Subcontracting goals and subcontracting objectives are two distinct but interconnected aspects of federal contracting compliance under GSA Schedules. Here’s what you need to know:

- Subcontracting Goals: These are specific, measurable targets (percentages or dollar amounts) for allocating subcontracting dollars to small business categories like Women-Owned, HUBZone, and Service-Disabled Veteran-Owned businesses. For example, FY 2025 goals include 23% for small businesses overall.

- Subcontracting Objectives: These focus on the actions contractors must take to meet those numerical goals, such as conducting outreach, maintaining records, and submitting timely reports. Compliance hinges on demonstrating a "good faith effort", even if all numerical targets aren’t met.

Failing to meet goals or objectives can lead to penalties like liquidated damages, poor performance ratings, or even material breaches of contract. Understanding the difference between these terms ensures contractors can meet federal requirements effectively.

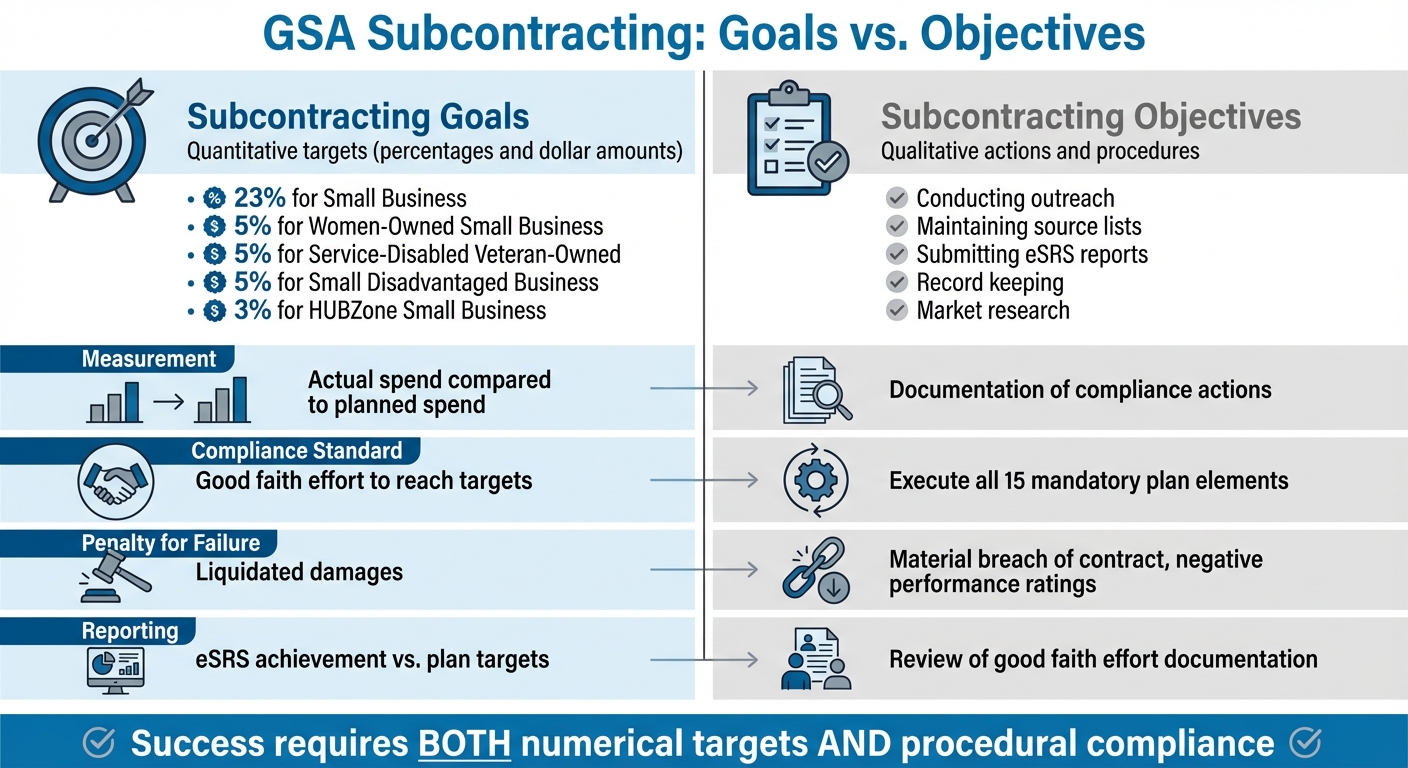

Quick Comparison:

| Feature | Subcontracting Goals | Subcontracting Objectives |

|---|---|---|

| Definition | Quantitative targets (percentages) | Qualitative actions and procedures |

| Examples | 23% for Small Business | Outreach, reporting, maintaining records |

| Compliance | Based on good faith effort | Based on procedural adherence |

| Penalties | Liquidated damages | Breach of contract, negative performance |

GSA Subcontracting Goals vs Objectives Comparison Chart

What Are Subcontracting Goals?

Definition and Main Features

Subcontracting goals are commitments that federal contractors make to allocate a specific percentage of their subcontracting dollars to various types of small businesses. These goals are expressed both as dollar amounts and percentages.

For instance, if your GSA contract includes $1,000,000 in planned subcontracting work and you commit to a 23% small business goal, this means you’re pledging $230,000 to small business subcontractors. These commitments are documented in a formal subcontracting plan, serving as benchmarks to ensure compliance.

Federal regulations shape these benchmarks, ensuring small businesses have the “maximum practicable opportunity” to participate in federal contracts. This policy is part of a broader effort to support small business communities, fostering economic and social benefits nationwide.

Federal Rules That Require Goals

The requirement for subcontracting goals is rooted in Section 8(d) of the Small Business Act (15 U.S.C. 637(d)), which lays the legal groundwork. The Federal Acquisition Regulation (FAR) implements this through Subpart 19.7, detailing the Small Business Subcontracting Program.

FAR 19.702 mandates subcontracting plans for contracts exceeding $900,000 – or $2,000,000 for construction projects – with clearly defined goals. FAR 19.704 outlines the 15 essential elements that these plans must include, such as separate percentage goals for various small business categories. For GSA contracts, GSAM 519.704 adds that goals must be expressed as total subcontract dollars and percentages of those dollars, but they don’t need to be listed as percentages of the total contract value.

Additionally, FAR clauses 52.219-8 and 52.219-9 legally bind contractors to these commitments, ensuring they meet their obligations and report progress. These regulations establish the framework contractors must follow to set and meet their subcontracting goals.

Small Business Categories Included in Goals

Subcontracting goals are designed to include a range of small business sectors, ensuring diverse participation. Contractors are required to set targets for six specific categories of small businesses, each with its own percentage goal.

| Small Business Category | Key Points |

|---|---|

| Small Business (SB) | Includes Alaska Native Corporations (ANCs) and Indian tribes |

| Small Disadvantaged Business (SDB) | Includes ANCs and Indian tribes |

| Women-Owned Small Business (WOSB) | Requires a specific percentage goal |

| Service-Disabled Veteran-Owned Small Business (SDVOSB) | Requires a specific percentage goal |

| Veteran-Owned Small Business (VOSB) | Requires a specific percentage goal |

| HUBZone Small Business | Must be SBA-certified to count toward goals |

When setting these goals, contractors must indicate whether indirect costs are included. This level of detail helps contracting officers assess the feasibility of the proposed goals based on the scope of work and the availability of qualified subcontractors.

What Are Subcontracting Objectives?

Definition and Main Features

Subcontracting objectives outline the steps contractors must take to meet their numerical targets. A critical part of these objectives is the requirement to demonstrate a "good faith effort", which involves taking documented, proactive steps to adhere to your subcontracting plan. Federal regulations acknowledge that external factors may sometimes prevent contractors from hitting their exact targets. As FAR 19.705-7 explains:

The fact that the contractor failed to meet its subcontracting goals does not, in and of itself, constitute a failure to make a good faith effort.

This means contracting officers assess your overall efforts and documentation, rather than focusing solely on whether your final numbers align with your original goals. For instance, if you can show that you actively worked with qualified small businesses but faced obstacles like limited supplier availability or unreasonable costs, those shortfalls may be justified.

Good Faith Effort Requirements

To meet the "good faith effort" standard, contractors need to back up their actions with clear, measurable documentation. This includes practical steps such as:

- Conducting market research using tools like SAM and posting subcontracting opportunities on SBA’s SUBNet.

- Dividing work into manageable units so small businesses can realistically participate.

- Engaging small businesses early by sharing clear project plans and specifications.

Beyond outreach, providing operational support can strengthen your case. For example, helping small business subcontractors secure bonding, access credit lines, or obtain necessary equipment shows a commitment to their success. Participating in formal mentor-protégé programs is another strong indicator of good faith.

Accurate and timely reporting is equally important. As GSAM 519.705-4 highlights:

Timely, accurate reporting demonstrates a contractor’s commitment to subcontracting responsibilities.

Contractors must submit Individual Subcontract Reports twice a year (within 30 days after each reporting period) and an annual Summary Subcontract Report by the specified deadline.

Actions that undermine these efforts, however, can be seen as a failure to make a good faith effort. Examples include falsifying subcontracting records, implementing policies that conflict with the subcontracting plan, failing to pay small business subcontractors as agreed, or not appointing a designated official to oversee the subcontracting program. These missteps can lead to stricter compliance monitoring.

How Compliance Is Monitored

Once these efforts are in place, compliance is verified through regular monitoring. Contracting officers and administrative contracting officers review performance by analyzing reports submitted via the Electronic Subcontracting Reporting System, examining past performance records, and conducting formal subcontracting compliance reviews. They compare your actual results against your stated goals and consider any documented reasons for falling short.

The Small Business Administration (SBA) also plays a role in monitoring. Commercial Market Representatives from the SBA review contractor performance, assess compliance, and flag deficiencies that need correction. In fiscal year 2024, the SBA increased its compliance reviews to 17, with plans to expand further in FY2025, following recommendations from the Government Accountability Office.

If a contracting officer concludes that you failed to make a good faith effort, you’ll receive a notice and have 15 working days to provide evidence of your efforts before a final decision is made. A failure to meet this standard can be treated as a material breach of contract, leading to liquidated damages equal to the dollar shortfall for each unmet subcontracting goal. Additionally, poor ratings in the Contractor Performance Assessment Reporting System could hurt your chances of securing future federal contracts.

Main Differences Between Goals and Objectives

This section breaks down the distinctions between goals and objectives, emphasizing their unique roles. While they might seem interchangeable, they serve different purposes. Goals are the measurable targets – specific percentages or dollar amounts allocated for spending with small businesses. On the other hand, objectives are the actionable steps required to achieve those goals, such as conducting outreach, keeping records, and submitting reports on time.

The compliance process further separates these two. Numerical goals are assessed based on documented efforts to achieve them, not solely on whether the targets were met. This is clarified in GSAM 519.705-4(c), which states:

Actions taken in accordance with the plan mean more than whether or not the offeror met the goals established in the plan. Contractors are required to make a good faith effort.

For instance, even if you fall short of the 5% Women-Owned Small Business goal, you can still be compliant if you’ve documented your outreach efforts and maintained accurate records. On the flip side, procedural objectives are stricter. Missing a reporting deadline in the Electronic Subcontracting Reporting System (eSRS) or failing to maintain proper documentation can lead to non-compliance – even if your numerical targets are met. This distinction is critical for understanding potential penalties and compliance requirements.

The penalties also differ. Failure to meet numerical goals could result in liquidated damages, while not following procedural objectives might lead to a material breach of contract and negatively affect performance ratings.

Goals vs. Objectives Comparison Table

| Feature | Subcontracting Goals | Subcontracting Objectives |

|---|---|---|

| What They Are | Quantitative targets (percentages and amounts) | Qualitative actions and procedures |

| Examples | 23% for Small Business; 5% for Women-Owned Small Business | Conducting outreach, maintaining source lists, submitting eSRS reports |

| How They’re Measured | Actual spend compared to planned spend | Documentation of outreach, record keeping, and compliance actions |

| When You’re Compliant | When you demonstrate a good faith effort to reach targets | When you execute all 15 mandatory plan elements |

| Penalty for Failure | May result in liquidated damages | Constitutes a material breach of contract |

| Reporting Tool | eSRS achievement versus plan targets | Review of good faith effort documentation |

These differences highlight the importance of balancing both measurable goals and procedural diligence. Simply meeting your numerical targets without adhering to required procedures won’t shield you from consequences. Likewise, following the steps without genuine efforts to achieve your targets isn’t enough. Success requires both solid targets and thorough documentation.

How Small Businesses Can Meet Goals and Objectives

Achieving subcontracting goals and objectives starts with setting practical targets and keeping detailed records of your efforts to engage with small businesses. Here’s how you can approach this effectively.

Setting Realistic Goals

Start by diving into thorough market research before drafting your subcontracting plan. Tools like DSBS and SUBNet are great for identifying qualified small business sources. This groundwork helps you set targets that align with the supplies and services you plan to subcontract.

While contracting officers won’t specify exact percentages, they may provide historical data or reference government-wide goals. For example, in FY 2025, the GSA’s subcontracting goals include a 23% target for small businesses overall, with 5% each for Small Disadvantaged, Women-Owned, and Service-Disabled Veteran-Owned Small Businesses, and 3% for HUBZone small businesses. Your plan should explain how you developed these targets, including whether indirect costs were considered and how you calculated the proportionate share of work.

Before locking in your targets, reach out to local resources to find qualified subcontractors. This proactive effort shows you’ve identified the "maximum practicable opportunities" for small businesses based on your acquisition needs. After setting your goals, make sure to document every step you take to achieve them.

Keeping Records of Good Faith Efforts

Keeping detailed records is essential to prove compliance. Track every effort to identify small business sources, including maintaining source lists and logs of organizations you’ve contacted. These could include trade associations, business development centers, local chambers of commerce, and minority business offices.

When submitting reports through the Electronic Subcontracting Reporting System (eSRS), use the "Remarks" section to highlight any new actions taken to boost small business participation, especially if your subcontracting numbers fall short of your targets. If you don’t meet your goals, provide a written explanation supported by evidence of your outreach and efforts to award subcontracts.

Make sure to submit Individual Subcontract Reports on time – typically by May 15 and November 14 – and file the Summary Subcontract Report by November 14. Missing these deadlines could be seen as a lack of good faith effort. With the SBA increasing subcontracting compliance reviews from 6 in FY 2022 to 17 in FY 2024, the emphasis on oversight is growing. For complex issues, seeking professional guidance can make the process smoother.

Getting Professional Help

Given the complexity of requirements and the need to demonstrate good faith efforts, professional assistance can be invaluable. Small Business Technical Advisors (SBTAs) and Procurement Center Representatives (PCRs) can assist during the pre-award phase, helping you set realistic goals based on market research and past performance.

GSA Focus offers expert support to ensure your subcontracting plans meet all requirements while clearly documenting your efforts. Since subcontracting achievements account for 20% of a federal agency’s Small Business Procurement Scorecard grade, having expert guidance can protect your current contract performance and boost your chances for future opportunities.

Conclusion

For federal contractors working under GSA Schedule contracts, understanding the distinction between goals and objectives is essential. Goals represent the numerical targets – specific dollar amounts and percentages – for small business participation. Objectives, on the other hand, are the actionable steps, like market research, source listing, and outreach, that are taken to meet those targets.

Compliance requires more than just hitting the numbers; it demands thorough documentation of your efforts. As outlined in GSAM 519.705-4:

Actions taken in accordance with the plan mean more than whether or not the offeror met the goals established in the plan. Contractors are required to make a good faith effort.

This means that contracting officers don’t just evaluate whether you met the targets – they also assess whether your documented actions align with your stated objectives. For instance, when setting FY 2025 targets, they’ll look at how well previous objectives were achieved and whether reports were submitted on time, emphasizing the connection between numerical benchmarks and procedural compliance.

Neglecting either aspect – goals or objectives – can lead to significant consequences. Maintaining detailed records of your market research, outreach efforts, and decision-making processes is key. Not only does solid documentation protect you from penalties, but it also strengthens your position for future contracts. Use these insights to refine your planning and ensure compliance as you prepare for upcoming opportunities.

FAQs

What happens if a contractor doesn’t meet their subcontracting goals or objectives?

If a contractor does not fulfill their subcontracting goals or objectives, they could face financial penalties. Specifically, if they fail to make a genuine effort to follow their subcontracting plan, the government has the authority to impose liquidated damages – a set financial penalty designed to discourage non-compliance.

Contracting officers assess whether the contractor has made a sincere attempt to meet their goals. Simply missing a goal does not automatically result in penalties, but failing to demonstrate good faith compliance can lead to financial liability. To avoid these outcomes, contractors must remain transparent and committed to their subcontracting plans.

What steps can contractors take to show they’ve made a ‘good faith effort’ toward subcontracting objectives?

Contractors can show a good faith effort by actively striving to meet the objectives outlined in their subcontracting plans. This means taking concrete steps like identifying opportunities for small businesses – including those owned by women, veterans, or located in HUBZone areas – through outreach programs, thorough market research, and maintaining open lines of communication.

To stay compliant, it’s essential for contractors to document their actions, monitor progress, and tweak strategies when necessary. Regularly comparing subcontracting activities against established goals not only highlights dedication but also promotes transparency and accountability. Consistent, proactive efforts are crucial for meeting federal standards and fulfilling contractual obligations.

What is the difference between subcontracting goals and objectives in federal contracting?

Subcontracting goals refer to the specific, measurable benchmarks set to ensure that a portion of contract work is allocated to small businesses. This includes businesses in socio-economic categories such as women-owned, veteran-owned, and disadvantaged small businesses. These goals are typically expressed as percentages of the total subcontract dollars, helping to monitor compliance with federal policies aimed at increasing small business participation.

Objectives, however, focus on the strategies and actions contractors use to achieve these goals. They lay out methods like identifying small business partners, building strong collaborations, and adhering to federal regulations. Unlike goals, which are about hitting specific numerical targets, objectives emphasize the approach or process.

Simply put, goals define the what – the measurable outcomes – while objectives define the how – the strategies to get there. Together, they ensure that small businesses have meaningful opportunities in federal contracting.

Related Blog Posts

- Penalties for Subcontracting Plan Violations

- Why Subcontracting Plans Matter for GSA Contracts

- GSA Subcontracting Plans: Key Requirements

- Why Subcontracting Reports Matter for GSA Contracts