Maintaining your GSA Schedule is crucial for staying compliant and competitive in the federal marketplace. Here’s what you need to know:

- Why It Matters: Neglecting maintenance risks contract cancellation, fines, or losing access to the $51.5 billion federal marketplace.

- Key Tasks: Regularly update pricing, products, and company info via the eMod system. Submit sales reports on time and pay the 0.75% Industrial Funding Fee (IFF).

- Extension Requirements: Meet sales thresholds ($100,000 in the first 5 years, $125,000 in subsequent periods) and submit extension requests 165 days before your contract ends.

- Compliance Risks: Non-compliance costs can exceed $50,000, and 30% of contract cancellations stem from poor maintenance practices.

Quick Tip: Start contract renewal prep 24–36 months before expiration and use tools like the GSA Vendor Support Center to streamline tasks.

Stay proactive to protect your GSA Schedule and maximize federal sales opportunities.

Required Tasks for GSA Schedule Maintenance

Keeping your GSA Schedule up to date isn’t just about staying compliant – it’s about staying competitive. As your business evolves, so do market conditions and government requirements. Regular updates to your GSA Schedule ensure your contract remains relevant and aligned with federal standards.

Whether it’s pricing adjustments, product changes, or company updates, timing and precision are key. Here’s a closer look at the essential tasks to keep your GSA Schedule in shape.

How to Update Pricing and Product/Service Offerings

Pricing Updates:

Adjusting your pricing periodically is essential to maintain competitiveness in the federal marketplace. You can request price increases through Economic Price Adjustments (EPA) to account for inflation, rising costs, or market shifts. On the flip side, if you offer lower prices to commercial customers or need to stay competitive, a price reduction modification is required. Keep in mind that new pricing cannot take effect until GSA approves your modification.

Product and Service Changes:

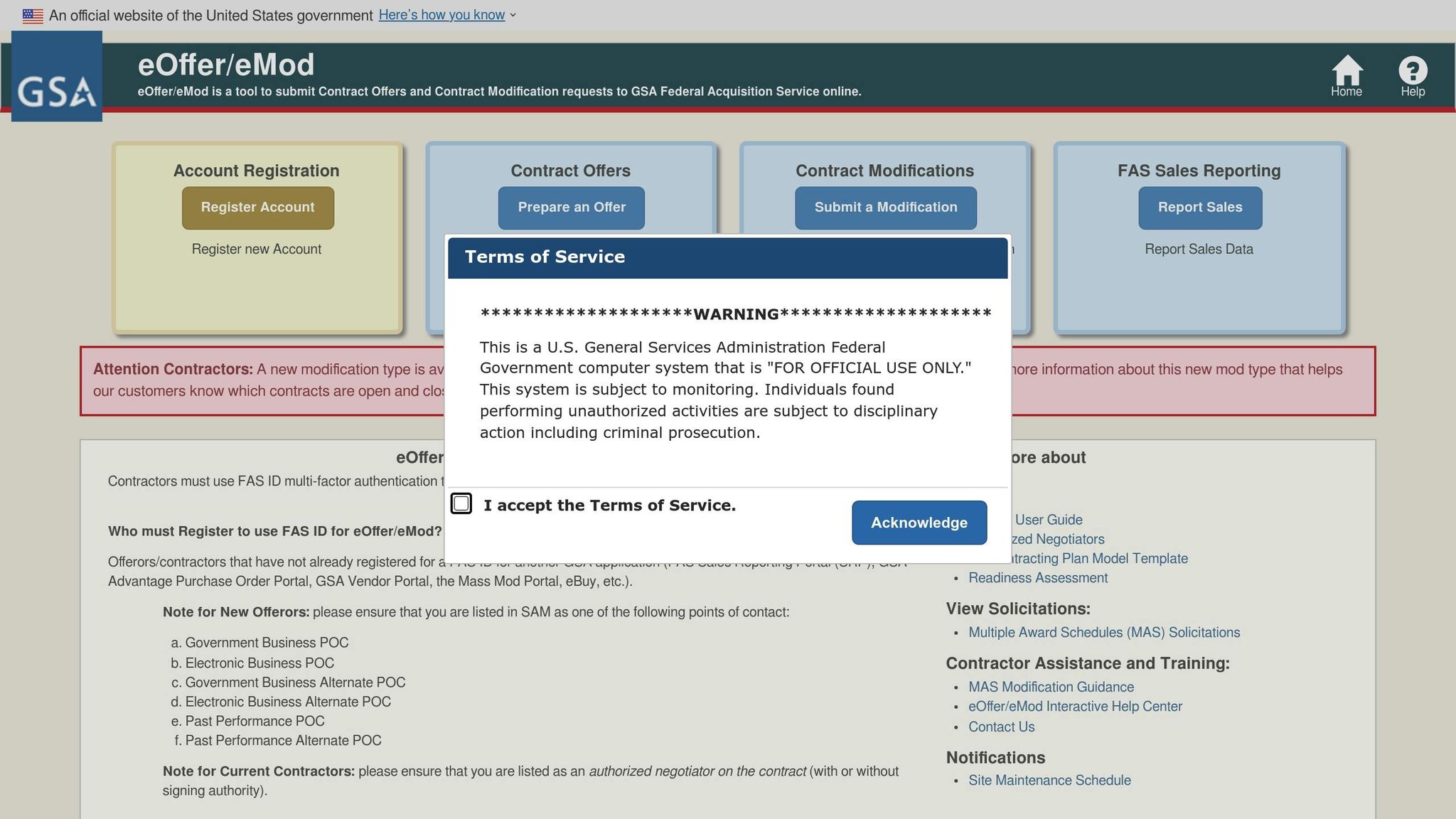

Adding or removing products and services? Use the eMod system to update your contract accordingly. It’s the official channel for making these adjustments.

Best Practices for Updates:

- Provide clear, well-documented justifications for all pricing and product changes to avoid unnecessary back-and-forth with your Contracting Officer.

- Prioritize updates based on your business goals.

- After approval, update your GSA Advantage! and eLibrary listings within 30 days to maintain visibility in the federal marketplace.

How to Submit Modifications Through the eMod System

The eMod system is your one-stop shop for contract changes. Mastering its process can save you time and prevent headaches.

Types of Modifications:

- eMods: Contractor-initiated changes like pricing or product updates.

- Mass Mods: GSA-initiated updates that apply across multiple contracts.

The Submission Process:

Before submitting, review the GSA MAS Modification Guide thoroughly. Always use the most current templates and refer to the Modifications and Mass Modification Guidance pages for updates. Choose the correct modification type in the eMod system to avoid delays.

Documentation Requirements:

Back up your modification requests with detailed explanations, commercial sales data, and pricing decisions. Strong documentation builds trust with your Contracting Officer and speeds up approvals.

Tips for Smooth Submissions:

- Communicate clearly with your Contracting Officer to address issues quickly.

- Avoid common mistakes like outdated templates, incorrect modification types, or insufficient review.

- Accept mandatory mass modifications within 90 days to avoid jeopardizing your contract status.

Once your modifications are in place, you can shift focus to preparing for option extensions.

How to Handle Option Extension Requests

GSA Schedule contracts come with a base period and up to three five-year option extensions. But these extensions aren’t automatic – you must meet specific criteria and submit the required documentation on time.

The Timeline:

The process kicks off about 7 months (210 days) before your current contract period ends. You’ll receive an email – commonly called a "210 letter" – from your Contracting Specialist or Officer, inviting you to extend your contract. You’ll need to submit all required documents via the eMod system by the deadline, typically 165 days before the extension. Missing this deadline means your contract will expire, cutting off your ability to sell through the MAS program.

Sales Requirements:

To qualify for an extension, your sales must meet these thresholds:

- $100,000 in the first five years

- $125,000 in each subsequent five-year period

| Requirement | Details |

|---|---|

| Contract Compliance | Must have accepted all mandatory mass modifications and adhered to terms |

| Current GSA Advantage! Price List | Ensure your pricing catalog is accurate and up to date |

| Sales Threshold Compliance | Meet sales requirements: $100,000 (first five years), $125,000 (subsequent periods) |

| Financial Stability | Demonstrate financial health and capability to perform |

| eSRS Compliance (if applicable) | Stay current with all Electronic Subcontracting Reporting System submissions |

Required Documentation:

Your extension package should include:

- A cover letter on company letterhead signed by an Authorized Negotiator.

- A statement confirming compliance with contract terms.

- Re-representation of your business size (if applicable).

- A Small Business Subcontracting Plan, if required.

Preparation Tips:

- Keep your Authorized Negotiator information up to date.

- Start preparing for the extension well before receiving the 210 letter to avoid last-minute issues.

- Submit all documents well before the 165-day deadline to allow time for corrections or additional requests.

If your Contracting Officer is satisfied with your submission, they’ll approve the extension. Otherwise, your contract may expire, cutting off access to the federal marketplace. Stay proactive, maintain compliance, and keep your documentation ready to ensure a smooth process.

Reporting and Compliance Requirements

Staying compliant with GSA reporting and regulatory mandates is not optional – it’s a necessity. Missing even a single deadline can put your contract at risk of termination, so keeping up with these obligations is essential for maintaining your GSA Schedule.

Sales Reporting: Monthly or Quarterly Submissions

How often you need to report depends on the type of contract you hold. Your participation in either the Transactional Data Reporting (TDR) program or the traditional Cooperative Supply Program (CSP) determines your schedule and the type of data you need to submit.

TDR vs. Non-TDR Reporting:

| Reporting Type | Frequency | Deadline | Data Required |

|---|---|---|---|

| Transactional Data Reporting (TDR) | Monthly | Within 30 calendar days from the end of the month | 16 transactional data elements |

| Non-TDR (CSP) | Quarterly | Within 30 calendar days after the end of the quarter | Total aggregate contract sales by SIN |

For TDR contractors, detailed monthly reports covering 16 transactional data elements are due within 30 days of the month’s end. On the other hand, Non-TDR contractors submit quarterly reports showing total sales by Special Item Number (SIN), with deadlines on January 30th, April 30th, July 30th, and October 30th.

Important Note: Even if you have no sales during a reporting period, you’re still required to file a "$0" report.

"The Contractor shall continue to furnish quarterly reports, including ‘zero’ sales, through physical completion of the last outstanding task order or delivery order of the contract."

Getting Started with Reporting: Before submitting your first report, you must register your contract with the FAS Vendor Support Center (VSC). Make sure your Multi-Factor Authentication credentials are active to access the FAS Sales Reporting Portal at https://srp.fas.gsa.gov.

What Sales Should Be Reported? Only include sales for products or services listed on your approved GSA price list. You can choose to report sales at various stages – when the order is received, shipped, invoiced, or paid – but consistency in your reporting method is key. Also, clearly separate GSA Schedule sales from non-GSA sales on all quotes, orders, and invoices.

Next, let’s look at how these reports tie into your Industrial Funding Fee (IFF) obligations.

How to Calculate and Pay the Industrial Funding Fee (IFF)

The Industrial Funding Fee (IFF), set at 0.75% of your GSA sales, helps fund the Multiple Award Schedule program.

Payment Schedule: Your reporting schedule dictates when you pay the IFF. CSP contractors pay quarterly, while TDR contractors can choose between monthly or quarterly payments.

How to Calculate IFF: To calculate the fee, multiply your total GSA sales by 0.0075. For example, $100,000 in sales equals a $750 fee. If you want to include the IFF in your pricing, divide your discounted GSA price by 0.9925.

Making Payments: Payments must be submitted electronically through pay.gov, as paper checks are no longer accepted. Use the Sales Reporting Portal (SRP) to handle both reporting and payments in one place.

Avoiding Errors: Train your accounting team on the electronic payment system and double-check your calculations. Mistakes in payments – whether overpaying or underpaying – can lead to compliance issues, so it’s worth consulting with MAS contracting professionals to get it right.

Federal Regulation Compliance Requirements

Compliance doesn’t stop at reporting – it extends to keeping your contract updated and meeting federal standards. Regular reviews are critical to staying on track.

Key Compliance Areas:

- SAM.gov Registration: Keep your registration active with up-to-date company details, banking information, and certifications.

- Equal Opportunity Employment: Follow federal non-discrimination laws, which apply to all GSA contractors.

- Small Business Certifications: Renew certifications as required by each program’s timelines.

- Trade Agreements Act (TAA): Ensure all products listed under your GSA Schedule comply with TAA rules, meaning they must be made or substantially transformed in designated countries.

Managing Your Contract:

- Keep your price list updated on the Vendor Support Center.

- Sign mass modifications within 90 days of receipt.

- Meet delivery performance standards to avoid jeopardizing your contract.

GSA also assigns an industrial operations analyst to assist with compliance issues throughout your contract term.

Staying Informed: GSA policies and federal regulations are constantly evolving. Use resources like the Vendor Support Center to stay updated, and remember that any changes to your contract terms must go through formal contract modifications. Regular internal compliance checks can help you catch and address potential issues before they escalate.

sbb-itb-8737801

Tools, Resources, and Methods for GSA Schedule Maintenance

Keeping your GSA Schedule in check doesn’t have to feel like a monumental task. With the right tools, resources, and internal systems, you can stay on top of deadlines and compliance requirements without breaking a sweat. Here’s how you can make it happen.

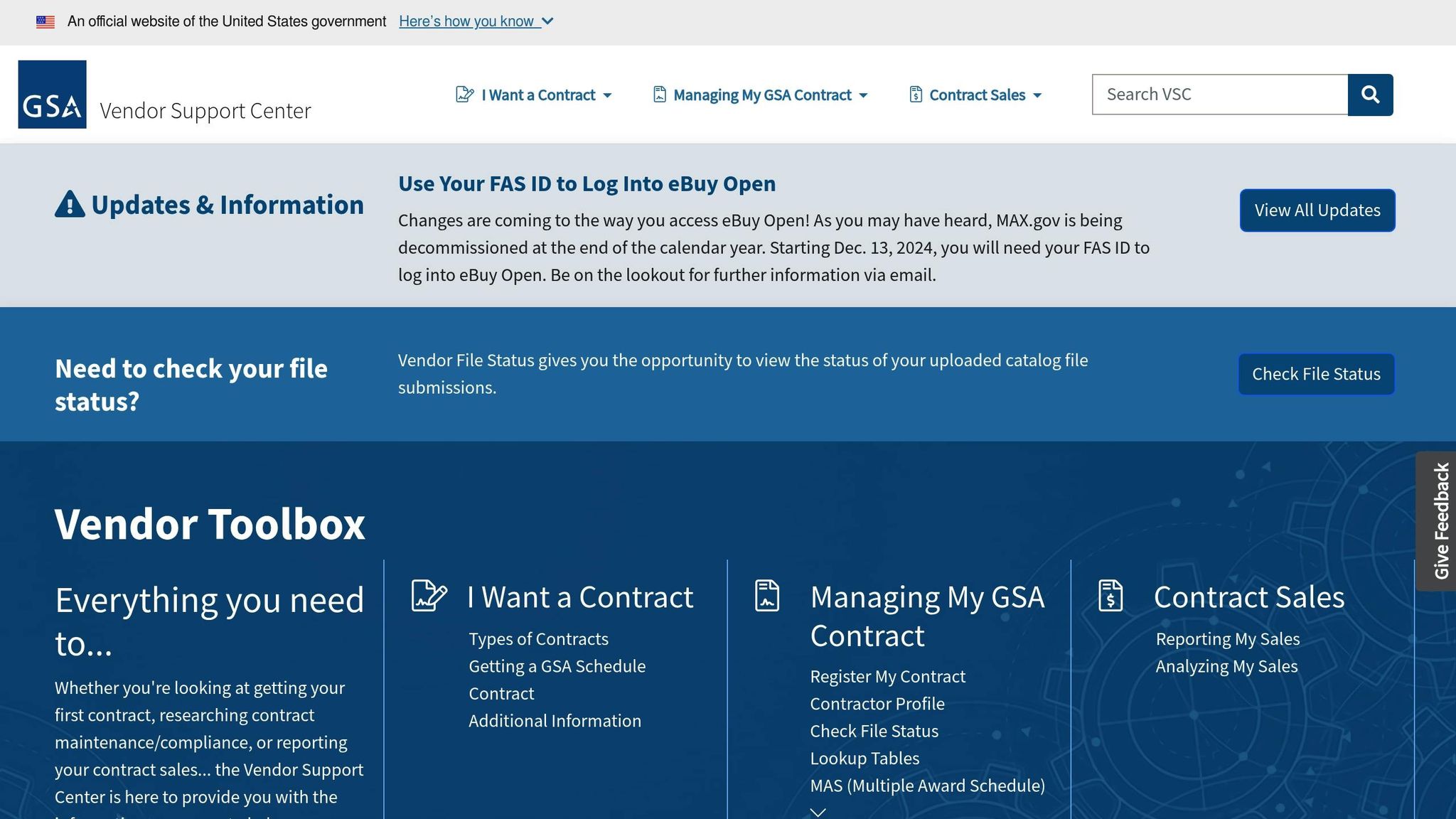

How to Use the GSA Vendor Support Center

The GSA Vendor Support Center (VSC) is your go-to platform for managing your GSA contract. From registering your contract to accessing essential tools like GSA Advantage and eBuy, the VSC simplifies federal contracting for GSA vendors.

One of its standout features is its support for submitting electronic catalog files to GSA Advantage! and managing your sales data submissions. The VSC also provides a handy contact directory to connect you with key personnel, including your Procurement Contracting Officer (PCO), Administrative Contracting Officer (ACO), and Industrial Operations Analyst (IOA). Additionally, under the "Managing My GSA Contract" section, you’ll find lookup tables for Special Item Numbers (SINs), Designated Country Codes, Prohibited Manufacturers, and Authorized BPA Vendors.

By tapping into these resources, you can streamline compliance tasks and ensure every update aligns with GSA’s standards.

Setting Up Internal Compliance Management

Designating a team to oversee GSA compliance is crucial. Train your team members on commercial pricing practices and the intricacies of GSA requirements, especially the Price Reductions Clause (PRC) and how it impacts your pricing.

To stay ahead:

- Use monitoring systems to track pricing and discounts for BOA customers.

- Set up automated alerts and detailed documentation to flag changes that could trigger PRC requirements.

- Conduct regular audits to spot discrepancies early.

- Stick to conservative pricing policies, limiting discounts for BOA customers unless reviewed and approved by your compliance team.

A proactive approach to internal compliance, paired with a robust Quality Control Plan, ensures your operations stay on track.

Creating a Quality Control Plan

A Quality Control Plan (QCP) is your blueprint for maintaining compliance and contract integrity. This document should clearly outline the procedures, roles, and responsibilities needed to meet GSA’s quality standards.

Key elements of your QCP should include:

- Objectives and Responsibilities: Define your goals, assign team duties, and establish processes for verifying work and setting supplier standards that meet GSA requirements.

- Inspection and Documentation: Develop protocols for inspections, set documentation standards, and outline corrective actions for any issues.

- Performance Standards: Establish testing parameters, performance benchmarks, and acceptance criteria for deliverables. Include audit schedules and training plans for team members involved in contract execution.

To keep your plan effective:

- Regularly review and update it as GSA regulations or your contract requirements change.

- Build in methods to measure progress, such as checkpoints and feedback loops.

- Include detailed procedures for tracking BOA pricing, conducting internal audits, and maintaining accurate records.

- Address notification triggers and internal checkpoints to flag pricing changes. This ensures you can notify GSA within the required 15 calendar days if price reductions occur.

Conclusion: Protect Your GSA Schedule Investment

Your GSA Schedule opens the door to a $51.5 billion federal marketplace. But with this incredible opportunity comes the responsibility to maintain your contract properly. Neglecting this responsibility can lead to serious consequences, including an average of 15% in lost revenue due to suspended contracts and missed opportunities.

Federal compliance is more critical than ever. As Federal Acquisition Service Commissioner Josh Gruenbaum stated, GSA is "rightsizing the MAS Program" with a focus on fiscal responsibility and delivering value. Even small compliance missteps can result in contract cancellations, making regular maintenance a must, not a choice.

Staying on top of key maintenance tasks is essential. Pricing and product updates should reflect current market trends and government requirements. Adhering to the Price Reductions Clause builds trust with government buyers and helps you avoid costly penalties. Consistently submitting sales reports and paying Industrial Funding Fees (IFF) on time keeps your contract in good standing, while staying informed about regulatory updates ensures you’re prepared for the long haul.

The rewards of proper maintenance are clear. One technology company saw a 200% increase in government sales within its first year, while a medical equipment supplier cut administrative overhead by 40% after adopting focused maintenance practices. On the other hand, relying solely on in-house management may increase compliance risks.

To stay competitive, proactive maintenance is key. GSA advises contractors to begin the renewal process 24 to 36 months before their contract expires. By planning ahead and maintaining consistent compliance, you can turn your GSA Schedule into a powerful tool for growth and success.

FAQs

What are common mistakes businesses make with GSA Schedule maintenance, and how can they avoid them?

Many companies stumble when managing their GSA Schedule, often overlooking key responsibilities like updating pricing or product and service offerings, submitting incomplete or incorrect modifications, or falling behind on mandatory reporting, such as monthly sales or the Industrial Funding Fee (IFF). These missteps can result in steep penalties, canceled contracts, or even losing eligibility altogether.

To steer clear of these pitfalls, make it a priority to regularly review and update your contract details. Double-check that all modifications are accurate and properly submitted through the eMod portal. It’s also a smart move to designate a compliance lead who can stay on top of reporting duties and ensure your business aligns with GSA regulations. Taking these steps can safeguard your contract and keep you positioned for future opportunities.

What is the Economic Price Adjustment (EPA) process, and when should you request one?

The Economic Price Adjustment (EPA) process gives GSA Schedule contractors a way to request price changes when market conditions or economic factors cause significant shifts. To get started, log into the GSA eMod system, click on ‘Create New Modification,’ and select the EPA option. Contractors are generally eligible to submit an EPA request after the first 12 months of their contract, with a limit of three requests allowed in any 12-month span.

If market conditions or rising costs are affecting your ability to stay competitive, it might be time to consider an EPA. To strengthen your case, make sure your request is thoroughly documented and complies with GSA guidelines to protect the integrity of your contract and maintain your competitive edge.

What steps should my company take to ensure a smooth GSA Schedule contract extension?

To smoothly navigate a GSA Schedule contract extension, start preparing as soon as you receive the 210-day notification from GSA. Begin by confirming your intent to extend, which involves submitting the necessary cover letter and documentation through the eMod portal. Use this opportunity to review and update essential contract details, such as pricing and your product or service offerings, to ensure they reflect any recent adjustments.

Equally important is maintaining compliance with GSA regulations. This includes keeping track of your Industrial Funding Fee (IFF) obligations and ensuring your sales reports are accurate and up to date. Regular communication with your GSA representatives can also make a big difference. If you have questions or need clarification, tools like the Vendor Support Center are there to help. Staying proactive and organized throughout the process will make the extension experience much smoother.

Related posts

- How to Manage GSA Contract Performance

- Common GSA Compliance Mistakes And Fixes

- Ultimate Guide To GSA Contracting Results

- GSA Schedule: What Happens After Approval