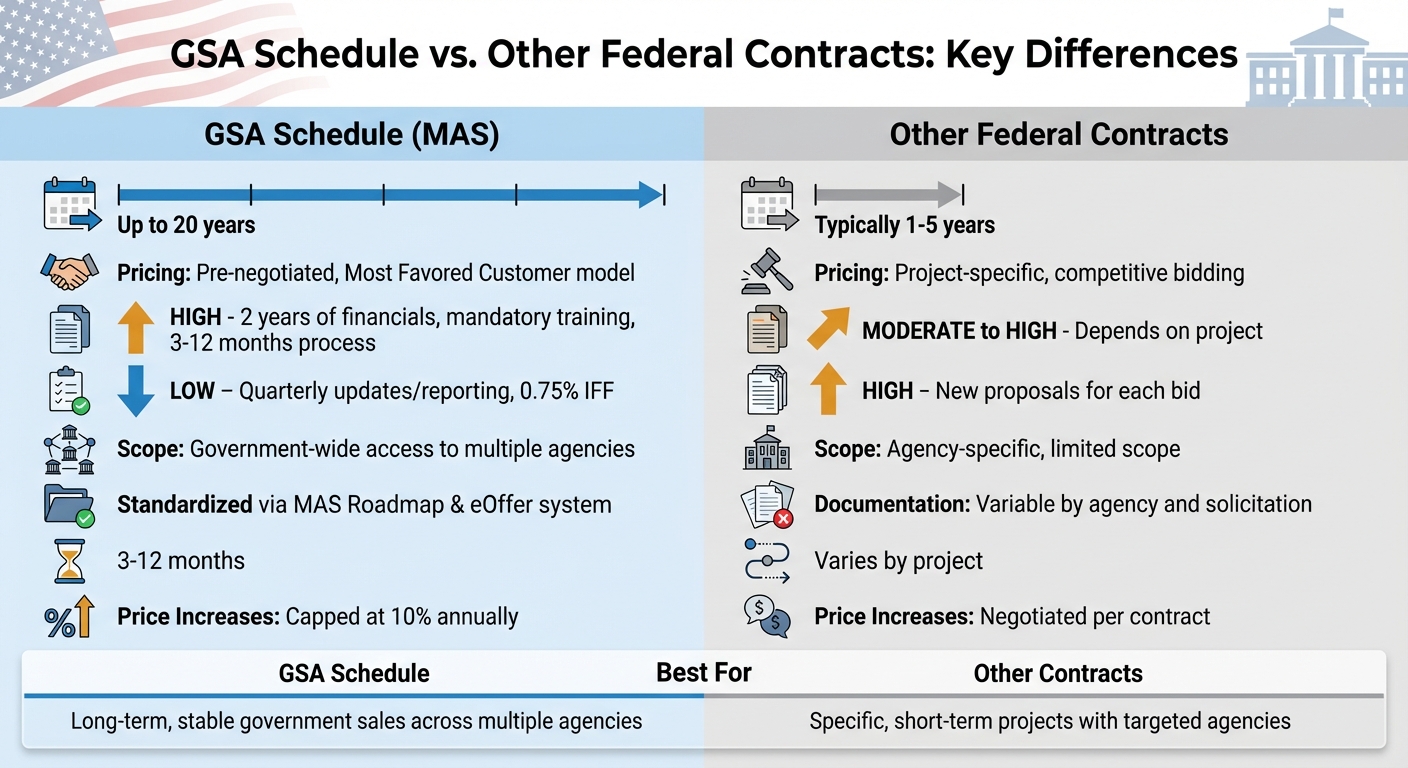

GSA Schedules and other federal contracts both allow businesses to sell to the U.S. government, but their processes are very different. GSA Schedules involve a one-time, detailed submission with pre-negotiated pricing, offering long-term access to multiple agencies. Other federal contracts require project-specific proposals, with documentation tailored to each solicitation. Choosing the right path depends on your business’s resources and goals.

Key Differences:

- GSA Schedules: Centralized, long-term contracts (up to 20 years), require extensive upfront documentation but less ongoing effort.

- Other Contracts: Short-term, project-specific, require new proposals for each opportunity, with varying requirements.

Quick Comparison:

| Feature | GSA Schedule (MAS) | Other Federal Contracts |

|---|---|---|

| Contract Length | Up to 20 years | Typically 1–5 years |

| Pricing | Pre-negotiated, Most Favored Customer model | Project-specific, competitive bidding |

| Initial Effort | High (2 years of financials, training, etc.) | Moderate to high, depends on project |

| Ongoing Effort | Low (quarterly updates/reporting) | High (new proposals for each bid) |

| Scope | Government-wide access | Agency-specific, limited scope |

GSA Schedules are ideal for businesses seeking long-term, stable government sales, while other contracts suit those targeting specific, short-term projects. Understanding these distinctions helps businesses allocate resources effectively and avoid unnecessary effort.

GSA Schedule vs Other Federal Contracts: Key Differences Comparison

Documentation Requirements for GSA Schedule Submission

Required Registrations and Training

Before you can submit a GSA Schedule offer, start by registering on SAM.gov to obtain your Unique Entity ID (UEI). You’ll also need to secure a FAS ID to access the eOffer system. Since March 8, 2021, GSA has done away with digital certificates, making the FAS ID the go-to login method – and the best part? It’s completely free.

Additionally, a decision-maker from your company must complete the Pathways to Success training. This training is designed to help you understand program requirements and set clear expectations .

Corporate and Financial Documents

Once your registrations are squared away, it’s time to gather the required corporate and financial documents. You’ll need to provide Balance Sheets and Profit and Loss Statements from the last two fiscal years to demonstrate your company’s financial stability . If your business is newer and lacks two full years of financial history, you can take advantage of the Startup Springboard program .

In addition, submit corporate disclosures that outline your organizational structure, ethics record, and Commercial Sales Practices (CSP) data. If your financial standing requires extra backing, include bank reference letters or irrevocable letters of credit.

Technical, Past Performance, and Pricing Documents

To prove your offerings are commercially available, you’ll need to provide actual invoices as evidence.

For past performance, prepare a detailed project write-up for each Special Item Number (SIN) you’re applying for. These write-ups should focus on projects that either lasted at least one year or were completed within the past two years.

Pricing is another critical piece. Your pricing must meet the Most Favored Customer standard and comply with the Trade Agreements Act (TAA) . Keep in mind that an Industrial Funding Fee (IFF) of 0.75% applies to all GSA sales, and annual price increases are capped at 10% per category item.

Documentation Requirements for Other Federal Contracts

Basic Requirements

When it comes to federal contracts outside the GSA Schedule, the documentation process shifts to being proposal-specific rather than a one-time submission. Each proposal requires tailored documentation to meet the specific needs of the solicitation.

To start, all federal contractors must register in SAM.gov to receive a Unique Entity Identifier (UEI). Once registered, the required standard forms depend on the type of acquisition. Commonly used forms include:

- SF 33: Used for sealed bidding and negotiated contracts.

- SF 1449: Applicable for commercial products and services.

- SF 1447: Covers general solicitation and contract needs.

These forms serve to capture essential activity and closing details for the contract. For negotiated contracts, the Uniform Contract Format (UCF) is the standard. It organizes documentation into four parts and 13 sections (A through M). This format includes key components like the Schedule, Contract Clauses, List of Attachments, and Representations and Instructions. However, specific agencies may adapt these sections to meet their unique requirements. These foundational documents lay the groundwork for more detailed submissions like technical and past performance proposals.

Technical and Past Performance Proposals

Under FAR Part 15, contractors must submit separate volumes addressing Management Plans, Staffing Plans, and Technical Approaches, all of which should align with the Statement of Work (SOW) or Performance Work Statement (PWS) outlined in the solicitation. Additionally, past performance narratives are essential. These narratives must directly connect to the scope of the solicitation, demonstrating how your prior experience aligns with the agency’s specific needs.

Formatting and evaluation guidelines are critical. Section L of the solicitation outlines formatting requirements, while Section M defines the evaluation factors. Failing to comply with these sections can lead to proposal rejection. The PWS includes mandatory "shall" statements that detail your performance obligations, ensuring clarity on what’s expected.

Cost and Pricing Documentation

In addition to technical narratives, accurate and detailed cost and pricing documentation is vital. Unlike GSA Schedules, which rely on pre-negotiated pricing, other federal contracts require you to calculate pricing from scratch for each solicitation. This includes providing cost breakdowns and labor estimates.

The level of complexity in pricing documentation depends on the contract type. For cost-reimbursement contracts, you’ll need to perform a "cost realism" analysis to prove that your proposed costs are reasonable for the work involved. On the other hand, firm-fixed-price contracts generally require only a price analysis. If the solicitation falls under FAR 15.403-4, certified cost or pricing data may be required unless an exception applies, such as adequate price competition or the procurement of commercial products or services.

The method of source selection also impacts documentation requirements. For contracts using the Tradeoff Process, you’ll need to justify why the government should pay a premium for the benefits your solution provides. In contrast, Lowest Price Technically Acceptable (LPTA) evaluations prioritize price once minimum technical requirements are met. However, federal agencies – except the Department of Defense – are now advised to avoid LPTA for knowledge-based professional services like IT and cybersecurity.

GSA Schedule vs. Other Federal Contract Documentation

Scope and Standardization Differences

When it comes to federal contracts, the process for submitting a GSA Schedule is much more standardized compared to other types of federal contracts. With GSA, everything follows the MAS New Offeror Roadmap, and submissions are handled through a centralized eOffer system. On the other hand, other federal contracts often rely on agency-specific portals and processes that can vary widely depending on the agency and the solicitation.

A GSA Schedule is essentially a long-term, government-wide contract. This contrasts with other federal contracts, which are typically tied to specific projects or the immediate needs of a single agency. Moreover, securing a GSA Schedule requires completing a mandatory training module, a step not typically required for other contracts. The vetting process for GSA contractors is also far more rigorous, going well beyond the basic registration needed for SAM.gov. These differences highlight just how distinct the workload and procedural expectations are between GSA Schedules and other federal contracts.

Initial vs. Recurring Documentation Work

Getting a GSA Schedule isn’t a quick or simple process. It can take anywhere from three to six months – or even longer for more complex industries. To get started, offerors need to compile at least two years of financial statements, complete a mandatory training session that takes three to four hours, and prepare a detailed technical and financial proposal that outlines all the products or services they intend to offer.

However, once the GSA Schedule is awarded, the ongoing documentation requirements become much lighter. Contractors mainly need to handle periodic price updates and quarterly sales reporting, along with paying a 0.75% Industrial Funding Fee (IFF) within 30 days after the end of each quarter. By contrast, other federal contracts often require a fresh proposal for every new solicitation. While the initial bid process for these contracts may be less exhaustive than a GSA Schedule submission, the recurring workload can quickly add up due to the need for new documentation with each opportunity.

Compliance and Pricing Documentation Comparison

Pricing under a GSA Schedule operates on a "Most Favored Customer" model, which ensures the government receives the best available commercial price. Contractors establish ceiling prices upfront using either the Commercial Sales Practices (CSP) format or the Transactional Data Reporting (TDR) option. Additionally, the Price Reductions Clause (PRC) ensures that negotiated prices remain consistent throughout the contract term. Price increases are capped at 10% per category annually unless additional justification is provided.

In contrast, pricing for other federal contracts is calculated on a per-solicitation basis. This often involves providing detailed cost breakdowns and labor estimates tailored to each specific project. The key takeaway is that while GSA contracts demand significant effort upfront to establish pricing and compliance documentation, they offer a more streamlined process afterward. On the other hand, other federal contracts require contractors to repeatedly prepare detailed documentation for each new bid.

| Feature | GSA Schedule (MAS) | Other Federal Contracts |

|---|---|---|

| Pricing Strategy | Most Favored Customer model; negotiated upfront | Project-specific cost estimates or competitive bidding |

| Documentation Scope | Comprehensive proposal covering all products/services | Specific to a single project or defined period |

| Initial Workload | Very high; includes mandatory training and two years of financials | Moderate to high; focused on the project at hand |

| Recurring Workload | Low; periodic updates and quarterly sales reporting (0.75% IFF) | High; full new proposal required for each opportunity |

| Contract Duration | Long-term (up to 20 years) | Typically short-term or project-based (1–5 years) |

| Standardization | Structured via MAS Roadmap and eOffer system | Variable; changes with each agency and solicitation |

How GSA Focus Simplifies GSA Documentation

Document Preparation and Compliance Support

GSA Focus takes the stress out of handling the extensive documentation required for GSA submissions. Tackling this process alone means dealing with hundreds of pages of pre-submission requirements, which can feel overwhelming.

Their team manages everything, from mandatory registrations and training to gathering and validating financial and performance records. They also ensure your Most Favored Customer (MFC) pricing is accurate and establish Commercial Sales Practices (CSP) to meet the GSA’s "fair and reasonable" pricing standards. As the GSA Vendor Support Center highlights:

"Complete, well-documented offers with competitive pricing are easier and faster to review."

This meticulous preparation is crucial because the GSA review process typically spans three to eight months. Incomplete or unclear documentation can push that timeline to over a year.

Continued Management and Support

Securing a GSA contract is just the beginning – ongoing compliance presents its own challenges. Contract holders must submit quarterly sales reports, pay the 0.75% Industrial Funding Fee (IFF), and sign mass modifications within 90 days to stay compliant.

GSA Focus makes this ongoing process manageable. They handle contract modifications, update price lists on the Vendor Support Center (VSC) and GSA Advantage, and ensure timely sales reporting and IFF payments. Additionally, they assist with annual SAM.gov registration renewals and help maintain certifications like 8(a), HUBZone, or WOSB.

This level of support is critical. As Lucy Hoak, Lead Proposal Writer at Winvale, warns:

"Contractors who aren’t regularly monitoring their inbox for email inquiries from GSA and responding in a timely manner could risk having their contract cancelled."

Access to Federal Opportunities with GSA Focus

From start to finish, GSA Focus offers a comprehensive solution that simplifies federal contracting. They manage everything, from document preparation to negotiating with GSA representatives, boasting a 98% success rate and offering a refund guarantee.

Their secure online portal allows for easy document uploads, and their advisory support ensures you’re guided every step of the way. Once your schedule is awarded, they continue to assist by supporting your marketing efforts and monitoring opportunities on GSA eBuy and SAM.gov.

For small businesses without the resources to navigate the GSA process alone, GSA Focus transforms what could be a grueling 12-month ordeal into a streamlined path to federal contracting success.

GSA Schedule Basics Part 1

Conclusion

Deciding between a GSA Schedule and other federal contracts often comes down to understanding their unique requirements. GSA submissions demand significantly more upfront effort compared to other federal contracts. While many federal contracts only require basic registration on SAM.gov and project-specific proposals, the GSA process involves a more rigorous approach. This includes mandatory training, extensive documentation, and strict compliance with standards like the Trade Agreements Act. The entire process can take anywhere from 3 to 12 months to complete.

The detailed documentation required for a GSA Schedule reflects the scope and longevity of these contracts. With terms potentially lasting up to 20 years and offering access across government agencies, your initial submission lays the groundwork for pricing, terms, and conditions that will influence every future sale and modification. Errors or incomplete submissions can lead to delays, adding another layer of complexity to an already demanding process.

This is where professional expertise can make a real difference. Companies like GSA Focus, with a 98% success rate, demonstrate how expert guidance can simplify the process. From the "Get Ready" phase to final negotiations, they ensure your submission meets GSA’s stringent requirements, allowing you to concentrate on your business. Their support not only smooths out the complexities but also helps position your business to take full advantage of long-term federal opportunities.

Ultimately, the choice between a GSA Schedule and other federal contracts should align with your business’s capacity and goals. While other contracts might offer quicker access for specific projects, GSA Schedules provide a long-term gateway to multiple agencies. By understanding these differences and planning accordingly, you can align your federal contracting strategy with your broader business objectives.

FAQs

What makes a GSA Schedule better than other federal contracts?

A GSA Schedule stands out as a powerful tool for businesses aiming to tap into federal contracting. It opens the door to billions of dollars in federal spending each year, as many government agencies prefer working with pre-approved GSA vendors. With pre-negotiated pricing, terms, and conditions, the procurement process becomes much smoother, cutting down on administrative hurdles and speeding up transactions for both buyers and sellers.

Another key advantage is reduced competition. Agencies can often award contracts directly to GSA Schedule holders without the need for open-market solicitations. Plus, these contracts are built for the long haul – starting with a five-year base period and extendable for up to 20 years. This structure provides businesses with steady revenue and a reliable partnership with the government.

For small businesses, the GSA Schedule offers a clear path to federal opportunities. It simplifies processes, minimizes competition, and provides long-term stability. GSA Focus helps businesses navigate this journey with full-service support, ensuring compliance and making the process as straightforward as possible.

What makes the GSA Schedule documentation process different from other federal contracts?

The GSA Schedule documentation process stands out for its detailed and specific requirements compared to most other federal contracts. Vendors must prepare a distinct set of forms and supporting documents, including SF 1449, GSA Form 3420, a Letter of Supply, a thorough pricing analysis, GAAP-compliant financial statements, trade agreement certifications, and records of past performance. Once these are ready, they must be submitted via the eOffer portal. However, before reaching this stage, vendors must complete key prerequisites, such as the “Pathways to Success” training and ensuring their SAM registration and compliance details are fully updated.

On the other hand, most federal contracts adhere to the general FAR (Federal Acquisition Regulation) process. This typically involves submitting standard solicitation documents, like RFPs or RFQs, without the need for GSA-specific forms, specialized eOffer submissions, or mandatory training. As a result, while the GSA Schedule process offers a more structured framework, it demands significantly more effort in terms of preparation and compliance.

What responsibilities do businesses have after obtaining a GSA Schedule?

Securing a GSA Schedule is just the first step – staying compliant and managing your contract effectively are vital to making the most of this opportunity. Within 30 days of receiving the award, your business must register the contract in the Vendor Support Center (VSC) and upload your price list to GSA Advantage®. You’ll also need to register for a Federal Acquisition Service ID (FAS ID) and access the FAS Sales Reporting Portal (SRP) to submit sales reports and pay the required Industrial Funding Fee (IFF).

Beyond the initial setup, managing your GSA Schedule involves handling contract modifications, such as price changes or adjustments to your scope of work. It’s also essential to comply with regulations like the Price Reduction Clause and Transactional Data Reporting (TDR). Regular reporting, accurate record-keeping, and adherence to policies such as the Trade Agreements Act and IT security standards are non-negotiable. Keeping your VSC profile updated and maintaining open communication with your Agency Contracting Officer (ACO) or Industrial Operations Analyst (IOA) can help you stay on track.

To truly maximize the value of your GSA Schedule, active marketing is a must. Promoting your offerings to federal, state, and local buyers ensures you’re positioning your business to generate revenue. By remaining compliant and proactive, you can safeguard your GSA Schedule while tapping into its full potential.

Related Blog Posts

- GSA Schedule vs Direct Federal Contracts: Which to Choose?

- GSA Schedules vs. Open Market Bidding

- How GSA Contracts Impact Federal Construction Compliance

- GSA Proposal Submission vs. Traditional Bids