align with your goals, you can schedule a free consultation to assess your GSA eligibility and plan your next steps. Visit GSA Focus to learn more about their comprehensive approach to federal contracting.

"The GSA process was a mystery to me. They were fully engaged and committed to our GSA approval." – Rick F., Executive Coach

For small businesses, especially those in fields like technology, construction, and professional services, GSA Focus’s expertise eliminates the guesswork. Their done-for-you model saves time, reduces errors, and helps you navigate the complexities of federal contracting with confidence.

Conclusion

Navigating federal subcontracting becomes much simpler when you tap into the right tools and resources. Start with FAR Subpart 19.7, which lays out the rules for contracts over $750,000 (or $1,500,000 for construction). Next, ensure your SAM registration is complete and pair it with socioeconomic certifications – like HUBZone, women-owned, veteran-owned, or service-disabled veteran-owned – to make your business stand out to prime contractors. Don’t forget to fill out your Small Business Search profile with your capabilities, NAICS codes, and past performance to boost your visibility.

Directories such as the GSA Subcontracting Directory and SUBNet are excellent for finding prime contractors actively posting opportunities. SUBNet, in particular, acts as a reverse marketplace, allowing you to explore potential matches without needing to register.

For personalized guidance, SBA Procurement Center Representatives are invaluable. Reach out to your local SBA Area Office or Commercial Market Representative to get advice tailored to your subcontracting efforts.

If you’re looking to simplify the process of securing a GSA Schedule contract, GSA Focus can help. They boast a 98% success rate and have helped clients generate an average of $927,000 in additional revenue. Plus, they keep you up to date with regulatory changes, such as the SBA’s new HUBZone certification rule rolling out on January 16, 2025.

Bringing all these resources together gives you a comprehensive strategy. By combining FAR guidelines, a polished SAM profile, targeted directories, expert SBA insights, and GSA Focus’s services, you’ll have a well-rounded approach to federal subcontracting. To measure your progress, track metrics like identified opportunities, bid-to-award ratios, and subcontract values.

Keep in mind, falling short of subcontracting goals can lead to severe consequences, including contract termination and even debarment. Ensure that required clauses flow down to lower-tier subcontractors as outlined in FAR regulations to avoid compliance issues.

Start by securing your SAM registration and certifications, then dive into FAR requirements and consult with SBA representatives. Use directories and leverage GSA Focus to manage the complexities of federal contracts. This step-by-step strategy sets you up for success while minimizing risks.

In 2023, federal agencies awarded $45 billion through GSA Schedules, yet only 4% of small businesses hold these contracts. With over $850 million in daily GSA awards and 44% of government awards receiving just one bid, the federal market is brimming with opportunity for businesses ready to seize it.

FAQs

How can small businesses qualify for federal subcontracting opportunities?

Small businesses looking to tap into federal subcontracting opportunities should explore securing a GSA Schedule Contract. This contract simplifies the process of accessing federal projects while ensuring all government regulations are met.

With the help of GSA Focus, small businesses can navigate this process with ease. Their services cover everything from preparing necessary documents and ensuring compliance to providing support during negotiations. This means you can focus on growing your business while they handle the complexities, saving you both effort and time.

How can socioeconomic certifications help small businesses win federal subcontracting opportunities?

Socioeconomic certifications can play a big role in helping small businesses win federal subcontracting opportunities. Certifications like Women-Owned Small Business (WOSB), Service-Disabled Veteran-Owned Small Business (SDVOSB), or HUBZone not only confirm your eligibility for set-aside contracts but also highlight how your business supports federal diversity initiatives.

Federal agencies and prime contractors often have subcontracting goals that include working with certified businesses. Securing one of these certifications positions your business as an essential partner in helping them meet those goals. This can boost your visibility and make your business more competitive in the federal contracting space.

What tools and services can help small businesses meet federal subcontracting compliance requirements?

GSA Focus provides a complete service package designed to assist small businesses in meeting federal subcontracting compliance requirements. Their offerings cover everything from document preparation to compliance checks and negotiation assistance, making the entire process smoother and less time-consuming.

With GSA Focus by their side, small businesses can tackle the challenges of federal contracting with confidence, ensuring all requirements are met while opening doors to new growth opportunities.

Related Blog Posts

- Ultimate Guide to Federal Subcontracting Strategies

- How to Use GSA Subcontracting Plan Templates

- Why Subcontracting Plans Matter for GSA Contracts

- Federal Procurement Process Overview