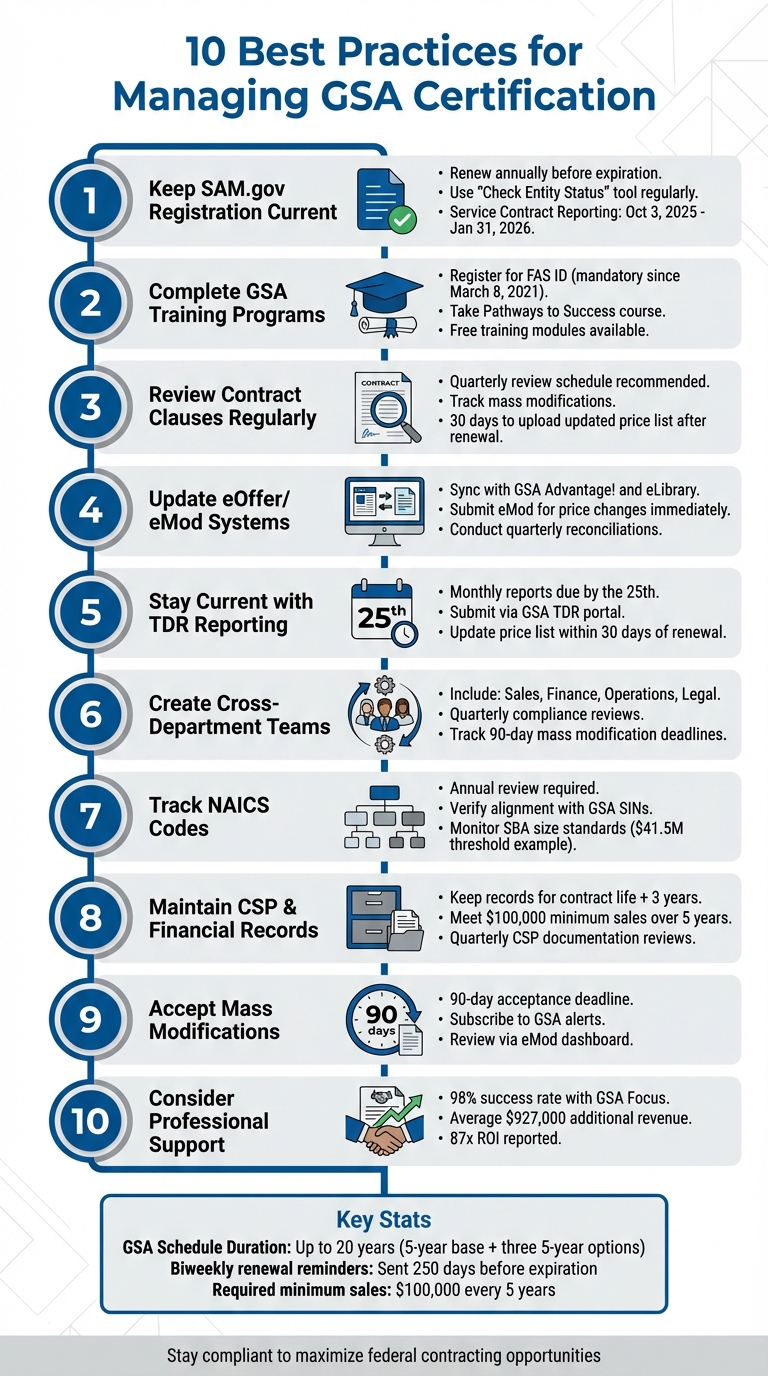

Securing a GSA Schedule contract is just the beginning. Proper management ensures compliance, avoids penalties, and maximizes revenue opportunities. Here’s a quick summary of what you need to know:

- Stay Compliant: Regularly update your SAM.gov registration, accept mass modifications within deadlines, and meet the $100,000 sales requirement every five years.

- Monitor Updates: Keep your contract clauses, pricing, and catalogs current using tools like eMod and GSA Advantage!.

- Meet Reporting Deadlines: Submit accurate TDR reports monthly and reconcile financial records quarterly.

- Collaborate Across Teams: Assign clear responsibilities for compliance tasks involving sales, finance, and legal departments.

- Track NAICS Codes: Ensure your codes and small business size standards align with your GSA Schedule.

- Maintain Documentation: Keep detailed records of commercial sales practices, financial health, and contract modifications.

10 Essential Steps for GSA Schedule Certification Management and Compliance

GSA Contracts Step by Step in 2025

1. Keep Your SAM.gov Registration and UEI Current

Your SAM.gov registration and Unique Entity ID (UEI) are the backbone of your federal contracting efforts. Without a current registration, you risk losing eligibility for payments, bids, and even your GSA Schedule. Since registrations expire annually, staying on top of renewals is a must to ensure compliance and avoid disruptions in your contracts.

SAM.gov regularly updates its data collection and compliance features. For example, on September 12, 2025, updates were introduced concerning legal proceedings and contact information. Additionally, the Revolutionary FAR Overhaul (RFO) is reshaping federal acquisition regulations, leading to changes in provisions, clauses, and certifications across multiple FAR parts – all of which directly affect SAM.gov. Staying informed about these updates and adjusting your registration accordingly is crucial for smooth operations.

To stay compliant, make use of the "Renew Entity" feature well before your registration expires. You can also check your status anytime using the "Check Entity Status" tool. Keep in mind that the Service Contract Reporting (SCR) period for fiscal year 2025 runs from October 3, 2025, to January 31, 2026. Missing these deadlines could lead to unnecessary complications.

Navigating SAM.gov’s requirements can be tricky, especially with frequent system updates and evolving regulations. Many contractors unintentionally fall out of compliance due to misunderstandings or overlooked details, which can force them to restart the process entirely. If you’re unsure about handling these updates or managing your registration, seeking professional guidance can save you time and help you avoid costly mistakes.

2. Complete Required GSA Training Programs Like Pathways to Success

Consistent training is the backbone of effective GSA Schedule management. GSA offers training programs that help you navigate the complexities of maintaining your Schedule certification. While these programs aren’t officially required for renewal, courses like Pathways to Success are invaluable for avoiding compliance missteps. To get started, register on the GSA training portal to access these resources.

Since March 8, 2021, a FAS ID has been mandatory for accessing GSA training materials. Once registered, you’ll find vendor training modules covering topics such as FAR regulations, eOffer/eMod systems, and compliance requirements. These interactive modules present practical scenarios, giving you the tools to handle real-life challenges in certification management.

Beyond the basics, additional modules like "Roadmap to Get a MAS Contract," cybersecurity (FISMA/CMMC), socioeconomic reporting, and contract extensions expand your knowledge base for each stage of your contract. The best part? These programs are free and tailored to guide you through the entire contracting process.

Put your training into action by practicing within GSA systems. This hands-on experience builds confidence and ensures you’re prepared to meet compliance standards. To strengthen your organization’s readiness, encourage multiple team members to complete these courses. This way, compliance expertise is shared across your team, minimizing risks if key personnel are unavailable.

3. Review Contract Clauses and Modifications Regularly

Your GSA Schedule contract isn’t static – it evolves with updates like mass modifications, solicitation refreshes, and clause adjustments that can impact pricing, sales, and reporting. Since the consolidation of legacy Schedules into the Multiple Award Schedule (MAS), contractors have had to navigate a series of changes, including stricter cybersecurity rules, supply chain requirements, domestic preference clauses, and Trade Agreements Act (TAA) compliance standards. Overlooking these updates can lead to audit issues, cure notices, or pricing discrepancies that risk your certification.

To stay ahead of these changes, establish a routine review process. A quarterly schedule works well for monitoring updates from sources like GSA Interact, Acquisition Letters, and MAS solicitations. Create a tracking system – a matrix that lists mandatory clauses, their effective dates, modification numbers, and assigned team members. This approach ensures updates are managed systematically and no critical changes are missed.

When GSA issues a mass modification, prompt action is essential. Review the modification summary immediately to adjust pricing templates, sales disclosures, TDR reporting schedules, and product eligibility. For example, recent MAS updates required contractors to revise accounting codes, update proposal templates, train sales teams on discounting policies, and adapt IT security protocols. These types of changes often require collaboration across multiple departments.

Before renewing or extending your contract, double-check that negotiator listings and contact details in SAM.gov are up to date. After a successful renewal modification, you have 30 days to upload an updated price list to GSA eLibrary, reflecting the new contract period and modification number.

Lastly, document every modification and related internal adjustment to maintain a clear audit trail. Proper documentation not only supports compliance but also protects your certification. If keeping up with these updates feels overwhelming, consider outsourcing to professional management services. They can handle clause tracking, analyze the impact of changes, and guide implementation – allowing your team to focus on driving sales rather than navigating compliance hurdles.

4. Update eOffer/eMod Systems to Keep Your Catalog Accurate

Keeping your GSA catalog up to date is not just a good practice – it’s essential. The eOffer system is where you submit your initial Multiple Award Schedule (MAS) contract offer, while eMod is the tool you’ll use for any contract modifications after that. These modifications could include price changes, adding or removing products, updating labor categories, or making administrative adjustments. To stay compliant, it’s crucial to ensure that these updates are in sync with GSA Advantage! and GSA eLibrary. If your catalog includes outdated prices, discontinued items, or unapproved services, you could face audit findings and compliance issues that demand immediate correction.

GSA has flagged outdated catalog information as a common compliance issue that can delay contract renewals and negatively impact performance ratings. Misaligned pricing and catalog details are often overlooked but can have serious repercussions for maintaining your GSA Schedule.

Whenever there’s a drop in your commercial prices or new products are introduced, submit an eMod modification as soon as possible. This ensures federal buyers always see accurate and current listings. After your eMod submission is approved, double-check that the updates are properly reflected in GSA Advantage! and update your pricelists in GSA eLibrary to avoid inconsistencies.

To stay ahead, appoint a GSA Schedule Manager to oversee catalog updates and maintain an internal change log. Every time you launch a new product, adjust prices, discontinue an item, or update contact information, review whether an eMod submission is necessary. Conduct quarterly reconciliations to compare your commercial catalog, internal pricing records, and GSA Advantage! listings to catch any discrepancies. Additionally, make sure to accept mass modifications well before your contract renewal to keep everything aligned. These proactive steps are key to maintaining compliance and supporting your federal sales goals.

Finally, never offer unapproved items or rates before receiving eMod approval. If the task of managing these updates feels overwhelming, companies like GSA Focus can help by handling eMod submissions, syncing your catalog, and ensuring all compliance documentation is in order.

5. Stay Current with Price Proposals and TDR Reporting

Keeping your GSA contract in good standing isn’t just about catalog updates. Staying on top of price proposals and Transactional Data Reporting (TDR) is equally important for maintaining compliance. Price proposals help ensure your rates remain fair and reasonable throughout the contract, while TDR reports document every federal sale you make. Missing deadlines or submitting incorrect data can lead to non-compliance and put your contract at risk.

TDR reports are due every month by the 25th, covering sales from the previous month. These reports, submitted through the GSA TDR portal, include critical sales details that GSA uses to monitor pricing trends and verify that your negotiated rates are being honored. To stay on track, consider using a compliance calendar to monitor deadlines and assign responsibility for submissions.

Price proposals come into play during contract modifications, option renewals, or when pricing adjustments are triggered. For five-year option renewals, you’ll need to confirm pricing accuracy via eMod and update your GSA eLibrary price list within 30 days of renewal.

Some common challenges include late TDR submissions, discrepancies between your commercial catalog and GSA rates, and failing to update your price list after modifications. To avoid these issues, GSA sends bi-weekly reminders for contracts set to expire in 250 days. Performing quarterly TDR reconciliations can help ensure your pricing stays aligned and compliant. These steps are essential to maintaining your GSA Schedule’s integrity.

If managing these tasks feels like too much, GSA Focus offers professional support for price proposal preparation and TDR reporting. They can help you meet deadlines and keep your documentation audit-ready, so you can focus on other priorities.

6. Create Teams to Monitor Compliance Across Departments

To meet GSA certification requirements, oversight needs to be a shared responsibility across departments. Relying on a single department can lead to critical oversights – like missing the 90-day mass modification deadlines or failing to track sales data accurately. These kinds of errors can put your entire contract at risk. By forming a cross-departmental team, you ensure that tasks such as SAM.gov renewals and catalog updates are consistently monitored.

Your compliance team should include representatives from key departments like sales, finance, operations, and legal. Each department plays a specific role: sales tracks commercial pricing and handles TDR submissions, finance oversees financial health documentation, operations ensures the accuracy of catalogs in eOffer/eMod, and legal reviews contract clauses and modifications. This collaborative structure helps ensure no department misses critical GSA correspondence, such as the renewal notifications sent every two weeks for contracts expiring in 250 days.

Regular quarterly compliance reviews are vital to keeping everyone on the same page. Use these reviews to confirm your SAM.gov registration is current, verify accurate NAICS codes, and ensure commercial sales documentation is up to date. A compliance calendar can also be a game-changer. It should track key deadlines, such as updating your GSA eLibrary pricelist within 30 days of approval. Assigning clear ownership of tasks ensures accountability and keeps everything running smoothly.

To avoid common mistakes like outdated contact information or poor communication, conduct regular self-audits. Document every change, from contact updates to pricelist modifications, and clarify task responsibilities. If coordinating internally feels overwhelming, GSA Focus offers compliance assurance services to help streamline your processes. Their expertise ensures nothing gets overlooked, reducing risks during renewals and simplifying ongoing monitoring.

7. Track NAICS Codes and Small Business Size Standards

The North American Industry Classification System (NAICS) codes are six-digit identifiers that the federal government uses to classify businesses by industry. These codes play a big role in determining your eligibility for a GSA Schedule. If your NAICS codes don’t match the Schedule Items or Special Item Numbers (SINs) listed in your contract, you could face serious consequences, like having your contract canceled or losing set-aside opportunities. Keeping your NAICS codes aligned with your GSA certification is a critical part of staying compliant.

Equally important are the small business size standards set by the SBA, which are tied to NAICS codes. These standards define the thresholds – such as average annual revenue or number of employees – that determine if your business qualifies as "small." For instance, some NAICS codes set the limit at $41.5 million in average annual receipts. If your business exceeds these thresholds, you lose your small business status. When this happens, you’re required to notify GSA right away. Failure to report this change could make you ineligible for small business preferences and even jeopardize your contract during renewals or option extensions.

Your GSA Schedule can last up to 20 years, broken into a 5-year base period with three 5-year renewal options. At each renewal, GSA reviews your NAICS codes and size standards to ensure you’re still in compliance. To stay ahead, use the SBA Size Standards Tool (available at sba.gov/size-standards) and regularly update your information in SAM.gov and eOffer/eMod.

Make it a habit to review your NAICS codes every year. Verify that the codes listed in SAM.gov align with your GSA SINs and reflect your current business operations. At the same time, monitor your revenue and employee numbers to ensure you’re staying within the SBA’s size limits. Outdated or incorrect NAICS information can lead to delays in contract renewals or even trigger audits, as GSA uses automated tools to flag potential issues.

For a hands-off approach, consider working with experts like GSA Focus. They offer services to monitor your NAICS codes and small business size standards, ensuring your classifications stay accurate and aligned with your contract. Partnering with professionals can simplify compliance and help you avoid unnecessary risks.

8. Keep Records of Commercial Sales Practices and Financial Health

Having well-maintained Commercial Sales Practices (CSP) documentation is crucial for staying compliant with GSA pricing requirements. Sloppy or incomplete records can lead to violations of the Price Reductions Clause, potentially resulting in audits, multimillion-dollar refund settlements, or even False Claims Act cases.

To stay organized, create a centralized CSP file that includes everything from current and past price lists to written discounting policies, BOA (Basis of Award) documentation, and matching invoices. Document every discount you offer, and establish clear procedures for discount approvals. Regular quarterly reviews are a good practice – compare the actual discounts you’ve given to the terms outlined in your BOA. This system allows you to quickly identify and address any discounts that might trigger the Price Reductions Clause.

Financial recordkeeping is just as important. Make sure to retain all GSA transaction records – quotes, purchase orders, invoices, delivery confirmations, and discount structures – for the life of your contract, plus three additional years. These records are essential for calculating and supporting your Industrial Funding Fee (IFF) payments and for tracking your progress toward the $100,000 minimum GSA sales requirement. Falling short of this sales threshold over a five-year period could lead to the cancellation of your contract. To avoid issues, reconcile your sales reports and IFF payments regularly.

Before renewing an option period, conduct a thorough internal review of your CSP documentation and financial records. Check that the last two to three years reflect consistent CSP practices and compliance with BOA discount terms. Ensure that your financial statements – such as your balance sheet, income statement, and cash flow statement – are up-to-date and accurate. Also, implement document retention controls to make it easy for your contract, finance, and sales teams to retrieve records when needed.

If you’re unsure about the state of your CSP documentation or financial records, GSA Focus can help. They specialize in setting up CSP files and reviewing financial records to ensure compliance with GSA standards. Their expertise can reduce audit risks and help you maintain smooth operations across your contract’s 20-year lifespan. By keeping detailed and accurate records, you protect your certification and pave the way for hassle-free contract renewals.

9. Accept Mass Modifications Before the 90-Day Deadline

The General Services Administration (GSA) periodically rolls out Mass Modifications – updates that apply across all contracts. These updates can include changes to terms, clauses, pricing structures, or compliance requirements. For example, recent modifications like Refresh 25 and Refresh #30 required contractors to review and accept them through the eMod system within a 90-day window. Staying on top of these updates is essential for maintaining your GSA Schedule certification.

Missing the deadline can lead to serious compliance issues, such as non-compliance notices, show-cause letters, or even contract termination. Considering that GSA Schedules can last up to 20 years, it’s clear why timely action is non-negotiable.

To avoid these pitfalls, make it a habit to subscribe to GSA alerts and check your eMod dashboard frequently. Setting calendar reminders and designating a team member to promptly review updates – whether they involve new clauses, pricing adjustments, or reporting changes – will give you enough time to fully understand and address them before the deadline. This proactive approach keeps your contract in good standing.

If juggling multiple contracts feels overwhelming, consider outsourcing this task. A service like GSA Focus can manage the review and acceptance process for you, ensuring your contracts remain compliant and sparing you the stress of last-minute rushes.

10. Work with GSA Focus for Professional Management Support

Managing a GSA Schedule Contract isn’t just about getting certified – it’s about staying on top of an ever-evolving list of responsibilities. From tracking mass modifications and ensuring compliance to updating pricing catalogs, the workload can quickly pile up. For small businesses, balancing these demands while focusing on winning contracts and delivering services can feel like a juggling act. That’s where professional management support can make all the difference.

By partnering with GSA Focus, you can offload these administrative tasks and free up your team to focus on what they do best. With over 600 clients served and a success rate of 98%, GSA Focus has proven its ability to handle the heavy lifting. They manage more than 95% of the required paperwork – requiring just about three hours of your time – and their process is 4–6 times faster than going it alone. On average, their clients see an additional $927,000 in revenue, translating to an 87x return on investment. Perhaps most impressively, 57% of their clients had no prior experience with government contracting before working with GSA Focus.

One client, Rick F., an Executive Coach, shared his experience:

"The GSA process was a mystery to me. They were fully engaged and committed to our GSA approval."

With over 18 years of experience and strong connections within the GSA, GSA Focus acts as your advocate, handling negotiations, preparing documents, and ensuring compliance with changing regulations. Their done-for-you approach allows you to focus on growing your business while they manage the complexities of keeping your certification current and compliant. It’s a hands-off solution that aligns perfectly with the structured practices outlined in this guide.

Conclusion

Successfully managing a GSA Schedule hinges on a well-coordinated, ongoing process that starts with accurate registration and extends to timely catalog and price updates. From ensuring your SAM.gov registration stays current to accepting mass modifications before deadlines, every step outlined in this guide helps you steer clear of delays and keeps the door open to federal contracting opportunities. By treating these tasks as interconnected, you create a solid foundation for long-term success in federal contracting.

GSA’s internal system exemplifies this structured approach by running biweekly queries to flag contracts set to expire within 250 days, prompting notifications to Contracting Officers. This highlights the importance of staying on top of deadlines and maintaining a similarly organized compliance strategy. Ignoring compliance issues can lead to costly setbacks, potentially causing months of missed opportunities.

For small businesses, juggling administrative requirements alongside daily operations can feel daunting. Bringing in professional management support can ease this burden, allowing you to focus on growing your business and delivering for federal clients. As Deena T. from Pacific Point noted:

"GSA Focus was crucial in helping us get our GSA contract quickly with no headaches, setting us on the path to some big wins".

FAQs

What steps should I take to stay compliant with GSA Schedule requirements?

To ensure you remain compliant with GSA Schedule requirements, it’s essential to focus on a few critical practices:

- Keep your documentation current: Regularly review and update certifications, pricing, and contract terms to match GSA standards.

- Maintain accurate pricing: Set rates that are fair, reasonable, and aligned with GSA policies.

- Adhere to contract obligations: Meet delivery deadlines, fulfill reporting requirements, and follow all applicable federal regulations.

- Conduct regular internal audits: Periodic reviews can help identify and resolve compliance issues before they become larger problems.

If the process feels overwhelming, you might want to collaborate with professionals who specialize in GSA Schedule Contracts. Their expertise can make the entire process more manageable and help you stay on track with compliance.

What are the best ways to manage and update a GSA catalog effectively?

To keep your GSA catalog in top shape, make it a habit to regularly review your product and service details. This ensures everything is accurate, meets compliance standards, and stays competitive in the market. Any changes to pricing, descriptions, or offerings should be updated promptly – don’t let outdated information hold you back. Staying in touch with your GSA Contracting Officer can also be a big help in addressing compliance questions or updates.

If managing updates feels overwhelming, you might want to look into professional services that specialize in GSA Schedule management. These experts can handle tasks like preparing documents, ensuring compliance, and managing updates, saving you time and hassle. By keeping your catalog current, you’re not just staying compliant – you’re also positioning yourself to make the most of sales opportunities with federal buyers.

Why should I regularly update my NAICS codes and small business size standards?

Keeping your NAICS codes and small business size standards current is crucial for staying compliant and maintaining eligibility for GSA contracts. By regularly updating this information, you ensure your business accurately represents its capabilities and aligns with the right federal contracting opportunities.

Staying on top of these updates not only helps you meet the latest requirements but also reduces the risk of disqualifications. It positions your business for greater success in the competitive federal marketplace.

Related Blog Posts

- How to Track GSA Contract Compliance

- How to Manage GSA Contract Performance

- Ultimate Guide to GSA Compliance Standards

- Common GSA Compliance Mistakes And Fixes