GSA Schedules, also called IDIQ contracts, simplify federal procurement by offering pre-negotiated terms for businesses selling to government agencies. They provide small businesses with a direct sales channel, bypassing lengthy bidding processes. To qualify, companies must meet specific criteria, including:

- At least 2 years of business history with consistent sales.

- Submission of financial documents (e.g., profit/loss statements).

- Registration on SAM.gov and obtaining a Unique Entity Identifier (UEI).

- Compliance with Trade Agreements Act (TAA) for product sourcing.

- Offering commercially available products or services with competitive pricing.

These contracts streamline government purchasing while giving businesses a stable entry into federal markets. However, the process involves detailed documentation, compliance, and ongoing maintenance to ensure eligibility and contract success.

How To Become A GSA Schedule Contractor? – CountyOffice.org

Basic Requirements for GSA Schedules

Securing approval for a GSA Schedule requires meeting specific criteria that confirm your business’s financial health and compliance with federal regulations. Here’s what you need to know.

Business History and Financial Requirements

The GSA prioritizes working with established businesses that have a track record of reliability. Your company must have at least two years of operational history to apply for a GSA Schedule. However, it’s not just about being in business for two years – you’ll need to show consistent commercial sales activity during that time.

To demonstrate your financial stability, you must submit detailed financial statements, including profit and loss reports, balance sheets, and cash flow statements, covering the past two years. These documents help prove that your business can handle the demands of federal contracts.

A strong commercial sales history is also key. It shows that your pricing is competitive and fair – an essential factor for the GSA, which expects government prices to be at or below your best commercial rates. Businesses without a solid sales foundation often struggle to meet these pricing expectations.

Additionally, your creditworthiness and bonding capacity matter. Federal agencies often prefer contractors who can secure performance bonds, as this reduces their risk. A strong credit profile and established banking relationships can go a long way in building trust with government buyers.

Registration and Compliance Steps

Once your business history is in order, you’ll need to complete several key registration and compliance steps. Start by registering on SAM.gov and keeping your registration active throughout the contract period.

As part of this process, you’ll receive a Unique Entity Identifier (UEI), which replaced the DUNS number system in April 2022. This 12-character alphanumeric code serves as your permanent identifier across federal systems. Ensure the information tied to your UEI is accurate and consistent across all applications.

Choosing the correct North American Industry Classification System (NAICS) codes is another critical step, especially for small businesses. These six-digit codes classify your industry and determine your size standards as defined by the Small Business Administration (SBA). For instance, a software development company might use NAICS code 541511, which has a size standard of $32.5 million in average annual receipts over three years.

If you’re pursuing small business set-aside opportunities, your company must meet the SBA’s size standards. These vary by industry – for example, manufacturing companies may qualify as small with up to 500 employees, while professional services firms might have revenue-based thresholds ranging from $8 million to $47 million annually.

Don’t overlook other compliance details, such as obtaining the necessary business licenses, maintaining proper insurance coverage, and ensuring your business structure aligns with federal contracting rules. Missing state or local licensing requirements can delay your approval if discovered during the GSA’s review process.

Trade Agreements Act (TAA) Compliance

Meeting Trade Agreements Act (TAA) compliance is one of the more intricate requirements for GSA Schedule eligibility. This law mandates that products sold to the government must either come from designated countries or undergo substantial transformation in the U.S. or another qualifying nation.

TAA-designated countries include World Trade Organization Government Procurement Agreement signatories, North American Free Trade Agreement partners, and nations with bilateral trade agreements with the U.S. For example, products manufactured in China generally don’t qualify unless they undergo substantial transformation in a designated country.

Substantial transformation means that the final product must have a new name, character, or use compared to its original components. For instance, importing electronic parts from non-designated countries and assembling them into a completely different finished product in the U.S. might meet this standard.

Accurate documentation is crucial for TAA compliance. You’ll need to maintain detailed records of each component’s origin and any transformation processes. Many businesses use TAA compliance matrices to track every element of their products, from raw materials to final assembly. These records should always be ready for GSA review or audits.

Service providers have different TAA considerations. While services themselves don’t have country-of-origin requirements, any products used in delivering those services must comply with TAA rules. For example, an IT consulting firm must ensure that any software or hardware used in its services meets TAA standards.

TAA compliance can be particularly challenging for businesses with global supply chains. Addressing these requirements early in the process can help you avoid costly delays or the need to reconfigure your supply chain to meet federal standards.

Product and Service Requirements

To qualify for GSA Schedules, businesses must meet strict eligibility criteria set by the GSA. These rules ensure government agencies receive high-quality products and services at competitive prices. Understanding these requirements can save you significant time and effort, as they build on the foundational compliance steps covered earlier.

What Products and Services Qualify

GSA Schedules encompass a wide range of offerings designed to meet government needs. Among the largest categories is Information Technology (IT), which includes hardware like servers, laptops, and networking equipment, as well as software licenses, cloud services, and cybersecurity tools.

Another major category is professional services, which covers areas like management consulting, financial advisory services, engineering support, and training programs. These services must clearly demonstrate value to government agencies.

Facilities maintenance and construction services are also included, ranging from janitorial work and landscaping to specialized construction projects and equipment upkeep. These address the operational needs of government facilities.

Additionally, office supplies and furniture are common procurement items, alongside medical and laboratory equipment, vehicles, and industrial supplies.

One key requirement is that your products or services must already be commercially available. This means they cannot be created exclusively for government use. The GSA looks for offerings with an established market presence, proving there’s genuine interest from potential government buyers.

Commercial Sales and Pricing Rules

Another critical factor for GSA Schedule approval is your commercial sales history and pricing structure. The GSA requires you to offer your best available pricing, often referred to as Most Favored Customer pricing. This ensures your rates are competitive when compared to what you offer your commercial clients.

To meet this requirement, you’ll need to submit commercial sales data, such as invoices and price lists, to show that your pricing aligns with your standard commercial practices. Volume discounts are also acceptable, as long as they mirror those offered to your commercial customers.

Your pricing strategy must remain consistent throughout the contract term, typically five years with potential extensions. Keeping detailed and transparent pricing documentation is crucial, as this will be reviewed during audits or when making contract modifications.

Country of Origin Rules

The origin of your products is another key factor in determining eligibility. Beyond compliance with the Trade Agreements Act (TAA), products must meet specific country-of-origin standards. In most cases, this means items should be made in the United States or in TAA-designated countries. Products from non-designated countries may only qualify if they undergo substantial transformation – a process where the final product differs significantly in name, character, or use from its original components.

To meet these requirements, you’ll need to document your supply chain in detail. This includes identifying each component’s supplier, manufacturing location, and any transformation processes involved. Ongoing supply chain audits are essential to ensure compliance, and you should have systems in place to address any changes in sourcing or manufacturing practices.

It’s also important to consider the potential costs associated with TAA compliance. While products from TAA-designated countries may sometimes come at a higher price, many businesses find that the opportunity to access the federal marketplace outweighs these costs in the long run.

How to Apply for a GSA Schedule

Securing a GSA Schedule involves a structured process that unfolds in three key phases: gathering the necessary documentation, submitting your application through the official system, and negotiating with GSA Contracting Officers. Here’s a detailed guide to help you prepare, submit, and navigate the negotiation process effectively.

Preparing Your Application

The first step is assembling all required documents to prove your qualifications. Accuracy and thoroughness are non-negotiable here.

You’ll need to provide three years of audited financial statements to demonstrate your financial stability. Additionally, include a comprehensive technical proposal, which should feature a Labor Category Matrix, records of past performance, and pricing details. If your business is newer and lacks audited financials, alternative documents like bank statements or a surety bond can be used as substitutes.

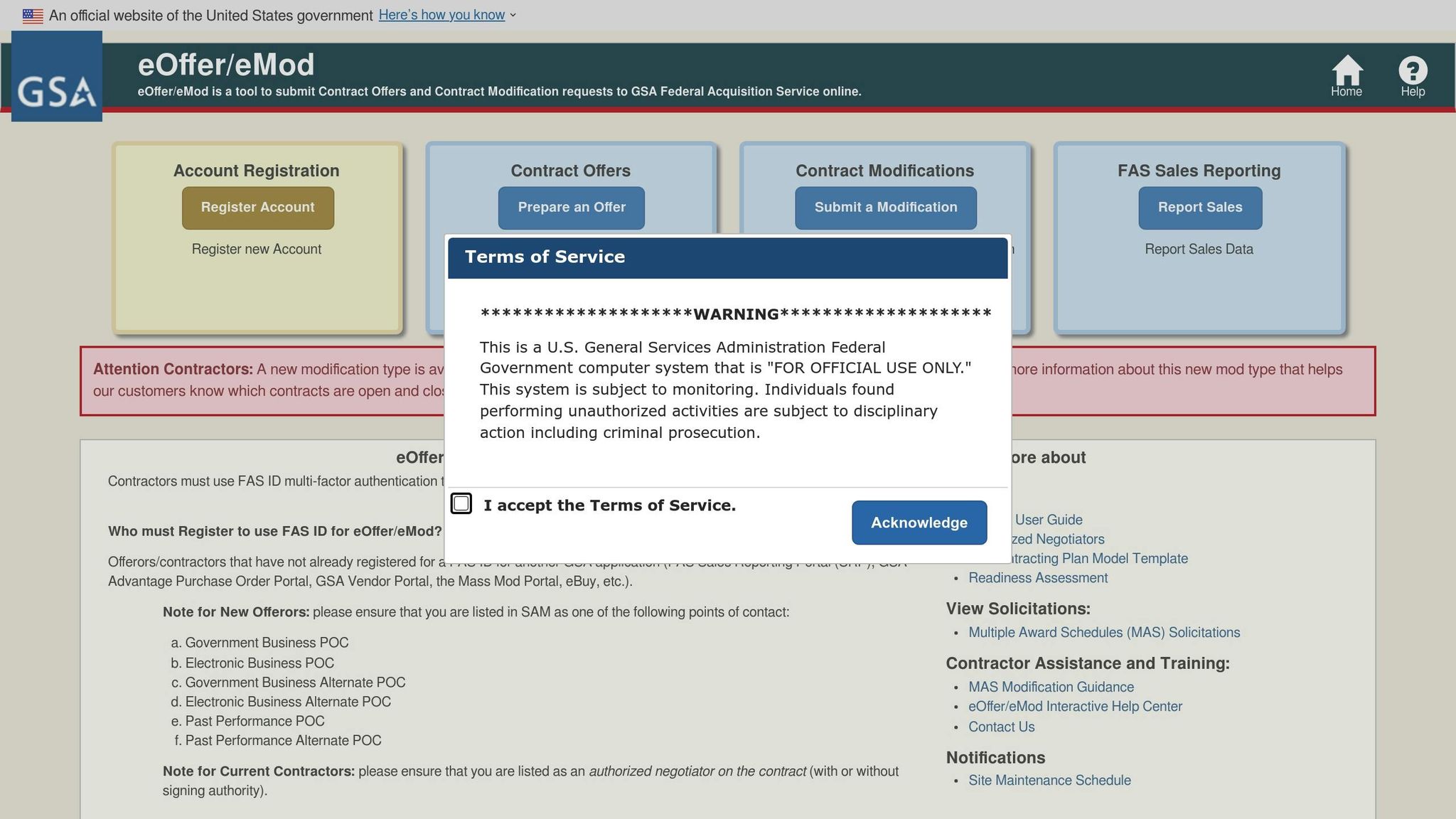

Submitting via GSA eOffer

Once your paperwork is in order, submit your application through GSA eOffer, the official online portal for GSA Schedule submissions. This system is designed to guide you step-by-step through the process, ensuring your application meets all technical and pricing requirements.

Pay close attention to the solicitation requirements for your specific schedule. Reference the correct solicitation number and make sure your offerings align with the scope outlined in the solicitation. You’ll also need to upload all supporting documents in PDF format. Using clear and descriptive file names will make it easier for reviewers to locate the information they need.

Navigating Negotiations with GSA Contracting Officers

After submission, your application moves into the negotiation phase, where you’ll work directly with GSA Contracting Officers. These officials are responsible for evaluating, negotiating, and awarding GSA Schedule contracts, so they’ll be your primary contacts throughout this process.

One of the first things the Contracting Officer will assess is the competitiveness of your pricing. Be prepared to explain your pricing methodology in detail. A key point of discussion will likely be the Equitable Price Adjustment, a mechanism that allows for future price changes based on market conditions. Understanding this concept can help you set your initial pricing more strategically.

Communication plays a huge role in this phase. Respond to requests for additional information promptly and remain transparent about your business practices. If any compliance issues with federal regulations arise, work collaboratively with the Contracting Officer to resolve them.

Keep in mind, this phase can take several months, depending on the complexity of your application and how quickly your team responds to inquiries. Staying organized and having knowledgeable staff on hand to address technical questions will go a long way in ensuring a smoother process. This thorough evaluation not only secures your contract but also sets the foundation for long-term success.

Staying Compliant After Approval

Securing a GSA Schedule contract is just the beginning. To keep your contract active and in good standing, you need to stay on top of compliance requirements and meet all reporting deadlines. Neglecting these responsibilities can lead to penalties or even contract suspension. Below, we’ll dive into the key tasks you’ll need to manage after approval.

Required Reports and Catalog Updates

Once your GSA Schedule is active, you’ll need to submit certain reports regularly. One of the most important is the Industrial Funding Fee (IFF) report, which is due quarterly through the GSA’s online portal. This report tracks your sales under the contract and calculates the 0.75% fee owed to GSA on those sales. Missing even one report could lead to suspension, so it’s crucial to have a dependable system in place to track deadlines. Automated reminders can be a lifesaver here.

Your GSA catalog also requires regular updates. Whether you’re adding new products, retiring old ones, or adjusting pricing, you must make these updates within 30 days. This includes uploading new product specs, revised pricing sheets, and any changes to labor categories or service descriptions.

If you lower prices for your commercial customers, you’re required to report the reduction to GSA within 30 days. Failing to do so can result in penalties, so staying vigilant about price changes is essential.

Meeting Sales Requirements

Compliance isn’t just about reports – it’s also about maintaining active sales. While GSA doesn’t set a specific minimum sales threshold for most schedules, contracts with little to no sales activity over time may not be renewed during the five-year review process.

To keep your contract viable, you need to show consistent and genuine sales efforts. That means marketing your GSA contract effectively, responding promptly to government inquiries, and offering competitive pricing.

The Most Favored Customer (MFC) pricing requirement is another critical factor. It ensures that the pricing you offer to GSA is as good as – or better than – what you offer commercial customers for similar quantities and terms. Regular pricing audits can help you stay compliant with this rule. Additionally, keeping detailed sales records for your commercial customers will make it easier to demonstrate compliance during reviews.

Handling Audits and Renewals

Audits are a routine part of GSA Schedule management, and being prepared can make the process much smoother. Pre-award audits typically focus on your initial pricing and sales practices, while post-award audits assess your ongoing compliance with contract terms.

During these audits, GSA reviewers will examine your sales records, pricing documentation, and adherence to contract clauses like the Trade Agreements Act and the price reduction clause. Keeping well-organized, accessible records can help you sail through these reviews and show that you’re committed to meeting your obligations.

Every five years, your contract will come up for renewal, and this requires careful planning. GSA will evaluate your sales performance, compliance history, and ability to meet contract requirements. Contractors with strong sales and clean compliance records usually have a smooth renewal process, while those with issues might face additional scrutiny or even modifications to their contract.

Start preparing for renewal at least six months before your contract expires. Update certifications, refresh financial documents, and make sure your catalog reflects your current offerings and pricing. This preparation period gives you time to address any potential red flags before they become problems.

The key to managing your GSA Schedule successfully over the long term is to treat compliance as an ongoing process, not something you only think about occasionally. Regular monitoring, systematic record-keeping, and proactive communication with GSA can help you maintain your contract as a valuable tool for federal contracting success.

How GSA Focus Can Help

Navigating the GSA Schedule process can feel like an uphill battle. Between the endless paperwork, strict compliance requirements, and long approval timelines, it’s no wonder small businesses often struggle to break into federal contracting. That’s where GSA Focus steps in, simplifying the process and making federal contracting more accessible. Below, we’ll dive into the services they provide and the benefits of working with them.

With over 18 years of experience and more than 550 GSA Contract awards under their belt, GSA Focus has helped clients generate upwards of $500 million in federal sales. Even more impressive? 98% of their clients secure GSA contracts, and 57% of those clients started with no prior experience in government contracting.

GSA Focus Services

GSA Focus offers an all-inclusive service that takes the weight off your shoulders. Their team manages virtually every aspect of the GSA Schedule process, saving you over 100 hours of work you’d otherwise have to tackle yourself. Here’s how they do it:

- Document Preparation and Compliance: They handle the nitty-gritty details, ensuring your application meets all GSA requirements.

- Application Submission: From start to finish, they guide your application through the approval process.

- Secure Online Portal: Their user-friendly portal acts as a checklist and guide, helping you upload required documents step by step.

- Direct Communication with GSA Officers: When questions arise during the review process, GSA Focus steps in to handle communications, even providing negotiation support to clear potential hurdles.

And their help doesn’t stop once your contract is awarded. GSA Focus continues to assist with contract maintenance and federal marketing support. This includes staying compliant with reporting requirements, managing catalog updates, and helping you strategize to win government contracts. In short, they’re with you every step of the way.

Benefits of Working with GSA Focus

One of the biggest perks of partnering with GSA Focus is the time you save. Instead of dedicating months to navigating the process on your own, clients only need to invest about 3–4 hours of their time throughout the entire process. That’s it. You can focus on running your business while they handle the heavy lifting.

Take it from their clients:

"Without GSA Focus, we couldn’t have navigated the complex process to secure GSA Contract Awards for several of our clients."

– John Wayne II, GrowMyBusinessQuick.com

"Delivered as advertised and went above and beyond. Couldn’t have received our GSA contract without them."

– Berj Garibekian, TransPacific Technologies

The financial benefits are equally compelling. On average, GSA Focus clients see an additional $927,000 in revenue thanks to their GSA Schedule. And with the team handling about 95% of the paperwork, you can rest easy knowing the process is under control.

What about risk? GSA Focus minimizes it with their "Guarantee of Award" – offering a full refund if they can’t secure your contract. Combine that with their 98% success rate, and you’ve got peace of mind knowing your investment is in good hands.

Their expertise is another standout factor. With a combined 44+ years of experience, the GSA Focus team knows what it takes to succeed. They understand the nuances of GSA applications, from presenting pricing effectively to ensuring compliance with the most scrutinized requirements.

"MacGyver Solutions is one of GSA Focus’ success stories – having them do the heavy lifting on the initial contract was a huge help."

– Mike Jackson, Founder, MacGyver Solutions, Inc

For small businesses that qualify for GSA Schedules but lack the internal resources or expertise to navigate the process, GSA Focus offers a proven pathway to success. They transform what is often a stressful and overwhelming experience into a manageable, predictable investment that delivers results.

Conclusion

Navigating GSA Schedule requirements demands detailed documentation, strict compliance, and well-thought-out planning. Securing a GSA Schedule opens doors to significant federal contracting opportunities, but it requires small businesses to prepare a comprehensive package of documents – such as financial statements, performance reviews, and pricing proposals – that align with GSA standards.

As iQuasar LLC explains, "However, the process of getting on the GSA Schedule can be intricate and demanding, underscoring the need for thorough preparation and strategic guidance." They further stress, "Accuracy and compliance are critical in the GSA Schedule application process. Small businesses must ensure that all information provided is accurate and in full compliance with GSA standards. This includes adhering to pricing policies, labor categories, and environmental regulations, which can be particularly challenging to navigate without specialized knowledge." This meticulous approach is essential for successfully entering the federal contracting space.

Expert assistance can make the application process significantly smoother, helping businesses reduce administrative hurdles and avoid common mistakes. For small businesses eager to step into federal contracting, working with specialists like GSA Focus can transform a complex journey into a series of manageable steps. With the right support, businesses can position themselves to secure federal contracts and establish a strong presence in government markets. By following these strategies, your business can gain a solid foothold in the federal marketplace and thrive within it.

Success in federal contracting hinges on preparation, compliance, and strategic expertise.

FAQs

What challenges do small businesses face when qualifying for GSA Schedules?

Small businesses face a variety of hurdles when working toward securing a GSA Schedule. One key challenge is ensuring all the necessary documentation is both accurate and complete. On top of that, they must comply with the Trade Agreements Act (TAA), meet specific labor qualifications, and adhere to subcontracting requirements. The responsibilities don’t stop there – accurate sales reporting and keeping up with ongoing audits and regulatory changes are also critical.

These tasks can be incredibly time-intensive, requiring businesses to stay on top of every detail throughout the entire contract lifecycle. Missing even a small requirement can lead to delays or compliance setbacks, making meticulous attention to detail a must for qualifying for and maintaining a GSA Schedule.

How does the Trade Agreements Act (TAA) impact GSA Schedule eligibility for businesses with global supply chains?

The Trade Agreements Act (TAA) mandates that products sold through GSA Schedule contracts must come from either the U.S. or countries recognized as TAA-compliant. This rule is in place to ensure that federal contracts give priority to goods made or significantly altered in approved nations.

For companies with international supply chains, adhering to TAA regulations is a must. Products need to be either manufactured in a compliant country or undergo a substantial transformation there. Non-compliance can lead to losing eligibility for GSA Schedule contracts, so businesses must thoroughly assess their sourcing and production practices to meet these standards.

How can small businesses stay compliant and successfully renew their GSA Schedule contracts?

To ensure a smooth GSA Schedule contract renewal, small businesses should start preparing well in advance – ideally 12 to 24 months before the contract expires. This preparation includes keeping your records up to date in systems like SAM.gov and GSA Advantage!, as well as maintaining accurate documentation and tracking performance metrics.

It’s also crucial to stay in regular contact with your GSA Contracting Officer, submit renewal requests on time, and ensure your GSA Advantage catalog reflects the most current information. Don’t overlook key obligations, such as renewing your SAM registration annually and meeting all reporting requirements. By staying organized and taking proactive steps, you’ll set yourself up for a seamless renewal process.

Related Blog Posts

- How To Qualify for a GSA Schedule

- Who Qualifies for a GSA Schedule?

- 5 Key Requirements for GSA Schedule Eligibility

- GSA Contract Eligibility: Key Requirements