Selling to federal agencies through a GSA Schedule can unlock access to a $45 billion marketplace. A GSA Price List is essential for small businesses to compete effectively, offering direct access to federal buyers with streamlined purchasing processes. With only 4% of small businesses holding GSA Schedules, the competition is limited, and opportunities are vast.

Key Takeaways:

- Federal Spending Potential: In 2023, small businesses earned over $10 billion through GSA contracts.

- Tools to Simplify the Process: Use platforms like GSA eOffer/eMod, GSA eLibrary, and CALC+ to streamline submissions, refine pricing, and stay compliant.

- Support for Success: Resources like GSA Focus and OSDBU offer guidance, document preparation, and training to help businesses navigate the process efficiently.

Maintaining an accurate, competitive GSA Price List is critical for winning contracts and staying compliant. By leveraging the right tools and resources, small businesses can maximize their chances of success in federal contracting.

What Are GSA MAS Contract Vehicles and Why Small Businesses Should Be On Them

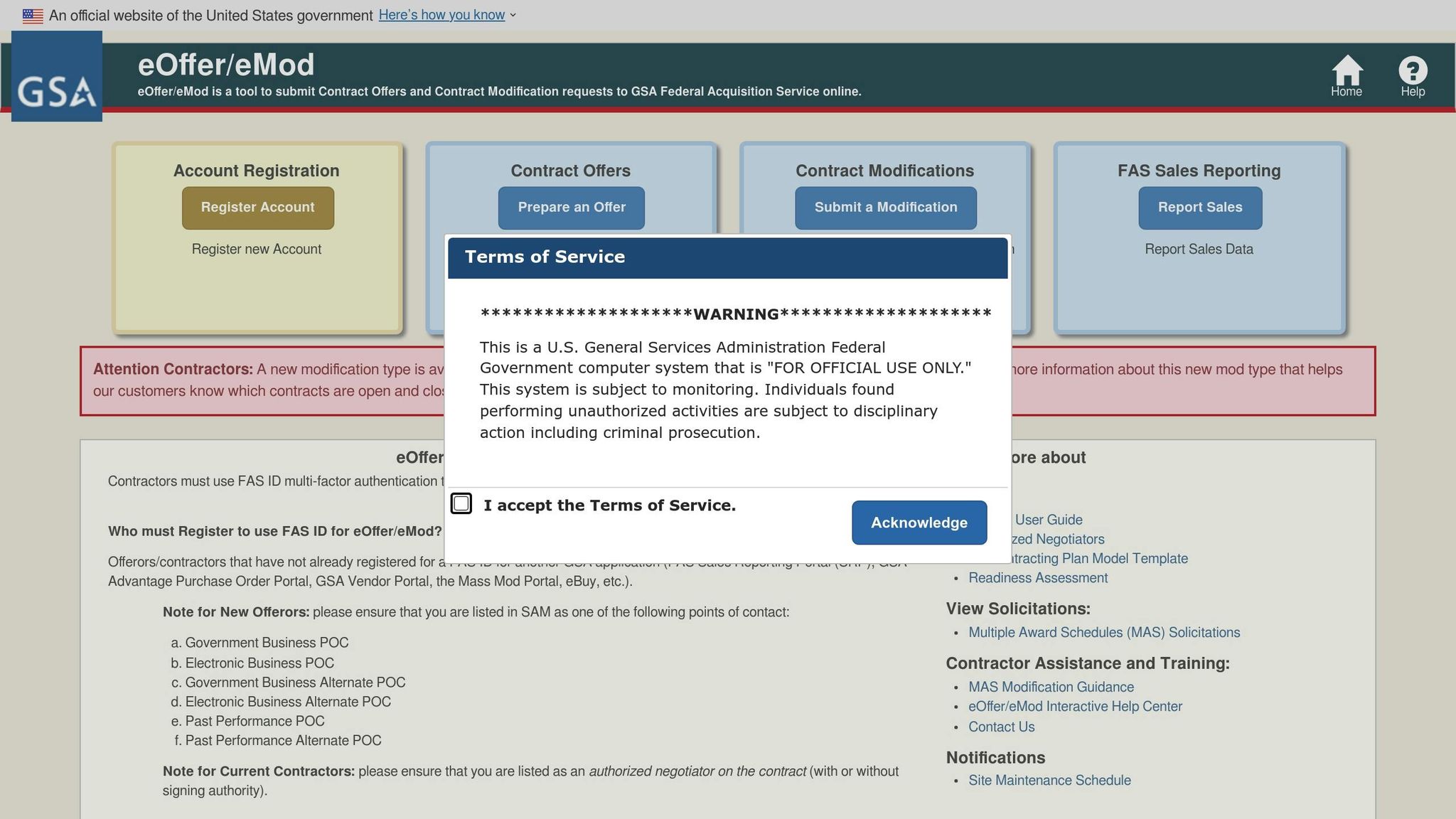

1. GSA eOffer/eMod

GSA eOffer/eMod is the official online system for small businesses to submit new GSA Schedule proposals or make changes to existing contracts. Gone are the days of sifting through stacks of paperwork; this platform simplifies what used to be a process involving over 100 pages of forms and compliance checks into a digital workflow. Here’s an overview of its key features and updates.

The system is divided into two main parts: eOffer, for submitting initial proposals, and eMod, for modifying contracts. To get started, you’ll need to register on SAM.gov, obtain a Unique Entity Identifier (UEI), select relevant NAICS codes, and complete GSA’s "Pathways to Success" training.

One standout feature is the automated compliance checking system. As you upload your documents and pricing details, the platform validates forms, pricing templates, and regulatory submissions in real time. This reduces the chance of mistakes that could hold up your proposal or contract modification.

When submitting your proposal, you’ll need to include several key templates:

- Price Proposal: Includes Commercial Sales Practices information.

- Technical Proposal: Covers labor descriptions.

- Terms & Conditions: Standardized terms for your offerings.

- Financial Records: Two years of financial statements.

- Past Performance: Based on CPARS evaluations.

GSA provides templates for each document type, ensuring consistency across submissions.

For businesses managing existing contracts, the eMod function allows updates to your GSA Schedule. Whether you’re adding or removing products and services, adjusting prices, revising terms, or updating basic company details like addresses, eMod makes these changes straightforward. This flexibility is crucial as your offerings evolve.

In 2025, GSA modernized eOffer/eMod, introducing upgraded digital workflows, a more user-friendly interface, and stronger automated compliance tools. These enhancements have made the entire process more efficient and transparent.

The platform also integrates with tools like GSA eLibrary, CALC+, and the Pricing Intelligence Suite to help you refine your proposals. For example, you can use GSA eLibrary to identify the right Special Item Numbers (SINs) for your offerings. Meanwhile, CALC+ and the Pricing Intelligence Suite provide pricing benchmarks, helping you position your rates competitively.

When it comes to pricing, GSA enforces strict rules to ensure fairness. Your submitted rates must align with GSA’s ceiling rates, Basis of Award requirements, and standards for being fair and reasonable. While the system’s validation processes help ensure compliance, it’s essential to maintain thorough documentation for future audits or Contractor Assistance Visits.

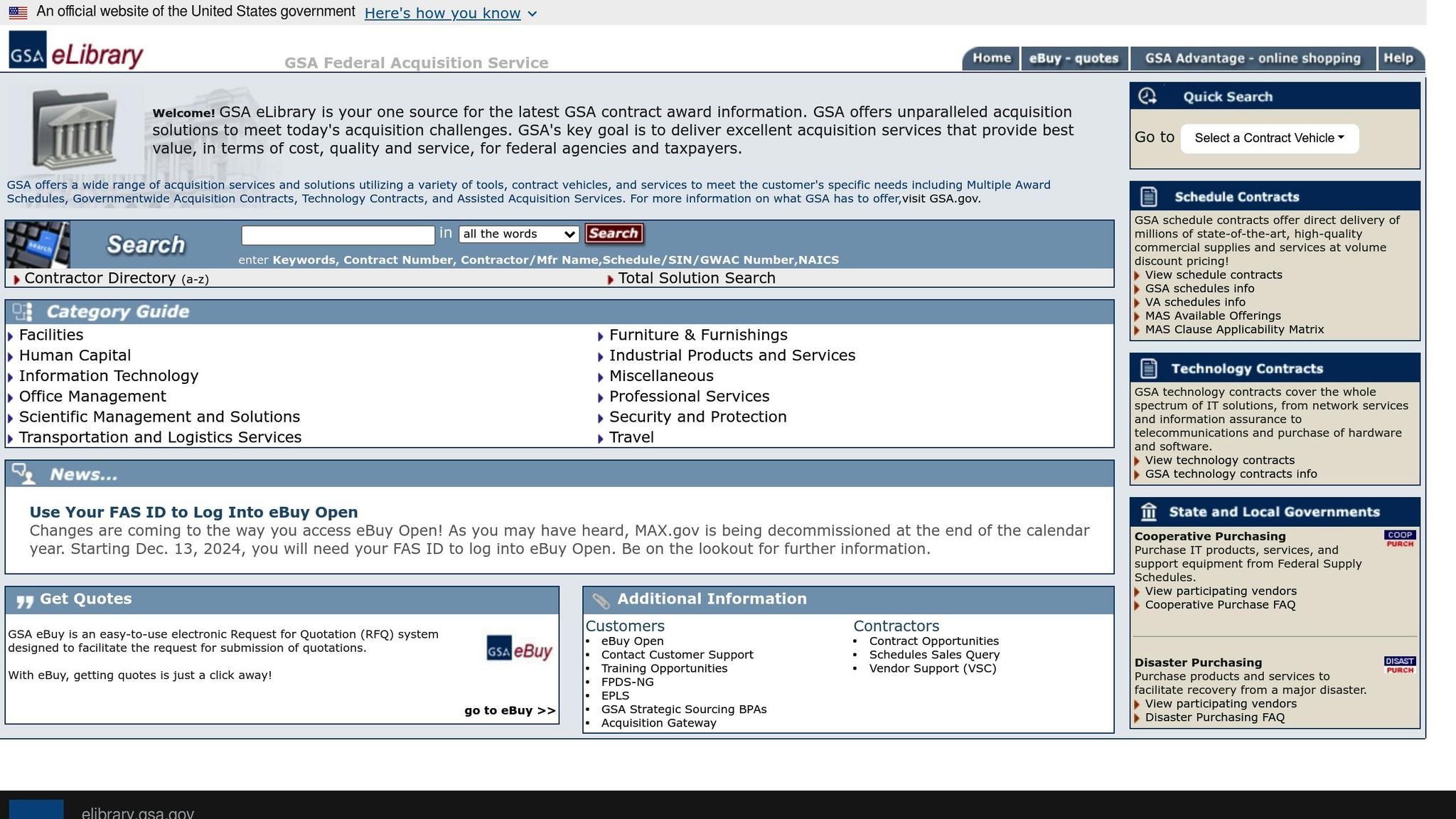

2. GSA eLibrary

The GSA eLibrary serves as the official database for approved GSA contractors and their offerings. As of 2025, it features over 15,000 contractors, making it an essential resource for competitive intelligence when developing or refining your GSA Price Lists. This comprehensive tool not only helps shape pricing strategies but also plays a vital role in defining market positioning.

With its user-friendly search options, you can look up contractors by name, contract number, Special Item Number (SIN), or keywords. This allows for quick access to market rates and category-specific offerings. Federal buyers frequently rely on GSA eLibrary to research vendors and compare options before making purchasing decisions.

Each contractor listing provides detailed information such as contractor names, contract numbers, awarded SINs, contract terms, and socioeconomic designations (e.g., small business, HUBZone, or WOSB). It also includes links to complete price lists. This level of transparency offers valuable insights into how similar products or services are priced, categorized, and described. Regular updates ensure the database reflects the latest contract information, including pricing adjustments and modifications.

When it comes to pricing benchmarking, GSA eLibrary is an indispensable tool. By searching for your relevant SIN, you can explore labor categories and hourly rates offered by competitors. This helps establish competitive rates that align with GSA’s "fair and reasonable" pricing standards.

The platform also highlights potential teaming or subcontracting opportunities with larger contractors. You’ll find details on contract terms, contact points, and direct links to GSA Advantage! for product and service listings.

GSA eLibrary doesn’t operate in isolation – it integrates seamlessly with other GSA tools. For instance, after identifying relevant SINs and competitors in eLibrary, you can use CALC+ for in-depth pricing analysis and then submit your refined proposal through eOffer/eMod.

To make the most of GSA eLibrary, leverage its advanced search features. You can filter results by SIN, NAICS code, or contract type, and even download competitor price lists for a broader market perspective. Document your benchmarking process to back up your pricing strategy during GSA negotiations. Regularly review the platform – ideally annually or before preparing contract modifications – to stay current with market trends, pricing shifts, and new competitors. These insights will help you fine-tune your GSA Price List and maintain strong market alignment.

3. CALC+ (Contract Awarded Labor Category Plus Tools)

CALC+ is a powerful tool from GSA that lets businesses search and compare fully burdened, not-to-exceed hourly labor rates under MAS contracts. Essentially, it provides a database of labor categories, helping small businesses understand market standards, avoid overpricing, and align their rates with GSA’s fair and reasonable pricing requirements. This makes it an excellent resource for crafting competitive and compliant proposals.

What sets CALC+ apart is its ability to refine searches using detailed filters like labor category, education, experience, contract type, and geography. For example, an IT consulting firm could use CALC+ to search for "IT Specialist" roles and analyze competitive ceiling rates, ensuring their GSA Schedule offer is well-positioned in the market.

While CALC+ is a great addition to your pricing toolkit, it’s important to remember that it shows awarded ceiling rates, not actual transaction rates. Since it doesn’t account for negotiated discounts or specific contract terms, think of it as a guide rather than an absolute pricing source.

To get the most out of CALC+, experts recommend using it early in the proposal process. Start by establishing a pricing baseline, then refine it with internal cost analysis and ongoing market research. It’s also a smart move to revisit CALC+ before modifying or renewing contracts to ensure your pricing remains competitive.

However, there are a few common mistakes to avoid. Solely relying on CALC+ data without factoring in your internal costs can lead to issues. Misaligning labor categories or overlooking contract-specific requirements can also cause problems. To sidestep these pitfalls, use CALC+ alongside other pricing tools, ensure accurate labor category mapping, and review GSA solicitation documents for compliance.

Even after a contract is awarded, CALC+ continues to be a useful resource. It helps businesses track market trends, adjust rates during contract modifications, and justify rate changes during negotiations with contracting officers. By leveraging CALC+ effectively, you can maintain compliance with GSA’s pricing standards while staying competitive in the federal marketplace.

4. Pricing Intelligence Suite

The Pricing Intelligence Suite brings together historical contract data, competitor pricing, labor categories, and market trends into easy-to-understand dashboards. With this tool, you can access price ranges, average rates, and spot pricing outliers through clear and intuitive visualizations. This not only simplifies the understanding of market trends but also ensures a strong foundation for compliance monitoring.

By keeping a close watch on discount structures and ensuring pricing aligns with regulations, the suite helps minimize risks like non-compliance or retroactive price adjustments.

Using insights from tools like GSA eLibrary and CALC+, you can integrate the Pricing Intelligence Suite effectively. Start by compiling your commercial sales data and competitor pricing information. Then, benchmark your rates against both market and federal standards. Be sure to document all pricing decisions, including any discount structures or exceptions, and regularly update your records to align with GSA’s "fair and reasonable" pricing standards.

The suite’s real-time benchmarking and compliance tools, combined with updates to Price Proposal Templates, make it easier to adapt to regulatory changes. For example, as GSA phases out small business set-aside SINs, the suite helps you stay competitive by focusing on broader pricing categories.

With accurate data and expert support, your pricing strategy can thrive. For those new to federal contracting, GSA Focus provides full-service assistance, from document preparation to compliance and negotiation – ensuring your pricing remains both competitive and compliant.

5. GSA Focus

GSA Focus brings a hands-on approach to federal contracting, simplifying the often overwhelming GSA Schedule process. From start to finish, they handle everything – document preparation, contract maintenance, and beyond – so small businesses can focus on what they do best.

Their "done-for-you" service covers the entire GSA Schedule lifecycle. This includes eligibility assessments, selecting the right NAICS codes and SINs, and preparing all necessary documents like financial statements, technical proposals, and pricing narratives. For small businesses, this is a game-changer, as it eliminates the headache of navigating extensive paperwork and ensures everything is done right the first time.

A standout feature of GSA Focus is their expertise in document preparation and compliance. They ensure your pricing and narratives align with GSA’s "fair and reasonable" standards by conducting detailed analyses of commercial sales practices and Basis of Award requirements. This attention to detail is a key reason they report an impressive 98% success rate. Plus, their refund guarantee underscores the confidence they have in their process.

But GSA Focus doesn’t stop at securing your contract. Their support extends well beyond the initial approval, offering help with contract modifications, price adjustments, and product or service updates. They also assist with GSA’s digital tools like eOffer and eMod, making it easier to keep your contract up to date. And when it comes to audits or Contractor Assistance Visits (CAVs), they ensure your documentation is always in order, helping you stay compliant and avoid costly issues.

Their secure online platform simplifies communication and document uploads, while milestone-based payment terms make their services budget-friendly for small businesses. This approach is particularly helpful for businesses with tight cash flow, offering flexibility without compromising on quality.

For small businesses venturing into federal contracting, GSA Focus provides the expertise and support to navigate this challenging landscape. By taking on the complexities of compliance and documentation, they allow you to focus on growing your business while they handle the rest. Combined with the advanced tools mentioned earlier, GSA Focus equips small businesses with everything they need to succeed in the federal marketplace.

6. GSA OSDBU (Office of Small and Disadvantaged Business Utilization)

The GSA Office of Small and Disadvantaged Business Utilization (OSDBU) plays a vital role in supporting small businesses aiming to succeed in the federal contracting landscape. Acting as a dedicated advocate, OSDBU ensures that small and disadvantaged businesses have equitable access to opportunities within GSA contracts.

OSDBU provides a variety of resources to help businesses navigate the complexities of GSA Schedule contracts. These include webinars, workshops, online courses, and personalized counseling that cover key areas like the application process, compliance requirements, proposal development, and pricing strategies.

To foster connections, OSDBU organizes matchmaking events, industry days, and expos. These gatherings bring together contractors, GSA officials, prime contractors, and potential partners, creating opportunities for teaming arrangements and subcontracting. This proactive approach has contributed to a 26% growth in small business sales through GSA Schedule contracts, totaling $18.2 billion in fiscal year 2024. With approximately 12,300 small business contractors on GSA Schedules, the average sales per business reached nearly $1.5 million.

A standout example involves a woman-owned small IT business that participated in OSDBU training and matchmaking events. Through these resources, the business connected with a prime contractor and received guidance on proposal preparation and compliance. This led to a successful subcontract under a GSA Schedule contract, significantly increasing both revenue and visibility in the federal market.

Accessing OSDBU’s resources is straightforward. They are available for free through the GSA website, local offices, and outreach events. While most programs are open to all U.S.-based small businesses, certain initiatives may prioritize those classified as disadvantaged, women-owned, or veteran-owned, or those meeting specific SBA size standards.

OSDBU also collaborates with agencies like the Small Business Administration, offering coordinated support that ranges from initial eligibility checks to ongoing compliance and federal market growth opportunities. For businesses working on their GSA Price List, OSDBU experts emphasize the importance of thorough market research, fair and reasonable pricing, detailed documentation, and regular updates. They also suggest using digital tools and personalized counseling to avoid compliance issues and maintain a competitive pricing strategy. Combining OSDBU’s resources with other digital tools can be a game-changer for fine-tuning your GSA Price List.

7. SBA Size Standards Tool

The SBA Size Standards Tool is your go-to resource for determining if your business qualifies as small under federal contracting programs like GSA Schedules. Created by the U.S. Small Business Administration, this free online tool simplifies the process of size classification by instantly evaluating your eligibility based on your industry and business metrics. It’s a crucial starting point for navigating federal contracts, connecting seamlessly with tools like SAM.gov registration and strategies for competitive pricing.

Why does your size status matter? Accurate size classification can unlock access to small business set-asides and GSA Schedule benefits, giving you a competitive edge in federal contracting. On the flip side, misclassification can lead to costly consequences, such as disqualification, contract termination, or penalties that can derail your efforts.

The tool works by combining your business data – like annual receipts or employee count – with North American Industry Classification System (NAICS) codes. For instance, a technology consulting firm qualifies as small if its annual revenue is under $34 million, while a manufacturing company must have fewer than 500 employees to maintain its small business status.

One of the tool’s biggest advantages is its up-to-date accuracy. The SBA regularly updates size standards to account for market conditions and inflation, ensuring the tool reflects current thresholds. This makes it essential to check your status regularly, especially before submitting GSA Schedule proposals or renewing contracts.

To avoid common errors, use precise and current data when using the tool. Mistakes like selecting the wrong NAICS code, using outdated financial information, or misunderstanding how to calculate receipts or employee counts can lead to incorrect classifications. Carefully review NAICS code definitions and ensure your financial data is up to date.

Once you’ve confirmed your small business status, you’re ready to take the next steps toward federal contracting. Update your profile in SAM.gov, select the appropriate NAICS codes for your services, and gather the necessary documentation for your GSA Schedule application. Your size determination becomes a cornerstone of your federal contracting strategy.

For additional help with size standards and compliance, consider reaching out to GSA Focus for expert advice.

Tool Comparison Table

Choosing the right tools can make the GSA Price List process much smoother. Each tool serves a specific purpose in the GSA contracting workflow, and knowing their strengths and limitations helps you create a more focused strategy.

| Tool/Resource | Primary Function | Key Benefits | Main Limitations | Best For | Cost |

|---|---|---|---|---|---|

| GSA eOffer/eMod | Electronic offer submission and contract modifications | Automated compliance checks and streamlined submissions; required for official GSA business | Complex interface for beginners; requires familiarity with GSA systems | All contractors (mandatory for submissions) | Free |

| GSA eLibrary | Contract research and market analysis | Access to awarded contracts, pricing benchmarks, and market insights | Data may lag behind real-time changes; can be overwhelming for newcomers | Market research and competitive positioning | Free |

| CALC+ | Labor rate analysis and benchmarking | Precise labor category data, geographic pricing benchmarks, and trend analysis | Focused only on labor categories; less useful for product-based offerings | Service providers setting hourly rates | Free |

| Pricing Intelligence Suite | Advanced pricing analytics and compliance support | Comprehensive pricing data, trend analysis, and validation of fair pricing | Requires analytical expertise to interpret data effectively | Businesses needing sophisticated pricing strategies | Free |

| GSA Focus | Full-service GSA contract support | 98% success rate; handles 95% of paperwork; expert negotiation; 4–6× faster than DIY | Involves service fees and reliance on third-party expertise | Small businesses lacking internal GSA expertise | Contact for pricing |

| GSA OSDBU | Small business training and advocacy | Free workshops, personalized counseling, and a focus on small businesses | Provides general guidance only; does not offer hands-on document preparation | New contractors seeking foundational knowledge | Free |

| SBA Size Standards Tool | Small business eligibility verification | Instant size determination with updated standards to prevent disqualification | Only determines eligibility; does not assist with pricing or proposal development | All small businesses before starting the GSA process | Free |

This table highlights how each tool fits into the bigger picture of GSA contracting. Using multiple tools together can significantly improve your strategy. For example, service-based businesses often turn to CALC+ for labor rate benchmarking, while product-driven companies gain value from GSA eLibrary and the broader analytics offered by the Pricing Intelligence Suite.

If you’re new to GSA contracting, the learning curve can feel steep. While free tools provide critical data, navigating compliance requirements often demands additional expertise. Professional services, like those from GSA Focus, can save time and reduce errors by managing the more intricate parts of the process.

Cost is another factor to weigh. Most GSA tools are free, but they require a considerable time investment to use effectively. For businesses with limited internal resources, outsourcing to experts can speed up approvals and ensure accuracy.

Ultimately, whether you’re analyzing labor rates with CALC+, conducting market research through GSA eLibrary, or seeking comprehensive support from GSA Focus, all efforts channel back to the official submission process. By aligning these tools with your expertise, you can build a more effective GSA Price List strategy.

Conclusion

The GSA Price List, combined with the right tools and expert guidance, simplifies federal contracting and creates opportunities for business growth.

To put this into perspective: In fiscal year 2024, small businesses achieved $18.2 billion in sales through GSA Schedules – a 26% increase over five years. These numbers highlight the potential for growth when businesses leverage the resources available to them.

The tools mentioned earlier – like eOffer/eMod and OSDBU – work together to create a solid strategy for success in federal contracting. They help ensure your GSA Price List is competitive and compliant. Plus, with professional services like GSA Focus, businesses can complete the process 4–6 times faster compared to doing it on their own.

Small businesses contribute roughly 35% of total GSA Schedule sales, proving that success isn’t about size – it’s about preparation and having access to the right tools and support. As federal contracting evolves, small businesses are finding it easier to participate, thanks to improved digital tools and resources.

FAQs

What steps should small businesses follow to secure a GSA Schedule contract?

Securing a GSA Schedule contract is a game-changer for businesses looking to break into federal contracting. But let’s face it – navigating the process can feel overwhelming. That’s where GSA Focus steps in. They offer a complete, hands-on service designed specifically for small businesses.

From preparing the required documents to ensuring everything aligns with GSA standards, GSA Focus takes care of the heavy lifting. They even provide expert guidance during negotiations, so you’re not left guessing at any step.

By partnering with them, small businesses can skip the headaches, save valuable time, and concentrate on using their GSA Schedule to boost federal sales.

What steps can small businesses take to keep their GSA Price List competitive and compliant?

To keep your GSA Price List both appealing and compliant, it’s crucial to give it regular attention. Start by ensuring your pricing reflects current market trends and remains fair for federal buyers. Take time to compare your offerings with those of similar vendors to confirm your prices stay competitive.

Compliance is equally important for maintaining your GSA Schedule. Be sure to stay updated on GSA regulations, including Trade Agreements Act (TAA) compliance and reporting requirements. If this feels overwhelming, consider using specialized services, like those offered by GSA Focus, to streamline the process. They can help ensure your price list checks all the boxes, saving you both time and effort.

What resources are available to help small businesses manage GSA contracts more effectively?

Small businesses often face challenges when diving into the world of GSA contracting, but they don’t have to go it alone. There are specialized services available to help streamline the process. From assisting with document preparation to ensuring compliance with federal requirements, these experts can make a complicated system far more manageable. They also offer guidance during negotiations, helping businesses save valuable time and effort. With this kind of support, small businesses can efficiently handle their GSA Price Lists and tap into the vast opportunities that federal contracting offers.

Related Blog Posts

- Top 7 GSA Schedule Benefits for Small Businesses

- How to Access GSA Small Business Support Programs

- How GSA Advantage Simplifies Federal Buying

- GSA Advantage Website 101: A Small Business Guide