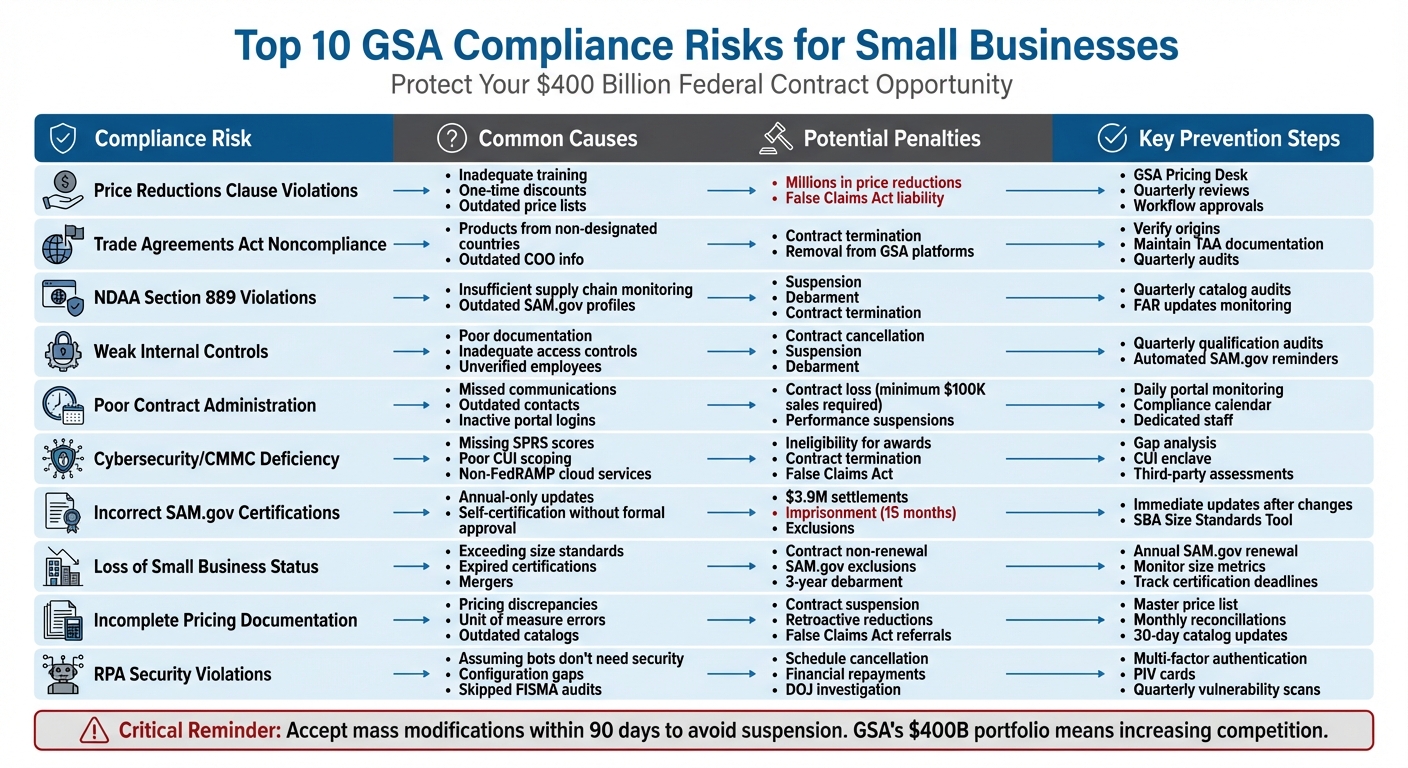

Securing a GSA Schedule contract gives small businesses access to over $400 billion in federal opportunities annually. But staying compliant is critical to avoid penalties, contract suspension, or even debarment. This article highlights the 10 most common GSA compliance risks and provides actionable steps to safeguard your contracts.

Key Risks:

- Price Reductions Clause Violations: Mismanaging discounts can trigger automatic price reductions and financial penalties.

- Trade Agreements Act Noncompliance: Selling non-compliant products risks contract termination.

- NDAA Section 889 Violations: Failure to monitor restricted telecom equipment can lead to serious consequences.

- Weak Internal Controls: Poor documentation and security gaps jeopardize contracts.

- Poor Contract Administration: Missed deadlines or updates can result in contract cancellation.

- Cybersecurity Deficiencies: Non-compliance with CMMC standards threatens eligibility.

- Incorrect SAM.gov Certifications: Errors in representations can lead to fines or imprisonment.

- Loss of Small Business Status: Growth beyond size thresholds can disqualify your business.

- Incomplete Pricing Documentation: Inaccurate pricing disclosures invite audits and penalties.

- RPA Security Issues: Mismanaging automation tools can lead to compliance violations.

Quick Solution:

Proactively address these risks by maintaining accurate records, conducting regular audits, and staying updated on federal regulations. Assign dedicated personnel or seek expert assistance to manage compliance effectively.

For detailed strategies to mitigate these risks, continue reading.

Top 10 GSA Compliance Risks for Small Businesses: Causes, Penalties, and Prevention

Government Contracting – GSA Schedule Compliance Basics – Win Federal Contracts

1. Price Reductions Clause Violations

The Price Reductions Clause (PRC) requires contractors to maintain a consistent price-to-discount ratio between what the government pays and what a specific commercial customer – referred to as the Basis of Award (BOA) – receives. If a contractor offers the BOA customer a better deal than initially disclosed, it triggers an automatic price reduction for the government. For example, if your GSA price is tied to a BOA ratio like 0.875, a BOA price drop from $80 to $60 results in the GSA price falling from $70 to $52.50.

Common Causes

Many violations occur due to miscommunication or a lack of alignment within sales teams. A commercial salesperson might unknowingly offer a one-time special discount to a BOA customer, unaware that this action mandates a government-wide price adjustment.

"A single salesperson’s decision to provide a one-time discount to the commercial BOA customer or customers could arguably trigger millions of dollars in price reductions on future MAS orders,"

explain Christopher Griesedieck, Jr. and Dismas Locaria from Venable LLP. Other common issues include failing to notify the GSA Contracting Officer within 15 days of a change, using outdated price lists, or making unit-of-measure errors (e.g., confusing "per box" with "each"). These mistakes not only disrupt pricing but can also lead to significant financial penalties.

Potential Penalties

Violations are often uncovered during Office of Inspector General audits, where they are flagged as "questioned costs." This can result in retroactive price reductions dating back to when the commercial discount was first offered. Contractors may also need to refund any overcharges, and repeated violations can lead to contract termination. The consequences are even more severe for deliberate violations:

"Knowing violations could lead to suspension or debarment and to claims for penalties or treble damages available under the False Claims Act".

Prevention Measures

To steer clear of PRC violations, keep an up-to-date master price list that aligns with your signed contract (including SKUs, prices, and volume discounts). Designate a specific individual to manage pricing updates and perform quarterly reviews of commercial sales data to identify any special deals that could cause compliance issues. Training for both government and commercial sales teams is essential to ensure they understand how discounting impacts GSA compliance. Additionally, consider implementing a system to monitor BOA relationships closely. For those looking for an alternative, opting into Transactional Data Reporting (TDR) can exempt you from the Price Reductions Clause.

2. Trade Agreements Act Noncompliance

The Trade Agreements Act (TAA) requires that all products sold to the U.S. Government through GSA Schedule contracts must either be manufactured in the United States or a TAA-designated country, or undergo "substantial transformation" in one of these locations. Selling items from non-designated countries is prohibited unless specific exceptions apply. Because TAA compliance is a cornerstone of MAS contracts, failing to meet these requirements is not an option. However, small businesses often encounter challenges navigating these rules.

Common Causes

Many violations occur because businesses rely on outdated Country of Origin (COO) information from suppliers or fail to track changes in manufacturing locations. Another common misunderstanding involves the concept of "substantial transformation." For a product to qualify, it must be transformed into a new article with a distinct name, character, or use. Simply assembling parts does not meet this standard. For example, assembling components from a non-designated country in the U.S. may not qualify if the final product retains the essential character of the original parts.

Potential Penalties

Noncompliance can have serious consequences. GSA may cancel contracts or refuse to renew them. During IOA assessments, which include reviews of financial and product records, TAA violations are often uncovered. If noncompliance is identified – particularly during the End of Term assessment in the fourth year of a contract – GSA may terminate the agreement or decline to extend it for another five years.

Prevention Measures

To avoid these pitfalls, businesses should take proactive steps:

- Regularly request updated COO certificates from vendors.

- Stay informed about the current list of TAA-designated countries, as trade agreements and statuses can change over time.

- Keep thorough documentation, including supplier certifications and detailed records of where products were manufactured or substantially transformed, to prepare for IOA reviews.

- Verify the origin of products before adding them to your GSA Advantage! catalog and conduct regular audits to ensure compliance.

3. Failure to Self-Report NDAA Section 889 Violations

NDAA Section 889 places strict limitations on federal contractors, prohibiting the use or sale of telecommunications and video surveillance equipment from certain foreign entities. This includes ByteDance applications and specific unmanned aircraft systems. For small businesses, self-reporting any violations is not just recommended – it’s essential to safeguard their contracts. However, navigating this regulation can lead to some common compliance challenges.

Common Causes

Many violations stem from insufficient monitoring of supply chains. For instance, suppliers might introduce new equipment or components that fall under Section 889 restrictions, and businesses fail to catch these updates. Another common issue is outdated or inaccurate profiles on SAM.gov, which can misrepresent current equipment usage. Adding to the complexity, the list of prohibited items continues to grow, now including both hardware and software applications. Without active monitoring of Federal Acquisition Regulation (FAR) updates, businesses can easily overlook these changes.

Potential Penalties

Noncompliance can lead to serious consequences. Businesses risk suspension or debarment proceedings, especially with FAR Case 2019-015 emphasizing stricter procedural consistency. Beyond this, Contracting Officers have the authority to modify or even terminate contracts if violations are discovered during administration. Preaward registration issues can also arise, making it harder for businesses to compete for new federal opportunities.

Prevention Measures

Staying ahead of compliance issues requires a proactive approach. Regularly reviewing the GSA Small Entity Compliance Guide is a good starting point, as it provides updates on FAR and GSAR cases tied to supply chain security. Conduct quarterly audits of your GSA Advantage! catalog to ensure no noncompliant items remain listed. If compliance gaps are identified, submit a corrective action plan within 90 days to address the issue and avoid contract removal from electronic ordering systems. Additionally, keeping your SAM.gov profile accurate and ensuring all equipment and applications used in your contracts meet the latest prohibitions are crucial steps in maintaining compliance.

4. Weak Internal Controls and Security Clearances

Weak internal controls and lax security clearances can put GSA contracts at serious risk. These vulnerabilities often arise from poor documentation, insufficient access controls, and inadequate employee verification processes. Without robust systems in place, contractors may fail routine assessments by Industrial Operations Analysts (IOAs), especially during the critical End of Term review in the fourth year. Just like pricing and trade compliance, strong internal controls are essential for protecting your GSA contract.

Common Causes

Several recurring issues can lead to non-compliance. For instance, labor category violations – like hiring employees who don’t meet the required qualifications – are a frequent problem. Imagine a contract specifying a bachelor’s degree and three years of experience, but the employee hired has only two years. This creates a clear compliance gap.

Another common oversight is failing to promptly revoke credentials when employees leave or change roles. Neglecting to retrieve Personal Identity Verification (PIV) cards or disable access to GSA systems leaves security holes wide open. Small businesses, in particular, often struggle with maintaining an active SAM.gov profile, forgetting to renew it annually. Skipping mandatory Security and Privacy Awareness training for employees with security responsibilities further compounds the issue.

Potential Penalties

The consequences of non-compliance can be severe. Contractors may face contract cancellation, denial of option period renewals, or even suspension and debarment. Just as accurate pricing and trade compliance are vital, strong internal controls play a direct role in keeping your GSA Schedule contract intact.

Prevention Measures

To strengthen internal controls and avoid compliance pitfalls, consider these practical steps:

- Set automated reminders for SAM.gov registration renewals at least 30 days before expiration to maintain your contractor status.

- Perform quarterly audits of employee qualifications, ensuring resumes align with the labor category requirements outlined in your contract.

- Develop a detailed offboarding checklist to immediately revoke system access and recover PIV cards when employees leave.

- Respond to mass modifications in the Mass Mod Portal within 90 days to keep up with solicitation updates and security requirements.

- Follow standardized IT security protocols outlined in GSA CIO-IT Security guides, such as 01-07 for Access Control and 03-23 for Termination procedures.

5. Poor Contract Administration Practices

Managing a GSA Schedule Contract is no small feat. It requires juggling multiple responsibilities, from monitoring various portals and responding to GSA communications to tracking sales data and keeping registrations up to date – all while running your day-to-day business. Depending on the complexity of your contract, this can range from a demanding side task to a full-time commitment.

Common Causes

Small businesses often struggle with contract administration due to missed communications, such as IOA messages or Contractor Assessment Visit (CAV) requests. Another common issue is failing to regularly check the GSA Advantage! Purchase Order portal or the eBuy system, leading to missed opportunities and declining performance scores.

Staffing challenges make these problems worse. Many businesses fail to assign or maintain key roles like Authorized Negotiators, Order Points of Contact (POC), and Industrial Funding Fee (IFF) POCs. Outdated contact information in the GSA eLibrary is another frequent issue. Additionally, contractors risk losing access to the Sales Reporting Portal (SRP) if they don’t log in at least once every 90 days, triggering automatic account suspension. Missing the 90-day deadline to accept mandatory Mass Modifications also puts contracts out of compliance with current regulations. These oversights can snowball into serious penalties.

Potential Penalties

Poor administration can lead to severe consequences, including the loss of your GSA contract. To retain a contract, contractors must generate at least $100,000 in sales during the first five years and $125,000 in each subsequent five-year renewal period. Falling short of these thresholds results in contract cancellation under GSAR 552.238-79.

Performance metrics are equally critical. Contractors are suspended from GSA Advantage and eBuy if they fail to meet the following standards: shipment status must exceed 95%, on-time performance must stay above 75%, and cancellation rates must remain below 15%.

The "End of Term" assessment in the fourth year is a pivotal moment when IOAs review overall compliance. Significant compliance issues during this review can prevent GSA from extending the contract for another five years. Beyond termination, other penalties include product removal from GSA Advantage, payment suspensions, and the burden of submitting corrective action plans to address compliance failures.

Prevention Measures

To avoid these pitfalls, it’s essential to establish strong administrative practices. Start by assigning dedicated staff to monitor emails and portals daily, ensuring no critical updates or warnings are missed. Regularly check the GSA Advantage! portal and eBuy system to stay on top of order statuses and new RFQ opportunities. Keep GSA sales records separate to simplify accurate reporting and the calculation of the 0.75% Industrial Funding Fee.

A compliance calendar can be a game-changer. Use it to track key deadlines, such as quarterly sales reporting (due January 30, April 30, July 30, and October 30 for non-TDR contractors), annual SAM.gov renewals (set reminders at least 30 days in advance), and the 90-day window for accepting Mass Modifications. Maintain detailed transaction records – including quotes, purchase orders, invoices, and delivery confirmations – for the contract’s duration plus three years.

Quarterly internal audits are another essential step. Compare your commercial pricing to GSA pricing to ensure Basis of Award (BOA) customers aren’t receiving deeper discounts that could violate the Price Reduction Clause. As Michael Perch, CEO of Road Map Consulting, explains:

"Many contractors only start thinking seriously about compliance after something goes wrong. A late report, a pricing question on an awarded contract that violates the Price Reduction Clause, or an unexpected audit notice is often what brings compliance into focus".

6. Cybersecurity and CMMC Deficiency

Federal cybersecurity rules now come with strict contractual obligations, especially for small businesses holding GSA Schedule Contracts. These businesses must meet stringent standards to protect Controlled Unclassified Information (CUI). Falling short in this area can mean losing access to federal contracting opportunities. This makes it critical for businesses to act quickly and decisively to secure their eligibility.

Common Challenges

One of the most common issues is missing SPRS scores. Contractors are required to submit their NIST SP 800-171 self-assessment scores to the Supplier Performance Risk System (SPRS), but many small businesses fail to do so. Ron Lewis from AtWork Systems highlights the importance of this step:

"The lowest-hanging fruit for DIBCAC is to simply check whether organizations has submitted its NIST SP 800-171 self-assessment score (SPRS score) as required: reports are that DIBCAC is steadily increasing such spot checks."

Another frequent problem is poor scoping. Many businesses struggle to clearly define which users, systems, and devices handle CUI. This can lead to either over-complying or under-complying with requirements. Additionally, relying on commercial cloud services like Microsoft 365 Commercial – services that don’t meet FedRAMP Moderate or DFARS 252.204-7012 standards – can open up serious vulnerabilities.

Documentation is another weak spot. Many contractors lack a proper System Security Plan (SSP) or a Plan of Action and Milestones (POA&M) to address deficiencies. With NIST SP 800-171 requiring 110 security controls, incomplete implementation remains a recurring challenge.

Consequences of Non-Compliance

Failing to meet CMMC certification standards can have severe repercussions. Contractors may become ineligible for new awards, face contract terminations, or even encounter legal action under the False Claims Act. Christina Reynolds from BDO explains:

"Contractors that cannot demonstrate certification at the required level for a given opportunity will be considered ineligible for award. This is a significant departure from past practice, where self-attestation sufficed."

Even maintaining compliance throughout the contract period is crucial. Contracting officers verify CMMC status in SPRS before extending contracts or exercising options. Falling out of compliance can lead to termination for default. Worse, misrepresenting your cybersecurity status could result in False Claims Act violations.

The clock is ticking. By 2028–2029, all contractors handling Federal Contract Information (FCI) or CUI must at least complete a Level 1 self-assessment. The Department of Defense (DoD) estimates that 1,104 small entities will need to comply in the first year, with that number growing to 229,818 by year four. Prime contractors are already removing non-compliant businesses from their subcontractor lists to protect their own eligibility.

How to Stay Ahead

To keep your federal contracting opportunities intact, it’s crucial to address these cybersecurity gaps. Start by conducting a gap analysis against the 110 security controls in NIST SP 800-171. This will help you pinpoint areas needing improvement. Creating a CUI enclave – essentially separating systems that handle CUI – can also simplify compliance and reduce costs.

Make sure your Cloud Service Providers meet FedRAMP Moderate standards, and consider hiring Managed Service Providers (MSPs) for fractional Chief Information Security Officer (CISO) support. Deploy Governance, Risk, and Compliance (GRC) tools if necessary. Remember, you can include CMMC certification costs in your bids; while these costs must be paid upfront, they’re considered allowable expenses.

Schedule your third-party assessments as early as possible. Certified Third-Party Assessment Organizations (C3PAOs) are reportedly booked through mid-2026, and preparing for CMMC Level 2 certification typically takes 9 to 12 months. That’s far longer than the average Procurement Administrative Lead Time of about 32 days. Finally, ensure that authorized officials submit annual affirmations of continuous compliance in SPRS to stay on track.

7. Incorrect Representations and Certifications in SAM.gov

Your SAM.gov profile isn’t just another business listing – it’s a legally binding declaration of your company’s status. Mistakes here can lead to serious consequences, including investigations, hefty fines, suspension from federal contracts, or even imprisonment.

Common Causes of Errors

One of the most frequent missteps is waiting until the annual renewal to update your profile. But here’s the catch: federal regulations, specifically FAR 4.1201, require updates "as necessary" to ensure your information is always accurate and complete – not just once per year. For instance, if your business merges with another, is acquired, or grows past the small business size standards, you’re required to update your profile immediately.

Another common error involves misunderstanding self-certification requirements. For example, checking the box for SDVOSB (Service-Disabled Veteran-Owned Small Business) or WOSB (Women-Owned Small Business) without obtaining the required formal certification through certify.sba.gov can land you in hot water. Some businesses also mistakenly continue certifying as "small" even after organic growth or new affiliations push them beyond the size thresholds.

These errors, whether intentional or not, can have severe repercussions.

The Risks and Penalties

The penalties for incorrect representations are no joke. Businesses have faced significant financial settlements, such as Planned Systems International, which paid $3.9 million for WOSB misrepresentation, and The Pavion Company, which paid $1.75 million for falsely claiming small business status. In more extreme cases, individuals have faced criminal charges, like Jonathan Walker, who received a 15-month prison sentence for fraudulently claiming SDVOSB status.

As Shane McCall, an Equity Partner at Koprince McCall Pottroff LLC, explains:

"Even if a misrepresentation is made through an honest mistake, however, the consequences can be dire should the government investigate".

The stakes are high, but with the right steps, these mistakes are entirely avoidable.

How to Stay Compliant

To keep your SAM profile accurate and avoid costly errors, take immediate action whenever there’s a change in ownership, size status, or corporate affiliations. Use the SBA Size Standards Tool to confirm your eligibility for small business status under your NAICS codes, and complete any required certifications, like WOSB or 8(a), through certify.sba.gov before making claims in your profile.

If your company is involved in a merger, acquisition, or private equity investment, consult legal counsel right away to understand how these changes affect your SAM.gov representations. Treat your SAM profile with the same level of care you’d apply to pricing strategies or cybersecurity controls. When in doubt, update your registration or seek professional advice. The effort to maintain accurate records is far less costly than dealing with the fallout of an error.

8. Loss of Small Business Set-Aside Eligibility

Losing your small business status doesn’t just mean missing out on future opportunities – it could put your current GSA contract at risk and even result in severe penalties. Many contractors mistakenly believe that once a contract is secured, eligibility is locked in. In reality, maintaining your small business status is an ongoing responsibility, just as crucial as keeping up with pricing and cybersecurity compliance.

Common Causes

There are two main reasons businesses lose their set-aside eligibility: exceeding SBA size standards and failing to update their size or socioeconomic status when required. Growth in revenue, workforce, or affiliations can lead to crossing the size thresholds defined by your NAICS codes. Additionally, events like mergers, acquisitions, or letting certifications expire without timely updates can disqualify your business.

Potential Penalties

The consequences of losing your eligibility can be serious. Federal agencies might choose not to renew or extend your contracts. Worse, your business could end up flagged on the SAM.gov Exclusions database, which alerts agencies to your ineligibility. You may also face restrictions on subcontracting – excluded businesses generally can’t receive subcontracts of $30,000 or more without a strong justification. Penalties can escalate to include debarment for up to three years or suspensions lasting up to 12 months before formal proceedings even begin.

Prevention Measures

To avoid these pitfalls, take a proactive approach:

- Renew your SAM.gov registration annually to ensure your information stays current.

- Monitor your size metrics regularly to confirm you remain within SBA standards.

- Track deadlines for certifications like 8(a), HUBZone, or WOSB, and ensure timely renewal.

- If your business undergoes changes like mergers, acquisitions, or significant growth, update your SAM.gov profile immediately to avoid misrepresentation risks.

Being proactive and maintaining disciplined compliance is key to protecting your eligibility. At GSA Focus, we’re here to guide small businesses through these challenges, helping you stay eligible and seize federal contracting opportunities.

9. Incomplete Pricing Disclosures and Documentation

Incomplete pricing disclosures can put your GSA contract at serious risk. Errors in pricing documentation can lead to audits, contract suspensions, and even investigations under the False Claims Act. Many small businesses mistakenly believe that their compliance obligations end once their contract is approved. However, pricing compliance is an ongoing responsibility that demands constant vigilance and careful record-keeping.

Common Causes

Several common mistakes can lead to issues with pricing documentation. Pricing discrepancies arise when contractors list prices on GSA Advantage that exceed their approved ceiling price or fail to account for required discount structures. Unit of measure errors – such as labeling items as "per box" instead of "each" – can create significant problems, including catalog rejections. Another frequent issue is outdated catalog data, where businesses neglect to update price lists after contract modifications, leaving discontinued items or incorrect prices visible. Additionally, technical formatting issues often occur during the transition from the legacy Schedule Input Program (SIP) to the Federal Acquisition Service Catalog Platform (FCP). The FCP enforces stricter validation rules, automatically rejecting improperly formatted files.

Potential Penalties

The consequences of incomplete pricing documentation can be severe. GSA may suspend or even terminate your contract if pricing disclosures are found to be inaccurate or misleading. Financial repercussions can include retroactive price reductions, government clawbacks for overcharges, and, in more serious cases, referrals to the Department of Justice under the False Claims Act. Beyond immediate penalties, non-compliance can jeopardize future opportunities – GSA may choose not to renew your contract for the next five-year option period. Contractors are also required to retain all pricing, sales, and compliance documentation for at least five years. Notably, the Office of Inspector General frequently identifies inaccurate Commercial Sales Practices disclosures as a key audit issue. These risks make proactive pricing management a necessity.

Prevention Measures

To avoid these pitfalls, establish a master price list that aligns exactly with your signed contract, detailing SINs, SKUs, units of measure, and country of origin. Assign a dedicated team member to oversee pricing updates and maintain a detailed change log. Conduct monthly reconciliations between your master price list, internal ERP systems, and GSA Advantage to identify and resolve discrepancies early. Keep in mind that electronic contract data must be submitted to GSA Advantage within 30 calendar days of any contract award or modification. Additionally, perform quarterly reviews of your commercial pricing and discount practices to ensure compliance with the Price Reduction Clause. Before submitting catalog updates, double-check that prices do not exceed ceiling rates and that all mandatory fields – such as Trade Agreements Act compliance – are accurately completed.

10. Ignoring Robotic Process Automation Security Requirements

Robotic Process Automation (RPA) is becoming a staple in federal contracts, including those under the General Services Administration (GSA) like Alliant 2. For small businesses leveraging RPA solutions or automating their contract operations, adhering to strict IT security standards is a non-negotiable. These systems require unique credentials, defined permissions, and robust access controls. Without these measures, agencies risk unauthorized access and serious compliance violations. Below, we’ll explore the risks RPA poses and practical steps to secure these systems.

Common Causes

One of the biggest misunderstandings about RPA is the assumption that it doesn’t require the same level of security as human users. This misconception often leads to configuration gaps – like failing to maintain bot software according to the manufacturer’s guidelines or making unauthorized changes to automation scripts. Another issue is excluding RPA systems from Federal Information Security Modernization Act (FISMA) audits, which require security authorization (ATO) and ongoing monitoring. Overlooking Information Exchange Agreements for RPA bots that transfer data between systems creates additional vulnerabilities, as these transfers may go undocumented. For cloud-based RPA solutions, meeting FedRAMP or GSA-specific SaaS authorization levels is critical, especially when handling sensitive data.

Potential Penalties

Non-compliance can carry serious consequences. GSA has the authority to cancel schedules that don’t meet requirements or let them expire. Patrick Morgans, Manager at Winvale, highlighted this point:

"GSA does plan to ‘rightsize’ the MAS program, one of the largest impacts of which will be cancelling non-compliant Schedules, or allowing them to expire".

Post-award audits can uncover violations, which may result in financial repayments, penalties, or even permanent rate reductions. In extreme cases, violations are escalated to the Department of Justice for further investigation and potential prosecution. For contractors handling personal information, additional risks arise under the Privacy Act, where violations could lead to criminal liability for officers or employees.

Prevention Measures

To safeguard your RPA systems, establish and follow targeted security protocols. Start with multi-factor authentication for system access, and ensure bots use Personal Identity Verification (PIV) or HSPD-12 cards when required. Familiarize yourself with the GSA CIO-IT-Security guides, particularly those for Access Control (CIO-IT-Security-01-07), Identification and Authentication (CIO-IT-Security-01-01), and Configuration Management (CIO-IT-Security-01-05).

Here are additional measures to consider:

- Audit Logging: Enable detailed logging for all data access and implement daily log reviews.

- Penetration Testing: Include RPA workflows in annual penetration tests to identify vulnerabilities in automated processes.

- Data Encryption: Use 128-bit encryption for any data transfers outside the GSA firewall.

- Privacy Impact Assessments (PIA): Complete a PIA before deploying any RPA system.

- Vulnerability Scans: Conduct quarterly scans on all Internet-facing systems.

- Pre-Audits: Perform internal reviews to catch security issues before formal GSA assessments.

Compliance Risk Comparison Table

Here’s a quick-reference table summarizing the key compliance risks discussed earlier. Use it to spot potential red flags, understand the consequences, and take proactive steps to safeguard your small business.

| Compliance Risk | Common Causes | Potential Penalties | Prevention Measures |

|---|---|---|---|

| Price Reductions Clause Violations | Inadequate training, inconsistent pricing updates, or one-time discounts leading to violations | Millions in price reductions, False Claims Act liability, or contract modifications | Establish a GSA Pricing Desk, provide company-wide training, and create workflow rules for proposal approvals |

| Trade Agreements Act Noncompliance | Selling products from non-designated countries or misrepresenting product origins | Contract modifications, removal from GSA platforms, or even criminal liability | Verify product origins, maintain TAA documentation, and conduct quarterly supply chain audits |

| Failure to Self-Report NDAA Section 889 Violations | Overlooking prohibited items, weak contractor assertions, or lack of internal controls | Removal from GSA contracts, potential debarment, or contract termination | Track supply chain data, document self-reporting efforts, and regularly review contractor assertions |

| Weak Internal Controls and Security Clearances | Employees without proper screening, poor access control, or incomplete documentation | Contract suspension, termination, or loss of federal contracting eligibility | Verify clearances, enforce access controls, document compliance, and perform internal audits |

| Poor Contract Administration Practices | Missing compliance updates, poor documentation, or untrained staff | Regulation violations, wasted taxpayer funds, or contract termination | Maintain complete contract files, conduct quarterly audits, assign a contract administrator, and track deadlines effectively |

| Cybersecurity and CMMC Deficiency | Failing to update security plans or inadequate IT security for automated processes | Contract termination, debarment, or loss of federal contracting eligibility | Document cybersecurity controls, maintain system security plans, ensure compliance for automated processes, and conduct penetration testing |

| Incorrect Representations and Certifications in SAM.gov | Outdated certifications, delayed updates, or OLM misclassification | Application delays, rejections requiring resubmission, or loss of eligibility for substantial revenue | Use document management systems, audit SAM.gov entries, and review certifications quarterly |

| Loss of Small Business Set-Aside Eligibility | Exceeding size thresholds, outdated size status, or failing to account for part-time employees | Loss of set-aside contracts, size protests, contract termination, or repayment of benefits | Audit eligibility against NAICS codes, verify subcontractor certifications, and review employee levels and annual receipts quarterly |

| Incomplete Pricing Disclosures and Documentation | Selling to ineligible entities, misrepresenting products, or failing to maintain agreed price relationships | False Claims Act penalties of $11,000 per invoice plus treble damages, defective pricing claims, or contract modifications | Require GSA Pricing Desk approval for proposals, maintain thorough pricing documentation, and verify customer eligibility prior to sales |

| Ignoring Robotic Process Automation Security Requirements | Assuming bots don’t need security controls, poor configuration, or skipping FISMA audits | Contract termination, debarment, or loss of federal contracting eligibility | Ensure automated processes meet federal IT security standards, update security plans to include RPA, and conduct regular cybersecurity assessments |

Reminder: Accept mass modifications within 90 days to avoid suspension. GSA’s $400 billion portfolio consolidation means competition is increasing . Explore earlier sections for detailed prevention strategies.

Conclusion

GSA compliance isn’t just a box to check – it’s a safeguard for your business against costly penalties and the potential loss of federal contracts. The risks discussed here, from pricing violations to cybersecurity lapses, highlight the challenges small businesses often face when navigating federal requirements.

With agencies enforcing stricter compliance standards, even minor errors – like incomplete pricing disclosures, TAA violations, or outdated SAM.gov certifications – can jeopardize not only a single contract but also your access to broader federal opportunities.

To maintain your eligibility, taking proactive steps is critical. This includes implementing strong internal controls, appointing a dedicated contract administrator, conducting regular audits, and keeping detailed records. These measures help ensure you stay ahead of compliance challenges.

If managing compliance feels like too much to handle, expert assistance is available. GSA Focus offers a comprehensive, done-for-you service to help small businesses secure and manage GSA Schedule Contracts. From document preparation to compliance checks and negotiation support, their team simplifies the process and saves you time. With a 98% success rate, they can help you avoid common pitfalls and make the most of government contracting opportunities.

FAQs

What steps can small businesses take to stay compliant with the Trade Agreements Act (TAA)?

To comply with the Trade Agreements Act (TAA), small businesses must ensure that all products listed on their GSA Schedule are either made in the United States or substantially transformed in a TAA-approved country, such as Canada or Mexico. Offering products from non-compliant countries, like China or India, is strictly prohibited and could lead to contract violations.

Staying compliant involves a few critical steps: regularly checking supplier compliance, keeping detailed records of product origins, and conducting periodic internal audits. These practices not only help maintain alignment with TAA requirements but also prepare your business for potential GSA audits. By actively managing your supply chain and maintaining thorough documentation, you can minimize compliance risks and safeguard your federal contracting opportunities.

How can small businesses avoid violations of the Price Reductions Clause (PRC)?

To steer clear of Price Reductions Clause (PRC) violations, it’s crucial to keep a close eye on your commercial pricing and make sure the discounts you offer through the GSA are in line with – or better than – those provided to your largest commercial customers. Stay on top of tracking and reporting any price adjustments accurately, and make it a priority to update your GSA price list promptly to reflect the latest pricing and discounts.

By maintaining detailed records and routinely reviewing your pricing practices, you can ensure compliance and minimize the risks tied to PRC violations.

Why is it important to keep your SAM.gov representations and certifications accurate?

Keeping your SAM.gov representations and certifications up-to-date is crucial if you want to stay eligible for federal contracts. Mistakes or outdated details can cause serious issues, like delays, compliance problems, or even penalties, including fines or suspension.

Maintaining accurate records also reflects positively on your business. It shows that you’re reliable and professional, which helps streamline the contracting process and minimizes potential hiccups when working with government agencies.

Related Blog Posts

- Top 5 Compliance Issues in GSA Contracts

- Ultimate Guide to GSA Compliance Standards

- Common GSA Compliance Mistakes And Fixes

- Common GSA Audit Issues and How to Avoid Them