Negotiating GSA prices can make or break your profitability over the long term. The key? Start with the right pricing strategy, backed by thorough research and compliance with GSA guidelines. Here’s what you need to know:

- Understand Pricing Tools: Use GSA Advantage! and CALC to research competitor pricing and ensure your rates are fair and competitive.

- Protect Your Margins: Build in safeguards like Economic Price Adjustment (EPA) clauses and tiered discounts to account for inflation and varying order sizes.

- Be Transparent: Organize and disclose accurate Commercial Sales Practices (CSP) and Most Favored Customer (MFC) data to avoid compliance issues.

- Offer Flexibility: Use volume discounts or prompt payment terms instead of cutting base prices to maintain profitability.

- Stay Audit-Ready: Document all pricing decisions meticulously to comply with the Price Reductions Clause (PRC).

- Get Expert Help: Consider working with GSA consultants to streamline negotiations and reduce risks.

GSA Pricing Terms: CSP, MFC, and Tracking Customer Comparison

1. Research Competitor Pricing on GSA Schedules

Before proposing rates to GSA, it’s crucial to understand how your pricing stacks up against the competition. Contracting Officers will evaluate your rates by comparing them to similar products or services already listed on GSA Schedules to ensure your pricing is fair and reasonable. Without solid research, you risk setting prices too high or too low, which can hurt your chances during negotiations.

Start by exploring GSA Advantage! and GSA eLibrary, the go-to resources for pricing research. GSA Advantage! offers live listings where you can search by Special Item Number (SIN) or keywords to find comparable products. For more detailed contract information, including Basis of Award (BOA) terms and discount structures, turn to GSA eLibrary – though note that it doesn’t show actual pricing. If you’re in the services sector, the CALC Tool is a must. It allows you to compare labor rates based on education, experience, and contract year, helping you craft competitive and compliant rates.

Focus your analysis on "like and similar" products within the same SIN or Federal Supply Class (FSC). Download pricing worksheets to evaluate ceiling prices, basic discounts, and volume tiers. For example, if you’re selling IT hardware under SIN 334111, you might notice that competitors typically offer basic discounts of 25-35% off catalog prices. One contractor used this exact strategy – after analyzing GSA Advantage! data, they proposed a 30% basic discount that aligned with their commercial sales practices. The Contracting Officer approved it quickly because it matched established market standards.

To keep your research organized, build a comparison spreadsheet. Track key data such as competitors’ ceiling prices, discount ranges (e.g., basic, volume, prompt payment), and tiered pricing models. Common benchmarks include basic discounts ranging from 20-40%, volume discounts of 5-15% for larger orders, and prompt payment terms offering 1-2% discounts for net 30. This evidence will help you justify your rates and demonstrate they are fair and reasonable.

2. Learn GSA’s Fair and Reasonable Pricing Standards

The General Services Administration (GSA) defines fair and reasonable pricing as aligning with competitive market rates for similar products or services. According to FAR 15.402, Contracting Officers (COs) are required to purchase goods and services from responsible sources at fair and reasonable prices. This principle is the cornerstone of evaluating your pricing strategy. If your pricing doesn’t meet these standards, it could lead to offer rejection or further negotiations.

COs assess pricing by conducting a price analysis, comparing your total prices with market data. As Stephanie Hagan, Training and Communications Manager at Winvale, puts it:

Price analysis is a subjective evaluation done by your Contracting Officer – different Contracting Officers might make different decisions about price reasonableness.

To gather data, COs rely on existing contracts, MAS contract data, and commercial market research.

Your reporting method significantly influences your pricing strategy. Vendors can follow one of two paths: Commercial Sales Practices (CSP) or Transactional Data Reporting (TDR). Here’s how they differ:

- CSP: Requires vendors to disclose their Most Favored Customer (MFC) – the customer or group receiving the best pricing – and submit sales data from the past 12 months to establish pricing relationships.

- TDR: Vendors skip disclosing commercial discounts but must provide details on commercial pricing and GSA discounts. COs then evaluate this information using market data.

Regardless of the path, the government’s objective remains consistent:

The Government will seek to obtain the offeror’s best price (the best price given to the most favored customer).

To comply, ensure all submitted data is accurate, complete, and up-to-date within 14 calendar days of submission. Any deviations, such as one-time discounts or prototype sales, should be clearly documented to prevent them from becoming pricing benchmarks. COs also consider factors like aggregate volume, minimum purchase requirements, contract length, warranties, training, and delivery terms when evaluating price reasonableness.

For contracts exceeding $2.5 million (as of July 1, 2018), you may need to provide certified cost or pricing data, although exemptions often apply to commercial products and services. By submitting an offer, you authorize COs to review your pricing data. Understanding and adhering to these standards is essential for negotiating GSA prices that safeguard your margins while staying compliant.

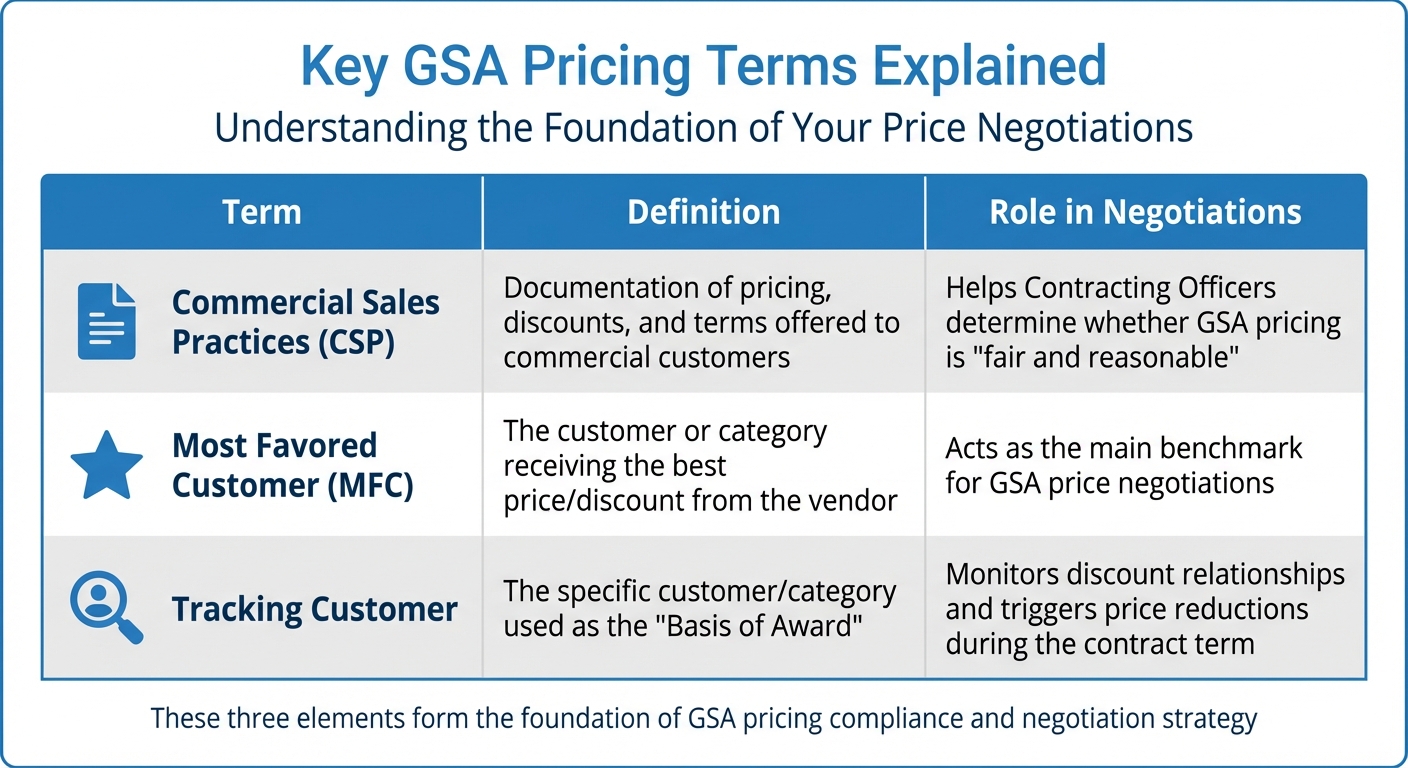

3. Organize Your Commercial Sales Practices and Most Favored Customer Data

Before heading into negotiations, it’s crucial to have your Commercial Sales Practices (CSP) and Most Favored Customer (MFC) data well-organized. Why? Because clear, accurate data lays the groundwork for negotiating fair and compliant GSA prices. The government relies on your MFC data to set its negotiation goals by comparing your offer to your MFC arrangement.

Start by ensuring your CSP data is up-to-date, accurate, and complete. Include sales data from the past 12 months, and be ready to disclose any commercial pricing that matches or beats the price you’re offering the government. If your discount structure changes after submitting your offer but before negotiations wrap up, you’re required to disclose those changes immediately. Double-check that your data reflects your most recent commercial practices to avoid any discrepancies.

The VA Federal Supply Schedule Service describes the MFC as “the customer or class of customer that receive(s) the best discount and/or price agreement on a given item from a supplier”. This definition acts as your starting point for pricing discussions. Alongside this, you’ll also need to negotiate a tracking customer (or Basis of Award) during the contract award process. This tracking customer represents the customer category against which GSA pricing will be monitored for the duration of the contract. Ideally, the tracking customer should align closely with the federal government’s purchasing behavior, and the discount relationship established must remain consistent throughout the contract term.

Be sure to document any deviations from your standard pricing – such as one-time discounts or sales of outdated products. Note the circumstances, frequency, and controls in place to maintain pricing integrity. Failing to disclose better commercial pricing elsewhere could later activate the Price Reductions Clause, leading to compliance headaches. To avoid this, implement tracking systems now to monitor the discount relationship with your Basis of Award customer. This proactive step helps you stay compliant and avoid future issues.

Here’s a quick overview of the key terms and their roles in pricing negotiations:

| Term | Definition | Role in Negotiations |

|---|---|---|

| Commercial Sales Practices (CSP) | Documentation of pricing, discounts, and terms offered to commercial customers. | Helps Contracting Officers determine whether GSA pricing is "fair and reasonable." |

| Most Favored Customer (MFC) | The customer or category receiving the best price/discount from the vendor. | Acts as the main benchmark for GSA price negotiations. |

| Tracking Customer | The specific customer/category used as the "Basis of Award." | Monitors discount relationships and triggers price reductions during the contract term. |

4. Structure Your Discounts: Basic, Quantity, and Prompt Payment

Once you’ve organized your commercial data, the next step is crafting a discount strategy that balances competitiveness with compliance. A well-thought-out approach to discounts can give you an edge in GSA negotiations while meeting agency needs. Instead of sticking to a single, flat-rate discount, consider using a mix of basic, quantity, and prompt payment discounts. Each type serves a specific purpose and offers flexibility to agencies, making them powerful tools under GSA guidelines.

Basic discounts set the groundwork by establishing your GSA ceiling price – the standard rate agencies pay, based on your commercial list price. These discounts are tied to your Basis of Award customer and form the baseline for all other pricing. Keeping this discount moderate ensures you protect your margins, particularly for smaller, routine orders.

Quantity (volume) discounts encourage agencies to place larger orders by offering tiered price reductions. For example, you might offer 5% off orders over $10,000 or 10% off purchases exceeding $50,000. These discounts not only incentivize bulk buying but also help distribute fixed costs, like shipping, across bigger orders. Just make sure your volume tiers stay aligned with your Basis of Award customer to avoid triggering the Price Reductions Clause.

Prompt payment discounts reward agencies for paying invoices earlier than the standard 30-day cycle, often within 10 or 15 days. For instance, offering "2% Net 10" can improve your cash flow without altering your ceiling price. Since these discounts generally don’t activate the Price Reductions Clause, they’re relatively straightforward to manage. However, any prompt payment discount included in your original GSA offer becomes binding and must appear clearly on every invoice.

There are a few critical considerations when offering prompt payment discounts. First, ensure the annualized return rate exceeds the Department of the Treasury’s "value of funds" rate – otherwise, GSA may deem the discount "uneconomical", disqualifying it from award criteria. Additionally, remember that these discounts don’t apply to purchases made with the government purchase card (SmartPay).

To strike the right balance, use fixed ceiling rates for everyday orders while layering in structured volume tiers for larger purchases. Keep detailed records of each discount threshold to ensure compliance during audits. This multi-tiered strategy not only provides agencies with flexible options but also safeguards your profitability across varying order sizes. Up next, we’ll dive into how to use GSA databases to strengthen your negotiation position.

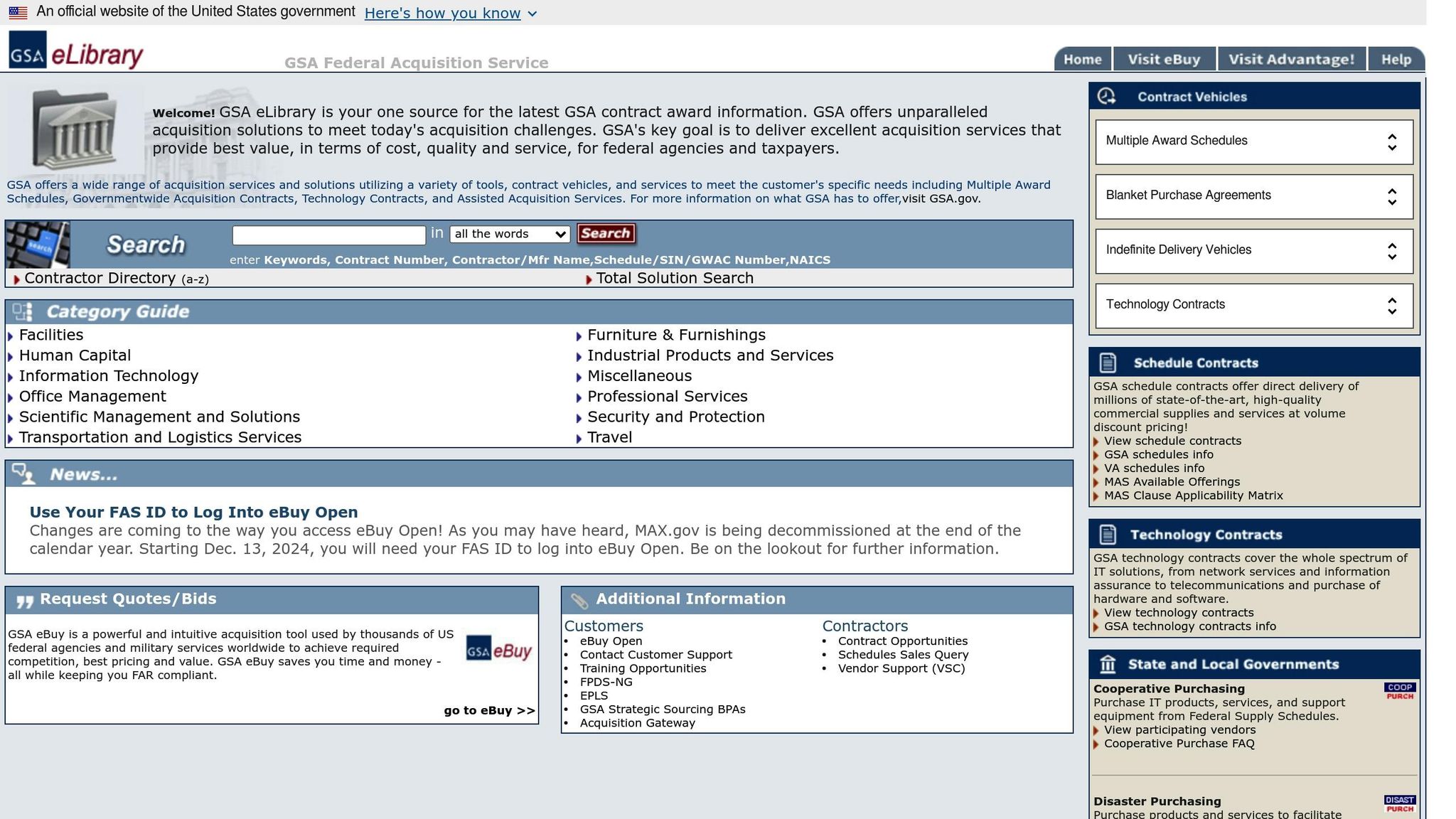

5. Use GSA eLibrary and GSA Advantage Data in Negotiations

Strengthen your negotiation strategy by incorporating real-time data into your pricing discussions. Both GSA eLibrary and GSA Advantage offer reliable market insights that contracting officers frequently rely on when reviewing proposals.

Start with GSA eLibrary to gather actionable market data. Pay close attention to vendors with consistent agency purchases and multiple contract modifications – these are signs of active engagement in the market. As noted by USFCR:

If you’re 40% higher than market rates, you’ll know before you waste time on a proposal.

Regularly reviewing eLibrary helps you stay updated on competitor activity and identify pricing trends. This data not only supports your pricing decisions but also equips you with the confidence to negotiate effectively.

On the other hand, GSA Advantage provides the same data federal buyers see, such as product names, unit prices, delivery terms, and minimum order amounts. This level of transparency allows you to compare your offerings directly with competitors. For instance, if your delivery time is 3 days ARO (After Receipt of Order) compared to a competitor’s 30 days, you can justify a higher price. Additionally, well-crafted product titles and detailed descriptions can reinforce your value during internal reviews. Use these insights to clearly articulate the advantages of your pricing during negotiations.

6. Create Tiered Pricing Models for Different Purchase Volumes

Tiered pricing is a smart way to balance flexibility for government buyers with maintaining your profit margins. Instead of sticking to a single flat rate, this approach introduces volume-based price breaks – offering discounts for larger purchases while keeping smaller orders competitive. Your GSA-negotiated rates act as ceiling prices, giving you the freedom to implement these discounts without exceeding those limits. This strategy complements earlier discount methods, ensuring you cater to all order sizes effectively.

Here’s how it works: align your tiered pricing with your commercial discount practices. For example, you might structure your pricing like this: 1-10 units at $100, 11-50 units at $95, and 51+ units at $90. And don’t forget to include the 0.75% Industrial Funding Fee (IFF) in all tiers.

Clarity is key when presenting these structures. As Michael Perch puts it:

Negotiations tend to slow down when pricing explanations are vague. They tend to move forward when the pricing story is simple: who gets discounts, when they apply, and why government pricing is structured the way it is. Clear explanations often matter more than aggressive discounting.

To justify your tiered rates, leverage market research from platforms like GSA Advantage! and analyze competitor data. Ensure any exceptions are clearly documented to stay compliant. Regularly review your pricing tiers – at least annually – to keep them aligned with market trends and contract requirements. This ongoing review process ensures your pricing remains both competitive and compliant.

7. Apply Economic Price Adjustments When Appropriate

The cost of doing business doesn’t stay static. Raw materials get pricier, labor costs climb, and inflation can throw a wrench into pricing strategies. That’s where an Economic Price Adjustment (EPA) clause comes in – it allows you to adjust your GSA contract pricing during the contract term to reflect these shifts. Unlike fixed pricing, EPAs account for both increases and decreases, as long as you can back them up with proper documentation.

As of August 2024, GSA simplified things by consolidating legacy EPA clauses into a single, streamlined clause: 552.238-120. This update removes old constraints like time-based limitations and percentage caps, replacing them with a focus on two key elements: the Method – how and when adjustments happen – and the Mechanism, such as fixed escalation rates or market indices. Your next step? Choose the mechanism that aligns with your cost structure.

- Fixed escalation rates: Ideal for services with predictable cost increases, often tied to your contract anniversary.

- Established pricing: Works for businesses that regularly update commercial catalogs, allowing adjustments based on changes to your published Commercial Price List.

Traditional EPA caps still act as guides: 4% for Human Capital, 5% for Professional Services and Travel, and 10% for most other categories.

When requesting an EPA adjustment, make sure your documentation is airtight. This includes using the latest Price Proposal Template and providing evidence like invoices, manufacturer letters, or proof of tariffs affecting materials. GSA Contracting Officers will review your request to ensure the adjustment aligns with the government’s interests. Stephanie Hagan from Winvale highlights the flexibility of the new clause:

The new clause does not include specific time-based limitations or ceiling percentage limits.

This shift gives contractors more leeway to address real-world market challenges. If your contract operates under older clauses, it’s worth acting now to update it.

For those with older contracts, incorporating the 552.238-120 clause can save you headaches later. Submit a "Revise Terms and Conditions" modification before you need a price adjustment. This proactive move ensures you’re ready to respond quickly when market conditions demand it.

8. Document Everything for Price Reductions Clause Compliance

The Price Reductions Clause (PRC) is one of the most common reasons for government audits. How well you document your pricing decisions can be the difference between staying compliant or facing hefty penalties. A case in point: back in 2000, Gateway, Inc. had to pay $9 million to settle allegations that it failed to honor required price reductions between May 1994 and March 1997. The issue? They couldn’t prove they maintained the necessary discount relationship with the government.

Start with your Basis of Award (BOA) documentation. This includes your commercial catalog, pricelist, or schedule that was in place when the contract was awarded. This baseline is critical to maintaining the agreed-upon discount relationship. Patrick Morgans from Winvale emphasizes the risks:

"If price reductions are discovered by GSA, and the proper procedure to offer the Price Reduction to GSA wasn’t followed, you can be assessed penalties, including refunding the government for the price reduction from the date the price reduction occurred."

If a price reduction occurs, you must notify your GSA Contracting Officer within 15 calendar days. Along with the notification, submit a detailed report explaining the circumstances behind the reduction. This report should include supporting documents like invoices, updated pricelists, and a clear explanation of why the discount was given. If the price change was due to a billing or quotation error, ensure you provide sufficient evidence to demonstrate it wasn’t intentional.

Your sales and accounting teams must be well-versed in PRC triggers. For instance, offering a special discount to your BOA customer without adjusting your GSA price could result in a compliance violation. Keep detailed records of all sales that qualify for exceptions, such as those to other federal agencies or firm-fixed-price contracts exceeding the Maximum Order Threshold. Remember, under the False Claims Act, the government can recover up to three times the damages and impose penalties of up to $10,000 per claim for knowingly failing to comply.

Thorough documentation isn’t just about staying organized – it’s a safeguard against financial risk. Proper records not only help you avoid PRC penalties but also open the door to alternative discount strategies. Up next, we’ll dive into ways to offer competitive value to government buyers without resorting to direct price cuts.

9. Offer Volume Discounts or Better Payment Terms Instead of Price Cuts

When government buyers push for lower prices, cutting rates across the board can hurt your margins and lead to complications with the Price Reductions Clause (PRC). A smarter move? Offer volume discounts or better payment terms. These strategies let you provide value without undermining your baseline pricing, keeping your profitability intact.

For service-based contracts, prompt payment discounts (PPDs) can be a game-changer. For instance, you could offer a 1–2% discount if the buyer pays within 10 or 15 days, rather than the typical 30-day payment cycle. This not only speeds up your cash flow but also avoids permanent reductions to your contract’s ceiling price. Plus, PPDs usually don’t fall under PRC or Transactional Data Reporting requirements, which means fewer administrative hassles and lower audit risks.

On the other hand, volume discounts are ideal for high-volume products like IT hardware or office supplies. They encourage larger orders while maintaining your baseline pricing. However, keep in mind that volume discounts require diligent tracking to stay compliant with PRC rules, unlike PPDs, which are simpler to manage.

These alternatives offer real savings to buyers while protecting your long-term profitability. For PPDs, apply the discount consistently across all qualifying orders to ensure compliance during Contractor Assistance Visits. If you go with volume pricing, document all discount thresholds to demonstrate alignment with your standard commercial practices.

Your choice depends on your business model. If steady cash flow is crucial – like in professional services – PPDs are the way to go. But if you’re selling high-volume products and want to encourage bulk purchases, tiered volume pricing is more effective. Either way, these strategies align with GSA compliance while supporting your broader pricing goals.

10. Work with GSA Experts for Negotiation Support

Navigating GSA price negotiations can feel like stepping into a maze of rules and regulations. Between the Price Reductions Clause (PRC), Economic Price Adjustments (EPA), and shifting market trends, it’s easy to feel overwhelmed – especially for small businesses taking their first steps into federal contracting. That’s where partnering with GSA consultants can make all the difference. Their expertise not only helps you avoid costly mistakes but also simplifies the entire negotiation process.

These specialists bring a wealth of knowledge to the table, helping you craft pricing strategies that comply with GSA’s fair pricing standards while protecting your profit margins. They take on the heavy lifting – handling up to 95% of the documentation workload. This includes everything from commercial sales practice disclosures to financial statements and compliance forms. With this support, you can stay focused on running your business while they deal directly with Contracting Officers to negotiate better terms and rates.

For example, GSA Focus offers comprehensive services tailored specifically to small businesses. With a 98% success rate, they manage document preparation, ensure compliance, and provide negotiation guidance. Through an Agent Authorization, they can even represent your company during negotiations, ensuring your pricing documentation is not only accurate but also strategically presented – improving your chances of securing modifications and approvals.

Beyond negotiations, GSA experts help you prepare for Contractor Assistance Visits (CAVs) and audits by creating well-organized documentation and a pricing policy handbook. This handbook serves as a go-to resource for your sales and contract teams, ensuring consistent pricing practices across all government buyers. Their long-term approach ensures your pricing strategies stay aligned with evolving government procurement trends, not just during the initial contract award but throughout the life of your contract.

Investing in expert support doesn’t just reduce compliance risks – it leads to better negotiation results and quicker contract modifications. With their ability to present strong arguments and hold firm on pricing, GSA consultants position your business for lasting success in the competitive world of federal contracting.

Conclusion

Navigating GSA price negotiations successfully hinges on careful preparation, strategic thinking, and strict adherence to guidelines. Start by researching competitor pricing and organizing your commercial sales data and Most Favored Customer information to establish a solid foundation. Instead of cutting prices right away, structure your discounts with a mix of basic GSA discounts, quantity-based incentives, and prompt payment terms. This approach safeguards your profit margins while giving you room to negotiate. Tiered pricing models that reward volume purchases can also encourage larger orders without risking Price Reductions Clause violations.

When market conditions change, keep detailed documentation of cost increases to support Economic Price Adjustments. Staying audit-ready is critical, so maintain thorough records for Contractor Assistance Visits and reporting requirements. Use market data from GSA CALC to show that your rates are competitive, providing Contracting Officers with the evidence needed to approve your pricing.

Remember, GSA negotiations are a two-way process, much like any business deal. Instead of immediately agreeing to price cuts, offer alternatives like better payment terms or volume discounts to protect your profitability.

Whether you’re new to federal contracting or handling contract modifications, working with GSA experts can streamline the process. These professionals manage the complex documentation, develop compliant pricing strategies, and represent you during negotiations, leading to smoother approvals and stronger results. By applying these strategies and leveraging expert help, your business is better positioned to thrive in the federal marketplace.

FAQs

Should I use CSP or TDR for my GSA offer?

If your products or services fall under eligible SINs and you’re comfortable submitting detailed sales data on a monthly basis, Transactional Data Reporting (TDR) could be the right fit. On the other hand, if you’d prefer to set the government’s lowest price based on how you handle commercial sales, Commercial Sales Practices (CSP) might work better for you. Take a moment to weigh your reporting preferences and compliance requirements before making a choice.

How do I choose a Basis of Award (tracking customer)?

To choose a Basis of Award (tracking customer), it’s crucial to ensure your GSA pricing matches your customer pricing, as outlined by the Most Favored Customer (MFC) clause. Keep detailed records of your sales data and pricing to stay compliant with your contract’s requirements, uphold this relationship, and meet GSA standards.

What records should I keep to stay PRC audit-ready?

To stay prepared for a PRC (Price Reductions Clause) audit, it’s crucial to keep thorough records of your GSA Schedule pricing and sales activities. Key documentation includes price proposals, invoices, sales data, and records of commercial prices and discounts. If you offer price reductions to commercial customers, ensure those adjustments are accurately mirrored in your GSA pricing. Regularly reviewing and updating these records not only shows compliance but also helps you sidestep potential issues during audits.

Related Blog Posts

- GSA Negotiation Objectives Explained

- Ultimate Guide to GSA Counteroffer Negotiations

- How to Set GSA Prices for Federal Contracts

- How GSA Negotiates Pricing