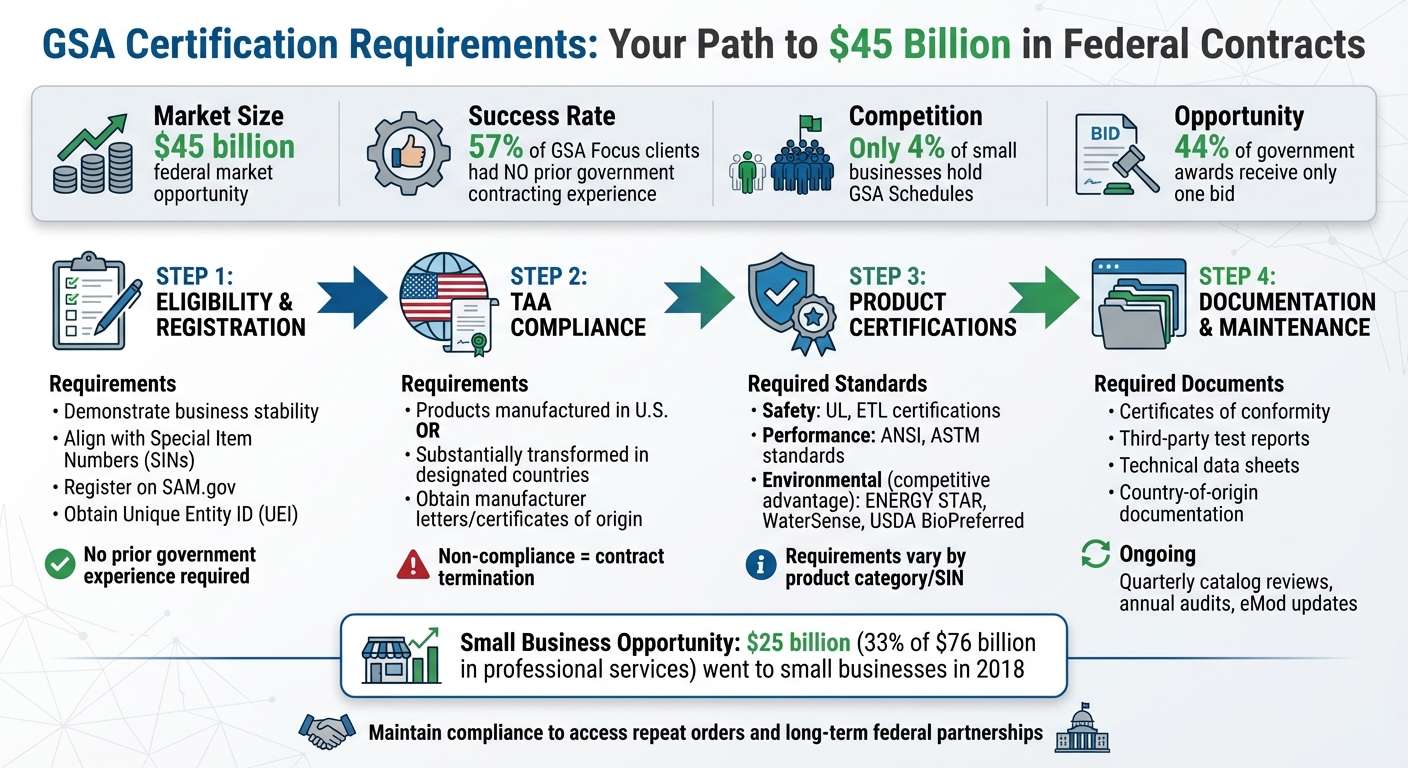

The GSA Multiple Award Schedule (MAS) program provides businesses with access to a $45 billion federal market, but to secure a contract, you must meet specific eligibility and product certification requirements. Here’s what you need to know:

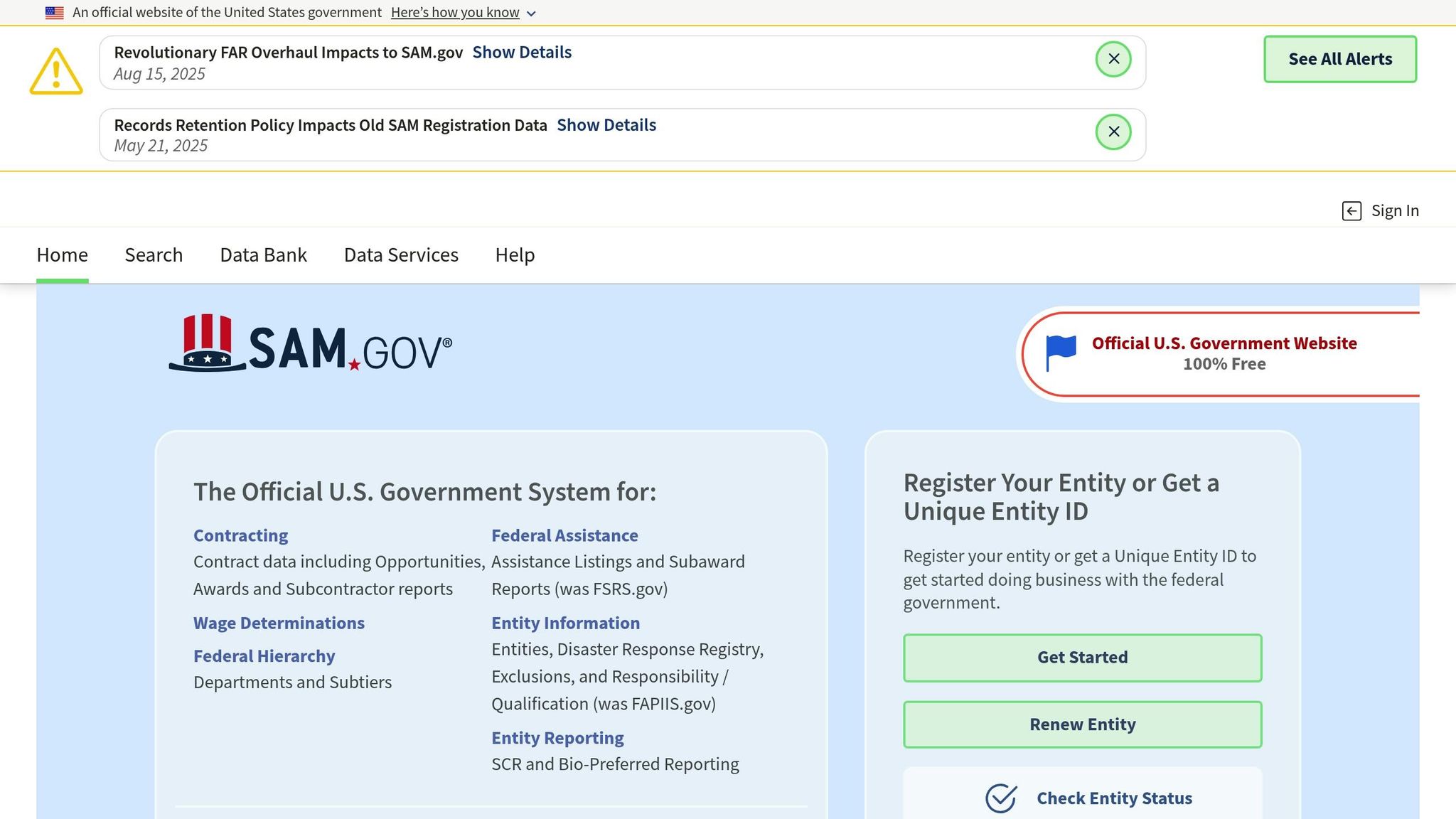

- Eligibility Basics: Your business must be stable, align with relevant Special Item Numbers (SINs), and register on SAM.gov to get your Unique Entity ID (UEI).

- Product Certifications: Compliance with the Trade Agreements Act (TAA) is mandatory, meaning products must be made or substantially transformed in the U.S. or certain approved countries. Other certifications, like UL or ENERGY STAR, may apply based on your product type.

- Documentation: Organize certificates of origin, safety test reports, and other compliance documents for GSA submission. Keep them updated to avoid issues during audits.

- Focus on High-Demand Products: Prioritize certifying products with strong federal demand to balance compliance costs and revenue potential.

GSA Certification Requirements: 4-Step Compliance Process for Federal Contractors

Eligibility and Federal Registration Requirements

Basic Business Eligibility Requirements

To qualify for a GSA contract, your business needs to meet a few key criteria. First, you must demonstrate stability and a track record of commercial success. Additionally, your products or services should align with the appropriate Special Item Numbers (SINs) under the MAS program. Here’s some good news: prior government contracting experience isn’t a must. In fact, 57% of GSA Focus’s clients earned their GSA contracts without any previous government work. Once you’ve confirmed eligibility, the next step is to register your business on SAM.gov to obtain your Unique Entity ID (UEI) and finalize federal registration.

Federal Registrations: UEI and SAM.gov

Securing your UEI is a critical step in the process. This federal identifier, which replaced the old DUNS number, is issued through SAM.gov. Start by visiting the site and selecting the "Get Started" option to register your entity or request a UEI. Accuracy is key here – errors can lead to delays in your application. Beyond registration, SAM.gov also stores your entity’s representations and certifications, which government buyers will review. To stay eligible, keep this information updated annually.

Small Business Certifications and Size Standards

Although specific small business certifications aren’t required to qualify for a GSA contract, make sure your business meets the federal size standards for contracting. With only a small percentage of businesses holding GSA Schedules, there’s plenty of opportunity for those who meet the requirements and take the leap.

Key GSA Product Certification Requirements

Trade Agreements Act (TAA) Compliance

If you’re selling products through a GSA Schedule, ensuring TAA compliance is non-negotiable. The Trade Agreements Act mandates that all products must be either manufactured or substantially transformed in the United States or in designated countries with approved trade agreements with the U.S. This means products made in non-designated countries are off-limits, even if they’re widely available elsewhere.

To demonstrate compliance, you’ll need manufacturer letters or certificates of origin that clearly confirm the production location. These documents must verify that the product underwent substantial modification or assembly in a compliant country. Inaccurate or missing TAA documentation can have serious consequences, including contract termination or even being barred from future federal opportunities. Double-checking your paperwork is critical to avoid these risks.

Safety, Performance, and Testing Standards

Your products must meet specific safety and performance standards, which vary depending on the category. For instance, electrical products often require certifications like UL (Underwriters Laboratories) or ETL (Intertek), while industrial equipment may need to comply with ANSI (American National Standards Institute) standards. Similarly, materials may need to meet ASTM (American Society for Testing and Materials) specifications.

The certifications required depend on the type of products you’re offering. For example, IT equipment will have different requirements than office furniture or security systems. To find the exact certifications for your product category, refer to the GSA eLibrary and identify the requirements tied to your Special Item Numbers (SINs). Keep your technical documentation up-to-date and accessible, as it will be needed during the application process and for any future audits.

Environmental and Sustainable Product Requirements

Sustainability is a growing priority for federal agencies, making certifications like ENERGY STAR, WaterSense, or USDA BioPreferred valuable assets. While these certifications aren’t always mandatory, they can give you a competitive edge since agencies actively prefer vendors that align with their environmental goals.

If your products naturally qualify for these certifications, it’s worth pursuing them. However, weigh the certification costs against the potential benefits. Focus on certifying products with strong commercial performance and clear demand in federal markets. This strategic approach ensures you maximize the return on your investment in certifications.

Federal Acquisition and Program-Specific Standards

Beyond general certifications, each Special Item Number (SIN) comes with its own set of requirements, including specific certifications, pricing guidelines, and compliance terms. Some SINs may also include additional clauses related to labor laws, security protocols, or industry-specific expectations. Since federal buyers typically search by SIN rather than company name, aligning your products with the correct SIN and meeting its specific requirements is crucial for visibility.

To ensure compliance, review the MAS Solicitation (47QSMD20R0001) on SAM.gov, which outlines offer requirements and SIN-specific clauses for your product categories. It’s also wise to establish a process for monitoring updates to solicitation requirements. Staying informed helps you avoid compliance issues and keeps your products eligible for GSA contracts in the long term.

Preparing and Managing Product Certifications

Conducting a Product Catalog Assessment

Before submitting your MAS offer, start by creating a detailed inventory of every product you plan to include. For each item, document essential details like the manufacturer, country of origin, model number or SKU, technical specifications, and commercial pricing in U.S. dollars. This inventory serves as the foundation for ensuring compliance.

Next, align each product with the relevant MAS Large Category and Special Item Number (SIN) you’ll use. This step is crucial because different SINs come with unique federal requirements. For example, some SINs may need energy-efficient certifications, while others could demand IT security features or specific safety standards. Compare your products against baseline GSA requirements, such as TAA compliance, safety and testing standards like UL or ANSI, and any mandatory criteria linked to your chosen SIN.

Identify any products missing critical data, such as country-of-origin information or test results. These are your "at-risk" items. Evaluate these flagged products based on regulatory risk and business value. Focus on items that are TAA-compliant and already have valid safety certifications. Products from non-TAA countries or those requiring expensive testing should be considered for removal or replacement before submitting your offer. This ensures your catalog is free of non-compliant products and minimizes future issues.

Collecting and Organizing Certification Documentation

For the products in your finalized catalog, gather all necessary compliance documents. At a minimum, you’ll need a certificate of conformity or a manufacturer attestation confirming the product meets relevant safety and performance standards. Obtain third-party test reports from recognized labs like UL or Intertek, ensuring these reports reference applicable standards and include testing dates. Include technical data sheets that outline performance details, materials, and operating specifications.

You’ll also need country-of-origin documentation to support your TAA compliance review. This could include bills of materials or manufacturing declarations. If applicable, make sure to collect any ecolabel documentation.

To stay organized, create a central digital folder for storing these documents. Group files by product family or SIN, with subfolders for certificates, test reports, and technical sheets. Use a consistent file naming system, such as "Manufacturer_Model_Standard_Type_Date.pdf", to make it easy to locate documents during GSA reviews or audits. Additionally, maintain a certification register or spreadsheet that tracks each SKU, the applicable standards, document names, expiration dates, and file locations. This system will be invaluable if GSA requests documentation during an Industrial Operations Analyst (IOA) assessment.

Integrating Certifications into GSA Offers

When preparing your MAS offer in eOffer, ensure your technical proposal clearly references the standards and certifications tied to your products. This is especially important for SINs that require specific programs, such as energy-efficient or IT security-related products. Make sure your pricelist and product descriptions align with your technical documentation – model numbers, descriptions, and units of measure should match exactly to avoid confusion during GSA’s review.

In your GSA Advantage! uploads, fill out all attribute fields related to certifications and environmental features, such as TAA compliance, ENERGY STAR status, or recycled content. Use precise and clear language in product titles and descriptions to highlight key certifications that federal buyers look for. Ensure that your catalog data – such as country of origin, model numbers, and feature claims – matches your internal certification records and MAS pricelist without discrepancies. Include certification files directly in your MAS submission to maintain compliance.

After your contract is awarded, review and update your GSA catalog quarterly to ensure your GSA Advantage! listings remain consistent with your internal product and certification records. Submit timely eMod catalog modifications whenever compliance-related attributes change. Stay vigilant about your supply chain – any shifts in distributors, manufacturing locations, or product designs can impact TAA status and technical compliance. If a product can no longer meet requirements or becomes too costly to maintain compliance, plan its removal through an eMod and, if possible, replace it with a compliant alternative. These proactive steps will help you avoid compliance issues and keep your catalog in top shape.

For additional support, GSA Focus offers services to help small businesses with structured product catalog assessments, identifying TAA and standards-related risks, and organizing manufacturer certificates and test reports to align with GSA’s requirements. They can also assist with catalog maintenance and eMod updates, allowing you to concentrate on growing your sales while staying compliant with U.S. government contracting standards. By following these practices, you’ll set yourself up for long-term success with your GSA contract.

Practical Tips for Small Businesses

Balancing Compliance Costs and Product Selection

When it comes to meeting GSA product certification requirements, small businesses need to strike a balance between compliance costs and smart product selection. Start by focusing on core products that already show strong demand in the federal market and meet compliance standards. Tools like historical MAS sales data by SIN (Special Item Number) can help pinpoint the products federal agencies are actively purchasing and where your offerings can make the most impact.

Before diving in, calculate the direct certification expenses for each product and weigh them against potential GSA revenue. Prioritize items that are already compliant – or close to it – with requirements like the Trade Agreements Act (TAA), safety regulations, and environmental standards. This approach can help you avoid hefty testing costs. Instead of front-loading all certifications, phase them in over time. Begin with high-margin products that can generate revenue quickly, then expand your catalog as you gain traction.

If certification costs for certain products outweigh their potential revenue, consider delaying or even dropping those items. This phased strategy allows you to enter the federal market faster and test demand without overcommitting resources. For context, in 2018, GSA spent over $76 billion on professional services, with 33% of that going to small businesses – roughly $25 billion in opportunities for those meeting compliance standards.

Once you’ve narrowed your product focus, it’s crucial to implement strong internal controls to maintain compliance over time.

Establishing Internal Compliance Controls

A solid compliance framework can help you avoid costly mistakes. Start by designating a GSA contract manager to oversee a centralized repository for certifications, including test reports and country-of-origin documents. This person should also stay on top of updates, such as solicitation refreshes, clause changes, and MAS revisions.

Create straightforward checklists for adding new products to your GSA catalog. These should cover essentials like verifying TAA compliance, confirming safety and environmental certifications, and ensuring accurate pricing. Conduct annual audits to confirm that all listed products remain compliant, remove discontinued items, and adjust prices as needed. Use version-controlled files to track when certifications were obtained or renewed, and make a note of which SINs and products they apply to. This level of organization can significantly strengthen your compliance efforts.

The SBA also advises businesses to develop systems for tracking representations, certifications, size status, and other key contract requirements. Since federal regulations evolve regularly, reviewing your compliance framework annually and adjusting your product lineup accordingly is critical.

With a robust internal system in place, you’ll be better prepared to leverage expert support for navigating the GSA process.

How GSA Focus Can Help Small Businesses

Navigating GSA certification can be a daunting and time-consuming task, especially for small businesses that lack in-house expertise or need to prioritize their core operations. This is where professional assistance can make a real difference.

GSA Focus offers a comprehensive solution to simplify the process. They handle everything from preparing documentation and ensuring compliance to providing negotiation support. Their services are designed to structure your initial offer around high-value, certifiable products, prepare pricing disclosures, and organize manufacturer certificates to meet GSA standards. By addressing these critical steps, they reduce the risk of application rejections and compliance issues after the award.

For businesses with complex product portfolios or those aiming to fast-track their certification process, expert guidance can help balance costs and risks, allowing you to start generating federal revenue more quickly.

How To Become GSA Certified? – CountyOffice.org

Conclusion

Meeting GSA product certification requirements is more than just a box to check – it’s the key to accessing a steady stream of federal revenue. For small businesses, skipping this step could mean missing out on over $50 million in daily opportunities and competing in a market where nearly half of government awards (44%) receive only one bid.

The process boils down to a few essential steps: ensure your UEI registration and SAM.gov profile are active, confirm your products comply with the Trade Agreements Act (TAA), safety, and environmental standards, and keep your documentation organized and current throughout your contract’s duration. Staying on top of these requirements not only keeps you eligible but also gives you a competitive advantage. A solid compliance framework reduces audit risks, builds trust with contracting officers, and can lead to faster evaluations, repeat orders, and long-term partnerships with federal agencies.

For small businesses with limited resources, expert assistance can make all the difference. As discussed earlier, GSA Focus offers services to handle documentation, verify compliance, and structure your offers, allowing you to concentrate on running your business while connecting with federal buyers more efficiently.

Staying compliant isn’t just about immediate gains – it’s about building a reputation for reliability and performance. This credibility can open doors beyond the MAS program, helping you secure non-Schedule contracts, pursue task orders, and even explore new product lines. With only 4% of small businesses holding GSA Schedules, certification gives you access to growth opportunities that most competitors can’t reach.

FAQs

How can I ensure my products comply with TAA requirements?

To make sure your products meet Trade Agreements Act (TAA) requirements, they need to be either manufactured in or substantially transformed within a designated country. These countries are approved under the TAA and include those with U.S. free trade agreements or participants in the World Trade Organization Government Procurement Agreement.

Start by checking the country of origin for each product to confirm it complies with TAA standards. It’s also essential to keep thorough documentation as evidence of compliance – this might come in handy during audits or contract reviews. If you’re feeling uncertain about the process, reaching out to a GSA Schedule expert can provide clarity and ensure you’re meeting all necessary requirements.

What’s the best way for small businesses to manage GSA certification costs while maximizing revenue opportunities?

Balancing the expenses of obtaining GSA certification with the potential revenue it can generate is no small feat for small businesses. However, with a well-thought-out strategy, this process can become much more manageable. Taking steps to streamline the application and ensuring everything is compliant from the outset can help you sidestep costly mistakes or delays.

Teaming up with professionals who specialize in GSA Schedule Contracts can also make a big difference. These experts can simplify the process, save you valuable time, and increase your likelihood of success. This way, small businesses can concentrate on tapping into the revenue opportunities that federal contracting offers, making the certification costs a smart and worthwhile investment.

What key documents are needed to stay compliant with a GSA contract?

To stay compliant with your GSA contract, keeping your documentation accurate and up to date is a must. The key records you’ll need include your Commercial Sales Practices (CSP) disclosures, pricing details, and sales tracking records – all critical for meeting the requirements of the Price Reductions Clause. On top of that, it’s important to maintain documentation for contract modifications, reporting data for the GSA Advantage platform, and quarterly sales reports submitted through the GSA’s reporting system.

Organizing these documents effectively not only helps you stay compliant but also minimizes the risk of penalties or interruptions to your contract. Regularly reviewing and updating your records is a smart habit that can set you up for long-term success in federal contracting.

Related Blog Posts

- Ultimate Guide to GSA Compliance Standards

- Who Qualifies for a GSA Schedule?

- 5 Key Requirements for GSA Schedule Eligibility

- GSA Contract Eligibility: Key Requirements