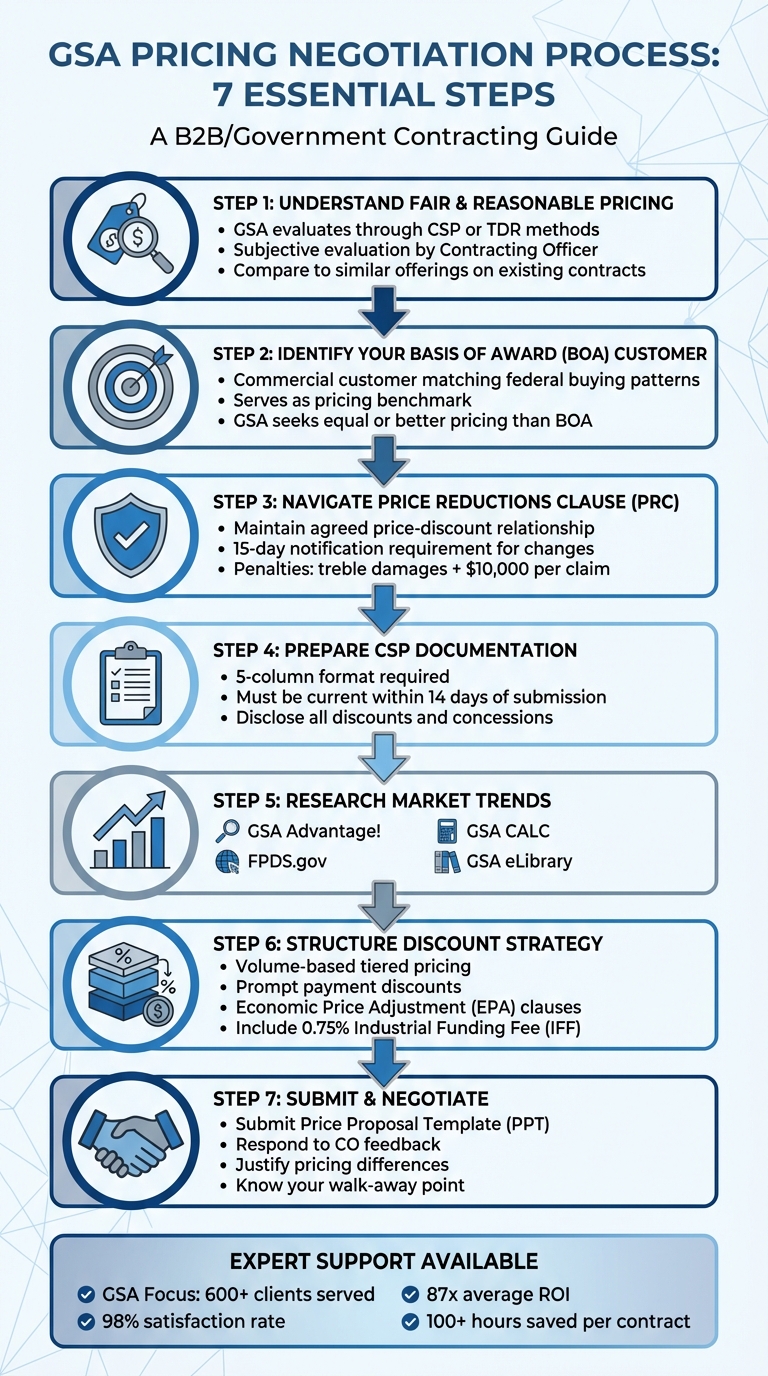

Negotiating GSA pricing terms can be challenging but rewarding, as it opens doors to lucrative federal contracts. Here are the essentials:

- Understand "Fair and Reasonable" Pricing: Your rates must align with market expectations. GSA evaluates this through Commercial Sales Practices (CSP) or Transactional Data Reporting (TDR).

- Identify Your Basis of Award (BOA) Customer: This is the commercial customer whose purchasing terms align most closely with federal buyers. GSA often seeks pricing equal to or better than this benchmark.

- Navigate the Price Reductions Clause (PRC): Maintain the agreed price-discount relationship with your BOA customer. Special exemptions apply, but compliance is critical to avoid penalties.

- Prepare Your CSP Documentation: Accurately disclose discounts, concessions, and pricing practices to support your proposed rates.

- Incorporate Economic Price Adjustment (EPA) Clauses: These allow flexibility for price changes due to market shifts, protecting your margins over time.

- Research Market Trends: Use tools like GSA Advantage! and FPDS.gov to benchmark competitive pricing and justify your rates.

- Structure Discounts Carefully: Use tiered pricing to offer volume-based discounts without slashing prices for smaller orders.

GSA Pricing Negotiation Process: 7 Essential Steps for Federal Contractors

Top 10 GSA FAQs – GSA Contracts for Beginners!

GSA Pricing Basics

To negotiate effectively, you need to understand three key elements: fair and reasonable pricing, Basis of Award (BOA) customers, and the Price Reductions Clause (PRC). Together, these components ensure the government gets competitive rates while helping you safeguard your profit margins. Let’s break these down to guide your pricing strategy.

Fair and Reasonable Pricing

The GSA determines if your pricing is "fair and reasonable" by comparing your goods or services to similar offerings already awarded under other contracts. This evaluation is subjective, meaning different Contracting Officers (COs) might reach different conclusions about the same pricing.

"Price analysis is a subjective evaluation done by your Contracting Officer – different Contracting Officers might make different decisions about price reasonableness." – Stephanie Hagan, Training and Communications Manager, Winvale

GSA uses two main methods to evaluate your pricing: Commercial Sales Practices (CSP), which focus on discounts given to your "Most Favored Customer", and Transactional Data Reporting (TDR), which relies on market research and "prices paid" data.

COs collect pricing data in a specific order:

- First, they review prices paid on similar contracts.

- Next, they examine contract-level pricing on other Multiple Award Schedule (MAS) contracts.

- Finally, they look at commercial data sources that aggregate vendor prices.

If your pricing isn’t the lowest, you’ll need to justify the difference. Explain higher costs due to government-specific requirements or added value from your services. To establish a strong pricing benchmark, pinpoint the commercial customer that closely resembles federal purchasing behavior.

Basis of Award (BOA) Customers

Your Basis of Award customer is the commercial customer (or group of customers) whose purchasing patterns align most closely with federal buyers. This customer serves as the benchmark for your GSA pricing negotiations. The GSA typically seeks pricing equal to or better than what you offer this customer but may accept higher rates if there are valid differences in terms and conditions.

During negotiations, you and the CO agree on a fixed pricing relationship, often referred to as a "delta", between your BOA customer pricing and your GSA pricing. For instance, if your BOA customer pays $80 and your GSA price is $70, the ratio is 0.875.

To avoid complications, choose a BOA customer that reflects government buying patterns and ensure your pricing remains sustainable. If you offer deeper discounts to your BOA customer, structure them through volume or quantity tiers. This prevents the GSA from demanding the same steep discounts for smaller orders. Additionally, document exceptions like one-time, high-volume commercial orders, as these may not trigger a GSA price reduction.

Price Reductions Clause (PRC)

The Price Reductions Clause (GSAR 552.238-81) is essentially a "Most Favored Customer" clause. It requires you to maintain the agreed price-discount relationship between the GSA and your BOA customer. If you lower your commercial catalog prices or offer better discounts to your BOA customer, you must notify your GSA Contracting Officer within 15 calendar days.

Failure to comply can lead to serious consequences, including treble damages and fines of up to $10,000 per claim.

However, there are exceptions. You don’t need to reduce your GSA pricing for:

- Sales to other federal agencies.

- Commercial sales exceeding the "maximum order threshold" (for firm-fixed-price contracts).

- Sales resulting from billing errors or one-off quotations.

If you’ve opted into Transactional Data Reporting (TDR), you’re generally exempt from the PRC. Instead of relying on a fixed price ratio, GSA uses actual transaction data to evaluate pricing.

To stay compliant, set up a system to monitor the discount relationship between your GSA and BOA pricing. Educate your sales teams – both commercial and government – about how even a "one-time" special discount to a BOA customer can lower your GSA pricing across the board.

Preparing for GSA Pricing Negotiations

Getting ready for GSA pricing negotiations requires careful planning and a solid understanding of your market and pricing practices. Before meeting with a GSA Contracting Officer, gather all necessary documents and evaluate your market position thoroughly. This preparation will help streamline the negotiation process. Here’s how to organize your commercial practices, analyze market trends, and structure discounts effectively.

Commercial Sales Practices (CSP) Documentation

If you’re not part of Transactional Data Reporting (TDR), the Commercial Sales Practices (CSP) Format becomes your primary tool for negotiations. This document outlines your commercial pricing and discounts, specifically focusing on concessions provided to customers over the last 12 months.

"GSA will likely use the discounts from your MFC as a starting point for negotiations, so it’s important that the information disclosed is current, complete, and accurate." – Haley Lawrie, Director of Training and Research, Winvale

Your CSP should follow a 5-column format that includes customer categories, discount percentages, quantity or volume requirements, FOB delivery terms, and additional concessions like extended warranties or free training. The information must be up-to-date as of 14 calendar days before submission. If your sales practices differ by Special Item Number (SIN), prepare separate CSP charts for each SIN. Otherwise, a single chart can cover all offered SINs.

It’s also essential to identify your Most Favored Customer (MFC) – the customer who gets your best pricing. The GSA uses this as a benchmark during negotiations. If the pricing you offer the government is better than what your MFC receives, the GSA will align you with that customer category under the Price Reduction Clause.

Be transparent about any pricing deviations, such as one-time discounts for clearing inventory or goodwill gestures. Explain how often these occur and what controls are in place to manage them. This context helps Contracting Officers assess whether your pricing is fair and reasonable.

Market Analysis and Competitive Pricing

Once your CSP is ready, focus on analyzing market trends to benchmark your pricing effectively. A clear understanding of the competitive landscape allows you to propose prices that align with GSA expectations while safeguarding your margins. Start by researching competitors’ pricing for similar products or services. Tools like GSA eLibrary can help you identify competitors and their awarded SINs, while GSA CALC provides ceiling rates for labor categories if you’re offering services. For product pricing, check GSA Advantage!.

Historical pricing data is also invaluable. Use the Federal Procurement Data System (FPDS.gov) to see what federal agencies have paid for similar offerings. This data gives insight into what the government considers reasonable. Additionally, the Acquisition Gateway can help you forecast upcoming federal contract opportunities and assess future demand.

Contracting Officers often review aggregate purchase volumes, historical buying patterns, and the value of concessions like warranties or training when setting their negotiation goals. By understanding their priorities, you can tailor your pricing to align with their expectations. Don’t forget to include the Industrial Funding Fee (IFF) – currently 0.75% of reported sales – when calculating your GSA pricing.

If you’re offering services, make sure your labor rates are competitive by researching ceiling rates for specific job categories in your locality. Federal contracting opportunities over $25,000 are listed on SAM.gov, which also provides wage data by region.

Discount Structures and Terms

Your discount structure plays a pivotal role in negotiations. The GSA typically uses the discounts you offer your Most Favored Customer as a baseline. To maintain flexibility, consider structuring discounts around volume tiers instead of flat percentages. This approach allows you to offer deeper discounts for larger orders without reducing prices across the board for smaller purchases.

In your CSP, detail the sales volumes required to qualify for each discount level and outline any concessions provided regardless of quantity, such as free installation, expedited shipping, or extended warranties. These added benefits can justify higher pricing compared to competitors who don’t include them. When comparing your pricing to others, take these concessions into account – they can explain differences between your GSA pricing and what you offer commercial customers.

For those participating in Transactional Data Reporting (TDR), you only need to disclose your commercial pricing and the discount offered to the GSA. The GSA will then evaluate reasonableness using "prices paid" data from other contracts and commercial sources.

Negotiating GSA Pricing Approaches

Once you’ve done your homework, it’s time to negotiate with the Contracting Officer. This phase is where all your research and preparation come to life. The goal? Protect your profit margins while meeting GSA requirements. To do this effectively, focus on three main strategies: structuring flexible discount models, incorporating price adjustment mechanisms, and backing your pricing with solid justifications. Let’s break these down.

Tiered Pricing and Volume Discounts

Contracting Officers often focus on three types of discounts: the GSA Basic Discount, Prompt Payment Discounts, and Quantity/Volume Discounts. One way to navigate this is by setting up tiered pricing. This approach not only gives you room to maneuver during negotiations but also rewards agencies for bulk purchases without slashing prices across the board.

To make tiered pricing work, establish clear discount levels tied to specific volume thresholds. For example, you might offer a 5% discount for orders over a certain dollar amount and a higher discount for even larger purchases. Be sure to clearly define these thresholds, so there’s no confusion about what triggers each discount.

Economic Price Adjustment (EPA) Clauses

In markets that can change on a dime, EPA clauses provide much-needed flexibility. These clauses allow for price adjustments based on market fluctuations, such as shifts in commodity prices or labor costs. As of late 2025, GSA consolidated multiple EPA clauses into a single, streamlined version: 552.238-120. This update simplifies the process for contractors under the Multiple Award Schedule program, making it easier to adapt to market changes.

The updated framework (Refresh #29) removed previous restrictions like time limits and percentage caps on price increases. This means contractors now have more room to negotiate adjustments when market conditions shift. However, the key to success lies in choosing reliable market indicators – such as data from the Bureau of Labor Statistics – that both parties agree on before the contract is awarded.

Keep in mind that EPA requests are subject to review by the Contracting Officer, who may accept, reject, or negotiate based on their own market research. Any approved adjustments will only apply to orders issued after the contract modification takes effect.

| EPA Mechanism | Best For | Key Characteristic |

|---|---|---|

| Market Index-Based | Products tied to commodity or labor costs | Relies on published indices (e.g., BLS data) |

| Unforeseeable Market Changes | Significant, unexpected cost increases | Requires documentation of substantial cost changes |

Justifying Pricing Adjustments

Just as your CSP data and market analysis informed your initial pricing, they’re also critical when justifying any adjustments. If your proposed pricing differs from your commercial terms, you’ll need to provide clear, evidence-based explanations. The Government understands that commercial pricing can vary, and there are valid reasons why the "best price" isn’t always achievable. For instance, if a commercial customer receives better pricing, you might explain that they handle value-added functions like distribution, marketing, or technical support, which the Government does not.

Thorough documentation is key. The Contracting Officer is required to record the price and discount relationship between the Government and the "Basis of Award" customer in the award document. If you’re requesting a price increase under an EPA clause, include data from your chosen market indicator to show that the adjustment is tied to actual market conditions.

If you decide to change your price adjustment method, consider offering a concession in exchange for reduced business risk. For existing contracts, make sure you’ve accepted Refresh #29 and submitted a "Revise Terms and Conditions" modification before requesting a price increase or adding new items. This step is crucial for ensuring your EPA adjustments are approved under the updated framework.

The GSA Negotiation Process

Once you’ve developed your pricing strategy, it’s time to dive into the actual negotiation process. This isn’t a simple “submit and wait” situation – it’s a dynamic back-and-forth with the Contracting Officer (CO). By understanding the steps involved, you can stay organized, respond effectively, and avoid costly errors.

Submitting Your Proposal

Your proposal starts with the Price Proposal Template (PPT), where you’ll outline SINs, units, descriptions, and proposed discounts. But the PPT isn’t enough on its own. You’ll also need a pricing narrative that explains your strategy and shows that you understand GSA compliance requirements.

Before submitting, double-check your pricing against tools like GSA CALC and GSA Advantage! to ensure it’s considered “fair and reasonable” compared to similar offerings already on the Schedule. For service contracts, provide cost substantiation, including crosswalks and invoices reflecting your lowest commercial rates. For labor categories, be sure to specify minimum experience and education requirements.

You’ll also need to confirm whether your submission follows CSP (Commercial Sales Practices) or TDR (Transactional Data Reporting) rules. Make sure your Most Favored Customer (MFC) information is up-to-date and accurate, as this will serve as the baseline for your negotiations.

"GSA does not want to be your first customer, and they utilize your already existing commercial discounts to determine Fair and Reasonable pricing."

- Haley Lawrie, Director of Training and Research, Winvale

Once submitted, your proposal will undergo a detailed review by the CO, and you should be ready for feedback.

Responding to Contracting Officer Feedback

When the CO reviews your proposal, they’ll analyze factors like aggregate volume, purchase patterns, and commercial terms (e.g., warranties and delivery practices). Their feedback might include requests for deeper discounts than you initially proposed – but don’t feel obligated to agree immediately.

Determine whether the CO’s requests are recommendations or requirements. Recommendations can be declined with a solid explanation, but requirements may call for a counteroffer or additional approval. If asked to lower your base price, consider offering improved terms like volume or prompt-payment discounts instead, helping you maintain a higher overall price.

Use your market research from tools like GSA CALC and GSA Advantage! to show that your pricing is already competitive. Document any differences between your commercial and government pricing to strengthen your case.

"If the best price is not offered to the Government, you should ask the offeror to identify and explain the reason for any differences."

- GSA Acquisition Manual (GSAM)

If the CO pushes for an adjustment that feels too steep, ask for time to review and come back with a counteroffer. Before any negotiation – whether it’s via email, phone, or video – know your walk-away point: the lowest price you can accept while still remaining profitable.

Avoiding Common Mistakes

Stay on top of your CSP disclosures and pricing justifications to avoid common errors. Negotiations are a two-way street, yet many contractors accept the CO’s initial discount requests without pushing back. Keep in mind that the GSA Federal Supply Service awards over $5 billion annually for goods and services under the schedules program, so there’s room to negotiate.

One major mistake is submitting incomplete or inaccurate Commercial Sales Practices disclosures. The CO relies on this data to identify your MFC and set negotiation objectives, so any errors here could derail your proposal.

Watch out for the PRC (Price Reductions Clause) trap. Don’t lock yourself into a fixed relationship with a Basis of Award (BOA) customer during negotiations. If you later offer that customer a price reduction, it could force you to lower prices across your entire GSA contract.

Lastly, always provide a clear justification for price differences. Proactively explain why the government might not receive your MFC price – whether it’s due to higher administrative costs or the absence of value-added services like marketing or training that commercial customers typically receive. Transparency builds trust and strengthens your negotiating position.

"The price analysis GSA does to establish the Government’s Multiple Award Schedule (MAS) negotiation objective should start with the best discount given to any of the vendor’s customers."

- U.S. General Accounting Office

Working with GSA Consultants

Benefits of Working with GSA Focus

Navigating GSA pricing terms on your own can be a massive time drain – easily taking over 100 hours and pulling you away from running your business. That’s where GSA Focus steps in. With over 600 clients served, a 98% satisfaction rate, and an average return on investment of 87x, they’ve proven their value time and time again. This ROI isn’t just a number; it reflects faster contract awards, better pricing terms, and fewer costly compliance missteps.

GSA Focus simplifies the complexities of contract negotiations, saving you from expensive delays and compliance headaches. Their team handles the heavy lifting, from preparing your Commercial Sales Practices documentation to structuring tiered discount strategies that safeguard your profit margins on smaller orders. They also use tools like the GSA CALC tool to ensure your pricing meets the "fair and reasonable" standard. And if a Contracting Officer raises concerns about your proposal, GSA Focus helps craft responses that address those issues without compromising your bottom line.

"Clear explanations often matter more than aggressive discounting." – Michael Perch, CEO of Road Map Consulting

This level of support doesn’t just help you secure better pricing – it creates a smoother path for all your future contracting needs.

How GSA Focus Simplifies the Process

Beyond pricing strategies, GSA Focus takes on the administrative workload so you can concentrate on staying competitive. They handle SIP uploads, E-Mod submissions, and ensure your documentation is always audit-ready.

Their support doesn’t end with the initial contract award. GSA Focus continues to assist with Economic Price Adjustment requests, helps you steer clear of Price Reductions Clause violations, and even develops internal pricing policy handbooks to keep your sales team aligned. With their refund guarantee, the financial risk of pursuing a GSA Schedule is significantly reduced. For businesses new to federal contracting, this makes the entire process far less intimidating. While you focus on delivering your products or services, GSA Focus takes care of the intricate regulatory details.

Conclusion

Navigating GSA pricing negotiations successfully requires careful preparation, a strong focus on compliance, and a well-thought-out strategy. Keeping your CSP documentation current is essential to avoid potential audit problems. While the government acknowledges that commercial sales terms can vary, and the best price may not always be feasible, your approach should align with your specific commercial sales history. These steps lay the groundwork for creating a solid pricing structure.

Developing a strong pricing framework involves balancing several key factors – such as basic discounts, volume-based tiers, prompt payment incentives, and Economic Price Adjustment (EPA) clauses. These elements work together to help protect your profit margins over the life of the contract. EPA clauses, for example, allow for price changes when market conditions shift, giving you some flexibility in uncertain times.

Maintaining open and transparent communication with your Contracting Officer is another critical piece of the puzzle. A well-prepared pricing narrative can build trust and lead to better outcomes than simply offering deeper discounts. Addressing concerns directly and clearly often results in stronger negotiation results, turning the process into a smooth transition from proposal to award.

For businesses stepping into federal contracting for the first time – or those aiming to refine their existing contracts – seeking expert guidance can make the entire process more manageable. This approach not only helps secure better pricing terms but also ensures compliance every step of the way. With the right support, you can avoid costly compliance missteps and focus on growing your business. Partnering with GSA Focus can streamline your negotiations and provide ongoing compliance assurance throughout your contracting journey.

FAQs

Why is the Basis of Award (BOA) customer important in GSA pricing negotiations?

The Basis of Award (BOA) customer plays a key role in GSA pricing negotiations, acting as the standard against which fair and reasonable pricing is measured. By pinpointing the BOA customer, contractors showcase their typical commercial pricing practices and discounts. This allows the GSA to assess whether the proposed prices align with market trends and the contractor’s actual sales patterns.

This approach not only ensures that GSA pricing remains competitive but also keeps everything in line with federal regulations. For businesses, this means the ability to secure contracts with both confidence and profitability.

How can businesses clearly explain pricing differences to the GSA?

To address pricing differences with the GSA effectively, businesses need to begin with thorough market research to grasp industry norms. Bring forward solid evidence – this could include past invoices, commercial sales figures, or detailed cost breakdowns – to back up your pricing.

It’s crucial to demonstrate that your prices are fair and reasonable, matching market rates and supported by a clear cost structure. Presenting this information transparently and professionally not only fosters trust but also highlights your dedication to compliance and delivering value.

What is the purpose of Economic Price Adjustment (EPA) clauses in GSA contracts?

Economic Price Adjustment (EPA) clauses in GSA contracts provide a mechanism for vendors to update their prices in response to market changes like inflation or shifts in costs. This approach ensures pricing stays fair and workable throughout the contract’s duration.

With EPA clauses in place, businesses can safeguard their profit margins while continuing to meet their commitments to the federal government, even when market conditions take an unexpected turn. These clauses strike a balance, offering protection to vendors while maintaining competitive pricing for government purchasers.

Related Blog Posts

- GSA Negotiation Objectives Explained

- How to Set GSA Prices for Federal Contracts

- How GSA Negotiates Pricing

- Price Reasonableness in GSA Contracts: Basics