Federal infrastructure spending is surging in FY2025, reaching $231 billion, a 13% increase from 2024. This growth is fueled by two landmark laws – the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA) – and supported by GSA Schedule Contracts. Together, these programs create opportunities for contractors in transportation, energy, water systems, clean energy, and more.

Key Takeaways:

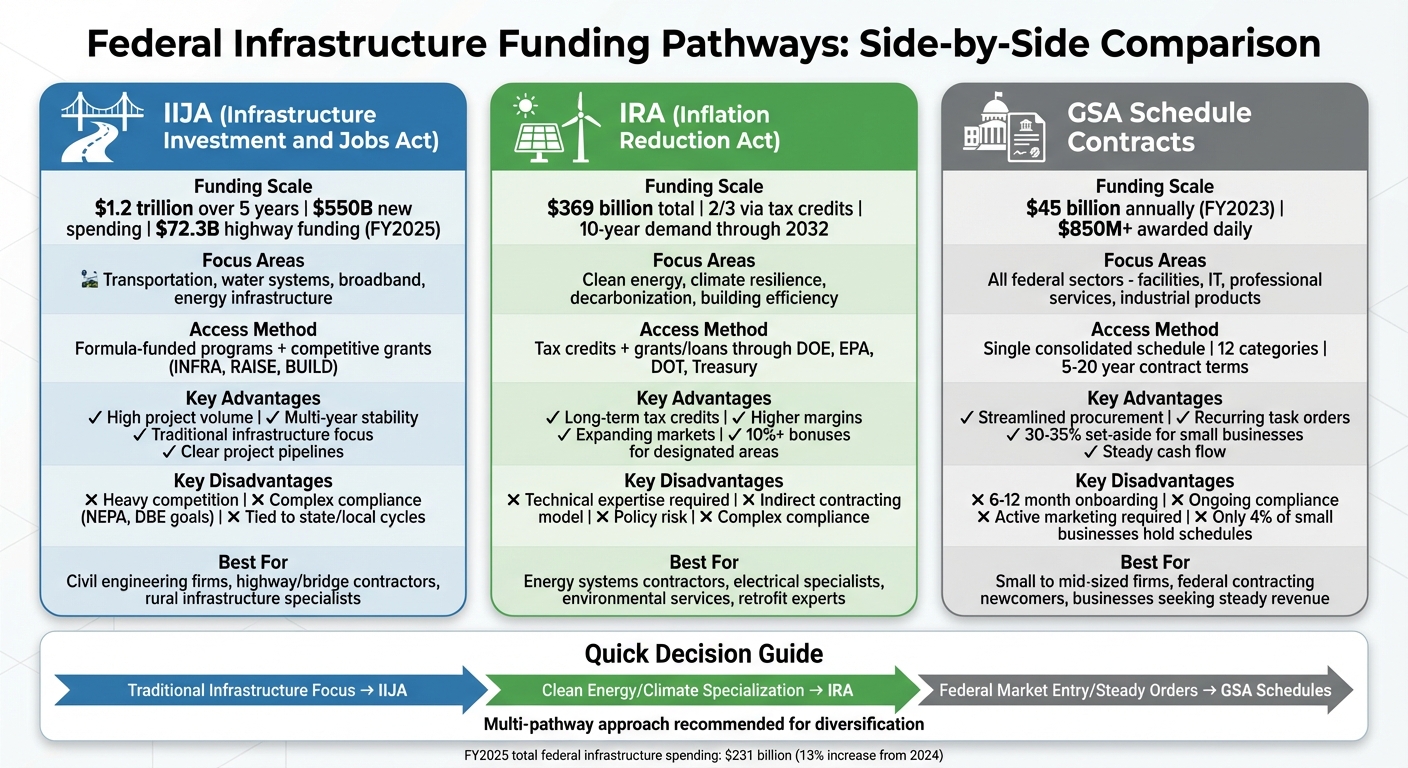

- IIJA: Focuses on transportation, water, and broadband with $1.2 trillion allocated over five years. Access funding via state projects or competitive grants.

- IRA: Targets clean energy and climate projects with $369 billion in funding, emphasizing tax credits and long-term demand.

- GSA Schedule Contracts: Simplifies federal procurement, offering contractors access to $45 billion annually across diverse sectors.

Each pathway requires compliance with federal standards and offers unique opportunities based on your expertise. Whether you’re a small business or an established contractor, aligning your services with these programs can unlock steady revenue streams.

1. Infrastructure Investment and Jobs Act (IIJA)

Funding Scale and Focus

The Infrastructure Investment and Jobs Act (IIJA) is channeling an impressive $1.2 trillion over five years, with $550 billion in new spending, creating a steady flow of projects through FY 2026. This long-term funding provides contractors across the U.S. with consistent opportunities to secure work.

The bulk of this funding is directed toward transportation, water systems, broadband, energy infrastructure, and climate resilience. For instance, the Federal Highway Administration’s FY 2025 budget, bolstered by IIJA funding, reaches $72.3 billion. Local governments are prioritizing water systems, roads, and bridges, with over 70% of municipalities emphasizing these areas. This demand highlights the need for contractors to be prepared to navigate a complex web of funding sources.

Contractor Access and Requirements

IIJA funds are distributed through two primary channels: formula-funded programs and competitive grants.

- Formula-funded programs allocate money directly to states based on predetermined calculations. Contractors can access these funds by bidding on state and local projects like road construction, bridge repairs, and safety improvements.

- Competitive grants, such as the INFRA, RAISE, and Reconnecting Communities programs, require public entities to apply for funding, with awards going to impactful, high-priority projects.

For contractors, accessing these funds means meeting stringent requirements. Compliance with domestic material mandates, prevailing wage laws, and Disadvantaged Business Enterprise goals is essential for federally assisted transportation projects. Environmental reviews under NEPA and a focus on projects benefiting underserved communities are also standard. Contractors with a strong track record in compliance and performance are more likely to stand out in this competitive landscape.

Sector-Specific Opportunities

The IIJA opens doors to lucrative opportunities across several key sectors.

- Transportation: This sector boasts the clearest project pipelines, with funding allocated for safety upgrades like guardrails and intersection improvements, freight infrastructure enhancements, and the expansion of EV charging networks through the National Electric Vehicle Infrastructure (NEVI) Formula Program, which provides about $1 billion annually. A notable example is the $185 million awarded in FY 2022 for 45 projects under the Reconnecting Communities program, aimed at addressing transportation infrastructure that divides neighborhoods.

- Water and Resilience Projects: Federal and state funds are being used to replace outdated pipes, upgrade water treatment plants, and improve stormwater systems. The PROTECT resilience program has allocated about $4.3 billion to states since the law’s enactment, funding projects that enhance infrastructure’s ability to withstand climate-related challenges like flooding and severe weather. This includes specialized work in elevation, flood protection, and resilient design.

For small businesses, direct federal contracting tied to infrastructure programs offers additional opportunities. Services like GSA Focus assist in navigating the complexities of acquiring and managing GSA Schedule Contracts, which are widely used by civilian agencies to procure professional services and IT support for infrastructure-related initiatives.

2. Inflation Reduction Act (IRA)

Funding Scale and Focus

The Inflation Reduction Act (IRA) marks the most extensive climate investment in U.S. history, dedicating roughly $369 billion to energy, climate initiatives, and decarbonization. About two-thirds of this funding is distributed through tax credits, with the remainder allocated via grants, loans, and rebates managed by agencies like the DOE, EPA, DOT, and Treasury.

This funding provides a 10-year demand signal through at least 2032, offering contractors a more predictable and extended project pipeline compared to earlier short-term programs. The IRA’s priorities include clean energy transitions, transportation electrification, renewable energy deployment, energy-efficient building upgrades, and climate resilience efforts. For instance, California alone is projected to receive approximately $3 billion by November 2024, with billions more allocated across other states.

This long-term investment framework introduces a new dynamic for contractors, requiring a strategic approach to secure access to these funds effectively.

Contractor Access and Requirements

Like the IIJA, the IRA creates a steady project pipeline but operates through an indirect contracting model. This means funds are channeled through public or private sponsors who secure tax credits or grants before hiring contractors. To participate, contractors must meet stringent requirements and maintain detailed documentation.

Compliance is essential, as project owners rely on contractors to help them meet the conditions necessary for full incentives. These include adhering to prevailing wage standards, apprenticeship requirements, and domestic content benchmarks, which can unlock enhanced credit values. Additionally, the IRA offers credit transfer options and direct pay mechanisms for tax-exempt entities such as cities and school districts, enabling a broader range of public sponsors to lead clean infrastructure projects. For contractors, this translates into expanded opportunities, particularly with the availability of 10 percentage-point bonuses for projects in designated energy or low-income communities, potentially stacking to subsidies exceeding 50%.

Sector-Specific Opportunities

The IRA presents considerable opportunities across various sectors:

- EV Charging and Fleet Conversion: Tax credits for commercial clean vehicles combined with programs like the $1 billion FY 2025 NEVI program are fueling demand for contractors skilled in electrical work, site preparation, and charging infrastructure installation along Alternative Fuel Corridors.

- Renewable Energy and Grid Upgrades: This sector offers the largest scope for contractors, with utility-scale solar, wind, battery storage, and transmission projects eligible for expanded production and investment tax credits.

- Building Retrofits and Efficiency: Incentives and rebates are driving demand for HVAC upgrades, weatherization, and electrification of heating systems in both residential and commercial buildings.

- Disadvantaged Communities: The EPA’s $27 billion Greenhouse Gas Reduction Fund focuses on clean energy projects in underserved areas. Contractors with expertise in community engagement and equity-focused initiatives are well-positioned to benefit.

For small businesses, there are additional opportunities to simplify the process of acquiring GSA Schedule Contracts, making it easier to participate in IRA-funded projects. This opens doors for contractors across all specialties to tap into the IRA’s extensive funding framework.

3. GSA Schedule Contracts

Funding Scale and Focus

GSA Schedule Contracts play a massive role in federal procurement, channeling over $40 billion annually. In fiscal year 2023 alone, these contracts facilitated $45 billion in purchases, with infrastructure-related categories – such as facilities, professional services, industrial products, IT systems, and transportation – receiving billions in task orders. These contracts simplify the process for federal agencies to buy a wide range of goods and services, from engineering expertise and construction materials to EV charging stations and smart-city technologies. This makes them a critical tool for efficiently deploying funds from the IIJA and IRA initiatives.

Previously split into 24 separate schedules, the GSA has streamlined its system into a single contracting vehicle with 12 broad categories. For contractors, this consolidation opens doors to opportunities across multiple infrastructure projects, spanning highway repairs to renewable energy developments. Unlike grants, GSA Schedules operate under an indefinite-delivery, indefinite-quantity (IDIQ) structure, offering a 5-year base period with three optional 5-year renewals – providing up to 20 years of steady access to the federal market. This structure not only simplifies procurement but also lays the groundwork for the detailed application process and sector-specific prospects outlined below.

Contractor Access and Requirements

While the potential rewards are substantial, securing a GSA Schedule requires contractors to meet stringent standards. The application process, which typically takes 6–12 months, involves multiple steps, starting with registration on SAM.gov and submission of an offer through GSA’s eOffer system. Applicants must provide competitive pricing, technical proposals, past performance records, and demonstrate adherence to Federal Acquisition Regulation clauses, such as those under the Trade Agreements Act.

Small businesses, in particular, gain an edge through set-asides, as roughly 30–35% of MAS dollars are allocated to small businesses annually. However, only about 4% of small businesses currently hold GSA Schedules, highlighting a significant opportunity for those willing to navigate the process.

Once awarded, contractors must adhere to ongoing requirements, including sales reporting, fee payments, price-reduction tracking, and audits. Interestingly, the federal market is less crowded than many believe – nearly 44% of government awards receive just one bid. This underscores the importance of actively marketing your services through platforms like GSA eBuy and GSA Advantage!. For those needing assistance, GSA Focus offers comprehensive support, from document preparation to compliance and negotiations, boasting a 98% success rate and helping clients generate an average of $927,000 in steady revenue.

Sector-Specific Opportunities

For infrastructure contractors, GSA Schedules align seamlessly with IIJA and IRA priorities through targeted Special Item Numbers (SINs):

- Facilities-related SINs: These cover maintenance, building materials, and energy management systems, essential for retrofitting buildings and improving resilience.

- Professional Services SINs: This category includes engineering, program management, and environmental services, supporting agencies with complex capital projects.

- Industrial Products and Transportation SINs: Contractors can supply equipment for freight corridors, EV charging stations, and highway safety improvements tied to programs like the National Highway Freight Program and BUILD grants.

GSA Schedules make it easier for contractors to secure recurring task orders. Additionally, some schedules are available to state and local governments for disaster recovery and cooperative purchasing, further expanding the market. With over $850 million awarded daily through GSA, contractors with active schedules are well-positioned to tap into ongoing opportunities in areas like transportation electrification, grid modernization, and climate resilience.

The Ultimate Guide to Winning Government Construction Contracts

Comparison: Advantages and Disadvantages

Federal Infrastructure Funding Comparison: IIJA vs IRA vs GSA Schedule Contracts

Choosing the right funding pathway can make or break a contractor’s ability to align their expertise with federal priorities. Each route comes with its own set of opportunities and challenges that demand careful consideration.

The IIJA (Infrastructure Investment and Jobs Act) opens doors to a massive scale of projects across traditional civil infrastructure. From highways and bridges to EV charging stations and rural roads, the scope is broad and ambitious. However, this also means fierce competition and strict compliance requirements, including labor standards, environmental reviews, and disadvantaged business participation. These projects often need extensive documentation and come with longer procurement timelines. But for those who can navigate these hurdles, the rewards include access to large, multi-year projects that can significantly boost revenue.

On the other hand, the IRA (Inflation Reduction Act) takes a narrower but highly specialized approach, focusing on clean energy, climate resilience, and decarbonization. Contractors with expertise in energy systems, electrical work, or environmental services may find these projects particularly rewarding, thanks to higher margins and long-term tax credits. That said, IRA projects demand advanced technical knowledge, especially in areas like tax-credit structures, domestic content rules, and policy compliance. Partnering with developers or technology providers might be necessary to fully capitalize on these opportunities.

GSA Schedule Contracts, in contrast, are not tied to a specific funding surge but serve as an ongoing procurement tool. They provide access to billions in federal budgets annually, offering a steady stream of smaller, recurring task orders. Once a contractor is on the Schedule, the process for securing work is streamlined, with shorter procurement cycles and opportunities across diverse sectors like IT, federal facilities, and infrastructure. Small businesses, in particular, can benefit from set-asides and simplified procedures, although the onboarding process can take 6–12 months and requires ongoing compliance, such as pricing disclosures and audits. For small firms, organizations like GSA Focus can help navigate this complex process.

From a financial and risk perspective, these pathways also differ significantly. IIJA projects, much like traditional public works, offer progress payments and lower credit risks but can face delays and potential cost overruns. IRA projects, by contrast, involve more intricate financial structures tied to tax-credit monetization and investor timelines. Meanwhile, GSA Schedule Contracts provide smaller, repeat orders that stabilize cash flow and reduce dependency on any single funding program. Contractors focusing on traditional infrastructure may lean toward IIJA, while those specializing in energy or environmental work might find IRA projects more aligned with their expertise. For smaller firms, GSA Schedules can serve as an entry point into federal contracting while allowing them to selectively pursue opportunities under IIJA or IRA.

| Aspect | IIJA | IRA | GSA Schedule Contracts |

|---|---|---|---|

| Funding Scale | Large-scale formula and competitive funding | Substantial clean energy and climate investment | Access to tens of billions in annual federal procurement |

| Access Requirements | State distribution and competitive NOFOs; safety and equity priorities | Tax-credit compliance; environmental and community focus | GSA certification; streamlined bidding post-approval |

| Sector Coverage | Traditional infrastructure (broad) | Clean energy and climate (specialized) | All federal sectors (flexible) |

| Key Advantages | High volume; multi-year projects; traditional infrastructure focus | Expanding clean energy markets; long-term tax credits; higher-margin work | Streamlined access; recurring task orders; small business benefits |

| Key Disadvantages | Heavy competition; complex compliance; tied to state/local cycles | Technical expertise required; policy risk; specialized knowledge needed | Lengthy onboarding; ongoing compliance; requires active marketing |

Each pathway offers unique opportunities, but the right choice depends on the contractor’s capabilities, industry focus, and risk tolerance.

Conclusion

Federal infrastructure spending has reached unprecedented levels – $231 billion is allocated for FY2025, nearly doubling the amount spent in 2017. With programs like the IIJA, IRA, and GSA Schedule Contracts, businesses have several avenues to tap into these federal investments. The right choice depends on your firm’s expertise and capacity to take on these opportunities.

The IIJA is ideal for firms specializing in civil engineering, highway and bridge construction, or rural infrastructure. With $62.8 billion earmarked in FY2025 for highway, bridge, and safety projects, this program is tailored for companies capable of managing large-scale, multi-year projects under strict compliance standards. If your firm focuses on traditional infrastructure like roads, bridges, freight systems, or EV charging stations, consider applying for opportunities such as the BUILD Grants program, which offers $1.5 billion for FY2026, with applications due February 24, 2026. This program provides consistent access to critical infrastructure projects, complementing broader federal contracting options.

On the other hand, the IRA caters to contractors working in clean energy and climate resilience. If your expertise includes EV infrastructure, renewable energy systems, water modernization, or broadband expansion, the IRA opens doors to emerging markets. Long-term tax credits and higher margins make this program particularly attractive. Partnering with states, tribes, or developers can help secure projects focused on electrification and decarbonization, aligning with federal goals for climate and energy innovation.

For small to mid-sized firms, GSA Schedule Contracts offer a straightforward entry into federal contracting without the complexities of competitive grant cycles. In 2023, $45 billion flowed through the GSA Schedule program, yet only 4% of small businesses currently hold these contracts. Once approved, businesses gain streamlined access to federal procurement in various sectors. For those new to federal contracting or lacking the resources to navigate the paperwork, services like GSA Focus can simplify the certification process. This pathway provides a steady flow of work and complements opportunities under IIJA and IRA, especially for firms seeking consistent federal agency contracts.

FAQs

What advantages do GSA Schedule Contracts offer small businesses in federal infrastructure projects?

GSA Schedule Contracts offer small businesses a simplified way to win federal infrastructure projects. These contracts provide a steady flow of government-backed opportunities, often with less competition than what’s found in the open market.

With a GSA Schedule, small businesses benefit from quicker sales processes, easier negotiations, and opportunities to grow at a faster pace. For many, this translates into increased revenue and a stronger foothold in the federal contracting space.

What requirements must contractors meet to access IIJA and IRA funding?

To secure funding through the IIJA and IRA, contractors need to follow federal procurement rules, which emphasize clarity, responsibility, and strict adherence to project-specific and funding requirements. This involves meeting labor standards, complying with environmental and cybersecurity regulations, and keeping thorough records to prove compliance.

It’s also crucial for contractors to stay updated on changes to federal guidelines. Staying informed helps ensure continued eligibility and smooth participation in these programs.

What industries present the best opportunities under the Inflation Reduction Act?

The Inflation Reduction Act brings new opportunities for contractors working in renewable energy, clean transportation, energy efficiency, and the manufacturing of sustainable technologies. These industries are at the forefront of federal infrastructure investments, driving demand for advanced solutions and specialized services.

Contractors with skills and experience in these fields have a chance to tap into this wave of increased funding and resources. To make the most of these opportunities, it’s crucial to stay up-to-date on project requirements and compliance standards, ensuring you’re well-prepared to meet the needs of these expanding markets.

Related Blog Posts

- How to Find Target Agencies for GSA Contracts

- Regulatory Requirements for Federal Contracts

- How GSA Plans $3.4B Infrastructure Upgrades

- How GSA Contracts Impact Federal Construction Compliance