Registering as a GSA vendor is a gateway to federal contracts but comes with hurdles that can slow down or derail the process. Here’s a quick summary of the key challenges businesses face and how to address them:

- SAM.gov Registration Delays: Issues with the Unique Entity Identifier (UEI) validation, address mismatches, or incomplete documents can stretch timelines. Double-check all records and respond promptly to manual review requests.

- Documentation Errors: Missing or incorrect paperwork – like financial records, Letters of Supply, or pricing documents – can pause the approval process. Use a detailed checklist to ensure accuracy.

- Trade Agreements Act (TAA) Compliance: Products must originate from TAA-compliant countries. Regularly verify your product catalog to avoid penalties or contract termination.

- Financial Stability Concerns: Weak financials, high debt, or inconsistent cash flow raise red flags. Submit clear, organized financial statements and address potential concerns upfront.

- Regulatory and SIN Code Issues: Misalignments between NAICS codes and SINs or failure to meet federal compliance standards can lead to rejections. Verify codes and ensure adherence to labor and procurement rules.

Preparation and attention to detail are key to overcoming these challenges. If needed, consider expert assistance to streamline the process and avoid costly mistakes.

Doing Business with GSA – Roadmap Getting on Contract

Challenge 1: SAM.gov Registration and UEI Problems

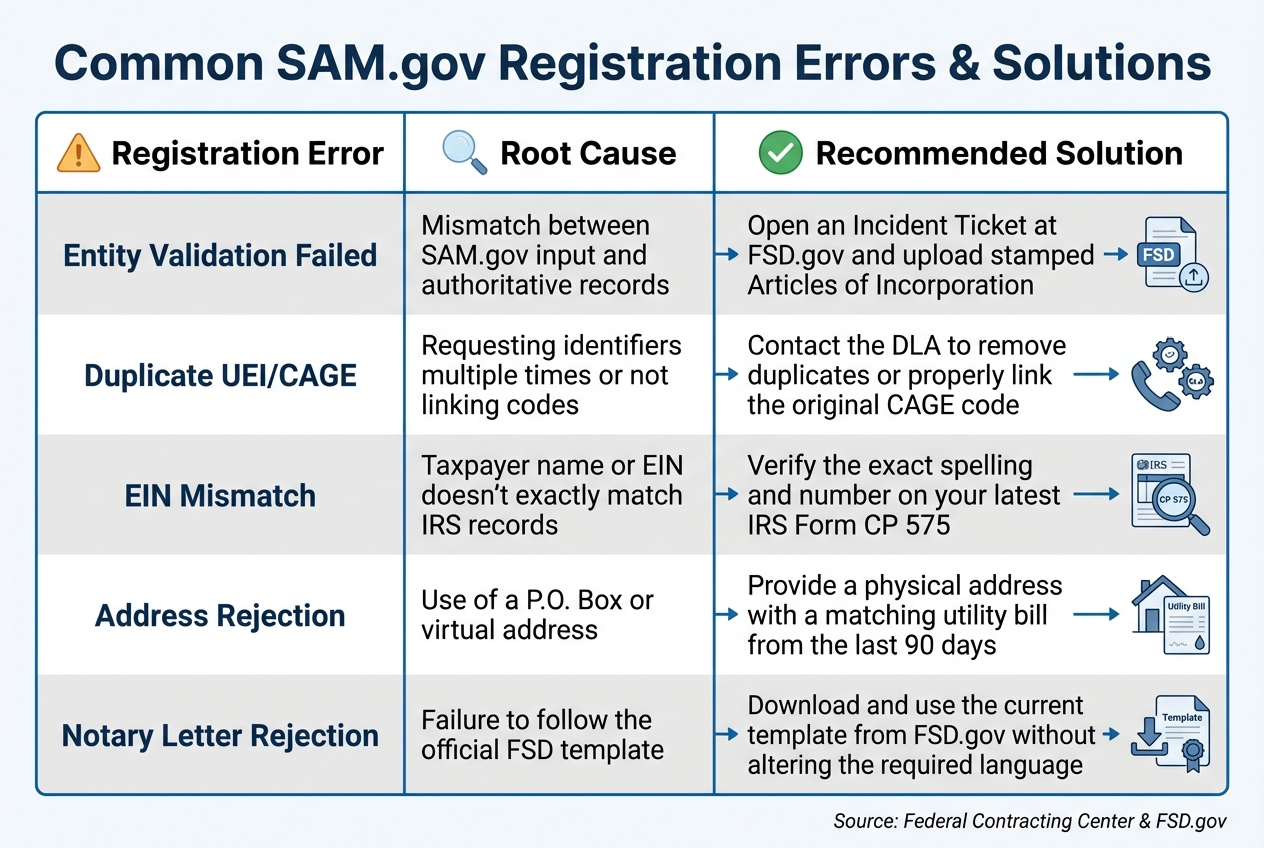

Common SAM.gov Registration Errors and Solutions for GSA Vendors

Getting registered on SAM.gov is often the first major obstacle for businesses aiming to secure GSA contracts. In April 2022, the system replaced the DUNS number with the government-owned Unique Entity Identifier (UEI), introducing a new validation process that cross-checks authoritative databases like Secretary of State filings and postal records. While the official timeline for approval is 10 to 15 business days, errors or missing information can stretch the process to 3–4 weeks – or even months in more complex cases.

Common SAM.gov Registration Errors

The Entity Validation Service (EVS) plays a key role in the registration process, but it’s also a frequent source of headaches. This algorithm requires an exact match – character-for-character – with authoritative records. Even small discrepancies, like using "and" instead of "&", can trigger a "No Match Found" error. Another common issue, known as the "Suite Number Paradox," happens when EVS strips suite numbers from addresses, potentially flagging your business as a duplicate if another entity shares the same street address.

"SAM.gov says ‘No Match Found.’ … This is the single most common ‘hard stop’ new SAM registrants face. It isn’t just a glitch. It is a structural feature of the new Entity Validation Service (EVS)." – Federal Contracting Center

Newly incorporated businesses might face delays due to data latency, as their records might not yet appear in the databases SAM.gov queries. Using a P.O. Box instead of a physical address or submitting screenshots instead of proper PDF scans of official documents are also common pitfalls that lead to automatic rejections. These errors often result in prolonged review times, adding more frustration to the process.

Long Review and Approval Times

If automated validation fails, you’ll need to open an "Incident Ticket" on FSD.gov to request a manual review by an EVS agent. However, this process can be slow, and missed deadlines can force you to start over. For instance, if you don’t respond to agent requests within five business days, your ticket will automatically close, requiring you to begin the process again.

"Once a red flag goes up, you’re no longer on a predictable timeline." – USFCR Academy

To avoid these setbacks, being prepared and responding promptly is essential.

How to Speed Up the Process

Start by double-checking that your Legal Business Name and Physical Address match exactly with what’s listed on IRS Form CP 575 and Secretary of State records. Pay close attention to punctuation and spacing. Have the necessary documents ready ahead of time, such as PDF scans (not screenshots) of stamped Articles of Incorporation, utility bills from the past three months, or bank statements with header details intact.

Stay proactive by checking your email and SAM.gov daily to ensure you don’t miss any deadlines. Download the official "Entity Registration Checklist" from SAM.gov to verify you’ve gathered all required information before starting the process. For additional support, APEX Accelerators (formerly PTACs) offer expert guidance to help you navigate registration issues. Lastly, remember that registrations must be renewed every 365 days. Set reminders to start the renewal process at least 60 days before your expiration date to avoid disruptions.

Overcoming these registration challenges is crucial for moving forward in the GSA vendor registration process and securing federal contracts.

| Common Registration Error | Root Cause | Recommended Solution |

|---|---|---|

| Entity Validation Failed | Mismatch between SAM.gov input and authoritative records | Open an Incident Ticket at FSD.gov and upload stamped Articles of Incorporation |

| Duplicate UEI/CAGE | Requesting identifiers multiple times or not linking codes | Contact the DLA to remove duplicates or properly link the original CAGE code |

| EIN Mismatch | Taxpayer name or EIN doesn’t exactly match IRS records | Verify the exact spelling and number on your latest IRS Form CP 575 |

| Address Rejection | Use of a P.O. Box or virtual address | Provide a physical address with a matching utility bill from the last 90 days |

| Notary Letter Rejection | Failure to follow the official FSD template | Download and use the current template from FSD.gov without altering the required language |

Challenge 2: Missing or Incorrect Documentation

Once you’ve completed your SAM.gov registration, the next big challenge is ensuring your documentation is accurate and complete. Missing or incorrect documents are one of the top reasons applications get rejected during GSA vendor registration. If your submission lacks any required documents listed in the MAS Solicitation, the Contracting Officer (CO) will have to pause the review process to request the missing pieces. This delay can add weeks – or even months – to your timeline. Having a clear and thorough checklist is the best way to make sure your documents meet GSA’s requirements before you hit submit.

Common Documentation Errors

Mistakes in documentation often fall into four categories: administrative, financial, technical, and pricing. Let’s break these down.

- Administrative Errors: Double-check that all certifications are up to date. For example, mandatory training must be completed by a company officer – like your President, VP, or CEO – before starting the eOffer process.

- Financial Gaps: GSA requires two years of balance sheets and income statements. If your financials show a net loss, you’ll need to explain why – whether it’s due to investments in R&D or expanding into new markets. Failing to address this could lead the CO to question your financial stability. Missing bank reference letters or incomplete profit and loss statements are also common reasons for delays.

- Technical Issues: Incomplete narratives on corporate experience or quality control can lead to rejection. As Jen Camp, Proposal Writer at Winvale, points out:

"GSA’s goal is to determine whether your company is a good fit for the proposed scope of work, you should provide comprehensive technical detail when answering the prompts for the technical section".

- Pricing Errors: Your pricing documents must include a commercial pricelist, a proposed Economic Price Adjustment (EPA) method, and evidence – like market research or prior sales data – that shows your pricing is "fair and reasonable".

- NAICS Code Mismatches: Be sure the NAICS codes in your SAM.gov account align with the SINs in your proposal. Any inconsistencies here can lead to rejection.

Creating a Detailed Documentation Checklist

The best way to avoid these pitfalls is by building a thorough checklist based on the MAS Solicitation and Roadmap. Here’s what to include:

- Entity Identification Documents: Ensure your Unique Entity Identifier (UEI) from SAM.gov, Taxpayer Identification Number (TIN), and CAGE or NCAGE codes are accurate and up to date. You’ll also need your banking information for Electronic Funds Transfer (EFT) and documentation for any socioeconomic certifications, such as 8(a), HUBZone, Woman-Owned Small Business (WOSB), or Service-Disabled Veteran-Owned Small Business (SDVOSB) status.

- Letter of Supply (LoS): If you’re not the manufacturer of the products you’re offering, you’ll need a Letter of Supply from your authorized suppliers. This document must be on official letterhead, signed by authorized representatives from both companies, dated within the last 12 months, and reference the correct MAS Solicitation number. It should also specify the brand or manufacturer of the products being supplied.

- Financial Records: Prepare two years of balance sheets and income statements. If your financials show a net loss, include a written explanation (e.g., startup costs or market expansion). This proactive step demonstrates financial responsibility and can help avoid automatic rejection.

- Submission Standards: Upload official documents as PDF scans – not screenshots or photos. Make sure everything is signed, current, and complete.

- TAA Compliance: Confirm Trade Agreements Act (TAA) compliance early. All items must be manufactured or "substantially transformed" in the U.S. or a TAA-designated country.

The timeline for securing a GSA Schedule contract typically ranges from 3 to 6 months. However, errors in your documentation can extend this significantly. By creating a detailed checklist and carefully reviewing every document before submission, you can avoid unnecessary delays and keep your application process on track.

Challenge 3: Trade Agreements Act (TAA) Non-Compliance

Ensuring your products comply with the Trade Agreements Act (TAA) is critical. Falling short of these requirements can lead to severe consequences, including the termination of your contract, exclusion from future government opportunities, and even legal action under the False Claims Act. The penalties are steep, and the General Services Administration (GSA) takes this matter seriously. Using automated review processes several times a year, the GSA identifies and removes non-compliant products from GSA Advantage! based on data from the Verified Products Portal and trusted distributors. If your products are found non-compliant, your contract could be canceled.

What TAA Compliance Means

Under TAA regulations (19 U.S.C. § 2501–2581), products must either be fully made in or undergo substantial transformation in the United States or a designated country. Substantial transformation means that at least 50% of the product’s production value or essential functional changes must occur in a compliant country. This rule applies not only to physical goods but also to software and the labor used in services.

Countries such as China, India, Russia, Malaysia, Pakistan, Indonesia, and Vietnam are not TAA-compliant. If your products originate from these nations, you must prove that substantial transformation took place in a designated country. This verification process isn’t a one-time task – it requires ongoing checks to maintain compliance and protect your contract.

Checking Product Catalogs for Compliance

Once you understand TAA requirements, the next step is to ensure your product catalog aligns with them. Regular verification is essential. The GSA Vendor Support Center emphasizes this point:

"It is a good practice to periodically review the country of origin of products offered on your GSA contract, as manufacturers sometimes change their manufacturing points".

To stay compliant, check the manufacturing origin of each item against the current TAA list in FAR Part 25. If your products are assembled using parts from non-TAA-compliant countries, maintain detailed documentation of each component’s origin and the transformation process. Consider requiring your suppliers to provide written certifications confirming their products meet TAA standards.

If a product is flagged and removed during an automated review, you have 30 days to present evidence of compliance to your Contracting Officer, which may allow the product to be reinstated. However, repeated violations can lead to stricter actions. The GSA also suppresses high-risk products, such as those from banned Chinese telecommunications companies, in accordance with FAR Subpart 4.21. To avoid issues, regularly audit your GSA Advantage! product listings and ensure all origin data is accurate and up to date. Consistent auditing, paired with thorough documentation, helps maintain compliance and safeguards your contract.

Challenge 4: Financial Stability and Credit History Issues

When it comes to securing a successful GSA application, financial stability is just as crucial as proper registration and documentation. The GSA evaluates your ability to manage federal contracts and meet long-term commitments, making solid financials a non-negotiable requirement. Weak financial records, irregular revenue streams, or excessive debt are red flags that can lead to rejection. To assess your financial health, reviewers scrutinize key metrics like the Debt-to-Equity ratio (ideally below 0.7) and the Current Ratio (greater than 1.0), ensuring your business can meet its contractual obligations. Pamela Pamintuan, Senior Contracts Manager at Road Map Consulting, emphasizes:

"GSA wants to see that you’re financially stable. If your financial statements show losses, inconsistent revenue, or high debt, you’ll struggle to qualify".

Addressing these issues proactively is essential before submitting your application.

Common Financial Red Flags

GSA reviewers are trained to spot signs that a business might struggle with the demands of long-term government contracts. Here are some of the most common issues that raise concerns:

- Negative cash flow: Indicates difficulty in covering operational costs while waiting for government payments.

- Bankruptcy history: Requires full disclosure along with proof of current financial stability.

- High Debt-to-Equity ratios: Suggests the business is overleveraged and may lack the resources to handle large contracts.

- Pending litigation, tax issues, or liens: Undermine trust in your reliability and financial health.

Michael Perch, CEO of Road Map Consulting, sums it up well:

"The strongest applications usually look boring – in a good way! Financials are organized. Sales history is easy to follow… When everything is clean and consistent, reviewers have fewer reasons to pause or question readiness".

How to Demonstrate Financial Stability

To address these red flags and strengthen your application, it’s essential to take deliberate steps to bolster your financial profile:

- Work with an accountant: Accurate financial statements are critical, especially if you’re dealing with low cash flow.

- Separate finances: Use accounting systems that distinguish government contracts from commercial work and keep personal finances separate from business accounts.

- Provide robust documentation: Submit two years of financial records, including Balance Sheets, Profit & Loss, and Cash Flow statements, along with proof of at least $25,000 in annual revenue.

- Reduce debt: Lower your Debt-to-Equity ratio by paying down liabilities or increasing equity.

- Build cash reserves: This ensures you can handle large government orders even if payments are delayed.

- Resolve legal and tax issues: Settle any pending litigation, tax problems, or liens before applying.

- Strengthen your application with extras: Documents like bank reference letters or irrevocable letters of credit can further demonstrate your financial reliability.

For IT firms, the GSA Startup Springboard program provides an alternative path. It allows companies to qualify without a full two-year financial history, provided they can demonstrate mature pricing models and technical competence. However, this route comes with heightened scrutiny of contract management capabilities.

Once your financial stability is in order, the focus shifts to regulatory compliance and accurate code selection, the next hurdles in the GSA application process.

Challenge 5: Regulatory Compliance and SIN Code Errors

Navigating regulatory compliance and selecting the correct SIN (Special Item Number) can be tricky but are absolutely essential for a successful GSA registration. Even small errors in these areas can derail your application. As Federal Filing puts it:

"Compliance is non-negotiable in federal contracting. Failing to adhere to evolving regulations can lead to penalties, disqualification, and loss of business reputation".

The stakes are high. Around 20% of reviewed GSA contracts are flagged for pricing discrepancies or failing to comply with Most Favored Customer policies. Getting a handle on these requirements before submitting your application is non-negotiable.

Aligning NAICS and SIN Codes

The GSA Multiple Award Schedule categorizes offerings into 12 large groups, which are further divided into subcategories and about 315 unique SINs. These SINs are the key to determining the government Requests for Quotes (RFQs) you’ll receive through the eBuy system. Jen Camp, a Proposal Writer at Winvale, underscores the importance of proper alignment:

"The NAICS Codes you register on your SAM account must align with the Special Item Numbers (SINs) you include on your contract proposal".

If your NAICS codes in SAM.gov don’t match the SINs in your proposal, expect delays – or worse, rejection. It’s also worth noting that SBA regulation 13 C.F.R. § 121.402(b) bans the use of Wholesale Trade (42) and Retail Trade (44, 45) NAICS codes in federal contracting. To avoid such pitfalls, verify your selections through the GSA eLibrary and back up every SIN with current invoices and Statements of Work. Beyond code alignment, ensuring compliance with federal legal standards is equally crucial.

Staying Compliant with Federal Regulations

Maintaining a clean legal record is critical for GSA approval. Vendors must show they comply with federal labor laws and avoid any debarment issues. The GSA closely monitors contractors for violations, including providing unqualified personnel. For example, if your contract specifies a Network Engineer with a bachelor’s degree and ten years of experience, failing to meet those qualifications violates the agreement.

Additionally, Section 889 regulations automatically block products from banned entities, particularly Chinese companies linked to unauthorized surveillance. The GSA employs an automated "Robomod" system several times a year to identify and remove non-compliant products from GSA Advantage!.

To stay eligible, keep your SAM registration current by renewing it annually. Missing a renewal could mean losing access to opportunities in the $45 billion annual federal market. Set reminders 60, 30, and 15 days before expiration to ensure you don’t miss critical deadlines.

Getting Help from GSA Registration Experts

Navigating the GSA vendor registration process can feel like a maze, especially with its strict compliance requirements, detailed documentation, and ever-changing regulations. For many small businesses, this often leads to frustrating delays or multiple resubmissions. But with the right expertise, the process can become much smoother, saving both time and effort.

How GSA Focus Simplifies the Process

Given the challenges of managing documentation, maintaining financial stability, and adhering to compliance rules, having expert assistance is invaluable. That’s where GSA Focus steps in, offering a streamlined, all-in-one solution tailored for small businesses. Their team takes care of the heavy lifting – from assembling a complete and compliant documentation package to ensuring every requirement is met with precision.

Their services cover critical tasks like verifying Trade Agreements Act (TAA) compliance, aligning NAICS codes with the correct SINs, and fine-tuning your pricing structure to meet federal standards. On top of that, GSA Focus provides hands-on support during negotiations with GSA contracting officers – a crucial advantage if you’re unsure about federal pricing norms.

With a proven 98% success rate and a refund guarantee, GSA Focus has earned a reputation for helping businesses navigate the registration process efficiently. Their secure online platform makes it easy to upload documents, while their team remains available for ongoing guidance throughout your application journey.

Why Expert Support Matters

By entrusting your GSA registration to seasoned professionals, you can focus on growing your business instead of wrestling with compliance and paperwork. These experts manage the intricate details, from documentation to negotiations, ensuring the process is handled quickly and accurately. Instead of spending months trying to figure it all out on your own, you can leave the complexities to the pros and keep your attention on what you do best – running your business.

Conclusion

Registering as a GSA vendor comes with its fair share of challenges, as we’ve outlined. These hurdles can not only complicate your application but also stretch out the timeline significantly.

The key to navigating these challenges lies in thorough preparation. As the GSA Vendor Support Center emphasizes:

"Complete, well-documented offers with competitive pricing are easier and faster to review".

Ensuring your documentation is complete and compliant before submission is critical. By taking the time to organize everything properly – and even seeking expert guidance if needed – you can avoid unnecessary delays and set yourself up for a more efficient registration process.

FAQs

What are the biggest mistakes businesses make during SAM.gov registration for GSA contracts?

One frequent misstep businesses encounter is assuming that simply creating a user account on SAM.gov means their registration is complete. The truth is, registration is tied to the specific entity and requires filling out all necessary sections, including submitting detailed and accurate business information.

Another common problem arises with the CAGE code – either failing to obtain it properly or neglecting to update it. This code plays a key role in validation and eligibility. Similarly, overlooking updates to critical business details, like a company name or address change, can cause delays or even result in registration rejection. These oversights can slow down the process and block access to federal contracting opportunities, making thorough preparation and precision absolutely crucial.

What steps can businesses take to ensure their products comply with TAA requirements?

To meet TAA (Trade Agreements Act) requirements, businesses need to ensure their products are either manufactured or significantly transformed in the United States or an approved TAA-designated country. This is a key condition for GSA Schedule contracts and aligns with federal procurement guidelines.

Staying compliant means keeping detailed records, such as supply chain documentation or manufacturing certifications, to confirm the product’s origin and transformation process. Falling short of these requirements can lead to rejected proposals or even contract termination. That’s why understanding TAA standards and maintaining meticulous documentation is so crucial.

By staying on top of record-keeping and verifying product origins, businesses can steer clear of compliance setbacks and approach the GSA registration and contracting process with confidence.

Why is financial stability important for registering as a GSA vendor?

Financial stability plays a key role in GSA vendor registration because it proves your business can handle the responsibilities tied to federal contracts. The GSA asks vendors to provide financial documents like profit and loss statements and balance sheets to confirm they can meet their commitments.

By showcasing solid financial health, you build trust with the GSA, signaling that your business is a reliable partner – an essential factor for securing and keeping a GSA Schedule Contract.

Related Blog Posts

- Ultimate Guide to GSA Proposal Documents

- How to Prepare a GSA Schedule Proposal

- Top Reasons GSA Applications Get Rejected

- How Long Does It Take to Get a GSA Contract?