When a GSA audit flags compliance issues, quick and accurate corrections are essential to keep your federal contract in good standing. Common findings include sales reporting errors, pricing discrepancies, and non-compliant product listings. Fortunately, digital tools like GSA eMod, FAS Sales Reporting Portal (SRP), and Schedule Input Program (SIP) simplify these corrections, while consulting services like GSA Focus provide expert guidance for more complex challenges.

Key Takeaways:

- Sales Reporting Errors: Use the FAS SRP to reconcile data and fix discrepancies.

- Pricing Discrepancies: Update pricing and disclosures via eMod and maintain accurate records.

- Product Listings: Correct catalog issues with SIP, EDI, and verify updates on GSA Advantage!.

- Expert Help: Consulting services can expedite resolutions and reduce risks.

By combining the right tools with consistent processes, you can address audit findings effectively and prevent future compliance headaches.

Common GSA Post-Audit Findings That Need Correction

Knowing what auditors frequently uncover can help you prepare for necessary corrective actions. The General Services Administration (GSA) conducts various types of post-award audits, such as Defective Pricing Reviews, Billing Reviews, Industrial Funding Audits, and Reviews of Cost Reimbursable Contracts. While these audits focus on different areas of compliance, certain problems crop up repeatedly.

Navigating GSA compliance can be tricky, even for seasoned contractors. The sheer volume of documentation required and the ever-changing regulations increase the risk of audit findings. Common issues like errors in sales reporting, pricing inconsistencies, and product listing problems often call for immediate attention.

Sales Reporting Errors

Mistakes in sales reporting are among the most frequent findings during audits. These errors can stem from incomplete transaction records, misclassified sales, or timing mismatches between when sales occur and when they’re reported. Examples of common issues include:

- Failing to report all GSA sales within the required timeframes.

- Incorrectly categorizing sales as either commercial or government.

- Missing quarterly reporting deadlines.

The FAS Sales Reporting Portal (SRP) is a critical tool for addressing these challenges. It allows contractors to align their internal records with the data submitted to GSA. However, reconciling high-volume sales or complex product lines often requires an extensive review of transaction histories.

Record retention rules further complicate matters. Contractors are required to keep sales records for three years after the final payment and retain contract modifications for the entire contract term. Missing or incomplete documentation during an audit can lead to additional corrective actions.

Pricing Discrepancies

Pricing issues are another common area where audits uncover problems. A frequent concern is the Price Reduction Clause (PRC), which requires contractors to offer GSA the same discounts extended to commercial customers. Violations of this clause are taken seriously and can result in significant findings.

Auditors also flag outdated price lists that remain in use after being superseded, creating confusion over which prices apply during specific periods. Additionally, inaccuracies in Commercial Sales Practice (CSP) disclosures – such as incomplete information about discount structures, customer categories, or pricing methods – can lead to compliance issues when actual practices don’t match what was disclosed.

To address pricing discrepancies, contractors should maintain up-to-date price lists, retain previous versions for comparison, and ensure CSP disclosures are thorough and accurate. Keeping detailed records of pricing changes and their effective dates is essential for demonstrating compliance. Digitally storing these records can make post-audit corrections much easier.

Non-Compliant Product Listings

Issues with product listings can also create significant compliance headaches. These errors often involve missing technical specifications, incorrect descriptions, outdated manufacturer data, or misclassified items. For example, inaccuracies in GSA Advantage! listings can leave buyers without the information they need to make informed decisions. Similarly, listings may lack required compliance certifications or fail to include country-of-origin details.

Problems can also arise with eBuy postings if submitted responses don’t align with the actual GSA contract offerings or if quoted prices conflict with established GSA rates. Such discrepancies often come to light during post-award audits, where submissions are scrutinized against contract terms.

Failing to remove discontinued items or update altered specifications can also result in audit findings. Tools like the Schedule Input Program (SIP) and Electronic Data Interchange (EDI) can help manage these updates, though their effectiveness depends on the accuracy of the data entered.

| Document Type | Compliance Purpose | Retention Period |

|---|---|---|

| Sales Records | Track transactions and pricing history | 3 years after final payment |

| Price Lists | Document commercial pricing structure | Current + previous versions |

| Contract Modifications | Record approved GSA changes | Full contract duration |

| CSP Disclosures | Detail commercial sales practices | Most recent submission |

| Price Reduction Documentation | Track PRC compliance | Full contract duration |

Tackling these common findings quickly can help prevent minor issues from escalating into larger compliance problems. By using effective digital tools and keeping accurate records, contractors can simplify the correction process, maintain compliance, and minimize disruptions to their federal contracting operations.

Top Tools for GSA Post-Audit Corrections

When audit findings arise, having the right resources can mean the difference between resolving issues quickly or enduring prolonged compliance headaches. The General Services Administration (GSA) offers several digital tools tailored to help contractors address post-audit challenges efficiently. These platforms streamline tasks like contract modifications and sales reporting corrections, ensuring a smoother path to compliance.

Understanding how each tool works can help contractors save time and avoid unnecessary delays in corrective actions. These platforms directly address common compliance issues, offering targeted solutions to help businesses stay on track.

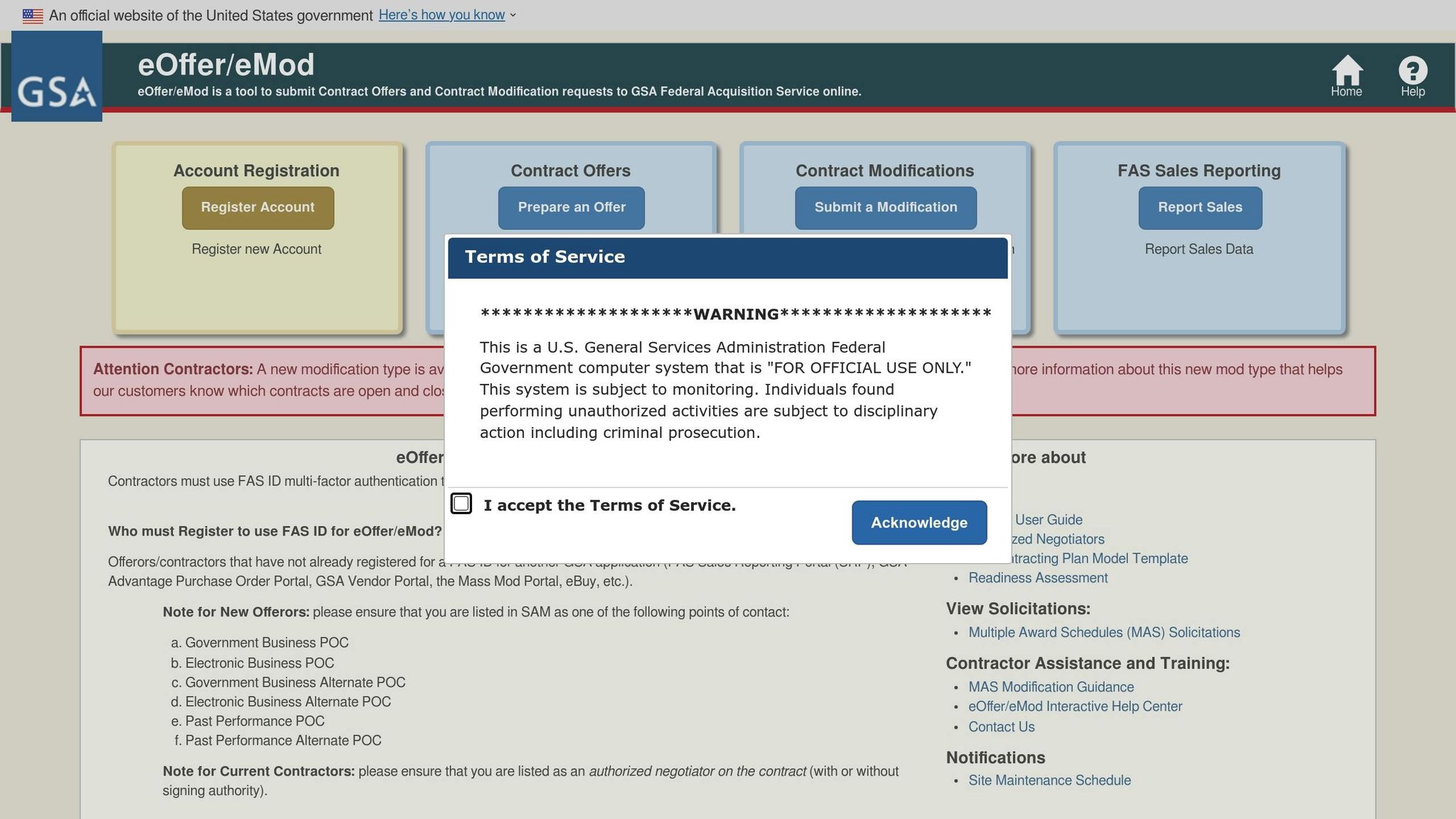

GSA eMod System

The GSA eMod System is the go-to platform for making contract modifications after an audit. This electronic system simplifies the process of submitting updated documents, fixing pricing errors, and adjusting contract terms – eliminating the delays associated with paper-based methods.

With eMod, contractors can tackle pricing discrepancies by uploading revised documentation and updating critical contract details. One of its standout features is the ability to track modification requests throughout the approval process. This ensures contractors can respond promptly to any additional information requests from GSA contracting officers. Plus, eMod keeps a complete digital record of all contract changes, which can be a lifesaver during future audits.

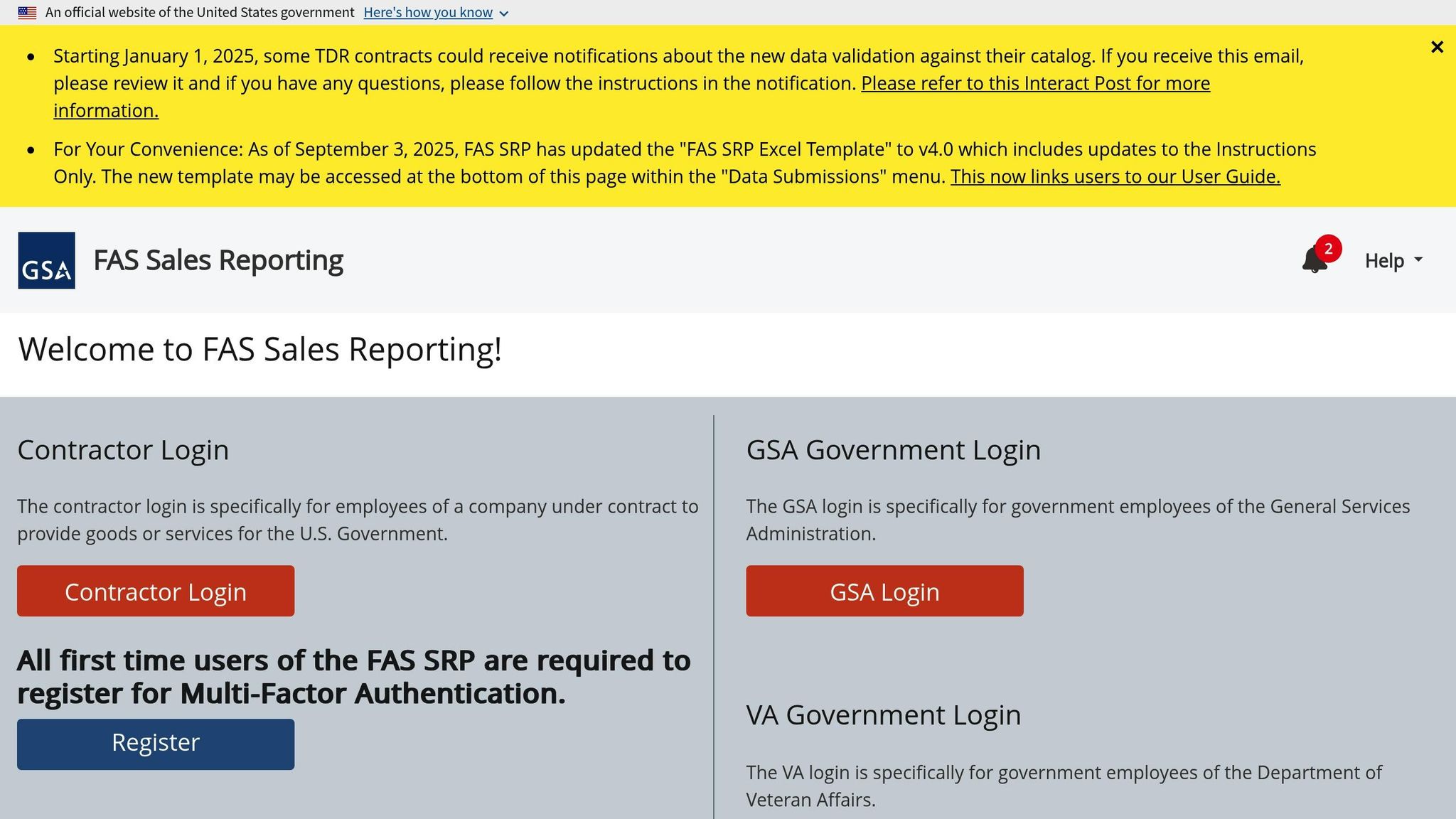

FAS Sales Reporting Portal (SRP)

The FAS Sales Reporting Portal (SRP) is essential for addressing sales reporting errors flagged during audits. This tool helps contractors reconcile their internal sales data with what’s been reported to the GSA, making it easier to pinpoint and fix discrepancies.

The SRP also allows contractors to review historical reporting trends, which can reveal systematic issues. For businesses managing high-volume sales or complex product lines, the bulk upload feature simplifies the correction process. Since SRP integrates with GSA’s broader compliance systems, corrections are reflected in real time – demonstrating to auditors that issues are being addressed promptly.

Schedule Input Program (SIP) and Electronic Data Interchange (EDI)

SIP and EDI play a crucial role in keeping product catalogs accurate and resolving issues with non-compliant product listings. These systems allow contractors to update product descriptions, correct classification errors, and ensure all catalog data meets GSA standards.

Working alongside SIP and EDI, the Formatted Product Tool (FPT) automates price comparisons for identical products and requires contractors to baseline their contracts within 60 days. If pricing falls outside acceptable ranges, the system may trigger renegotiations, highlighting the importance of accurate product data.

Additionally, the Transactional Data Reporting (TDR) system simplifies compliance by requiring electronic reporting of actual prices paid for GSA contract products. This eliminates the need to track the traditional Basis of Award and Price Reductions Clause. TDR and FPT were introduced across various schedules starting in 2016–2017, as shown below:

| GSA Schedule | TDR Rollout Date | FPT Implementation |

|---|---|---|

| Schedule 72 | August 26, 2016 | July 22, 2016 |

| Schedule 75 | October 7, 2016 | Fall 2016 |

| Schedule 03FAC | September 9, 2016 | Not applicable |

| Schedule 70 (select SINs) | November 20, 2016 | Spring 2017 |

Accurate product data is critical for leveraging SIP and EDI effectively and avoiding compliance issues.

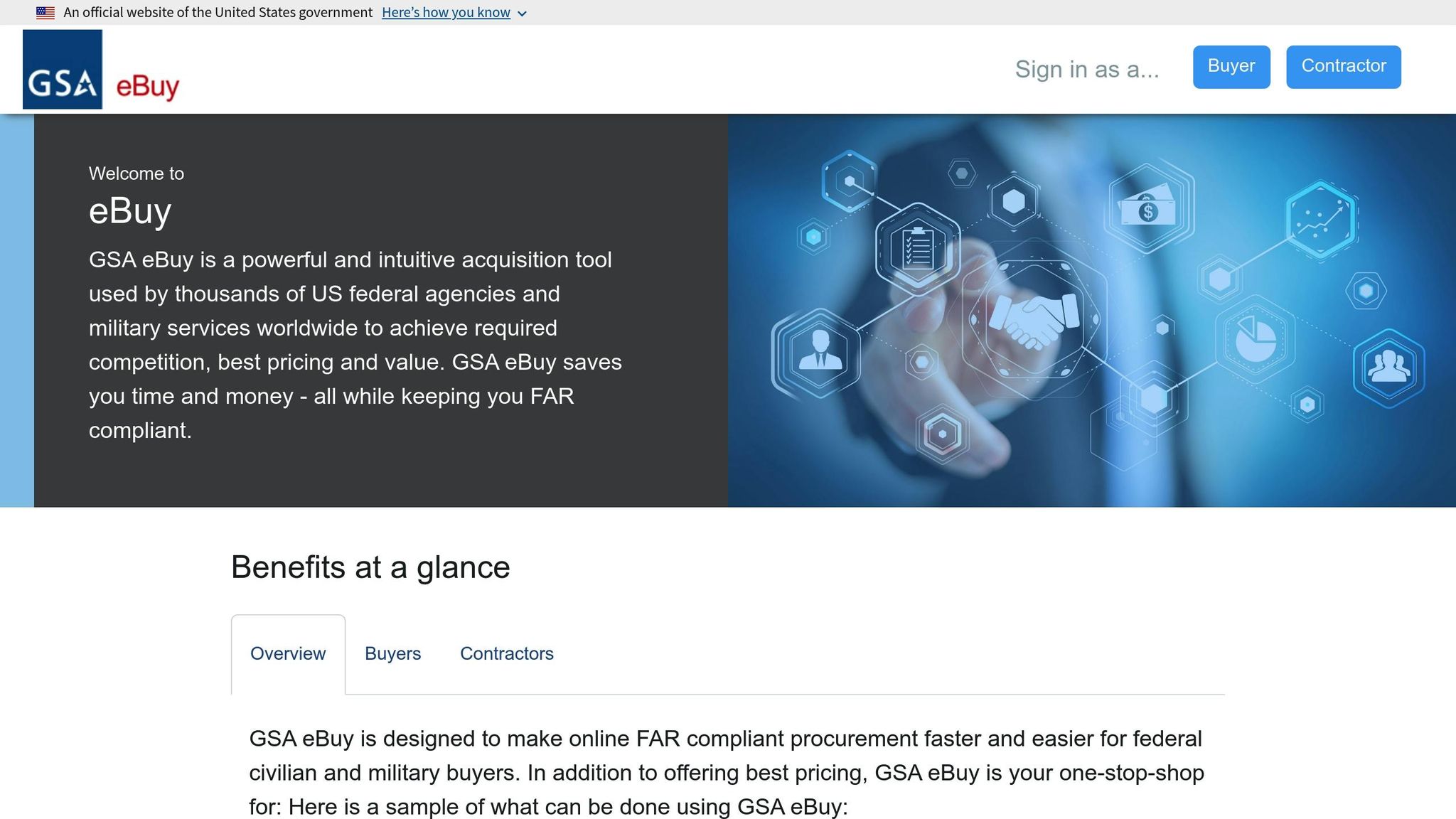

GSA Advantage! and eBuy

GSA Advantage! and eBuy serve as verification platforms, allowing contractors to confirm that their corrected product listings are accurate and visible to federal buyers. GSA Advantage! showcases products to government buyers, so ensuring updated information – like descriptions, pricing, and classifications – is essential after audit corrections.

Similarly, eBuy supports the quoting and proposal process for federal buyers. Contractors can use eBuy to verify that their responses align with their GSA contract offerings and that quoted prices match established GSA rates. Both platforms provide real-time visibility into how corrected data appears to buyers, enabling immediate adjustments when needed.

Consulting Services: GSA Focus

When digital tools aren’t enough, expert consulting services can provide the extra support needed for complex post-audit corrections. While GSA’s platforms handle the technical side of compliance, navigating the nuances of post-audit requirements often benefits from professional guidance. GSA Focus specializes in assisting small businesses with GSA Schedule contracts, offering services like document preparation, compliance reviews, and negotiation support with GSA contracting officers.

"GSA Focus was crucial in helping us get our GSA contract quickly with no headaches, setting us on the path to some big wins."

- Deena T., Pacific Point

GSA Focus also provides ongoing compliance monitoring to help businesses avoid future audit issues. As one contractor shared:

"The results speak for themselves – we’ve seen our GSA sales grow exponentially year after year. We highly recommend GSA Focus."

- Steven P., BMNT Inc.

With a 98% success rate and a refund guarantee, GSA Focus is committed to helping small businesses succeed. Their president and founder, Josh Ladick, emphasizes their hands-on approach:

"We’ll be there with you, on-call, as your authorized negotiator, to make sure you get the prices your Small Business deserves."

- Josh Ladick, President and Founder, GSA Focus

For contractors facing their first audit or dealing with particularly challenging findings, professional consulting can significantly reduce stress and expedite resolutions. The investment often pays off through faster compliance and fewer risks of future issues.

How to Use These Tools Effectively

Getting the most out of GSA’s digital tools requires more than just access – you need a clear plan to incorporate them into your workflows. A structured approach ensures issues are resolved thoroughly and helps prevent them from cropping up again. By consistently applying these practices, you can make post-audit corrections a seamless part of your process.

Regular Data Reconciliation

Making monthly data reconciliation a routine part of your GSA compliance strategy can save you from bigger headaches later. The FAS Sales Reporting Portal (SRP) is a vital resource for spotting discrepancies before they escalate into audit findings. Create a process where you download sales reports from the SRP and compare them against your internal accounting records. Pay close attention to recurring discrepancies or timing mismatches – like differences in when sales are recorded internally versus when they’re reported to GSA. According to the GSA Office of Inspector General, failing to address these issues and maintain data quality in tools like CALC+ can lead to inaccurate pricing decisions and ongoing compliance risks.

Assign a team member with access to both internal data and the SRP to oversee this reconciliation process. If you find multiple errors, take advantage of the SRP’s bulk upload feature to correct them all at once.

Once your data is reconciled, don’t forget about keeping your product catalogs up to date – it’s just as important.

Keep Product Catalogs Updated

Quarterly reviews using SIP and EDI can help you stay ahead of product listing issues and maintain high data quality. A 2023 audit revealed that FAS had not fully addressed two out of three recommendations related to data quality and documentation in pricing tools. GSA is increasingly focusing on automated data validation and real-time compliance monitoring to minimize manual errors and improve audit outcomes.

To stay compliant, regularly update product descriptions, classifications, and pricing to reflect current GSA standards. Any changes to your product catalog should be validated through SIP and verified on GSA Advantage!, where updates typically appear within 24–48 hours. Keeping a log of review dates and updates can serve as a helpful reference during future audits.

Work with Expert Consultants

While digital tools are excellent for routine corrections, more complex compliance issues often require a deeper level of expertise. Understanding GSA’s detailed requirements and navigating communications with contracting officers can be challenging without specialized knowledge.

This is where expert consultants come in. For example, GSA Focus provides hands-on support to simplify the post-audit correction process. Consultants can review your internal processes, identify gaps, and recommend improvements to your data management approach. Their guidance can help you resolve issues faster and reduce the risk of repeat audit findings.

When selecting a consultant, look for a proven track record in GSA contracting and demonstrated success in managing compliance corrections. This expertise can make all the difference in keeping your operations on track.

Conclusion

Taking swift action to address GSA post-audit corrections is crucial for staying on track in federal contracting.

Beyond quick fixes, using digital tools can simplify compliance efforts. With the GSA expanding transactional data reporting to include more products and services, keeping accurate records has never been more important. Tools like the GSA eMod System and the FAS Sales Reporting Portal offer a strong starting point for managing corrections effectively.

However, when technology falls short, understanding and meeting GSA requirements often calls for professional expertise. GSA Focus provides comprehensive support to streamline post-audit corrections and minimize potential risks.

The key to long-term success in federal contracting lies in viewing compliance as an ongoing priority. By combining digital tools, structured processes, and expert guidance, businesses can turn post-audit corrections from a stressful task into an opportunity to strengthen their operations. With the right approach and support, these corrections can become a strategic step forward.

FAQs

How does the FAS Sales Reporting Portal help reduce sales reporting errors for future GSA audits?

The FAS Sales Reporting Portal is a dedicated platform created to simplify and organize the sales reporting process for GSA contract holders. It provides businesses with an easy-to-use system to accurately track, report, and manage their sales data while staying compliant with GSA regulations.

By automating critical parts of the reporting process, the portal helps reduce the likelihood of human errors. It also offers clear instructions and timely reminders, making it simpler to meet reporting deadlines and keep precise records for potential audits. This tool not only saves time but also helps businesses avoid common mistakes and stay prepared for audits.

What actions should contractors take to comply with the Price Reduction Clause?

To stay on top of the Price Reduction Clause (PRC) requirements, contractors need to take deliberate steps to ensure pricing stays consistent and compliant. Start by creating clear internal systems to track and record any changes to your commercial pricing. These changes can directly affect your GSA contract pricing, so it’s crucial to monitor them closely. Regularly reviewing your contract terms will also help confirm that your pricing matches the agreed-upon discount structure.

Another key step is educating your team about PRC rules. Proper training can prevent accidental violations and ensure everyone understands the importance of compliance. Keeping detailed records is equally important – these will be invaluable if your business faces an audit. If you’re uncertain about any part of the process, reaching out to specialists like GSA Focus can provide clarity and help you navigate the requirements with confidence.

Why should contractors consider consulting services like GSA Focus for post-audit corrections instead of just using digital tools?

Managing GSA compliance can feel overwhelming for contractors, especially when facing the complexities of post-audit corrections. While digital tools can assist with some tasks, they often fall short in providing the tailored guidance and deep expertise needed to navigate complicated regulations or resolve issues thoroughly.

This is where GSA Focus steps in. They offer a full-service solution designed to take the stress out of the process. From managing documentation and conducting compliance checks to handling negotiations, GSA Focus ensures contractors meet all necessary standards. Their approach allows businesses to concentrate on what they do best, knowing their GSA compliance is being expertly managed.

Related Blog Posts

- How to Track GSA Contract Compliance

- Common GSA Compliance Mistakes And Fixes

- GSA Post-Award Checklist for Contractors

- Common GSA Audit Issues and How to Avoid Them