The Buy American Act (BAA) is a key regulation for businesses working with GSA Multiple Award Schedules (MAS). It prioritizes U.S.-made products in federal procurement but includes exceptions for certain scenarios. This guide explains the BAA’s rules, thresholds, and exceptions, helping businesses maintain compliance and take advantage of opportunities.

Key Takeaways:

- BAA Basics: Requires products to be manufactured in the U.S. with specific domestic content thresholds (65% starting 2024, increasing to 75% by 2029).

- Exceptions: Includes waivers for nonavailability, unreasonable costs, and IT products. COTS items are exempt from the domestic content test unless primarily made of iron or steel.

- BAA vs. TAA: TAA can waive BAA requirements for products from designated countries, applying to higher-value contracts ($183,000+ for supplies).

- Compliance: Maintain proper documentation at all stages – pre-award, post-award, and order-level – to manage BAA exceptions effectively.

Understanding these rules and exceptions is crucial for businesses to stay competitive in the federal marketplace while ensuring compliance.

The Buy American Act and Trade Agreements Act: What Government Contractors Need to Know

Buy American Act Requirements for GSA Schedules

The Buy American Act (BAA) sets clear guidelines for domestic products and establishes evaluation criteria for contracts under GSA Schedules.

Key Definitions and Thresholds

To qualify as a domestic end product, an item must be manufactured in the United States and meet specific domestic content thresholds. For standard manufactured goods, the domestic content must be at least 65% for items delivered between 2024 and 2028. This requirement increases to 75% starting in 2029. When it comes to products primarily made of iron or steel, the rules are even stricter – foreign iron and steel components must account for less than 5% of the total cost.

A U.S.-made end product is defined as an item that is either mined, produced, or manufactured in the U.S., or one that undergoes substantial transformation in the U.S. into a completely new product. However, simply being made in the U.S. isn’t enough – it must also meet the domestic content requirements to qualify. These standards are crucial for compliance and maintaining competitive pricing on GSA Schedules.

One key exception is for Commercially Available Off-the-Shelf (COTS) items. The domestic content test does not apply to COTS items unless they are primarily made of iron or steel.

Now, let’s examine how these BAA requirements compare to the Trade Agreements Act (TAA) standards for GSA contracts.

BAA vs. TAA in GSA Contracts

When it comes to GSA Schedules, the BAA and TAA rules are mutually exclusive – only one applies to a specific contract, and the chosen rule extends to all individual orders under that contract, regardless of their value.

- BAA Thresholds: The BAA applies to supply contracts exceeding the micro-purchase threshold, which is typically $10,000.

- TAA Thresholds: The TAA, on the other hand, governs higher-value contracts, with a threshold of $183,000 for supplies and services.

The two acts also differ in how they evaluate products:

- BAA: Focuses on domestic content percentages. Only domestic products are given preferential treatment, with a price preference system that adds 20% to foreign offers when compared to large businesses and 30% when compared to small businesses.

- TAA: Relies on a substantial transformation test. It treats products from designated countries as equivalent to domestic products. However, it generally bans items from non-designated countries like China or India unless specific exceptions apply.

For small business set-asides, the TAA does not apply. This means that BAA requirements govern these contracts, even if their total value would normally fall under TAA rules. Small business contractors must therefore ensure compliance with BAA standards, regardless of the contract’s size or scope.

Common Buy American Act Exceptions

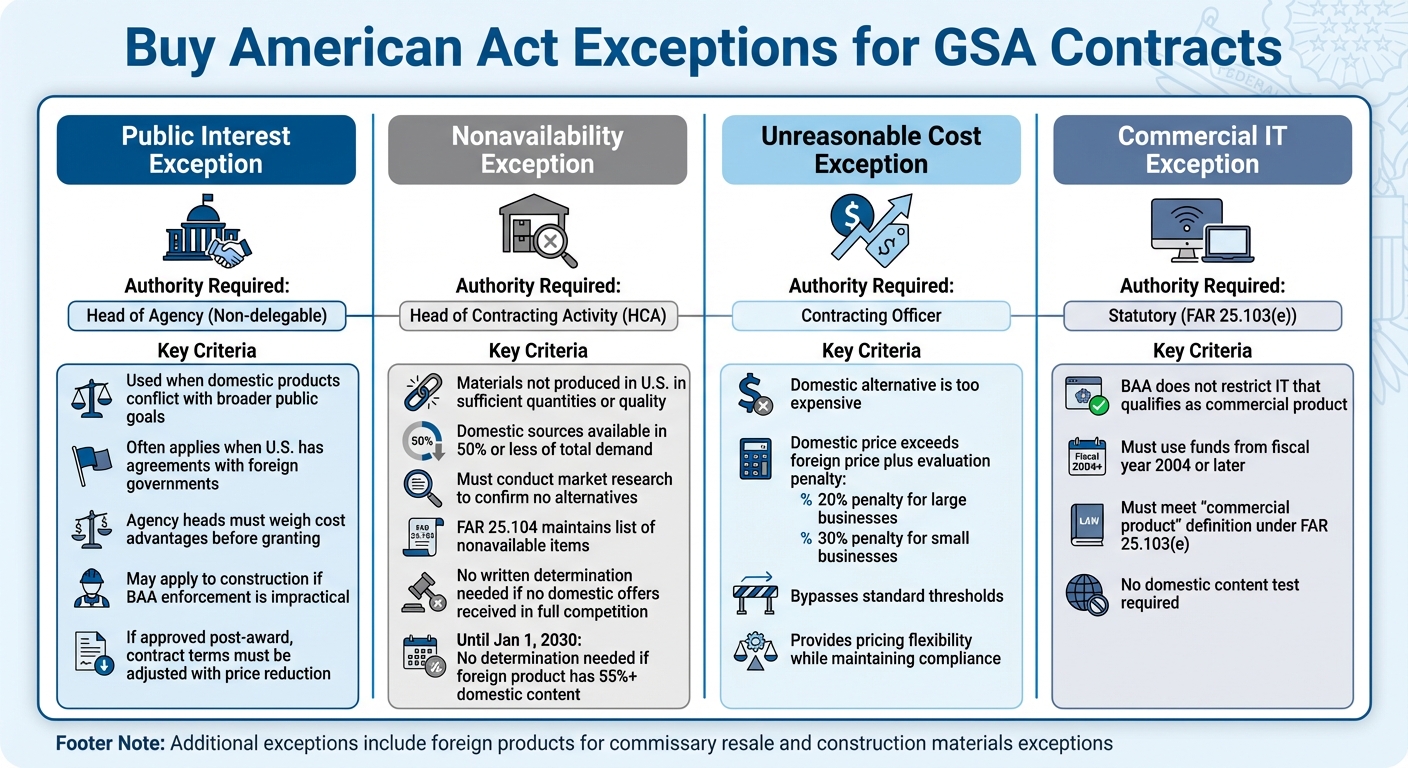

Buy American Act Exceptions: Types, Authority Requirements, and Key Criteria for GSA Contracts

The Buy American Act imposes strict rules on domestic content, but there are several exceptions that allow GSA Schedule contractors to include foreign-sourced products under certain conditions. For businesses with international supply chains or limited domestic sourcing options, understanding these exceptions is crucial. Below, we break down each exception to clarify their application within GSA contracts.

Public Interest Exceptions

The public interest exception can be used when prioritizing domestic products would conflict with broader public goals. This often comes into play when the U.S. Government has agreements with foreign governments. For GSA acquisitions, agency heads must weigh the cost advantages of foreign-sourced materials like steel, iron, or manufactured goods before granting this exception. In construction projects, this exception may apply if enforcing the Buy American Act is deemed impractical. If approved after a contract is awarded, the contracting officer must adjust the contract terms, including a price reduction.

Nonavailability and Unreasonable Cost Exceptions

The nonavailability exception applies when required materials or supplies are not produced in the U.S. in sufficient quantities or satisfactory quality. FAR 25.104 maintains a list of items classified as nonavailable, but agencies must still conduct market research to confirm no domestic alternatives exist. For GSA contracts, only the Head of the Contracting Activity (HCA) can approve individual nonavailability determinations, and this authority cannot be delegated. In cases where acquisitions involve full and open competition and no domestic offers are received, a written determination is not required. Additionally, until January 1, 2030, no formal determination is needed if a foreign product with over 55% domestic content is offered.

The unreasonable cost exception allows contracting officers to procure foreign products if the domestic alternative is too expensive. This exception bypasses standard thresholds when the domestic price exceeds the adjusted foreign price after applying the evaluation penalty (20% for large businesses and 30% for small businesses). These exceptions provide flexibility while maintaining compliance with Buy American Act principles.

Information Technology and Other Exceptions

The Buy American Act does not restrict the acquisition of information technology that qualifies as a commercial product, provided funds from fiscal year 2004 or later are used. To use this exception, ensure the IT product meets the "commercial product" definition under FAR 25.103(e). Other exceptions include foreign products purchased for resale in commissaries. For construction materials, exceptions related to public interest, nonavailability, unreasonable cost, and commercial IT apply to materials used in public buildings or works.

Below is a summary table highlighting the key criteria for each exception type:

| Exception Type | Authority Required (GSA) | Key Criteria |

|---|---|---|

| Public Interest | Head of Agency (Non-delegable) | Inconsistency with public interest or existing international agreements |

| Nonavailability | Head of Contracting Activity (HCA) | Domestic sources available in 50% or less of total demand |

| Unreasonable Cost | Contracting Officer | Domestic price exceeds foreign price plus 20% (large) or 30% (small) penalty |

| Commercial IT | Statutory (FAR 25.103(e)) | Must be a commercial product and use FY2004+ funds |

Managing BAA Exceptions Throughout the GSA MAS Lifecycle

Navigating the Buy American Act (BAA) exceptions isn’t just about understanding the rules – it’s about applying them effectively throughout the lifecycle of your GSA Multiple Award Schedule (MAS) contract. From the initial offer to post-award modifications and individual orders, staying compliant is key.

Pre-Award: Preparing Your Offer

Before submitting your offer, it’s important to identify which of your products qualify for BAA exceptions and document this thoroughly. Start by determining if your products fall under the Commercially Available Off-The-Shelf (COTS) category. This classification simplifies compliance by waiving the domestic content test, except for products primarily made of iron or steel. For products that aren’t COTS, ensure they meet the required domestic content thresholds.

If you’re offering commercial IT products, make sure to document their status early. These products are exempt from BAA restrictions if they qualify as commercial items. For products needing an individual nonavailability determination, conduct detailed market research before seeking approval from the Head of Contracting Activity (HCA) – this authority is not delegable for GSA contracts.

Keep in mind that acquisition rules are determined at the contract level. These rules apply to all orders under the contract, regardless of their dollar value. Once your offer is submitted, you’ll need to stay proactive in managing compliance as your contract progresses.

Post-Award: Managing Products and Modifications

After securing a compliant contract, managing modifications becomes a top priority. For starters, you’re required to execute GSA mass modifications within 90 days. These modifications often address updates to BAA/TAA clauses or other regulatory changes. Missing a modification means subsequent updates will include all previously unsigned changes.

When updating products, services, or pricing that could affect BAA compliance, use the eOffer/eMod system. For instance, if a product’s country of origin changes and no longer meets BAA exceptions, you must update your contract to reflect this change. After any catalog modification, submit updated electronic contract data to GSA Advantage! within 30 calendar days. Additionally, ensure you maintain current Letters of Supply for all COTS products, particularly when adding new manufacturers to your contract.

Your assigned Industrial Operations Analyst (IOA) can be a valuable resource for resolving compliance issues during modifications. For price reductions due to commercial pricing changes or discounts, notify your Contracting Officer within 15 days. If you anticipate nonavailability of an item affecting future acquisitions, provide supporting documentation to the Senior Procurement Executive (SPE) for potential inclusion on the FAR 25.104 nonavailability list.

Order-Level Compliance and Documentation

Once your contract is modified, the compliance framework extends to every individual order. Rules established at the contract level cascade down to all orders, regardless of their dollar value. This means even small-dollar transactions must follow the BAA exceptions outlined in your contract. When adding Order-Level Materials (OLMs) to a task or delivery order, ensure these items comply with the same terms and conditions as your master contract, including FAR 52.225-5 (Trade Agreements). Clearly label OLMs as items not currently on your MAS contract or BPA for compliance tracking purposes.

For GSA audits, maintain thorough ordering files. These should include quotes, communications, price reasonableness determinations, competition documentation or limited source justifications, and proof of compliance with MAS clauses and restrictions. Before proposing OLMs, double-check that your MAS contract includes the OLM SIN, as not all contracts have been updated to allow this flexibility.

Finally, for multi-year contracts, closely monitor delivery dates to ensure compliance with scheduled increases in domestic content thresholds. Even for items on the FAR 25.104 nonavailability list, agencies must still conduct market research to identify potential domestic sources before proceeding with acquisitions.

Practical Tips for Small Businesses Using BAA Exceptions

Structuring Product Lines for BAA Compliance

When it comes to aligning your product catalog with the Buy American Act (BAA), focusing on COTS (commercially available off-the-shelf) items can make life a lot easier. These products only need to be manufactured in the U.S., so there’s no need to calculate domestic component cost percentages. This approach not only simplifies compliance but also cuts down on the paperwork required during contract modifications.

For products that aren’t classified as COTS, ensure they meet the current domestic content thresholds. If your GSA contract spans into future periods, especially beyond 2029, double-check that your supply chain can handle the stricter thresholds that will apply to delivery dates in that timeframe.

If you’re dealing with information technology products, there’s good news: IT products classified as commercial items are exempt from the BAA. Just make sure your IT products meet the commercial item definition before submitting them, so you can take full advantage of this exception.

Additionally, consult FAR 25.104’s nonavailability list before pursuing individual exceptions. This list includes items like specific fibers, specialized spare parts for foreign equipment, and certain raw materials that are pre-approved as nonavailable. If your products incorporate these components, you can treat them as domestic in your calculations without needing further approvals.

By structuring your product lines with these strategies, you’ll be better positioned to manage your supply chain effectively – something we’ll dive into next.

Supply Chain and Sourcing Best Practices

Keep meticulous records. Document every cost associated with your components, including acquisition, transportation, and duties. These records are critical for GSA audits and for justifying domestic content percentages during contract modifications.

For products containing iron or steel components, the rules are even more stringent. Foreign iron and steel must account for less than 5% of the total component cost to qualify as domestic. Keep in mind that the COTS waiver doesn’t apply here, except for fasteners. Partner closely with your suppliers to monitor and reduce foreign content in these cases.

Small businesses have a pricing edge when competing against foreign offers. Contracting officers apply a 30% price evaluation factor to foreign bids, which gives you greater flexibility to price competitively with domestic products. However, even in small business set-asides, your product still needs to pass the domestic content test to qualify as a "domestic end product".

These best practices, combined with expert guidance, can make navigating BAA compliance much more manageable.

How GSA Focus Can Help

Successfully managing BAA exceptions requires a solid understanding of federal procurement rules, supply chain documentation, and GSA compliance requirements. That’s where GSA Focus steps in. They handle the complexities of BAA exception management throughout the entire GSA Schedule lifecycle, so you don’t have to.

Their services include preparing the detailed documentation needed for BAA exception claims, verifying that your product classifications are accurate, and managing contract modifications when supply chains or thresholds change. With a 98% success rate, they offer peace of mind by staying ahead of threshold changes and helping you prepare your supply chain for upcoming requirements.

Conclusion

Grasping the nuances of Buy American Act (BAA) exceptions isn’t just about staying compliant – it’s about unlocking opportunities within the massive $600+ billion federal procurement market. The BAA acts as a gateway to federal contracts, and understanding its exceptions can be the deciding factor in securing those contracts.

On the flip side, missteps in applying these exceptions could lead to contract termination or strained relationships with federal agencies. However, when used strategically – whether through nonavailability exceptions, unreasonable cost waivers, or IT-specific exemptions – these rules can help create flexible and compliant supply chains.

For small businesses, the stakes are even higher. The 30% price evaluation factor offers a significant competitive advantage, but success hinges on knowing how to navigate the rules and apply them correctly.

Given the complexity of BAA regulations, expert guidance becomes a valuable asset. GSA Focus specializes in handling the details – documentation, classification verification, and contract modifications – so you can focus on growing your business. With a 98% success rate, they help small businesses stay compliant while navigating the challenges of the GSA Schedule lifecycle. Whether you’re just entering the federal contracting space or looking to expand, having expert support can make all the difference.

FAQs

What is the difference between the Buy American Act and the Trade Agreements Act?

The Buy American Act (BAA) mandates federal agencies to prioritize the purchase of goods made in the United States. To meet this requirement, at least 55% of a product’s components must be sourced domestically. The goal is to bolster American manufacturing and labor by giving preference to U.S.-made products.

In contrast, the Trade Agreements Act (TAA) permits federal agencies to procure goods from specific TAA-designated countries or those that have undergone substantial transformation within these nations. When applicable trade agreements exist, the TAA can override the BAA’s domestic content rules, fostering partnerships in international trade.

For businesses working within the GSA Schedule framework, understanding these regulations is essential. Compliance not only ensures eligibility for federal contracts but also positions companies for success in the competitive government marketplace.

How can small businesses use Buy American Act exceptions to succeed in federal contracts?

Small businesses have the opportunity to leverage specific exceptions under the Buy American Act (BAA) to stay competitive in federal contracting. Two key exceptions often come into play:

- Public Interest Exception: Used when domestic sourcing conflicts with broader public policy goals.

- Non-Availability Exception: Applied when certain items cannot reasonably be sourced in the U.S. due to issues like insufficient quantity, quality, or prohibitive costs.

To make the most of these exceptions, businesses should take a few strategic steps:

- Examine Your Supply Chain: Conduct a thorough review to pinpoint the origin of materials and catch any potential compliance issues early.

- Build a Solid Case for an Exception: Gather and present clear evidence, such as supplier quotes, market research, and cost comparisons, to demonstrate why domestic sourcing isn’t feasible.

- Collaborate with Contracting Officers: Proactively engage with contracting officers or GSA specialists to discuss exceptions before submitting your bid.

By meticulously documenting their case and offering a cost-effective, compliant alternative, small businesses can position themselves to secure contracts that might otherwise be unattainable. For added support, partnering with experts like GSA Focus can streamline the process, ensuring all compliance and documentation requirements are met efficiently. This proactive approach can give small businesses a valuable edge in the competitive federal contracting space.

How can a company properly document compliance with Buy American Act exceptions?

To properly document compliance with the Buy American Act (BAA) exceptions, start by pinpointing the specific exception that applies. This could be a public-interest waiver, a non-availability determination, or a value-threshold waiver. Once you’ve identified the exception, secure and keep any official documentation tied to it, such as waiver letters or non-availability notices, as part of your compliance records.

Next, gather a manufacturer’s certification that confirms the product’s origin and outlines its domestic content percentages. If necessary, include additional documents that trace the supply chain back to U.S. sources. Prepare a signed certification letter from an authorized company representative that explains the rationale for the exception. Organize all supporting materials – like supplier invoices, certificates of origin, and compliance checklists – into a dedicated, well-maintained folder.

Keep these records for the duration of the contract and any required retention period. To stay prepared for government reviews, regularly audit your compliance folder to ensure it’s current and complete. Integrating these records into your company’s GSA Schedule compliance system can simplify audits and demonstrate your commitment to meeting BAA requirements.

Related Blog Posts

- 5 Misconceptions About Buy American Act Compliance

- Buy American Act Checklist for GSA Contractors

- 5 Challenges of Sourcing Under Buy American Act

- How GSA Contractors Use Buy American Act Waivers