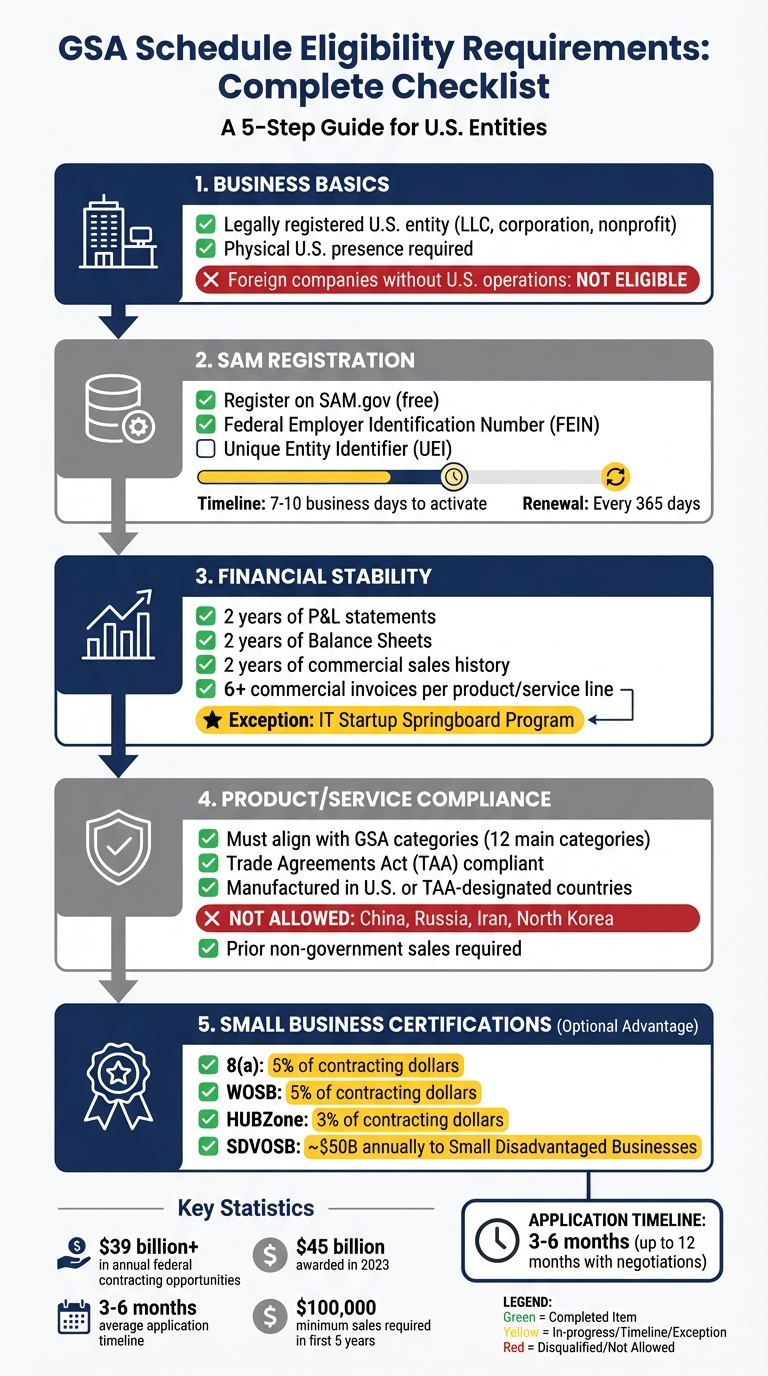

To secure a GSA Schedule, your business must meet specific criteria to access federal contracting opportunities worth over $39 billion annually. Here’s a quick overview of what you need to know:

- Business Basics: Must be a legally registered U.S. entity (LLC, corporation, nonprofit, etc.) with a physical U.S. presence. Foreign companies without U.S. operations are not eligible.

- SAM Registration: Your business must be registered on SAM.gov with a Federal Employer Identification Number (FEIN) and a Unique Entity Identifier (UEI).

- Financial Stability: Provide two years of Profit & Loss statements and Balance Sheets. Demonstrate operational history with at least two years of commercial sales.

- Product/Service Compliance: Offerings must align with GSA categories, adhere to Trade Agreements Act (TAA) standards, and show prior non-government sales.

- Small Business Certifications: Programs like 8(a), WOSB, HUBZone, and SDVOSB can give you access to set-aside contracts.

The application process takes 3–6 months and requires thorough preparation. Meeting these requirements ensures your business is ready to compete in the federal marketplace. Keep reading for detailed steps and a readiness checklist.

GSA Schedule Eligibility Requirements Checklist

GSA MSA Schedule Eligibility Everything to know

Basic Business Requirements

Before diving into the GSA Schedule application process, your business needs to meet certain baseline criteria. These requirements are in place to ensure that only properly registered and legitimate entities can participate in the federal marketplace. Here’s what you need to know about your business structure and registration essentials.

Legal Business Structure and U.S. Operations

To qualify, your company must be legally registered and have a physical presence in the United States. Eligible entities include LLCs, corporations, nonprofit organizations, educational institutions, and structured joint ventures or partnerships. Additionally, small businesses with special designations – like 8(a), WOSB, SDVOSB, or HUBZone certifications – are encouraged to apply.

Your business must either be incorporated in the U.S. or maintain a fully operational office on U.S. soil with staff physically working there. Unfortunately, foreign businesses without a U.S.-based office are not eligible for a GSA Schedule.

SAM Registration and FEIN

Every GSA Schedule applicant must register with SAM.gov (System for Award Management), the federal government’s primary database for contractors. This step is free and acts as your business’s official identity within the federal marketplace. As stated by SAM.gov:

"Registration is required to bid on federal contract awards or receive assistance directly from the federal government".

To complete the process, you’ll need a Federal Employer Identification Number (FEIN) issued by the IRS and a Unique Entity Identifier (UEI), which SAM.gov assigns automatically during registration. It’s worth noting that the UEI replaced the DUNS number system in April 2022. Additionally, you must register the appropriate NAICS codes that align with your products or services.

The SAM registration process typically takes 7–10 business days to activate. Inputting your business information typically requires 1–3 hours, provided you have all necessary details ready. Keep in mind, SAM registration must be renewed every 365 days to stay eligible for federal contracts.

Financial and Experience Requirements

When applying for GSA approval, it’s not just about basic registration. The GSA also looks closely at your company’s financial health and operational history to ensure you can handle the demands of government contracts, which can last up to 20 years. They need to see that your business is built for the long haul.

2-Year Commercial Sales History

To meet GSA’s standards, your business must show at least two years of operational history backed by verified sales records. This requirement helps confirm that your business model works and that you’re capable of delivering on contracts. You’ll need to provide commercial invoices to prove your non-government sales history. These documents also allow GSA to compare your proposed government pricing with your Most Favored Customer (MFC) rates, ensuring your rates are "fair and reasonable".

However, there’s an exception for certain IT companies under the Startup Springboard Program. This program lets eligible businesses bypass the two-year history requirement by relying on the professional experience of key personnel instead.

Financial Stability and Past Performance

To demonstrate financial stability, you’ll need to submit Profit and Loss (P&L) statements and Balance Sheets from the last two fiscal years. As outlined on GSA.gov:

"Profit and loss statements, bank reference letters, and irrevocable letters of credit are documents which can be provided to support a favorable determination of financial responsibility".

Additionally, your accounting system must be capable of separately tracking government contracts. Beyond financial documents, GSA requires evidence of past performance. This includes submitting a project summary for each Special Item Number (SIN) from the past two years or proof of a project that has been active for at least one year.

Before applying, address any potential issues like high debt-to-income ratios, recent financial losses, or ongoing litigation, as these could lead to disqualification. GSA may also contact your references to verify the quality of your work, so it’s a good idea to give your current customers a heads-up.

Meeting these financial and performance requirements not only showcases your stability but also lays the groundwork for evaluating your products and services.

Product and Service Requirements

To participate in the GSA marketplace, your products and services must meet strict standards. In 2023 alone, the GSA awarded more than $45 billion in contracts, but only offerings that meet specific commercial availability and compliance requirements are eligible for this lucrative opportunity.

GSA Categories and Commercial Availability

Your offerings need to be commercially available and demonstrate a history of sales in the private sector. To prove this, you’ll need to submit invoices that show prior non-government sales and consistent, fair pricing.

GSA organizes its contracts into 12 main categories, covering over 12 million commercial items. Services include IT, management consulting, engineering, healthcare, facilities maintenance, and more. Products range from office supplies and IT hardware/software to laboratory equipment, building materials, and tactical gear. Each product or service must align with a specific Special Item Number (SIN) within these categories. To find the right match for your offerings, use the GSA eLibrary, which helps identify SINs based on your capabilities and product specifications.

Trade Agreements Act (TAA) Compliance

Compliance with federal trade laws, particularly the Trade Agreements Act (TAA), is another critical requirement. Unless explicitly exempted in a solicitation, all GSA Multiple Award Schedule contracts must comply with TAA regulations. This means the products you sell must be manufactured or "substantially transformed" in the U.S. or a TAA-designated country, such as Canada, EU nations, and other approved regions.

Products from non-compliant countries like China, Russia, Iran, or North Korea are generally prohibited. The term "substantial transformation" refers to a manufacturing process that results in a new product with a different name, character, or use compared to its original components.

Before you submit your proposal, confirm the country of origin for each product. Regularly check the list of TAA-designated countries under FAR clause 52.225-5, as this list is subject to updates. If your products use components from non-compliant countries, you must maintain detailed records to show how those components are substantially transformed in a compliant country. Failure to meet TAA requirements can lead to disqualification or removal of your products from GSA Schedules.

Small Business Opportunities

The federal government offers set-aside programs and specialized pathways to help small businesses with key certifications succeed in federal contracting. These programs are designed to provide opportunities that might otherwise be out of reach.

Set-Asides for 8(a), WOSB, SDVOSB, and HUBZone Firms

If your small business holds socio-economic certifications, you can access contracts specifically reserved for businesses like yours. Federal agencies aim to allocate 5% of contracting dollars to Women-Owned Small Businesses (WOSBs) and 8(a) firms, 3% to HUBZone businesses, and around $50 billion annually to Small Disadvantaged Businesses.

Here’s a quick breakdown of these certifications:

- 8(a) Certification: To qualify, your business must be at least 51% owned by socially and economically disadvantaged U.S. citizens with a net worth under $750,000. The program runs for nine years, split into a four-year development phase and a five-year transitional phase.

- WOSB Certification: Requires 51% female ownership and control. Certification is done online through the SBA, and businesses must recertify every three years. Any material changes affecting eligibility must be reported to the SBA within 30 days.

- HUBZone Certification: Your principal office must be in a historically underutilized business zone, and at least 35% of employees must live in the HUBZone. This certification offers a 10% price evaluation preference in full and open contract competitions.

- SDVOSB Certification: Requires 51% ownership and control by one or more service-disabled veterans with service-connected disabilities. Certification is managed through the Department of Veterans Affairs.

Before applying for any of these certifications, ensure your business meets the SBA size standards for your primary NAICS code. These certifications not only open doors to reserved contracts but also improve your chances of competing for broader federal opportunities.

Polaris Program and Subcontracting Options

Beyond set-aside programs, there are other ways for small businesses to engage in federal contracting. One option is the Polaris Program, a multiple-award Indefinite Delivery, Indefinite Quantity (IDIQ) Governmentwide Acquisition Contract (GWAC). Polaris focuses on IT solutions and is designed to make federal contracting more accessible to small businesses. Unlike traditional GSA Schedules, GWACs often don’t require a minimum operating period or revenue threshold, which can benefit newer or smaller firms.

Subcontracting is another excellent way to gain experience in federal contracting without taking on the full risks of a prime contract. As the GSA explains:

"Subcontracting and other partnerships involves working with other contractors in order to test the waters of federal business without suffering undue risk".

Prime contractors are encouraged to include small businesses in their subcontracting plans. Under SBA rules, they can even use "similarly situated entities" – subcontractors with the same small business certification status – to meet performance requirements for set-aside contracts.

For small businesses awarded set-aside contracts, there are limits on how much work can be subcontracted out:

- Service Contracts: No more than 50% of the government payment can go to non-similarly situated subcontractors.

- Supply Contracts: The same 50% limit applies, excluding material costs.

- General Construction: Up to 85% of the payment can go to subcontractors, excluding materials.

- Specialty Construction: Allows up to 75% payment to subcontractors, excluding materials.

If navigating these certifications and opportunities feels overwhelming, you’re not alone. Full-service solutions like those offered by GSA Focus can provide the guidance you need to make the most of federal contracting opportunities.

Common Disqualifiers and Readiness Checklist

Common Reasons for Disqualification

Knowing what can disqualify your business from a GSA Schedule is crucial – it can save you time, money, and frustration. One of the most common reasons is insufficient business history. Most schedules require at least two years of operational history unless you’re applying under the IT Springboard Program. Simply having a distributor relationship or making occasional trips to the U.S. won’t cut it. Foreign businesses must establish a physical presence in the United States to qualify.

Another frequent issue is non-compliance with the Trade Agreements Act (TAA). TAA regulations require that products be either manufactured in, or substantially transformed within, the U.S. or a designated country. Products from non-designated countries like China or Russia – even if repackaged or slightly modified – are not compliant and can lead to disqualification.

Financial stability is another critical factor. GSA analysts look for businesses with at least three months of operating reserves, six consecutive quarters of positive cash flow, a debt-to-equity ratio below 3:1, tax liabilities under 10% of total assets, receivables collected within 45 days, and no bankruptcies in the last three years. Once awarded a contract, businesses are expected to generate $100,000 in sales within the first five years to retain their GSA Schedule.

Certain industries are outright excluded from eligibility. These include manufacturers of weapons and ammunition, providers of architectural and engineering services, and construction services. If your business operates in one of these areas, a GSA Schedule is not an option.

GSA Readiness Checklist

To determine if your business is ready to apply, review the following checklist:

| Category | Requirement | Status Check |

|---|---|---|

| Business History | 2+ years in operation (or eligibility for IT Springboard) | [ ] |

| Financials | 2 years of audited P&L statements and Balance Sheets | [ ] |

| Registration | Active SAM.gov profile and UEI (Unique Entity Identifier) | [ ] |

| Compliance | TAA-compliant products (No China/Russia origin) | [ ] |

| Sales History | 6+ commercial invoices per product/service line | [ ] |

| Pricing | Documented Most Favored Customer (MFC) pricing and discounts | [ ] |

| Performance | 3 CPARS ratings or equivalent client references | [ ] |

| Integrity | Satisfactory business ethics and no recent bankruptcies | [ ] |

This checklist highlights the essential criteria for GSA readiness, such as having a solid business history, sound financials, and compliance with all regulations. Staying on top of these requirements is critical. As Pamela Pamintuan, Senior Contracts Manager at Road Map Consulting, advises:

"All entity information changes must be updated in SAM.gov within 3 business days, followed by a corresponding GSA Modification Package".

To strengthen your application, ensure your SAM.gov registration is up-to-date and that your NAICS codes align with the GSA categories (SINs) you’re targeting. Address any gaps before applying. For example, verify your products’ country of origin to meet TAA standards. Build a commercial sales history by securing at least six invoices per product or service line. Additionally, maintain cash reserves of 15–20% of the proposed contract value to demonstrate financial readiness. Taking these steps can help you avoid delays or outright rejection.

Next Steps

You’ve reached a major milestone by meeting the core GSA eligibility requirements: two years of operations, TAA-compliant products, solid financials, and an active SAM.gov registration. Now, it’s time to decide if you’re fully prepared to submit your application or if there are areas that need attention first. With your eligibility established, here’s how to move forward successfully.

Start by conducting market research to confirm federal demand for your products or services through the Multiple Award Schedule (MAS) program. The Schedule Sales Query Plus (SSQ+) dashboard is a great tool for reviewing historical sales data and identifying ways to stand out from competitors already holding contracts. Double-check that your SAM.gov profile and FAS ID are active, as you’ll need them to access the eOffer system. Additionally, at least one officer from your company must complete the "Pathways to Success" training before submitting an offer.

Follow the steps outlined in the MAS Roadmap: preparation, offer assembly, and finalization. On average, the process takes 3–6 months, though negotiations can extend it to as long as 12 months. Submitting a well-documented and competitive offer can help speed up the GSA review process.

To boost your chances of success, consider obtaining small business certifications. Programs like 8(a), HUBZone, or WOSB certifications from the SBA or VA can provide a significant advantage. These certifications take time – potentially several weeks or months – so prioritize this step early. Free resources, such as APEX Accelerators (formerly PTACs) and local SBA District Offices, can help you refine your marketing plans and guide you through the application process at no cost.

If you’d prefer expert support, consider working with specialists like GSA Focus, which offers a full-service solution to help small businesses acquire and manage GSA Schedule Contracts. Their services include document preparation, compliance checks, and negotiation assistance. As the GSA Vendor Support Center explains:

"Holding a MAS contract can potentially open doors for the contractor, but it requires effort and commitment on your part to succeed".

Investing time and effort into preparation – whether you choose to go it alone or seek professional help – can make the application process smoother and position your business for success in the federal marketplace once approved.

FAQs

How do I register my business on SAM.gov to meet GSA eligibility requirements?

To get your business registered on SAM.gov and move toward GSA eligibility, the first step is creating a user account on the SAM.gov website. After logging in, you’ll need to provide some key details about your business. These include your DUNS number (or Unique Entity ID), your Taxpayer Identification Number (TIN), and your banking information for payment purposes.

As part of the process, you’ll also need to classify your business using the appropriate NAICS codes that reflect the services or products you offer. Make sure to fill out all required fields carefully to prevent any delays in the approval process. Once you’ve submitted your registration, it typically takes a few days to process and approve. After that, you’ll be one step closer to securing a GSA Schedule Contract.

How can small businesses use 8(a) or WOSB certifications to secure GSA contracts?

Small businesses holding certifications like 8(a) or Women-Owned Small Business (WOSB) have a valuable advantage when competing for GSA contracts. The process begins with registering your business on SAM.gov and obtaining a Unique Entity Identifier (UEI). After registering, you’ll need to apply for the relevant certification through the SBA’s portal. Once approved, make sure to update your SAM profile to reflect the certification, showcasing your eligibility for set-aside contracts aimed at socially or economically disadvantaged businesses.

Including your certification documentation when bidding on a GSA Schedule is essential for meeting small-business set-aside requirements. These certifications not only confirm your eligibility but may also provide a preferential status for contracts specifically allocated to 8(a) or WOSB participants.

If the process feels overwhelming, GSA Focus can help. They handle the paperwork, ensure compliance with GSA regulations, and guide you through the GSA Schedule application, streamlining the process and opening doors to federal contracting opportunities.

Why is Trade Agreements Act (TAA) compliance important for GSA eligibility?

Trade Agreements Act (TAA) compliance plays a critical role for businesses aiming to qualify for a GSA Schedule. This act ensures that the products and services offered through GSA contracts originate from approved countries, supporting fair trade practices.

To meet TAA requirements, businesses must verify that their products or services are either manufactured in the United States or come from a TAA-designated country. Failing to comply can lead to disqualification from obtaining or keeping a GSA Schedule, making it essential to thoroughly review your offerings before applying.

Related Blog Posts

- How To Qualify for a GSA Schedule

- Who Qualifies for a GSA Schedule?

- 5 Key Requirements for GSA Schedule Eligibility

- GSA Contract Eligibility: Key Requirements