Want to sell your services to the U.S. government? The GSA Schedule (Multiple Award Schedule) is your gateway. Here’s what you need to know to succeed:

- What is GSA Schedule? A government-approved marketplace where federal agencies buy services and products worth $42 billion annually.

- Why join? Long-term contracts (up to 20 years), higher win rates (30% more), and reduced competition.

- Challenges: Complex application process, compliance rules (e.g., Trade Agreements Act, Section 889), and mandatory $25,000 annual sales.

Key Steps to Get Started:

- Choose the Right SINs: Match your services with Special Item Numbers (SINs) using the GSA eLibrary.

- Prepare Documents: Include past performance, financial records, and compliance proof.

- Set Competitive Pricing: Research competitors and ensure GSA-compliant rates.

- Stay Compliant: Follow rules like TAA and Section 889 to avoid penalties.

- Use GSA Tools: Platforms like eMod and eLibrary help manage contracts and stay competitive.

Quick Tip:

Success with GSA isn’t just about getting listed. It’s about maintaining compliance, building relationships with government agencies, and meeting sales benchmarks.

Ready to dive deeper? Keep reading for a step-by-step guide to mastering GSA contracts.

How to Choose the Right SINs for Your Services

What Are Special Item Numbers (SINs)?

Special Item Numbers (SINs) are unique codes used by the General Services Administration (GSA) to categorize the products and services offered by GSA contract holders. These codes play a key role in helping federal agencies quickly find and purchase the services they need. Essentially, SINs are the backbone of the GSA Multiple Award Schedule (MAS) system.

The GSA MAS Program is organized into 12 Large Categories, which break down further into subcategories and, ultimately, into 315 SINs. For businesses, SINs provide a way to identify and access opportunities listed on platforms like the GSA’s eBuy system. For government buyers, SINs simplify the process of requesting quotes and information for services or major purchases. This makes it critical for businesses to keep their SINs accurate and up to date in order to receive notifications for RFQs (Requests for Quotes) and RFPs (Requests for Proposals).

Understanding SINs is more than just a technical requirement – it’s a strategic necessity. They help contractors determine their eligibility, refine their marketing strategies, and ensure compliance with GSA guidelines. Without the right SINs, your services may not show up in relevant government searches, limiting your visibility to potential buyers.

How to Match Your Services to SINs

Once you understand the importance of SINs, the next step is aligning your services with the right ones. Getting this alignment right is crucial for standing out and securing contracts. The GSA eLibrary is your go-to resource here. It offers detailed descriptions of each SIN, including their scope, requirements, and typical service offerings. Don’t just skim the titles – dive into the specifics to ensure your services match the defined scope.

To improve your chances of success:

- Optimize your listings: Use relevant keywords to increase visibility on platforms like GSA eBuy and GSA Advantage.

- Study the competition: Look at how competitors are using SINs and analyze past government contracts to identify high-demand categories.

- Seek expert advice: GSA specialists can provide valuable guidance on which SINs align best with your offerings.

Regularly reviewing and updating your SIN listings is also essential to stay ahead of emerging opportunities. Keep in mind that GSA may reject your SIN proposal if it’s deemed out of scope, so always double-check solicitation requirements before applying.

Once you’ve identified the right SINs, focus on preparing thorough documentation to back up your eligibility.

Required Documentation for SIN Eligibility

Clear and complete documentation is crucial to proving your capability and experience. Since requirements vary by SIN, knowing what’s needed upfront can save you time and avoid unnecessary delays.

Past performance is a cornerstone of SIN eligibility. You’ll need to provide a detailed Statement of Work (SOW) that outlines similar projects you’ve completed within the past two years, including contract terms and deliverables.

Other essential documents include:

- Financial records: Profit and Loss Statements and Balance Sheets for the last two fiscal years. You’ll also need proof of commercial sales, such as invoices or agreements, to demonstrate financial stability.

- Compliance evidence: Ensure you meet the Trade Agreements Act (TAA) requirements, maintain an active SAM.gov registration with a valid DUNS Number, and have a strong record of business ethics. Pricing must align with your standard commercial practices and adhere to the Price Reductions Clause.

Certain SINs may have additional requirements. For example:

- IT services: Information Technology SINs often require additional documentation to demonstrate past performance.

- Specialized services: Medical and pharmaceutical waste disposal services (SIN 562112) require an audit report, certifications, and a compliance program description.

- Identity protection services: SIN 541990IPS demands a technical proposal and a detailed System Security Plan following NIST SP 800-53 guidelines.

Before submitting your application, carefully review the solicitation for any SIN-specific instructions. Make sure all your documentation is current and accurate – outdated or incomplete paperwork is one of the most common reasons for rejection. Stay in close contact with your GSA Contracting Officer during the eMod submission process to resolve any issues quickly.

How To Get A GSA Schedule Contract? – CountyOffice.org

How to Build a Competitive Service Proposal

Creating a strong GSA service proposal requires a careful balance between staying competitive and adhering to compliance standards. To achieve this, your proposal should address three key areas: Administrative, Technical, and Pricing elements. Below, we’ll explore how to define labor categories, establish pricing, and organize your proposal for maximum impact.

How to Define Clear Labor Categories

Defining clear labor categories (LCATs) is a cornerstone of both compliance and operational success. Start by identifying the specific labor categories needed for your contract. For each category, outline the qualifications required, such as education, experience, and certifications. For instance, if you’re proposing a Senior Systems Analyst, you might specify a bachelor’s degree in computer science, five years of relevant experience, and certifications like CISSP or PMP.

Develop detailed job descriptions that clearly define responsibilities, duties, and performance expectations, ensuring they align with contract terms and federal regulations. Benchmark these roles against industry standards to stay competitive, and validate the categories internally with teams like HR, legal, and compliance. Keeping detailed records is critical for demonstrating compliance during audits. These well-defined labor categories not only ensure regulatory alignment but also set the stage for competitive and transparent pricing.

How to Set Competitive and Compliant Pricing

Pricing for GSA contracts differs significantly from commercial pricing. Your GSA Schedule rates act as ceiling rates, meaning you cannot exceed these pre-negotiated amounts. This makes understanding the nuances of GSA pricing essential for maintaining profitability while following the rules.

"GSA rates must be both competitive and compliant to avoid reductions or audit flags".

To set your rates, research competitor pricing on platforms like GSA Advantage! and eLibrary. Additionally, pay close attention to your Basis of Award (BOA) customer – the commercial client who receives your best pricing terms. Any changes in discounts for this customer could impact your GSA pricing under the Price Reductions Clause.

Develop discount tiers that balance your BOA obligations with competitive government rates. Discounts can be based on factors like volume or prompt payment. To avoid compliance issues, document any exceptions or non-comparable sales and maintain detailed, audit-ready records of all pricing decisions.

How to Structure a Winning Proposal

A well-structured proposal not only simplifies the review process for GSA evaluators but also clearly communicates your value. Building on your defined labor categories and pricing strategy, focus on presenting a proposal that demonstrates your ability to deliver effectively.

Since pricing is often the most complex aspect, ensure accuracy and include comprehensive documentation for any adjustments. Provide a detailed price list along with supporting materials to showcase a fair and sustainable business model that meets GSA standards. A Labor Category Matrix can help illustrate how your personnel qualifications and rates align with your service offerings.

In your technical narrative, emphasize your capabilities and past performance using concrete examples and measurable outcomes. Meanwhile, the administrative section should highlight your operational readiness, including your understanding of federal procurement requirements, quality assurance measures, and any special considerations like security clearances or reporting protocols. Transparency in your pricing methodology and regular internal reviews will further strengthen your proposal, demonstrating your commitment to compliance and value delivery.

sbb-itb-8737801

How to Meet Compliance Requirements from the Start

Getting a handle on GSA compliance requirements from the beginning can save you from headaches like delays or audit complications down the road. Once you’ve nailed down the compliance rules, you can shift your attention to the digital steps needed for a smooth proposal submission.

Key Compliance Rules: TAA and Section 889

Two big rules dominate the GSA contracting world: the Trade Agreements Act (TAA) and Section 889 of the National Defense Authorization Act. Violating either can have serious consequences, so it’s important to fully understand them.

The Trade Agreements Act (TAA) mandates that the U.S. government can only purchase goods made in the U.S. or designated countries. If you’re selling products through a GSA contract, they need to come from approved countries. Even service contractors should double-check that any equipment or software they use meets TAA standards.

Section 889, on the other hand, is a bit trickier. It bans the use and procurement of certain telecom equipment and services, mainly targeting companies linked to the People’s Republic of China. This includes gear from Huawei, ZTE, Hytera, Hangzhou Hikvision, and Dahua, as well as their subsidiaries and affiliates. The rule has two parts: Part A prohibits the government from buying such technology, and Part B bans contractors from using it – even for contracts of any size or type.

To comply, check if your company uses any restricted telecom equipment or services. Train your purchasing and material teams on Section 889 requirements and ensure your compliance plan is solid. Review contracts and documents carefully, and incorporate Cybersecurity Supply Chain Risk Management (C-SCRM) practices into your quality control processes.

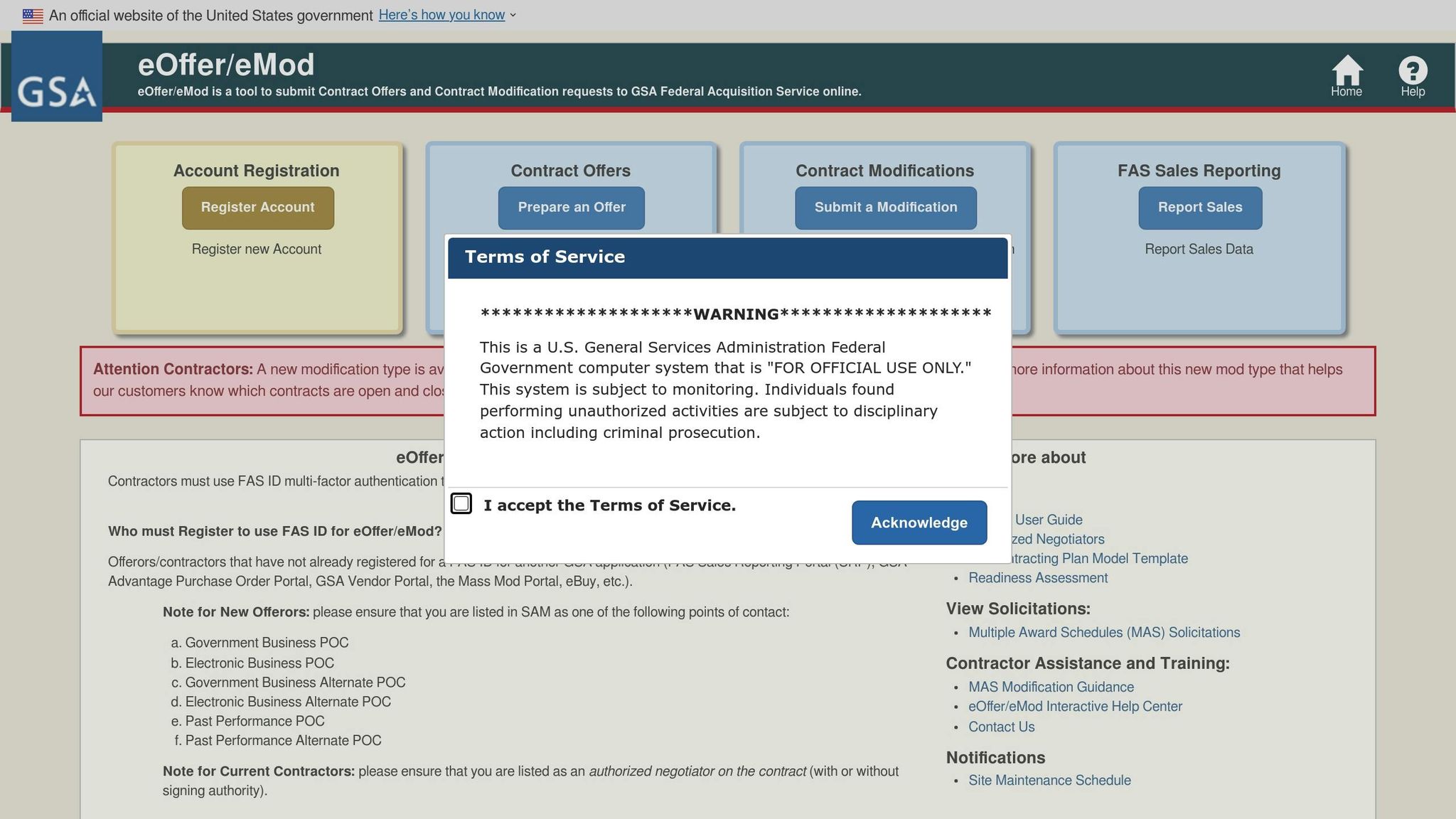

How to Submit Your Proposal via eOffer

Submitting your proposal through GSA’s eOffer system requires a few digital steps, starting with a valid digital certificate. This certificate is essential for signing in and validating your submission, helping to speed up processing and reduce errors.

To get started, obtain your digital certificate from a GSA-approved provider like IdenTrust, and test it regularly to ensure it works for logging in and signing documents. You’ll also need to prove that you’re authorized to represent your company.

Secure your FAS ID account with multi-factor authentication, and make sure your SAM profile is current. Once your certificate is installed on a secure workstation, the eOffer system will validate it when you sign in. Keep track of your certificate’s expiration date and renew it in advance to avoid disruptions.

How to Maintain Audit-Ready Documentation

After submitting your proposal, staying organized with clear, audit-ready documentation is critical for ongoing compliance. The GSA Office of Inspector General (OIG) may conduct audits, either before or after awarding a contract. Pre-award audits often happen during option exercises.

Set up a system to monitor BOA (Basis of Award) pricing and discounts. Use automated alerts to flag changes that could impact your BOA status, and maintain detailed logs of discounts, including any exceptions like non-standard discounts.

Train your sales and contracts teams on key compliance areas, such as the Price Reductions Clause, the implications of BOA on GSA pricing, and the difference between standard and non-standard discounts. A conservative pricing approach – where discounts require compliance team approval – can help protect your BOA status.

Regularly review your discounting practices and compliance records to catch issues early. Keep detailed documentation of all major decisions and training sessions.

"When the time comes to exercise the option to extend a contractor’s GSA Schedule contract, they should take the opportunity to confirm that their practices are properly disclosed and that they have an effective compliance program in place." – Leo Alvarez, Principal at Baker Tilly

Post-award audits can follow pre-award findings, contractor evaluations, Contracting Officer requests, or even tips to the OIG hotline. Having strong documentation and internal controls not only protects your business but also shows your commitment to staying compliant throughout your contract’s lifecycle.

Tips for Long-Term GSA Service Delivery

Securing a GSA service contract is just the beginning. To ensure long-term success, you’ll need effective tools, consistent oversight, and strong internal systems. Managing your contract well means staying proactive with updates, preparing for audits, and building internal controls that can handle both expected and unexpected challenges.

How to Use GSA Management Tools

GSA provides several digital tools to help contractors efficiently manage their contracts. Two key platforms – eMod and eLibrary – are essential for keeping your contract competitive and compliant.

- eMod: This tool is your go-to for submitting and updating contract modifications. Whether you need to adjust pricing, add new services, or update labor categories, eMod makes these changes straightforward. It even offers a modification type to close contracts to new awards if needed. Before using eMod, ensure all authorized negotiators are registered with a FAS ID, which includes multi-factor authentication for secure access.

- eLibrary: Think of this as your research hub. eLibrary provides access to competitor pricing, current GSA regulations, and new solicitation opportunities. Regularly reviewing this data helps you stay informed and competitive. Check eLibrary monthly for updates and analyze competitor data quarterly to refine your strategy.

| Tool | Primary Function | Key Benefits |

|---|---|---|

| eMod | Contract modifications and updates | Submit pricing changes, add services, manage awards |

| eLibrary | Research and compliance monitoring | Access competitor data and identify opportunities |

| FAS ID | Secure access authentication | Multi-factor security for authorized users |

Timely use of these tools is critical. For example, delays in submitting contract modifications through eMod could hurt your chances of competing for new opportunities. By keeping your contract updated, you’re not only ensuring compliance but also making audit preparations and performance tracking much smoother.

How to Prepare for Audits and Performance Tracking

GSA audits are designed to ensure contractors are meeting their obligations, offering the government the best pricing, and adhering to contract terms. Both pre-award and post-award audits can occur, and being prepared will save you time and resources.

- Pre-Award Audits: These typically happen during contract renewals or option exercises. GSA usually requests documentation within two months, so it’s wise to prepare early. Conduct internal pre-audits to identify any issues with pricing, discounting, or documentation. Organize all required materials and train your team on what to expect.

- Post-Award Audits: These can be triggered by suspected violations, such as overbilling, defective pricing, or non-compliance with the Price Reduction Clause. Violations can lead to penalties, refunds, or even referrals to the Department of Justice.

When an audit begins, request an entrance meeting to clarify the scope and designate a single point of contact to handle communications. Prepare your team for potential interviews and maintain professional, cooperative communication throughout the process.

"GSA audits can be tricky, but careful attention to the government’s requests and adherence to best practices can help your company successfully navigate its way through." – Global Services

After the audit, an exit conference provides an opportunity to review findings and determine next steps. Address any issues promptly and use the experience to improve your internal compliance processes, reducing the risk of future problems.

How to Set Up Internal Controls for Success

Effective internal controls are the backbone of long-term GSA contract performance. These systems help you address challenges and adapt to unexpected changes, ensuring compliance and operational efficiency.

Start by mapping out all activities under your contract and identifying potential risks. For example, assess how pricing, discount tracking, and performance reporting align with GSA requirements. Where gaps exist, implement additional controls, especially for complex contract features like time-and-materials or cost-reimbursement arrangements.

Key focus areas for internal controls include:

- Monitoring Basis of Award pricing and discount structures

- Tracking performance metrics and deliverables

- Keeping audit-ready documentation

- Ensuring consistent policy application across all locations

- Providing clear backup coverage for employee responsibilities

Train your team on these controls before contract performance begins, emphasizing their role in maintaining compliance. For flexible contract features, like time-and-materials, establish detailed procedures to ensure proper oversight.

Review and update your internal controls annually to account for regulatory changes, business growth, or new risks. Align your systems with federal standards, such as the Government Accountability Office’s five components and 17 principles of internal control. Regular monitoring will ensure your controls are functioning as intended, giving you confidence in your contract management processes.

Conclusion: How to Achieve Long-Term Success with GSA

Navigating the world of GSA contracts requires careful planning, unwavering compliance, and consistent effort to unlock the vast opportunities available in the federal market.

Key Takeaways for GSA Success

To start, focus on selecting the appropriate Special Item Numbers (SINs) and ensuring all documentation is in order. Your proposal should clearly define labor categories and offer pricing that is both competitive and compliant. But remember, the real challenge begins once the contract is awarded.

Compliance is the cornerstone of success. Lucy Hoak from Winvale emphasizes:

"Contract compliance should always be a priority for Multiple Award Schedule (MAS) contractors, but it’s now more important than ever."

Even small compliance issues can lead to contract termination, so staying vigilant is essential.

Meeting sales benchmarks – $100,000 in the first five years and $125,000 annually after that – requires a proactive approach. This includes a solid marketing plan, active client outreach, timely quarterly reports, and precise handling of the 0.75% Industrial Funding Fee.

For contracts exceeding $150,000, performance tracking becomes critical. GSA evaluates contractors on product quality, cost control, and timeliness. If you’re working with GSA Global Supply, aim for at least a 95% order acknowledgment rate, 90% shipment status updates, and 80% on-time delivery.

Make use of GSA management tools to ensure your contract stays competitive and up to date. Respond promptly to GSA communications to demonstrate both compliance and strong contract management.

By sticking to these core strategies, you’ll not only secure your initial success but also set the stage for long-term growth.

The Path to Federal Contracting Growth

Once you’ve built a strong foundation of compliance and competitive proposals, expanding your presence in federal contracting becomes a realistic goal. GSA contracts open doors to a massive network of federal buyers, with GSA Advantage! attracting over one million visitors weekly and processing more than 30,000 orders.

Developing relationships with contracting officers through outreach and participating in industry events can lead to opportunities that extend beyond individual contracts. Enhancing your GSA Advantage! listings with accurate details and strategic keywords, while actively monitoring eBuy for competitive bidding opportunities, can further boost your success.

Strong compliance and effective performance metrics position you for sustained federal engagement. As your business grows, consider expanding your GSA Schedule offerings to reach additional agencies.

Keep in mind, GSA has tightened its policies on inactive contracts. If you fail to meet minimum sales requirements, your contract could expire. Treat your GSA contract as a dynamic tool for business development, not just a static opportunity. With strategic planning, consistent compliance, and diligent management, your GSA contract can serve as a solid foundation for ongoing federal contracting success.

FAQs

What are some common mistakes businesses make when applying for a GSA Schedule, and how can they avoid them?

Submitting a GSA Schedule application comes with its challenges, and one of the most common missteps businesses make is providing incomplete or inaccurate paperwork. Missing details in financial records, service descriptions, or pricing information can lead to frustrating delays – or worse, outright rejection.

Another frequent hurdle is misunderstanding the pricing rules set by GSA. For example, failing to ensure that your service pricing matches market rates or aligns with tools like the GSA CALC tool can cause complications. On top of that, businesses sometimes neglect compliance with key regulations, such as the Trade Agreements Act (TAA) and Section 889, which could result in penalties for non-compliance.

To steer clear of these issues, double-check every piece of documentation for accuracy and completeness before submitting. Take the time to familiarize yourself with GSA guidelines, ensure you’re meeting all regulatory requirements, and adjust your pricing strategy to meet GSA standards. A carefully prepared application not only saves time but also greatly improves your chances of approval.

What are the best strategies for marketing your services to federal agencies after getting listed on the GSA Schedule?

To successfully market your services to federal agencies after securing a spot on the GSA Schedule, start with a focused marketing plan. Pinpoint the agencies most likely to need your services and customize your outreach to meet their unique requirements. Dig into their procurement history to understand their buying patterns and align your offerings accordingly.

Take advantage of tools like GSA Advantage! and eBuy to increase your visibility and streamline the purchasing process for agencies. Make sure your website and marketing materials clearly showcase your GSA contract details, so potential buyers can easily find and understand what you offer. Attending government events, conferences, and networking gatherings can also open doors to forming valuable connections and earning trust with key decision-makers.

Consistency matters – keep the momentum going by staying engaged with potential clients, keeping an eye on new opportunities, and tweaking your approach based on feedback and results.

What steps can businesses take to stay compliant with GSA regulations and avoid penalties?

To stay on the right side of GSA regulations and steer clear of penalties, businesses need to consistently review their processes to ensure they align with the latest contractual requirements. This means keeping documentation accurate and current, sticking to pricing guidelines, and completing essential registrations like SAM.gov.

It’s equally important to stay updated on key compliance rules like TAA and Section 889. Preparing for potential audits is another critical step – this involves tracking performance and maintaining well-organized records. Tools like eMod can be incredibly useful for reviewing and updating your contract, helping to ensure your services not only meet compliance standards but also remain competitive in the market.

Related posts

- How to Read GSA Solicitation Documents

- Ultimate Guide To GSA Contracting Results

- What Services Can You Sell Under a GSA Schedule?

- Selling Services via GSA Schedule: A Complete Walkthrough