Subcontracting reports are mandatory for federal contractors with GSA Schedule contracts valued at $750,000 or more (or $2 million for construction) if classified as "Other Than Small Business." These reports demonstrate compliance with Small Business Subcontracting Plans, proving efforts to involve small businesses in federal contracts.

Key points:

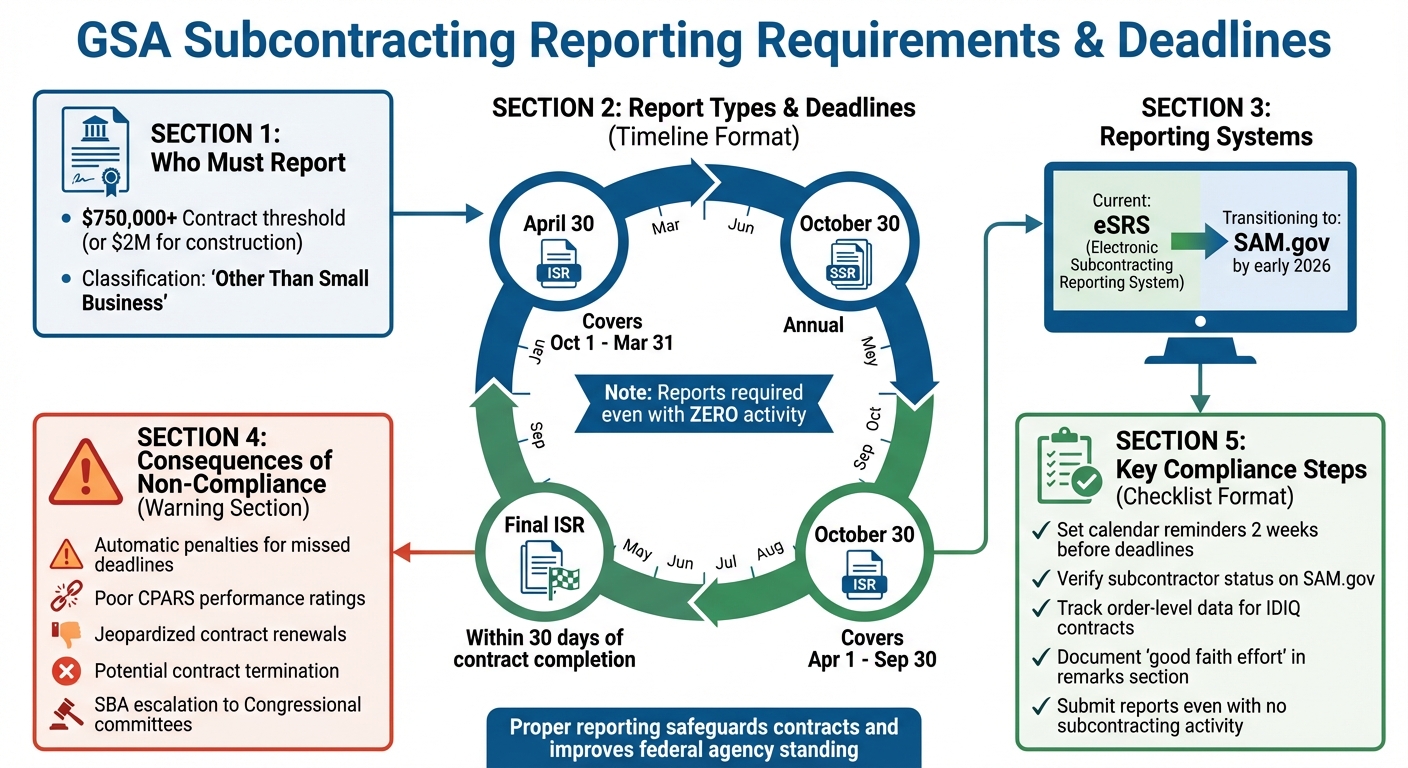

- Deadlines: Individual Subcontracting Reports (ISRs) are due April 30 and October 30, while Summary Subcontracting Reports (SSRs) are due October 30 annually.

- Compliance: Even with no subcontracting activity, reports must still be submitted to avoid penalties.

- Consequences: Late or inaccurate reports can lead to penalties, poor performance ratings, and jeopardized contract renewals.

- Tools: Reports are filed via eSRS, transitioning to SAM.gov by early 2026.

Proper reporting safeguards your contracts, improves your standing with federal agencies, and impacts future opportunities. Staying organized and submitting accurate, timely reports is crucial for success.

GSA Subcontracting Reporting Requirements and Deadlines

Subcontracting Plan Compliance: What Large and Small Contractors Need to Know

The Consequences of Poor Subcontracting Report Management

Mismanaging subcontracting reports can have serious repercussions, far beyond simple administrative hiccups. Since your subcontracting plan is a "material part" of your GSA Schedule contract, failing to handle these reports properly could jeopardize your entire agreement.

Late or Missing Report Submissions

Missing deadlines for subcontracting reports is one of the most damaging mistakes a contractor can make. The deadlines – April 30th and October 30th for Individual Subcontracting Reports (ISRs) and October 30th for Summary Subcontracting Reports (SSRs) – are not flexible. Even if there’s no activity to report, submission is still required. Contractors who miss these deadlines face automatic penalties, as the Electronic Subcontracting Reporting System (eSRS) sends delinquent notices and reminders to ensure compliance.

The stakes are even higher because the Small Business Administration (SBA) is required to escalate delinquency issues to the House and Senate Committees on Small Business. For instance, in FY2024, the SBA granted a 15-day extension for year-end reports due to increased reporting demands, emphasizing how critical these deadlines are to the government.

Errors and Incomplete Information

Accuracy in reporting is just as important as timeliness. Contracting Officers rely on these reports to assess your performance, and mistakes can lead to rejections until corrections are made. For contracts requiring order-level data, even a single error in one order can result in the rejection of your entire ISR. This isn’t just a theoretical issue – GSA itself has had to revise previous subcontracting reports to fix errors.

Common mistakes include choosing an Individual Subcontracting Plan when a Commercial Plan would be more efficient, unnecessarily increasing reporting complexity. Another frequent error is failing to verify the size status of subcontractors, which is crucial since companies self-certify their size in the System for Award Management (SAM). Misclassifying subcontractors signals a lack of oversight, delaying compliance and tarnishing your performance record.

Not Meeting Small Business Utilization Goals

Falling short of small business utilization goals is another red flag that can have lasting consequences. If you fail to meet the targets outlined in your subcontracting plan, you risk losing contract renewals and future opportunities. As an "Other Than Small Business" contractor, you are legally required to provide small businesses with the "maximum practicable opportunity" to participate in contract performance.

Your ISRs and SSRs serve as the primary evidence of your compliance with the Small Business Subcontracting Program. Consistently missing these goals doesn’t just hurt your performance record – it also impacts your Contractor Performance Assessment Reporting System (CPARS) evaluations. Poor CPARS ratings can make government agencies hesitant to renew your contracts or award you new ones. These commitments aren’t optional; they’re binding obligations, and failing to meet them carries real consequences.

Why Subcontracting Reports Matter for GSA Contracts

Subcontracting reports are far more than just a routine task – they’re a cornerstone of compliance, a way to build trust with the GSA, and a key to unlocking future contract opportunities.

Meeting Federal Reporting Requirements

If your GSA contract is worth $750,000 or more (including all option periods), you’re legally required to participate in the Small Business Subcontracting Program and submit progress reports via the Electronic Subcontracting Reporting System (eSRS). These reports act as proof that you’re giving small businesses the "maximum practicable opportunity" to participate.

Your Contracting Officer (CO) relies on these reports to ensure you’re following your Small Business Subcontracting Plan. Contracting Officer’s Representatives (CORs) also review the timeliness and quality of your submissions. Once filed, these reports become part of your permanent contract record and play a role in your performance evaluations.

"Submission of timely and accurate reports is an indication a contractor takes its small business subcontracting responsibilities seriously."

– GSAM 519.705-4

Missing deadlines or submitting incomplete reports can signal a lack of effort and may result in penalties like liquidated damages or poor past performance evaluations. COs don’t just check whether you’ve met your goals – they also assess whether you’ve shown a genuine effort and documented it thoroughly. This documentation doesn’t just ensure compliance; it can significantly impact your chances of securing future contracts.

How Reports Affect Contract Renewals and New Awards

Your reporting history can directly influence your ability to win new contracts or secure renewals. COs review your eSRS submissions when evaluating contractors for new awards. Late reports, errors, or missed goals leave a lasting mark on your record.

Past performance evaluations are a critical factor in the award process. Contractors who consistently submit accurate and on-time reports – and show progress toward small business utilization goals – gain a competitive edge. On the flip side, repeated issues with report quality or timeliness can make agencies hesitant to award future contracts. In some cases, COs may even reach out to previous COs to verify whether you met your objectives and adhered to reporting requirements.

Strengthening Relationships with Government Agencies

Accurate and timely reporting doesn’t just meet requirements – it builds trust with the GSA and other government stakeholders. Transparency is key. Using the "Remarks" section of your reports to explain challenges and document your efforts can strengthen communication with your CO. This level of openness helps maintain a positive working relationship, even when achieving goals proves difficult.

For example, if your small business utilization dollars fall short, COs often review the "Remarks" section to understand why. This is your chance to highlight outreach efforts, such as using the Dynamic Small Business Search or APEX Accelerators to find qualified small business partners. Demonstrating your commitment, even in challenging circumstances, can make a big difference.

Additionally, your reporting performance shapes how GSA Small Business Technical Advisors (SBTAs) and the Office of Small and Disadvantaged Business Utilization (OSDBU) perceive your company. A solid track record of compliance can earn you a "Concur" recommendation, which makes contract renewals and modifications easier. On the other hand, failing to submit required reports could lead to a "Non-Concur" from OSDBU, creating significant hurdles for your business.

"The contracting officer shall consider overall compliance (e.g., timely submittal of reports, making a good faith effort to meet subcontracting goals). Actions taken in accordance with the plan mean more than whether or not the offeror met the goals established in the plan."

– GSAM 519.705-4

This guidance emphasizes that your effort and transparency matter as much as the results. By consistently submitting clear and detailed reports, you’re not just meeting requirements – you’re building a reputation as a dependable contractor who values small business participation.

How to Create a Reliable Subcontracting Reporting Process

Setting up a solid subcontracting reporting process is key to meeting deadlines and ensuring accuracy. Here’s how you can establish workflows that keep everything running smoothly.

Setting Up a Reporting Schedule

The first step is to align your reporting calendar with your subcontracting plan type. For those with an Individual Subcontracting Plan, you’ll need to submit Individual Subcontracting Reports (ISR) twice a year:

- By April 30 (covering October 1–March 31)

- By October 30 (covering April 1–September 30)

Additionally, a Summary Subcontracting Report (SSR) is due annually by October 30. If you have a Commercial Subcontracting Plan, you’ll file just one SSR annually, also due by October 30, covering all federal contracts across your company.

To stay ahead, sync your reporting calendar with the government’s fiscal year (October 1–September 30). Set reminders at least two weeks before each deadline to allow time for gathering and verifying data. Don’t forget: if your contract ends, you’ll need to submit a final ISR within 30 days of completion – even if it doesn’t align with the usual reporting cycle.

And here’s an important note: submit your reports even if there’s been zero subcontracting activity. Once your schedule is set, it’s time to focus on collecting accurate data.

Collecting and Verifying Subcontractor Data

Accurate reporting starts with reliable data. While the Electronic Subcontracting Reporting System (eSRS) pulls key contract details from the Federal Procurement Data System (FPDS), it’s your responsibility to verify subcontractor classifications and amounts. Double-check each subcontractor’s registration on SAM.gov and confirm their current socioeconomic status, such as WOSB, SDVOSB, or HUBZone.

When entering data, avoid using decimals, commas, or spaces. For IDIQ contracts with Individual Plans, track task and delivery orders separately since multi-agency contracts require order-level reporting. If you spot errors in your organizational data, correct them in SAM.gov first – updates usually take about 48 hours to reflect in the reporting system.

Prime contractors should also review and acknowledge ISRs submitted by lower-tier subcontractors. This ensures the overall data for the entire contract is both complete and accurate.

Working with GSA Compliance Specialists

Once you’ve established your schedule and data processes, consider partnering with specialists to streamline your efforts. Managing reports on top of other responsibilities can stretch your resources thin. That’s where GSA Focus specialists come in – they simplify compliance, help with plan selection, and guide you through system transitions, like the upcoming shift from eSRS.gov to SAM.gov in early 2026.

Specialists can also assist with documenting your "good faith effort" if you fall short of small business utilization goals. The remarks section of your report becomes critical in these cases, and consultants can help you effectively outline your outreach activities and challenges to satisfy federal reviewers.

Beyond reporting, these experts help you maintain detailed records and respond promptly if the GSA flags discrepancies. Addressing issues swiftly avoids penalties or even contract termination, allowing you to focus on delivering on your contract while staying compliant.

Conclusion

Subcontracting reports play a crucial role in your GSA Schedule contract, serving as a direct reflection of your commitment to compliance. If you’re classified as an "Other Than Small Business" and hold contracts worth $750,000 or more, submitting accurate and timely reports through the Electronic Subcontracting Reporting System (eSRS) is essential. These reports showcase your "good faith effort" to meet small business utilization goals, and GSA Contracting Officers rely on them to evaluate your performance. In fact, your reporting track record can significantly influence your chances of securing future contracts.

Meeting these requirements isn’t without its challenges. Missing a reporting deadline often prompts immediate follow-up from your Contracting Officer, and repeated lapses could lead to liquidated damages. That’s why having a dependable reporting system in place is critical. This includes setting up calendar alerts, verifying subcontractor data, and maintaining thorough documentation of your outreach efforts.

Balancing these obligations with your day-to-day business operations can be overwhelming, especially with the transition from eSRS.gov to SAM.gov slated for early 2026. This shift adds another layer of complexity, making expert guidance more valuable than ever. Specialists at GSA Focus can help you navigate these changes, choose the appropriate plan type, and document your efforts to meet goals – even when challenges arise. Their expertise strengthens your reporting framework, ensuring compliance and positioning you for future opportunities.

Properly managing subcontracting reports not only safeguards your current contracts but also boosts your credibility with federal buyers. Whether you tackle reporting internally or enlist professional support, staying organized, meeting deadlines, and maintaining accurate records are essential for thriving in the federal marketplace.

FAQs

What happens if I miss a subcontracting report deadline for my GSA Schedule contract?

Missing a subcontracting report deadline can have serious repercussions for your GSA Schedule contract. These can range from financial penalties and contract termination to being barred from bidding on future government contracts. Beyond the immediate penalties, it can also damage your reputation as a dependable contractor, making it much more challenging to win federal projects down the road.

To steer clear of these risks, staying vigilant about reporting requirements and deadlines is essential. Meeting these obligations not only safeguards your business but also helps build trust and credibility with government agencies.

How do I ensure my subcontracting reports meet GSA compliance standards?

To make sure your subcontracting reports are both accurate and compliant, start by getting a solid grasp of the rules and requirements. If you’re classified as an Other-Than-Small Business (OTSB) and have contracts worth $750,000 or more, you’re required to submit an Individual Subcontracting Report (ISR) using SF-294. It’s essential to familiarize yourself with key FAR clauses like 52.219-8, 52.219-9, and 52.219-16 to understand your subcontracting goals and reporting responsibilities.

Once you know the requirements, gather and double-check all subcontracting data as early as possible. Make sure subcontract numbers match their corresponding prime contracts, verify subcontractor socio-economic classifications (such as HUBZone, women-owned, or SDVOSB), and confirm that dollar values align with your internal records. Cross-referencing your data with the Electronic Subcontract Reporting System (eSRS) or SAM.gov can help catch any inconsistencies. If you find that you’re falling short of any goals, document your efforts to meet the "good-faith effort" standard.

Before submitting your report, take the time to review it thoroughly for accuracy and completeness. Check that all formatting is correct – dates should follow the MM/DD/YYYY format, and dollar amounts should be reported in U.S. currency. Ensure every required field is filled out, then submit your report through the electronic system. Save your confirmation receipts and keep all supporting documents on file for at least three years in case of an audit. By following these steps – or by partnering with GSA Focus for expert guidance – you can maintain compliance and safeguard your GSA Schedule contract.

Why is involving small businesses important in GSA contracts?

Involving small businesses in GSA Schedule contracts plays a crucial role in strengthening the U.S. economy. These businesses make up nearly half of all private-sector jobs and are a driving force behind innovation. By encouraging their participation, the federal government not only boosts economic growth but also promotes competition and ensures taxpayer dollars reach a diverse group of American entrepreneurs.

For larger contractors – those not classified as small businesses – federal regulations require a subcontracting plan for contracts exceeding $750,000 ($700,000 for non-construction contracts). These plans must detail percentage goals, sourcing approaches, and reporting procedures. Falling short on these obligations can lead to serious consequences, including penalties, contract termination, or disqualification from future opportunities. A comprehensive and well-structured subcontracting plan is key to maintaining compliance and succeeding with GSA contracts.

Beyond meeting regulatory requirements, collaborating with small businesses offers numerous advantages. It provides access to specialized expertise, broadens the supplier base, and often leads to more cost-efficient solutions. For small businesses, GSA contracts open doors to valuable federal opportunities. Services like GSA Focus make the process easier, helping businesses stay compliant and position themselves for success in the competitive federal contracting landscape.

Related Blog Posts

- Top 5 Compliance Issues in GSA Contracts

- Why Subcontracting Plans Matter for GSA Contracts

- GSA Subcontracting Plans: Key Requirements

- How to Track Subcontractor Performance in GSA Contracts